March 2023 - TAPAS

By: Kyle M. McBurney CFP

Do we have any Margaret Thatcher fans out there?

Plagued by years of slow growth and high inflation (sound familiar?), Margaret Thatcher had quite a task in her first year as Prime Minister in 1979. Famously dubbed the "Iron Lady," it was her priority to tackle Britain's economic woes and set the country back on a sustainable path. The cure, in her eyes, was simple enough but likely unpopular – spend less, borrow less, and let the free market rebalance the economy. In a notable speech in May 1980, Thatcher appealed to this idea, "There's no easy popularity in what we are proposing, but it is fundamentally sound. Yet I believe people accept there's no real alternative." Later in the speech, she returned to the theme: "What's the alternative?"

From here, the acronym TINA – there is no alternative - was born and became a rallying cry for Thatcher's policies.

Fast forward to the great financial crisis of 2008. A student of the great depression, Fed Chair Ben Bernanke was obsessed with the notion of the wealth effect. In his eyes, this was the path to economic growth and price stability. The wealth effect is a simple idea – if people’s assets go up and they feel wealthier, they will spend more, travel more, and thus heal the broken economy. But with a broken housing market, how was this possible?

In Bernanke’s eyes, the stock market was the best mechanism to accomplish this. What transpired next was historic. Interest rates were slashed to zero, and easy money flooded the economy. The Fed further informed the market that rates would remain "exceptionally low for an extended period." Predictably, bond yields cratered. In just a few years, the 10-year treasury fell from 4% all the way down to 1.5%. Corporate and Muni bond yields also fell, and income became harder and harder to attain.

There is no alternative was reborn. With unattractively low bond yields, stocks suddenly became the only game in town, just as Bernanke and the Fed intended. Talking heads everywhere began using the TINA acronym. It was everywhere and the unofficial motto of a surging stock market. Stocks over bonds became painfully apparent. This TINA trade environment flourished for over a decade, driving fantastic stock market returns well ahead of historical norms. As a result, people began to feel better and spend more, just as Bernanke had hoped.

Even as a young financial advisor and industry neophyte at Morgan Stanley in 2010, the choice was clear – why would I invest in a 10-year treasury giving me 1.5% when I can own S&P 500 index for 10 years and earn a 2% dividend yield?

Jump forward to 2020 and the COVID response from the Federal Reserve fueled the TINA trade even further. A return to emergency-level interest rates and record stimulus pushed the 10-year treasury to an eye-popping 0.65%. We all remember the story here – money supply exploded and flows into stocks exploded as cash had nowhere else to go. This drove prices higher and was a powerful force behind '20 and '21's spectacular equity returns.

Don’t look now, but it appears that stocks finally have a legitimate alternative.

As I write this, a one-year treasury bond yields 5%. Treasury bonds have never been this exciting. I’ve probably discussed money markets and treasuries more in the last three months than I have in the last ten years!

After a fantastic run, is the TINA paradigm finally over?

Most likely. In fact, we are already seeing some fancy new acronyms around town. Deutsche Bank, for example, has dubbed the shift TAPAS – there are plenty of alternatives – not to be confused with frustratingly small plates of food. As interest rates continue to go higher, bond yields continue to become more and more attractive. For the first time in decades, treasuries and cash are valuable components of a well-diversified portfolio. Tapas, as it turns out, is a perfect analogy – as portfolio managers, we now have multiple dishes we can choose from instead of just one.

As it relates to stocks, things get more complicated. The current environment contrasts sharply with the landscape that followed the financial crisis. As new cash enters the market, stocks have more competition. More and more money is being diverted into bond and cash funds. Higher rates also hinder market valuations. Put another way, investors are less likely to pay for stocks that cannot generate earnings higher than current interest rates. Higher yields also give pause to investors who see a 5% yield as a better alternative to a less predictable stock market.

So, as an investor, why not bail on stocks entirely and sit comfortably in a short-term treasury with a 5% yield?

If it were only that simple.

Hypothetically speaking, getting out of the stock market for a 5% treasury bond may reduce your near-term blood pressure, but it creates challenges for the long-term picture. Such a strategy would result in some rather obvious challenges -

1) Reduction in purchasing power against inflation (CPI is higher)

2) Tax inefficient – Treasury Bonds, while State tax free, incur federal taxation

3) When do you get back into the stock market?

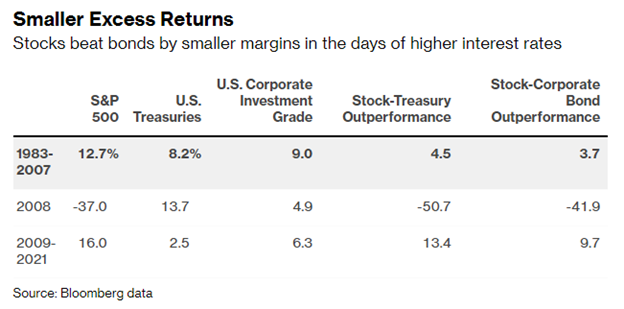

With higher rates and more attractive yields, expecting more muted stock market returns is reasonable, but that does not mean that investors should give up on equities. Not at all. If history is any guide, stocks do fine when rates are elevated. Below are pre-financial crisis returns – when the 10-year treasury spent much of the time at +6%.

Ultimately, the environment of higher rates, and more attractive yields should be considered a positive. Yes, stock returns may come down, but investors should still expect a solid return in the long run. As portfolio managers, getting clients 4-5% on cash and cash equivalents is a beautiful thing. The flexibility is refreshing. We no longer feel forced to deploy all cash into a single asset class. Fixed income overall looks more and more appealing. Perhaps reports of the death of the 60/40 portfolio have been greatly exaggerated!

This will be an important theme as we get deeper into 2023. We will do our best to communicate our future thoughts.

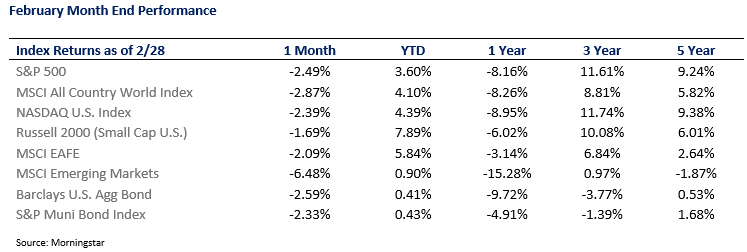

An historically challenging month for stocks, this past February was no exception.

After a euphoric January, stocks and bonds fell in unison as optimism of a new bull market and a softer Fed was dashed. Economic data released last month came in hot – consumer spending jumped 3%. Wall Street was further rattled by inflation reports that remain stubbornly high, and the rate of decline was not as prominent as hoped. In addition, the labor market remains tight, with employment data coming in above expectations – good for the economy but a mixed bag for stocks.

Add it all up, and markets are beginning to price in the possibility of more rate hikes than previously anticipated. Below is a helpful chart that illustrates what the market is pricing in (green dots) versus the previously released Fed outlook (blue dots).

The Fed isn’t disputing this either. For example, Fed Governor Chris Waller remarked, “recent data suggest that consumer spending isn’t slowing that much, that the labor market continues to run unsustainably hot, and that inflation is not coming down as fast as I had thought.”

Today, markets expect an additional 0.25% rate hike at the March 21-22 meeting. There is still a good deal of uncertainty when it comes to inflation and monetary policy. We will pay close attention to see if their Fed language has changed. At a minimum, recent economic strength has likely taken the possibility of any significant rate cuts off the table.

Corporate Earnings

Adding to February’s hangover, corporate earnings in the 4th quarter of ’22 came in a little softer than hoped. Not disastrous, but not encouraging, either. Of the 465 companies in the S&P 500 that have reported earnings, only 68% have reported earnings above analyst estimates. This may sound good, but this is the lowest number since 2020 and below the 12-month average of 76%.

Source: Strategas

A Quick Look at Europe

As discussed in previous newsletters, we continue to look favorably at European stocks.

Of course, we are not alone. Recently, global stock investors are finding the value-heavy European market more appealing than their U.S. counterparts. Despite a lackluster February in most markets, the EURO STOXX 50 (the European equivalent to the Dow Jones) finished in the green. When compared to US stocks, European stocks have a few notable positives –

1) More attractive valuations – forward PE of 14.7x vs. the S&P 500 at 18.4x

2) Promising forward looking data – Manufacturing data coming in strong

3) ECB currently more dovish than Fed

Recent returns reflect this optimism. The MSCI EAFE index has outperformed the S&P 500 by almost 2% year-to-date, and by an impressing 5% over the past 12 months.

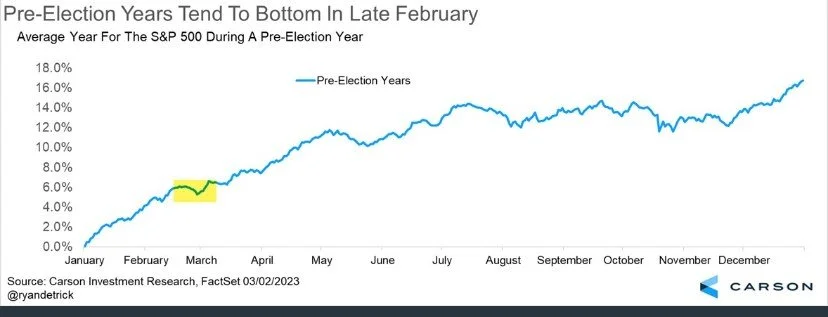

Chart of the Month - A Reminder of What Pre-Election Years Usually Look Like

Allocation Update

Our outlook remains the same as last month: risks to economic growth continue to skew to the downside.

However, we see some encouraging signs in the stock market, specifically around trading activity. For one, small-cap stocks continue to lead the way. This is common in the early stages of new bull markets and a rarity leading up to an economic recession. At a sector level, "growth" sectors such as technology and consumer discretionary are the top performers, while the classic recessionary sectors (like utilities and consumer staples) are laggards.

Looking more granularly, it is also interesting to see which stocks are obtaining new highs. Last week, markets saw new highs in steel, casinos, lodging, building materials, auto manufacturers, and industrial machinery – all very cyclical industries. These are not the companies you would expect to see thriving on the cusp of recession. Then again, maybe the market is telling us something. To quote famous investor Stanley Druckenmiller, "the stock market is the best economist I know." It will be interesting to see if this trend continues.

Nevertheless, we continue to remain underweight in equities. We are happy to cheer on stocks from a slightly more defensive position. However, our focus remains on uncertainty around the Fed and a deteriorating outlook for corporate profits. In addition, it is hard to look past the persistence of sticky inflation and all that it implies. Eventually, the Fed should feel comfortable pausing or cutting rates – essential to move past the downside risk of declining corporate earnings and economic growth. However, we're just not there yet, and recent data implies this may be a ways away.

On the fixed income side, we prefer to be overweight. After all, bonds and cash equivalents now offer their most compelling return potential since the early days of the global financial crisis. At these levels, we are happy to lock in higher-yielding bonds and treasuries as we wait for more clarity from the federal reserve. Given the state of the yield curve, we like short-term bonds (think 1-5 years) but plan on adding longer bonds once the Fed pauses.

Tax Season

The joys of tax season are upon us. Per our last communication with NFS, all 1099s and other tax documents should be ready by mid-March or sooner. Our team stands by, waiting to help. Please do not hesitate to reach out if you have any questions or if you would like us to email your respective forms to your CPA via secure email. We want to make the process as easy as possible.

I wish LEGO was a publicly traded company. Talk about recession-proof.

Despite an impressive collection, our four-year-old is determined to grow his LEGO collection. His lineup of police stations, fire stations, trucks, and jails just won’t cut it. He must have the new police command center; there is no alternative. However, as parents, we do our best to instill good financial habits and well-adjusted children. We made it clear to Teddy that he has two options – wait for his birthday or buy it himself. His birthday is in August, an eternity in toddler world. Therefore, all his focus the past week has been on how to make money. Finally, after hours of questioning, Teddy has decided on a classic – open a lemonade stand. Margaret Thatcher would be proud! And, as a father, I certainly don’t want to get in the way of this newfound entrepreneurial spirit. So, if you see me on the side of the street, pull over and say hello! After all, lemonade tastes best in 40-degree winter weather, no?

As always, thank you for your support and readership. Questions and comments are welcome.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202603-4027030