April 2023 - Ripples

By: Kyle McBurney, CFP

Managing Partner at Highland Peak Wealth

While cruising past Woodrow Wilson's birthplace of Staunton, Virginia, along the famously fast-paced Interstate 81, the car in front of me decided to slam on its brakes going 80 mph. The driver claims to have seen a deer, but let's be honest - that move was pure stupidity. Unsurprisingly, a nasty crunch ensued. Amazingly, and thankfully, everyone, including yours truly, walked away with only minor injuries. That result was a testament to the remarkable safety features in today's cars.

A few days later, I found myself in my doctor's office. Nothing serious, but I was experiencing some quirky discomforts and pains. After a quick summary of events, my doctor told me something I would never forget. A car crash, he said, is like throwing a rock in a perfectly still pond – the initial impact is loud and chaotic, but the ripples spread outwards and disrupt the entire pond's tranquility.

“It’s the ripples and how the body reacts’, he continued, “that gives me more concern.”

This metaphor perfectly captures how we view the current crisis provoked by the collapse of Silicon Valley Bank (SVB). So far, markets are resilient, but the ripple effects in the broader economy are still unknown and will be for quite some time.

For those previously unfamiliar, Silicon Valley Bank was the 16th largest bank in the US, but it reported an astounding $1.8B loss in early March, leading to shockwaves all over Wall Street. The unexpected loss caused a classic bank run, spreading panic among customers and investors. Within a week, the situation worsened and SVB ultimately became the largest bank to fail in over a decade.

Of course, we recognize that March was a bit of a roller coaster on the nerves. As it relates to the noisy headlines, first and foremost, breathe. The woes of others do not impact client cash or liquidity availability. Our cash protection programs are designed for this exact reason. For us, it's business as usual. As is tradition, in moments like these, we encourage you to take a deep breath, tune out the noise, and focus on your long-term investment strategy.

One question I have heard from a handful of clients is whether the collapse is a sign of a 2008 repeat?

Simply put, we do not believe so. The banking and regulatory landscape has changed significantly since the 2008 financial crisis, making it less likely to experience a repeat. While smaller banks may face challenges, we're confident in the sector's stability, thanks to stronger regulation, capital requirements, and risk management practices.

Also noteworthy to keep in mind:

1) SVB was a very niche bank, and in hindsight was not a well-run bank

2) Most banks are far more diversified and defensive

3) In “07, banks were taking excessive risk. Today, it is the exact opposite – most are described as very risk-averse

4) Default swaps of the largest US banks, an investor concern, have barely changed

Interestingly, the first ripple following the collapse of Silicon Valley Bank (and others) has so far been a positive for markets. While stocks first sold off, indexes rallied in the final weeks of March. If nothing else, it is yet another reminder of how difficult it is to time markets – after all, one must get both the event and market interpretation correct.

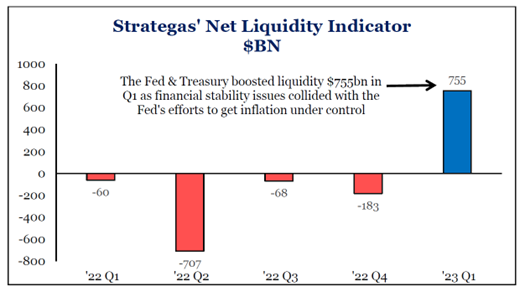

For now, market bulls are enjoying the recovery in equities. SVB’s collapse has led to a perception that the Federal Reserve may adopt a more lenient approach to inflation. Additionally, the Fed pumped liquidity back into the system to avoid systemic risk. In so doing, they reversed five months of balance sheet tightening in only two weeks. It’s like quantitative easing (QE) never left. Strategas’s Jason De Sena Trennert cleverly likens our state of never-ending QE to The Hotel California – “You can check out any time you want, but you can never leave.”

Below is a fantastic summary of how quickly things changed post SVB –

Source: Strategas

Ultimately, the full extent of the issues plaguing the banking system, including those faced by SVB and other similar institutions, is yet to be determined. Or, to put it another way, the ripples are still unsettled. Whether these problems are isolated incidents or symptomatic of more significant systemic issues remains uncertain.

Given all that has transpired, the risk of recession has increased over the past three weeks. It is hard to argue otherwise. As risk managers, we focus on fortifying client portfolios from any near-term economic slowdown.

We continue taking a defensive approach and letting the ripples play out. But rest assured, we will keep our clients informed of any pertinent updates as they arise.

March Month End Performance

Source: Morningstar Direct℠

Past Performance is No Guarantee of Future Results

Q1 Summary

Reminiscent of previous pre-election years, 2023 has gotten off to a good start for investors.

The ride, of course, could have been smoother. To begin the year, stocks and bonds rallied on optimism around a stronger-than-expected economy. This didn't last, however, as February put a chill on the market recovery. Persistently high inflation levels and a robust job market led to expectations of further Federal Reserve rate hikes. However, the market's expectations changed overnight with the collapse of Silicon Valley Bank, which raised concerns about a possible credit crunch as the quarter ended. Stocks quickly fell on contagion fears, only to rally in the final weeks as a softer, more mild Federal Reserve is priced into markets.

Investors have also been flocking to US Treasury bonds, which have performed well in the first quarter of 2023. Bond prices rose as investors anticipate the Fed to pause on rate hikes earlier than expected. US Treasury bonds have been particularly attractive, as they provide a safe-haven asset and continue to offer investors attractive yields.

Other noteworthy observations from the first quarter –

1) While totally beat up in ’22, Tech stocks have had a surprisingly good start for the year

2) Small-cap US – an index comprised of small and regional banks – got walloped in March

3) Developed International (Europe, Japan, Australia, etc.) continues to outperform US stocks

4) Gold continues to climb and provides portfolios with additional diversification

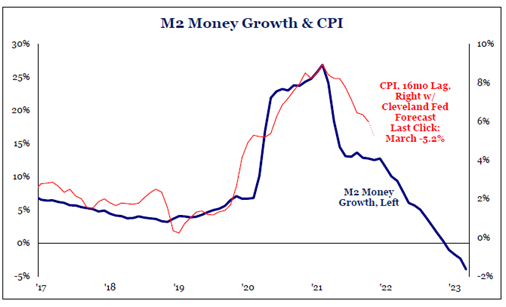

A Quick Inflation Update

On the inflation front, the trend continues to decline. The February consumer price index (CPI), released in March, increased 0.4% for the month and rose 6% year over year. As you can see below, down from the peak inflation of 9.1% last June but still well above the Fed’s long-term target of 2%.

The fate of interest rates in the near-term hangs in the balance, dependent on the somewhat unpredictable ebb and flow of inflation. As I write this, markets appear to be pricing in a 50/50 chance that the Fed will hit the brakes on interest rates in May due to a decline in inflation and worries about the state of the bank sector. However, despite the strong job market and the persistently high energy costs, we remain skeptical. Only time will tell if our skepticism is well-founded. Also, if we get cuts from the Fed, we may not like the reasons behind it.

Naturally, we'll be keeping a close eye on inflation numbers and Fed updates.

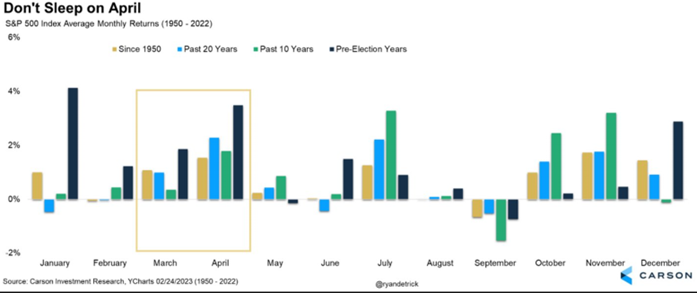

April Flowers Ahead?

It is worth noting that over the past two decades and beyond, April has consistently been the best performing month in the stock market calendar. Although this trend is not always the case (as demonstrated by the painful returns last April), there are a few key reasons why April generates above-average returns.

Firstly, April marks the end of the first quarter, and many investors and portfolio managers will take the opportunity to reposition their portfolios. This often leads to a surge of buying and selling, which can drive up stock prices.

Secondly, companies report their first-quarter earnings in April which can lead to a flurry of additional trading. Normally this is a positive for stocks, but given the uncertainty around corporate earnings, we are less optimistic.

Lastly, and perhaps most importantly, April is tax season, and many investors may have extra cash on hand to invest in the market. This influx of cash can help fuel the market's upward momentum.

Chart of the Month – Decline in M2 (Money Supply) good for inflation, bad for economic growth.

Allocation Update

Let's face it – these are uncertain times. Even the policymakers don't know how the banking upheaval will ultimately play out. Yes, newfound liquidity and lower rates are generally good for stocks, but they do not solve the concerns. When the Fed "breaks" something by raising rates too quickly, collateral damage typically shows up in surprising areas. Markets have demonstrated this confusion. The "risk on" technology, communications, and consumer discretionary sectors led stocks higher in Q1. Conversely, traditionally risk-off assets - gold and treasuries - also rallied significantly. In other words, both bulls and bears seem hesitant to plant their flag in the ground with any conviction.

In such unpredictable times, a more cautious approach is wise. As mentioned earlier, increased defensiveness is a sensible strategy as risks continue to skew towards the downside. Moreover, the stock market is practically addicted to low (or falling) interest rates. And with inflation staying stubbornly high and oil prices rising, we're not convinced that the Fed will totally abandon its previous battle with inflation. To help, below is a summary of our current portfolio positioning:

- Equities – Underweight

o While growth outperformed value in Q1, we still like value long-term

o We remain constructive on International and Emerging Market equities

- Fixed Income – Slightly Underweight

o With rates expected to decrease, we are interested in adding longer-term bonds to lock in yields

o We still like high yield, especially of those companies that have strong fundamentals

- Alternatives – Neutral

o Alternatives can serve as a means of diversifying the portfolio allocation and a hedge against turbulence

o Gold has been particularly strong as nervous investors have flocked to the age old-currency

- Cash – Overweight

o Maintaining above-average cash position for defensiveness and attractive yields (still +4%)

A quick public service announcement: our favorite day of the year, Tax Day, is just around the corner. Please let us know how we can help. Our team stands ready to assist you and your tax advisor in any way possible.

I spoke with a client the other day, and she was eager for Cooper updates. You see, our lovable Teddy usually steals the show when it comes to family updates. But fear not, dear reader - Cooper, now a whopping 10 months old, is thriving. Unlike Teddy, who marches to the beat of his own drum, “Coop” is more of a "by the book" kind of kid. He eats like a champ, crawls like he's training for the baby Olympics, and, most importantly, sleeps on a schedule. The little guy even got baptized last weekend and let me tell you - he was the star of the show. He clapped along to the sermon like he was at a music festival. But don't be fooled - Cooper is just like any other kid when it comes to toys. He's got a house full of them, but what does he love the most? Doors, bathroom accessories, and dog bowls, of course. Typical kid, am I right?

As always, thank you for your support and readership. Questions and comments are welcome.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202604-4205520

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.