April 2022 - Could Be Raining

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

In the Mel Brooks movie Young Frankenstein, two characters (Dr. Frankenstein and Igor) have the unfortunate task of digging up dead bodies in a cemetery. Yuck! I suppose when you are in the business of dead bodies, this comes with the territory. Either way, covered in dirt, Dr. Frankenstein and Igor are predictably miserable.

Igor, forever the optimist, tries to find something positive to say – "could be worse…could be raining" – words that have since squeezed their way into our everyday vernacular.

To best reflect on the first quarter of '22, it can best be described as not great but not terrible. Or, to channel my inner Igor, it could be worse!

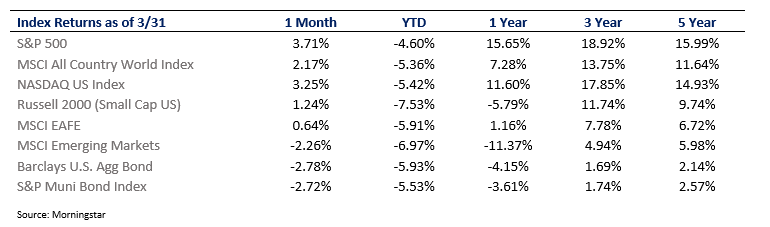

Stocks remained quite resilient to start the year, despite numerous headlines. But, of course, it has been a bumpy ride. As recently as March 15th, the S&P 500 was down 14% for the year, with the tech‐heavy Nasdaq in bear market territory

(down 20%). Markets, however, rallied to close the quarter, ending with the S&P 500 only 5% away from the January 4th all‐time high. It was an impressive rally, especially when considering the global environment. Stocks have thus far weathered a Russian invasion, energy/commodity increased price shock, rising interest rates, inflationary pressures, bond market plunge, and market swings.

How did this rally happen in the face of so much bad news?

While we expect elevated volatility to remain, we see two areas of real strength –

1) A very healthy US consumer

a. Spending and earning more

b. $2.5 trillion richer post‐pandemic

2) Corporate Balance Sheets/earnings remain strong

a. Expected earnings growth increased to 9.5% (FactSet)

b. Positive earnings growth very supportive of market performance

Of course, we are all aware of the risks and believe that plenty of bumps lie ahead. Among other concerns, inflation continues to run hot, and the Federal Reserve is becoming more emboldened to raise rates than previously anticipated. Yet, even in this backdrop, we remain optimistic that markets will see modest gains over the next 12 months – particularly post mid‐term elections.

As an important reminder, our job at HPW is to manage core wealth. Client portfolios will always be diversified and balanced. Despite Q1’s noise, well‐diversified portfolios held their own, typically down just ~5%. We have, however, made some sensible adjustments within client portfolios. We provide some specifics in the Allocation Update section.

March Performance

Bond Market Turbulence

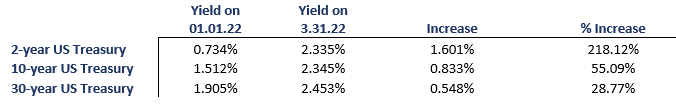

Bonds have performed very poorly to start ‘22. While stocks have rallied nicely over the past few weeks, the bond market has continued to tumble in the face of rising rates and inflation. This period has been the worst stretch for bonds in over 50 years – with the Bloomberg Aggregate Bond Index falling 11% from its January 2021 peak. Not a fun ride, with the market’s attempt to price in the Fed’s future rate trajectory quickly. The Federal Reserve (Fed) raised interest rates by 0.25% in March, with clear signals for more aggressive tightening looming. As a result, we expect numerous rate hikes throughout 2022 and into 2023.

As a quick reminder, bond prices decrease when yields (income payments) rise. The opposite is also true, as bond

prices increase when yields fall. To start ’22, yields have moved noticeably higher, thus pushing prices lower. See below:

Source: Koyfin

The price decline in bonds has frustrated diversified investors. Typically, bonds thrive when stocks tumble as more money flows into less risky assets. Unfortunately, this has not been the case thus far in ’22. Bonds have neither provided stable returns nor a cushion for stock market declines. It is just a challenging fixed‐income environment – a double whammy of high inflation and an aggressive Federal Reserve.

So why even hold bonds at all?

While bonds have underperformed to start the year, fixed income will always play a valuable role in client portfolios. It is also possible that the bond market has mostly priced in the Fed’s plans (even 0.50% hikes) and that volatility will slowly subside. Looking ahead, we see two positive developments in fixed income:

1. History suggests that bonds see strong performance after declines of this magnitude

2. Newly issued bonds will provide higher yields and better income

While we remain very underweight fixed income, we are certainly not abandoning the asset class. Instead, as you will read in our allocation update, we have made tweaks—constructing client portfolios that are better protected against rising rates. On a positive note, we may be on the precipice of attractive levels of bond income and the death of T.I.N.A – providing investors with the opportunity for a more attractive/stable future income environment. After all, rising interest rates are good for the patient bond investor and very bad for the impatient investor.

Yield Curve Inversion? Pardon?

You may have seen some headlines around yield curve and yield curve inversions. In the final week of March, the yield curve briefly inverted for the first time since the summer of '19. So, to break through some of the noise, we thought it best to cover the basics and communicate our thoughts.

A yield curve inversion occurs when the interest paid on shorter‐term Treasury bonds surpasses interest paid on longer‐term bonds of equal credit quality. In real terms, it's when a two‐year treasury pays you more interest than a 10‐year treasury. This is an economic irregularity that doesn't make sense – as investors who lock up their money for a more extended period should be rewarded with more income. As you can see below, the slope of the curve is quite different than the slope only one year ago:

Source: FactSet, as of 3.30.22

Why exactly do people care? There are a handful of explanations, but in our view, for its predictive powers:

1. A flatter/inverted yield curve can indicate poorer economic conditions ahead – lower growth and inflation

2. Yield curve inversions have been a historically strong indicator of a coming recession

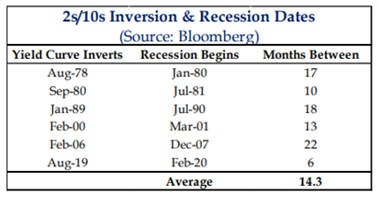

That second point is significant and likely why we make such a big fuss over it. Over the last 50 years, yield curve inversions, particularly the 2s/10s inversion, have been a relatively reliable indicator of a coming recession. While not perfect, just about every time the yield curve has inverted, a recession has followed within the next 6 to 24 months.

Since 1978 there have been six inversions of the 2s/10s yield curve (not including March) ‐

So, time to sell stocks, right?

Well, it’s not that simple. Nothing in markets ever is. Imagine, for example, that you sold everything in ’19, only to miss the roller coaster 60% rally of ’20 and ’21. If we look at the performance of the U.S. stock market following a yield curve inversion, we can see that, tapping into my inner Mark Twain, reports of a stock market demise are greatly exaggerated.

Source: Strategas

While it looks great, these are a tick below the historical average. In addition, in the five years following a yield curve inversion, the median inflation‐adjusted return on US stocks was 6% annually compared to an 8% average.

What about bonds? Historically, bonds do just fine, albeit below historical norms, with a 5‐year median return of 4%.

Given this information, what is an investor to do?

In our view, stay the course and allow us to make adjustments around the edges. A boring answer, but usually the correct one. Yield curve inversions may be more helpful for economists, but remember, the stock market is not the economy. From a market perspective, this indicator gives us little by way of crystal ball insights. No one should assume to know how this will play out. I would also argue that yield curve inversions have become less useful as an indicator, especially as it is discussed, dissected, and debated more frequently (more on the Heisenberg Uncertainty Principle and Goodhart’s Law another month).

As portfolio managers, we don’t treat inversions as fate, but we also don’t dismiss it. History gives us a loose playbook to alter stock and bond tilts to a more defensive position – we have done this and explain it in the allocation update.

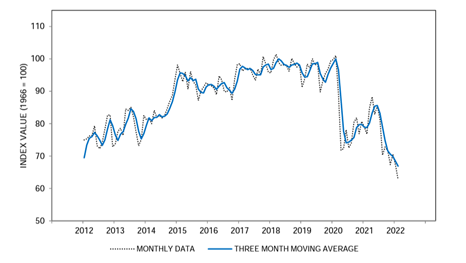

Chart of the Month – U of Michigan Consumer Sentiment (a contrarian indicator and possible catalyst for stocks)

Allocation Update:

Investors should continue to brace for more volatility in April and May. The market is digesting quite a bit (inflation, rates, Russia, midterms), and it will take some time for these concerns to subside.

Alternative investments have thrived to start ’22. When we say alternatives, we primarily mean commodities, real estate, private investments, and structured solutions. Alternatives have done a tremendous job of providing a cushion within client portfolios thus far in ‘22. These asset classes, while volatile, provide a hedge against inflationary pressures and geopolitical uncertainty – of which we have had both. In addition, commodities (think oil, gold, wheat, etc.) have done exceptionally well, providing positive returns in Q1.

In March, we made some noteworthy changes within client portfolios:

Equities

o Continued to tilt portfolios more into value and dividend-paying stocks

o These stocks are more resilient to inflation and higher rates

Fixed Income

o Reduced our allocation to fixed income by 2% - we are now very underweight bonds vs. neutral target

o Within our allocation, we reduced exposure to long-term bonds and more into short duration

Alternatives

o Added 2% to the alternative bucket to better hedge against inflation and slowing growth

o Introduced gold to client portfolios

A quick public service announcement: our favorite day of the year, Tax Day, is nearly here. Huzzah! Please let us know how we can help. Our team stands ready to assist you and your tax advisor in any way possible.

The McBurney family followed the New England seasonal pilgrimage down to Florida for part of March. It was a pleasure enjoying some sunshine, warm weather, and watching Teddy pick up a tennis racket. He absolutely loved it. But I don’t think anyone will confuse him for Roger Federer. His ability to hit a tennis ball likely tracks my own ability to hit a Max Scherzer fastball – it ain’t great!

Speaking of Teddy, I suppose he has entered the inevitable phase of superhero obsession as he spends his days running around our house in full cape and mask attire. It’s a balancing act for parents, as his school has warned of play fighting that’s a tad too rough. Rest assured, he positively did not learn that from yours truly.

A reminder that McBurney baby #2 arrives in early/mid‐June. Make sure you get your “Kyle time” while I am still well‐rested in a (relatively) quiet environment.

Cheers to a great spring! I would normally close with “could be worse, could be raining,” but as we all know, this time of year in New England…it probably is!

As always, questions and comments are welcome.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202504 - 102206