First Quarter 2022 - Market Update

Kelly Kowalski, Robert Lingberg, Cliff Noreen, Bronwyn Shinnick

MassMutual Investment Management

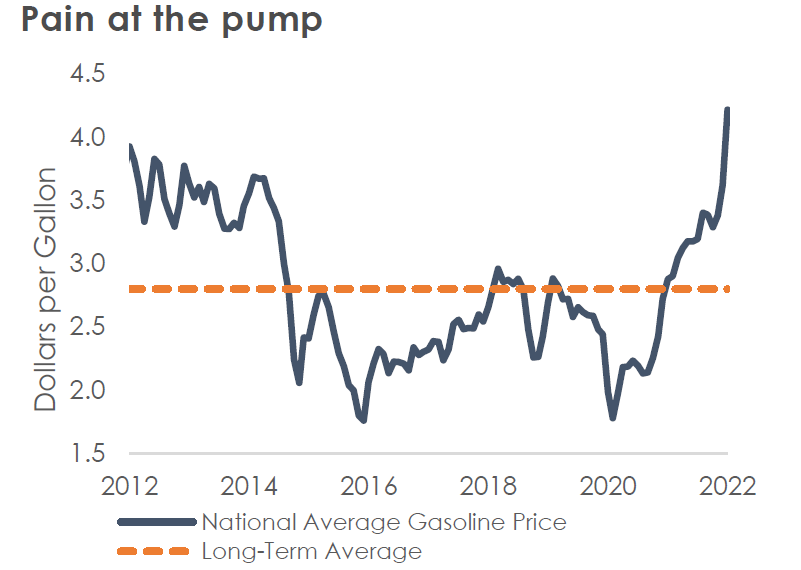

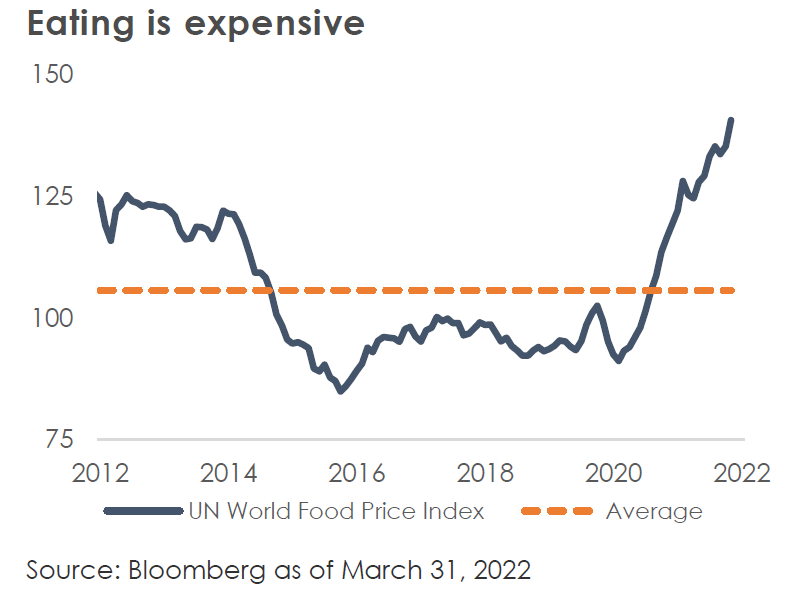

As we approached the two-year anniversary of an unprecedented and devastating global pandemic and emerged from the Omicron wave, we were confronted with one of the worst geopolitical and humanitarian crises since World War II as Russia launched a brutal and senseless attack on Ukraine. Nuclear weapons usage and World War III were added to the list of investor worries which, prior to Russia’s invasion, centered around inflation and tighter monetary policy. Though paling in comparison to the human toll of the war in Ukraine, the conflict has altered the global growth, inflation, and investment outlook. Russia has been abruptly cut off from Western economies and financial systems, and its supply of key commodities, including oil and gas, has material implications for inflation, which is already at multi-decade highs. Commodity prices are soaring, and the financial pain for consumers is worsening at the grocery store and at the gas pump.

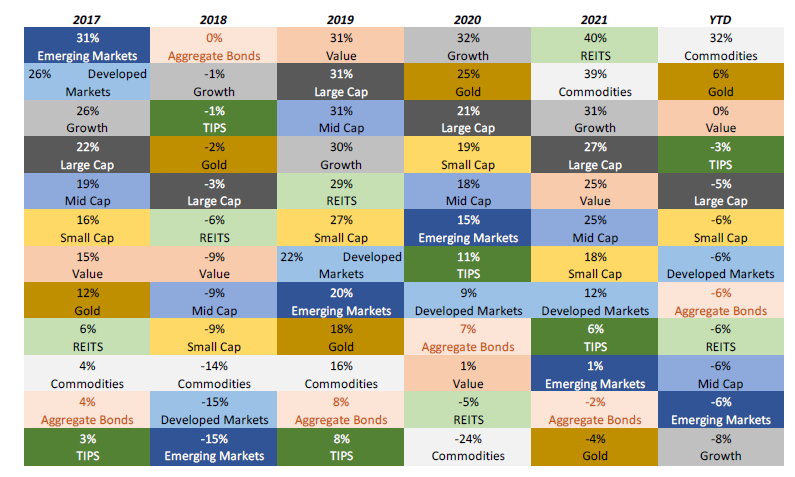

Russia’s invasion of Ukraine unsurprisingly led to a sharp sell-off in equity markets in the first quarter. The S&P 500 suffered its first quarterly decline since the depths of the pandemic, and all major asset classes suffered negative returns except commodities. The Federal Reserve ended quantitative easing and hiked short-term interest rates 25 basis points in March, but it is still very much behind the curve in reining in inflation of around 8%. Treasury yields soared as investors priced in an accelerated tightening cycle and higher inflation with the U.S. 2-year Treasury yield more than tripling since the beginning of the year. Despite worrisome headlines, corporate profits continue to grow, and we have not seen signs of stress in financial markets. Consumer balance sheets remain healthy with record household net worth and a very tight labor market. Nevertheless, economic growth is slowing. Record federal fiscal stimulus programs are a distant memory, and we have yet to feel the full impacts from the Russia-Ukraine conflict and from expected Fed tightening.

2022 YTD total returns: Commodities outperform

Source: Cornerstone Macro, as of March 31, 2022

Russia’s attack on Ukraine: Investment implications for 2022 and for years to come

On Feb. 24, Russia shocked the world by launching an unprovoked and violent attack on Ukraine, which was swiftly met with harsh economic and financial sanctions, including freezing central bank reserves, from Western countries and notable self-sanctioning by many corporations with operations and assets in Russia. Russia is the world’s third largest oil producer, producing eleven million barrels of oil per day and is the world’s largest exporter of oil to global markets. Russia is also the second largest producer of natural gas and accounts for more than 40% of the European Union’s natural gas imports. Russia and Ukraine account for approximately 29% of the global wheat market.

Source: Bloomberg as of March 31, 2022

In the near-term, it is clear that the war Russia started will lead to higher inflation and will be a drag on growth, particularly for Europe. Eurozone 2022 growth has been revised down over 1% to 3.1% since the beginning of the year, and Europe is likely at risk of recession as soaring energy and food costs weigh on growth. U.S. 2022 growth has been downgraded 0.5% to 3.4%, and first quarter growth is expected to slow sharply to 1.5% from 6.9% in the fourth quarter of 2021.

The Russia-Ukraine conflict also has significant long-term implications for the global economy and financial markets. It has accelerated many trends already in place including deglobalization, or less integration with and dependence on foreign economies and supply chains, and the transition to a low carbon economy, both of which are inflationary in the near-term. Dependence on Russian fossil fuels has left Europe in particular in a precarious situation, and underinvestment in oil and gas production capacity globally had led to structurally lower supply, intensifying the need for energy independence and renewable energy. Lastly, defense spending will undoubtedly increase for many countries due to the conflict, leading to higher government spending and higher debt levels. Following Russia's seizure of Crimea from Ukraine in 2014, NATO members pledged to spend at least 2% of their gross domestic product on defense by 2024; currently only eight of thirty NATO member countries including the U.S. have met the 2% target.

Inflation: Higher for longer

One year ago, the Fed and many experts dismissed inflation concerns. Market pricing of inflation expectations one year ago implied an expected one-year inflation rate of under 3%. Now, the U.S. economy has the highest inflation rate in the developed world with the CPI approaching 8%! Incredibly tight U.S. labor markets, increased rents and costs of shelter in the U.S., renewed lockdowns in China, stretched supply chains, and now surging commodity prices are putting upward pressure on already high inflation. According to Bloomberg economists, inflation will mean the average U.S. household has to spend an extra $5,200 this year ($433 per month) compared to last year. This compares to annual U.S. median household income of just under $70,000.

Source: Bloomberg as of March 31, 2022

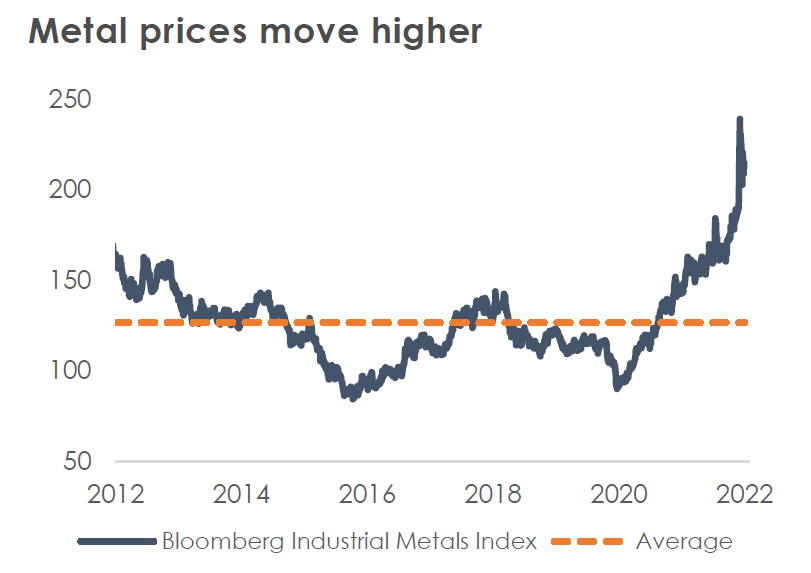

It is not just energy prices on the rise. Global food shortages are a risk as fertilizer prices also spike on short supplies. Wheat prices have risen over 30% this year, and the prices of metals including aluminum, iron ore, and nickel have also soared. Demand for metals will certainly remain elevated over the next several years given they play a critical role in renewable energy infrastructure. Building a single 100-megawatt wind farm requires 30,000 tons of iron ore and 50,000 tons of concrete, and electric vehicle batteries require significant amounts of steel, aluminum, copper, graphite, and other metals. As a result, there is strong support for broadly higher commodity prices over the next several years.

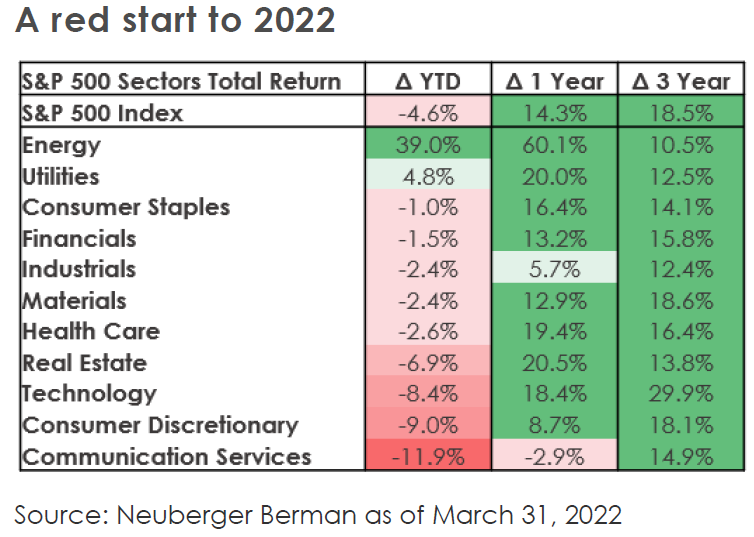

Energy and value stocks outperform

Inflationary pressures and higher interest rates have clearly driven sector performance in equity markets with the energy sector dramatically outperforming in the first quarter. Energy outperformed technology and consumer discretionary by nearly 50% to start the year as many richly valued growth-oriented companies saw a significant repricing and investors rotated into inflation and interest rate sensitive sectors such energy and financials. After years of growth outperformance, we continue to see value stocks catching up as inflationary pressures intensify and interest rates increase from record-lows, reinforcing the importance of a diversified portfolio and serving as a reminder that what has generated the strongest returns over the past several years might not do the same going forward.

The Fed’s fight against inflation

The Federal Reserve and central banks around the world are in one of the most challenging positions in history as they attempt to stifle record high inflation. The Fed is undoubtedly behind the curve in addressing inflation, evidenced by growing expectations for hikes of 50 basis points in a single meeting. After hiking 25 basis points in March, the Fed is expected to raise short term interest rates by at least another 2% or eight, 25 basis point hikes in 2022. Since the 1970s, it has been unusual for the Fed to hike rates through a large global commodity price shock, but this time appears to be different. To further tighten policy, the Fed is also expected to begin shrinking its balance sheet this year.

Accelerated Fed tightening expectations have led to a rapid rise in Treasury yields, and yields globally have risen as other central banks seek to tighten policy amid rising inflation. The amount of negative yielding debt globally has fallen from a peak of over $18 trillion in 2020 to $11 trillion at the end of 2021 and less than $3 trillion currently. There is a clear shift happening in bond markets. On many investors’ minds is the U.S. Treasury yield curve, which has inverted between the two and ten-year maturities. Inversion historically has been an indicator of an impending recession. In our view, the most recent inversion suggests that the economy is vulnerable to future shocks and that aggressive Fed tightening could send the economy into recession. Although yield curve inversions typically do lead recessions, the lead time is highly variable, and in many cases, equity markets can rally for some period of time following inversion. Technical indicators can be useful, but we believe underlying fundamentals are highly critical to investment decision making.

Outlook

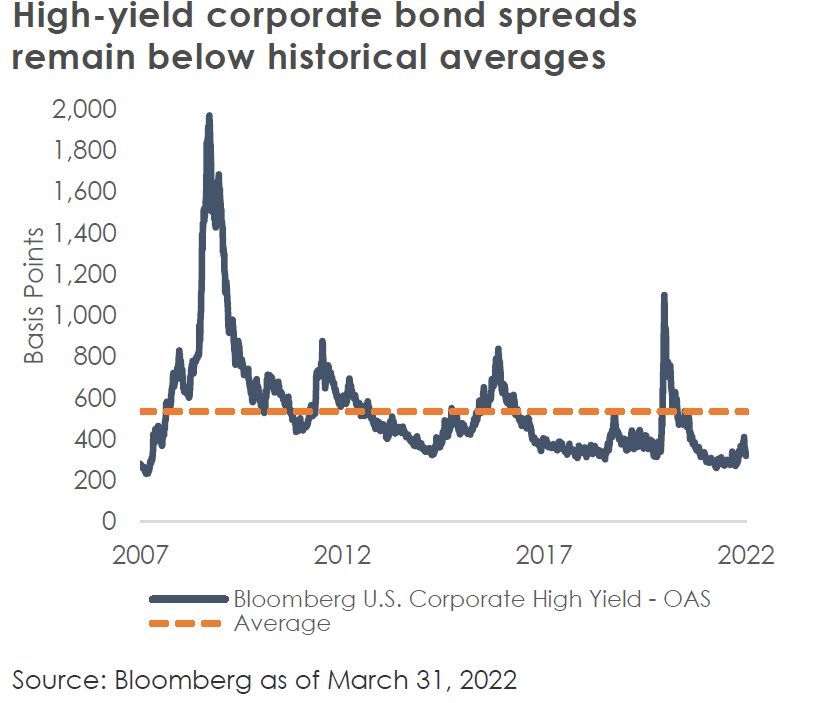

With unemployment falling and at an exceptionally low 3.6%, corporate profits still rising, and household net worth near record highs, we do not believe that a recession is imminent. First quarter S&P 500 earnings per share are expected to rise 5%. Furthermore, credit spreads, an indicator of the creditworthiness of a debt issuer and often of perceptions of overall market risk or stress, have declined after increasing throughout March and February. Credit spreads, though wider than where they were at year end, are at levels that would not suggest poor economic fundamentals or rapid deterioration. The outlook for downgrades and defaults is also favorable.

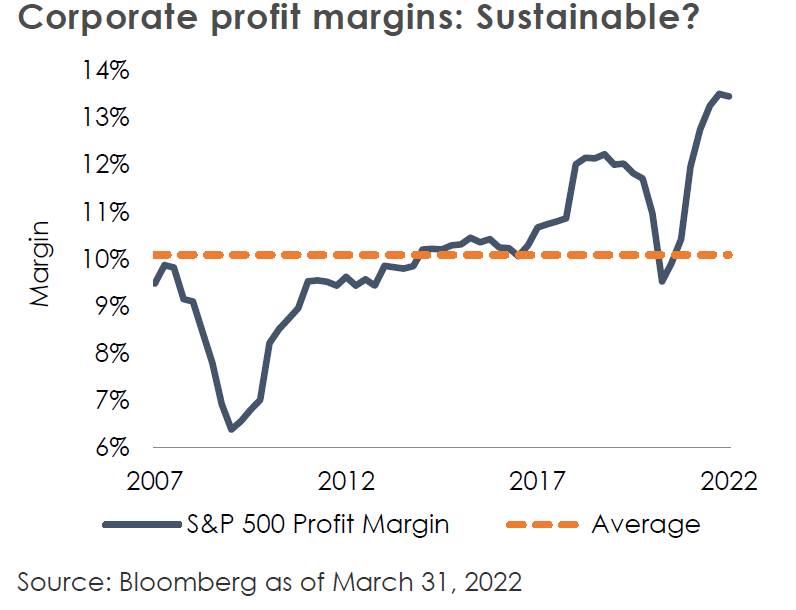

However, looking out over the next several months, we do see risks skewed to the downside, as the Fed continues to tighten and inflation weighs on consumer spending. The most recent University of Michigan consumer sentiment survey revealed that personal finances were expected to worsen in the year ahead by the largest proportion since the surveys started in mid-1940, reinforcing that the high inflation rate is impacting households. How the Fed will adjust its policy in the face of a material growth slowdown or market stress likely depends on the inflation rate and adds to further uncertainty over the next several months. We are also closely watching corporate profits and profit margins, which are at peak levels.

Companies have been able to maintain high profit margins and for the most part pass along increased costs to consumers. With average hourly earnings continuing to rise, up 5.6% in March, and commodity prices advancing, profits and profit margins remain susceptible.

There is no doubt the conflict in Ukraine, even if resolved in short order, has altered both the near and long-term investment landscape, placing Russia amongst the ranks of North Korea and Iran, and putting energy policy, defense spending, and supply chain dependencies at the forefront for policy makers. While we cannot predict the outcome of this horrific situation, we hope for a peaceful resolution as soon as possible. We will see you back this summer for our second quarter outlook.

Kelly Kowalski, Robert Lindberg, Cliff Noreen, Bronwyn Shinnick

MassMutual Investment Management