January 2022 - A Year in Review

By Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

In his infinite wisdom, my father-in-law likes to tell the family of a story that reminds us of a useful lesson.

As the story goes, people are led into an auditorium. Then, as a movie is played in the background, an individual comes out and sets out ten candles on a table – lighting the first 9 in order, but deliberately leaving the 10th candle unlit.

At the movie's end, an exit interview is carried out. The administrators ask each participant, “What did you notice about the candles?” The most common response, in so many words, were:

You missed one!

There was one that wasn’t lit!

Unsurprisingly, the total focus and ire of the contestants lay on the unlit candle. There was zero mention of the nine candles that were lit. This, in a nutshell, is negativity bias.

Negativity bias reflects our tendency to react more strongly to negative stimuli and react more powerfully to adverse events. In investing terms, negativity bias is our collective inclination to focus on the negative news and ignore the positive. Even worse, it pushes us to focus on negative possibilities instead of positive events that are actually occurring.

2021 was a year defined by one all-time market high after another, record profits, and roaring economic growth not seen since the 1950s – pushing the S&P 500 to a +28% gain. The Federal Reserve remained accommodative and kept interest/borrowing rates ultra-low. And yet, it was a year where, as advisors, we were regularly battling overstated headlines – with inflation concerns stirring us all.

From our humble perch, the 24/7 news cycle and corresponding social media is only getting louder, larger, and increasingly gloomy. The collective noise has become a test for even the most committed investors. Looking ahead, 2022 will likely be a far more challenging year for investors in many ways. The double threat of an unpredictable pandemic and looming interest-rate increases will provide plenty of reason for worry.

As a new year’s resolution of sorts, let’s all work to focus on those nine-lit candles and do our best to ignore that candle that remains unlit. After all, we remain bullish on ’22, despite some expected bumpiness. Mid-term elections and rising rates will certainly make things interesting, but we believe the same cocktail of low rates, economic growth, and consumer strength will push stocks higher, albeit at a more moderate pace.

A Review of 2021

Did 2021 feel like a long year to anyone else? Was it just me?

If anything, calendar year 2021, as with 2020, was not dull. Contested elections, COVID’s persistency, supply chain issues, and inflation galvanized our attention but did little to deter rallying markets. Yet, despite the clamor, US stocks produced a remarkable year. Outside of some weakness in the emerging markets sector, markets were up across the board. The S&P 500 led the charge, up a whopping 28.71% for the year, and with its fourth-best annual return in the last 25 years. The Nasdaq Composite Index was close behind, the leader for most of 2021 before a tech selloff in December.

The stock market also avoided any sort of meaningful pullback in 2021. From a historical perspective, it was a very calm year. Outside of a few short periods of tumult, markets simply climbed higher and higher. In fact, according to Strategas, there were 70 new market highs made in 2021 – second best only behind 1995.

The growth vs. value trade was essentially neutral last year. As a reminder, growth companies can create profits independent of what the economy is doing (think tech, discretionary, and pandemic stocks) whereas value companies are more economically sensitive and typically trade at more reasonable valuations (think bank, staples, industrials, and energy stocks). Both segments had an excellent year – growths stocks gained 27.5% while value rose 25%. Our call was that value stocks would lead the charge in ‘21. We were looking “wicked smaht” for some time, but growth stocks gained momentum as new variants arose. More on growth vs. value later in this newsletter.

Outside the US, other countries didn’t fare quite so well. The MSCI All Country World Index (ACWI), about 65% of US stocks and 35% International, rose 18.5% in 2021 - an impressive return but a reflection of international stocks not quite keeping up with US markets. The MSCI EAFE Index, a barometer of developed international (Europe, Japan, Australia, etc.), rose 11.26% in ’21. A very good year, but modest compared to US market returns. Either way, investors should be happy with the returns, especially given the number of variants and corresponding lockdowns that ripped through Europe.

Despite a rally in commodity prices, emerging market stocks did poorly. This is somewhat unusual but less surprising when China is considered. Within the emerging market index, the most significant component is China. The CSI 300 Index, which tracks the largest Chinese mainland-listed stocks, fell 5% in 2021. Yes, we know about property developer Evergrande and its complications, but China’s economy is looking more and more fragile, and the government response to its currency/tech sector is concerning. As a result, we are keeping emerging market exposure light.

Fixed Income trudged through ’21, and we expect more of the same in ’22. At this point, the direction of interest rates is quite clear, and we would be surprised to see rates go lower (a positive good for bond prices) in the short term. Having said that, the remarkably stable munis have demonstrated all year how valuable the asset class can be as a hedge against volatility in a well-diversified portfolio. We don’t expect that to change.

In summary, ’21 was a fantastic year for client portfolios. The below numbers are truly remarkable:

The Unlit Candle

Yes – I realize I am going back on my own advice, but a little perspective is always helpful against noisy headlines.

Throughout 2021, inflationary pressures grew as consumer demand increased and overwhelmed supply. Supply chain bottlenecks have been an ongoing struggle, as is an enduring labor shortage domestically and abroad. By year-end, inflation had spiked and stayed elevated long enough to force Jerome Powell and the Federal Reserve to remove the word “transitory” from its commentary, thus taking a somewhat more hawkish stance.

Inflation was certainly not a problem for risk assets in 2021. Despite U.S. inflation reaching nearly a four-decade high last month, stocks continued to rally. However, elevated levels of inflation will remain a theme in the first half of ’22. But, as a healthy reminder, a strong economy requires some level of inflation. Even more, markets in the past have done just fine if inflation rates remain reasonable. Below is a terrific graphic from the Capital Group:

Source: Strategas

A few things jump out at me here:

1) The stock market generally performs well if inflation remains below 6%

2) If inflation rates settle in that 2-4% sweet spot, markets should react positively

3) Deflation, or negative inflation, continues to remain the more hazardous environment for stocks

Our primary concern of inflation is less about inflation itself and more about the corresponding reaction from the Federal Reserve. Over the past few months, Jerome Powell and friends have pivoted and changed their message – communicating a willingness to hike rates sooner and reduce their bond-buying program. Markets have taken this transition in stride and appear comfortable with the plan. Should the Federal Reserve stick to its strategy of raising rates (not in an aggressive manner) throughout the year, markets should react quite positively.

However, and this is important, should the Federal Reserve become more aggressive or alter their language (like they did on 1/5), expect some extra volatility within markets. We will be monitoring the situation closely.

The “Midterm” Year

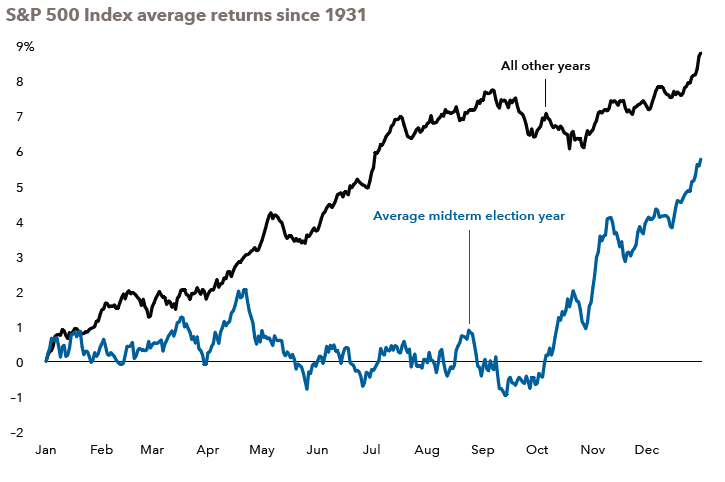

The below chart from Capital Group shows that the midterm election year can be a grind for US Stocks. That is until election results become priced in:

Source: Strategas

The big takeaway here is that it doesn’t matter who wins, but rather that the election happened. Markets hate uncertainty, and the conclusion of elections are almost always bullish. In Presidential election years, stocks generally sell off in the late summer/early fall days, only to rally up to and following election day. Midterm election years, by contrast, historically lag all other years but still produce a ~6% return on average. We expect to revisit this chart later in the year as election cycle chatter picks up.

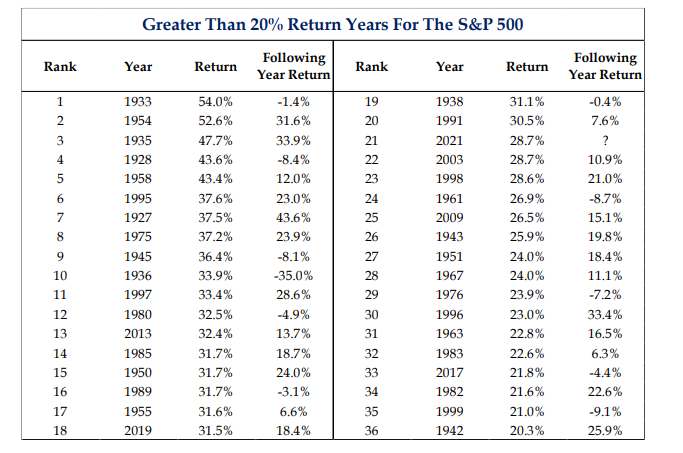

Chart of the Month – Newton’s First Law of Motion

There are a lot of numbers here, but to summarize, following a 20% return in a year, markets the following year average an 11.3% return and produce a positive return 69% of the time. An object in motion tends to stay in motion.

Source: Strategas

Allocation Update:

Throughout 2021, we maintained an overweight in stocks with less exposure to bonds. This approach worked out tremendously well for client portfolios in ’21. In addition, we gained even more outperformance by tilting portfolios heavier into U.S. markets and lighter internationally.

As we enter 2022, we continue to maintain our overweight in stocks (as well as a tilt towards U.S. stocks) for three primary reasons: 1) consumer balance sheets are in great shape, pushing spending and corporate profits higher; 2) interest rates remain ultra-low, albeit rising at the current time; and 3) The acronym T.I.N.A is still alive and well.

I want to take a second to revisit T.I.N.A – There is no alternative (to stocks). This is a powerful, less discussed catalyst for stocks in our option. I have mentioned it before; it essentially reflects the idea that there is no comfortable place to find decent returns outside of stocks. Certainly, the answer is not in bonds, as rising interest rates pressure total return. And while Real Estate and Commodities are options, we already have quite a bit of exposure in these areas and currently hesitate to add more. Our team, along with portfolio managers all over the country, have difficulty allocating new cash anywhere other than to stocks. Also, it is a challenge to “reduce” stock exposure where no reliable alternative exists.

Within our allocation to stocks, however, we have made what we believe are some sensible adjustments:

1) We have increased our tilt to value stocks – reducing investment in tech stocks and increasing investment in “boring” companies.

a. This approach is better suited against rising interest rates

b. Better suited to deal with inflationary pressures

2) We have added exposure to the Financial Sector – banks are especially well positioned heading into ’22.

a. They make more $$ as rates move higher

b. They benefit from the strong housing market and lending environment

3) We are reducing Emerging Market exposure – China too risky; we feel more confident in U.S. markets.

We continue to favor shorter-term bonds on the fixed-income side, focusing on high credit quality companies. Our team sees rough waters ahead for fixed income, so our exposure remains limited versus long-term targets. We continue to monitor TIPS (Treasury Inflation-Protected Securities) to potentially hedge our bond allocation against inflation. TIPS had a decent ’21 but have been showing weakness of late. Before we add to client portfolios, we want to see more price stability.

Putting it all together, we feel like client portfolios are very well positioned heading into a higher interest rate environment. Our team will continue to analyze market activity and communicate changes as they come.

We hope that you all had a wonderful holiday season and New Year. The McBurney holiday season was chalk full of trucks, spaceships, and finance books (for me of course 😊). We look forward to seeing each of you soon.

Cheers to 2022! I am trying my best not to use my “2020 too” joke again. May we all have a happier, healthier year ahead.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index

Copyright 2021, Highland Peak Wealth. All rights reserved. Troy Newman and Kyle Mc Burney are registered representatives of and offer securities and investment services through MML Investors Services, LLC, Member SIPC. Supervisory Address: 101 Federal Street, Suite 800, Boston, MA 02110. 617 - 439 - 4389. CRN202410-1022206