December 2021: Deja-Vu All Over Again

By Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

Forgive me if I let out a loud sigh.

“Just when I thought I was out, they pull me back in!”

Michael Corleone in The Godfather: Part III

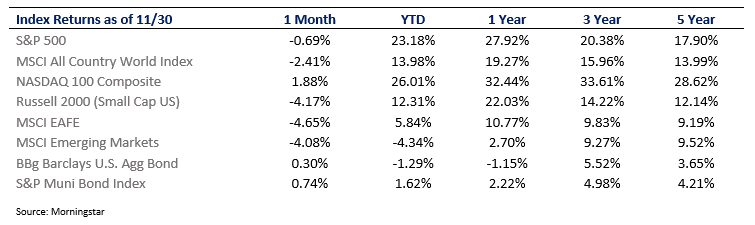

A quiet Wednesday morning has allowed me to gather my thoughts on recent events. Of course, we can’t pretend to know much about the most recent Covid headlines, but we can do our best to interpret data and evaluate from our market-centric lens.

First discovered in Botswana, the Omicron variant appears more contagious than the Delta and therefore has markets rattled. If it turns out to be mild/less severe than other variants (which is entirely possible), investors can go back to focusing on inflation and interest rates. Until then, we expect prices to continue to swing around a fair bit as markets try to get ahead of the science (as was the case last March) and calculate the risk of new lockdowns.

In times like these, it is helpful to lean on the lessons learned from 2020. Even if you got last year’s Covid call correct, you likely got the market call wrong. To put it another way, even if you were right in predicting the severity of the virus, you most likely did not simultaneously predict a remarkable stock market rally.

Although easier said than done, ignoring the day-to-day gyrations in the market is often the best strategy. Days like the Friday after Thanksgiving are a good reminder of that. Of course, we would all love to time the market and miss the worst days, but that isn’t realistic. Most likely, you will miss out on the best days, which is far more damaging.

Markets are complex, and timing them is impossible. Stay the course.

Thoughts on Omicron

I hear famed investor/baseball catcher Yogi Berra in my head saying, “It’s Deja-Vu all over again!”

As a disclaimer of sorts, it is still very early in terms of understanding the Omicron variant. Also, we certainly don’t pretend to be medical experts (or pretend to play them on television!). However, we can surmise how markets will be impacted.

For investors, the market risk of the new variant has less to do with the virus itself and more to do with the associated policy response. Lockdowns and restrictions are likely to slow down the economy and alter fiscal, monetary, and health policies. This is especially important as it relates to the market's pricing in (that is, taking into account) Fed interest rate increases.

A few quick opinions on what we see –

1) Lockdown policies carry with them greater political risk today than they did in 2020 (unlikely to be as extreme)

2) Restrictions or a purposeful slowdown of the economy will likely necessitate greater fiscal spending

3) It is unclear how renewed lockdowns will impact inflation

a. Positive – potential ease at the pump (Oil down +10% over past week)

b. Negative – continued/amplified supply chain disruptions

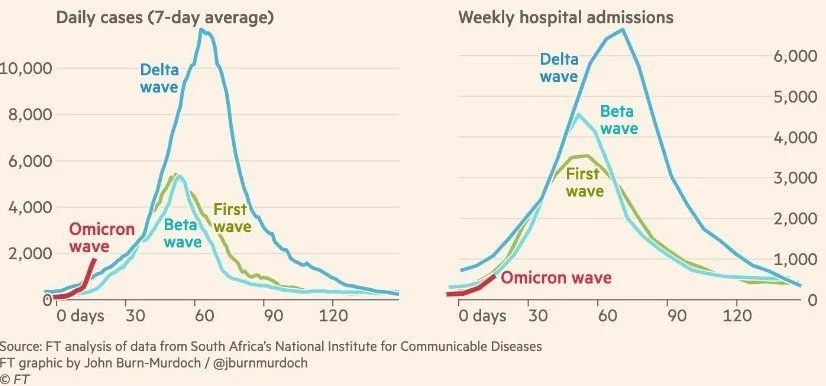

The past few days have been a real gut punch. Outside of bonds, just about everything is down, even gold. Despite this, we ask you to take a deep breath and allow our understanding of the new variant to develop. The Omicron variant may be less severe and milder than previous strains (or vaccines may still provide a suitable defense). This will significantly reduce the risk of any notable lockdown or economic restriction if this is the case. So far, the numbers out of South Africa point to this. See below:

As the graph indicates, the Omicron variant is highly contagious but thus far is less severe than the other strains. This data should be interpreted with caution, of course, given its newness and small sample size. However, doctors who have been treating it in South Africa describe it as less virulent than Delta. According to experts, this is relatively consistent with the natural evolution of viruses – virulence tends to moderate as they mutate. This mutation causes the virus to become more easily infectious but simultaneously lose the ability to cause severe disease. Fingers crossed that this is what is happening with the Omicron variant. We will be paying close attention to data as it comes out.

Put it all together and we feel that it is far too early to make any significant adjustments to our portfolios. Instead, it is prudent to wait for the data to come out in order to arrive at an improved understanding of Omicron. After all, we certainly do not want to miss a potential market rally should we receive positive data points.

Inflation & the Fed

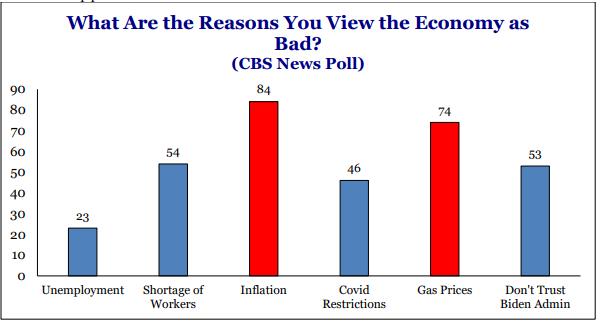

Just three short days ago, it was inflation that had the full attention of the market. Inflation is the number one political issue for American voters. For the first time in a long time, more voters are worried about inflation/rising costs than unemployment. This shouldn’t be surprising at all. Inflation has surged this year, up 5% from last October, with gas prices at multi-year highs. Below is a recent voter poll from CBS New:

Source: Strategas

Citing this inflation threat, Federal Reserve Chairman Jerome Powell expressed a willingness to accelerate the Fed’s easy-money policies pullback. His comments display a noticeable shift from prior Senate hearings. If nothing else, developments indicate a clear pivot away from employment concerns and towards a focus on inflation.

Upon Chairman Powell’s announcement, markets sold off. Given the additional news of the Omicron variant, this sell-off was likely out of line with expectations. Either way, we find Powell’s comments to be prudent. Getting more hawkish (fed speak for aggressive) on tapering their bond-buying program allows the Fed to take a firmer stance on inflationary pressures. If prices begin to come down in the Spring of 2022, it may minimize the need to raise rates too quickly. However, that is an enormous “If,” especially with the Omicron variant looming large. Of course, we will keep you updated on this.

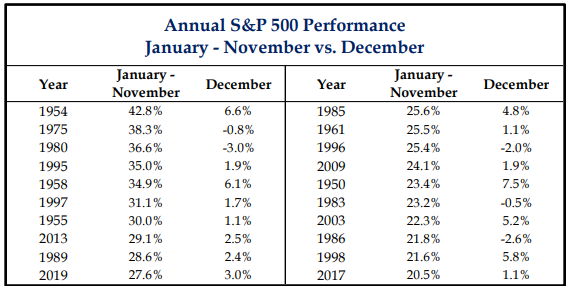

Santa Claus Rally Still Around the Corner?

According to Strategas, since 1950, there have been twenty instances where the S&P 500 return was greater than 20% from January to November. In those instances, the S&P 500 in December has been up an average of 2.2% - with positive returns 75% of the time. Of course, markets are processing a lot right now, but this is usually a very bullish time of year.

Source: Strategas

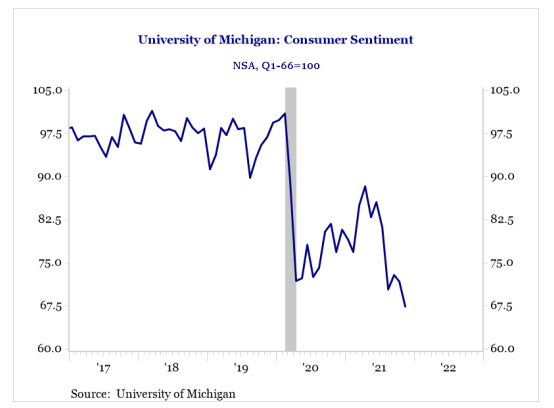

Chart(s) of the Month – US consumers saying one thing but doing another

Consumers say they are not feeling so great….

Source: Strategas

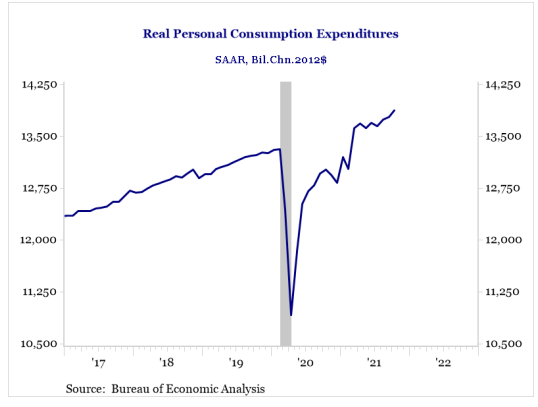

But still spending and buying a lot of stuff (fueling optimism for strong holiday season).

Source: Strategas

Allocation Update –

Throughout the year, we have maintained a slight overweight to stocks. This has worked out tremendously well for client portfolios that have benefited from the market rally. Despite the noise, we have no plans to reduce our overall exposure in the short term. Under the surface, however, we have been making some adjustments within client portfolios. For example, as mentioned last month, we have reduced our exposure to the emerging market space. This move comes from more significant concern around the increasingly fragile Chinese economy and supply chain disruptions.

While we see a return of shelter-in-place mandates as socially and politically risky, some restrictions/lockdown environments would not be beyond our imagination. The list of international travel restrictions, for example, is growing by the day. Should this continue, expect us to shift our equity allocation towards more growth stocks. As a reminder, these are the names that thrived during lockdown – predominately tech stocks that flourished while we were all stuck at home. Currently, we are in a holding pattern on this, but looking closely at market internals and trading activity.

Important to note, the TINA paradigm (there is no alternative . . . to stocks) is still alive and well. Fixed Income markets continue their struggle to provide a positive return. We expect this trend to continue into 2022. As such, our team will utilize the additional cash on the sidelines to position portfolios better as we head into year-end. If this sell-off continues, we may do this quicker than previously anticipated. We will keep you updated every step of the way.

Operationally, this is the time of year where we ramp up tax-loss harvesting. Of course, this is a significant focus throughout the year, but we pay extra attention in the closing months. Although a +20% rally in stocks limits our ability to harvest losses, the recent Omicron-related sell-off may provide additional opportunities. Every little bit helps!

Every Thanksgiving, it is a McBurney tradition to go around the dinner table and tell everyone what you are thankful for, as well as to complain about a pet peeve. Not surprisingly, the pet peeve portion usually takes the most time, and it becomes a sort of airing of grievances. But I digress. There are many things we are all thankful for, and we tried to list them all. Yours truly, of course, mentioned how grateful I am to have clients/colleagues who laugh at my jokes (wink wink). As it was my three-year-old son Teddy’s turn, you could tell his brain was working hard. After a slight pause, Teddy proclaimed, “I am grateful for water because when I drink it, I go ahhh.” Thus, Teddy won the award for best comment. All other answers were inconsequential and silly by comparison.

Cheers to a successful and healthy 2022 ahead! I now get to use one of my favorite math jokes.

Did you know that 10+10 and 11+11 are the same?

10+10 equals twenty, and 11+11 equals twenty too 😊

You are quite welcome. I have waited years to use that.

Have a safe and happy holiday!! Thank you for being such fantastic clients and colleagues.

As always, questions and comments are welcome.:

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202412-1336379.