February 2022 - Early Bumps

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

February 2022 – Early Bumps

With all due respect to T.S. Eliot, April is not the cruelest month.

With the holidays over, and our “diets” kicking into gear, investors faced a grueling January. The usually bullish month produced flustered markets, Omicron-related sick days, and a couple Nor’easters here on the East Coast for extra fun. Put it all together, and the expected market bumps of 2022 arrived earlier than anticipated. Even a strong market rally in the final week couldn’t entirely reverse the worst month for stocks since the onset of the pandemic.

While markets evaded a correction – a dip of 10% or more – January’s sell-off certainly had an edgy feel to it. Markets hate uncertainty, and thus far, 2022 has provided plenty of it. Investors had plenty to digest in January, from unknowns around the Federal Reserve, elevated inflation numbers, as well as Omicron-related slowdowns. There were few places to hide, as the sell-off encompassed just about every asset class. Even bonds, steady by nature, fluctuated around Fed speculations and expected rate hikes.

This type of market volatility, if the temporary pain can be ignored (or at least endured), can be tremendously helpful in the long run. Yes, it's no fun when stocks are going down, but environments like these can provide excellent rebalancing and tax-loss harvesting opportunities. Therefore, we thought that a quick guide of Do’s and Don’ts would be helpful.

At Highland Peak Wealth, we manage core wealth. Client portfolios will always be diversified and balanced. Despite January’s noise, well-diversified portfolios held their own, typically down just ~4%. The speculators of cryptocurrency, NFTs, SPACs, “Meme” Stocks and other notorious high-flying growth stocks were seriously hurt in January and, quite honestly, may never recover. That’s not what we do here. Our portfolios are constructed to weather the storm. We have, however, made some intelligent alterations within client portfolios. More on this later.

We understand that these types of markets can be nauseating and stress-inducing. We ask that you continue to keep the long-term in mind and ignore these day-to-day fluctuations. We knew that ’22 would have its share of bumps and more lie ahead. We still believe ’22 in the end will provide a positive return for stock investors.

The successful long-term investor does not try to evade downturns but instead endures them.

January Performance

Looking At History for Guidance

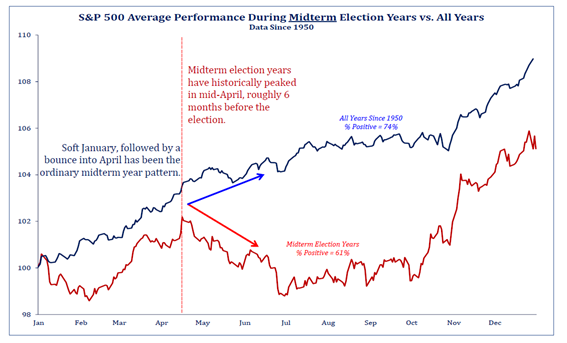

When it comes to midterm election years, a selloff in January is historically common. This is especially interesting because January is typically one of the best months of the calendar year (in all other years). So whether it is markets getting ahead of an uncertain year, or something more complex, it deserves our attention. Below is a fantastic chart from Strategas:

Source: Strategas

This chart helps to illustrate a few interesting points –

In midterm election years, it is customary to see a January sell-off followed by a Feb/March rally

Markets seem to hit a wall in the spring and slog through months leading up to the midterm elections

It is a reminder of just how powerful that post-election rally can be

Given January’s end-of-month rally, which has continued to bleed into February, I find this historical performance particularly interesting and applicable. Should markets continue to follow this trend, it may convince our team to raise some cash in April. This would accomplish the dual goal of increased defensiveness over the summer and dry powder leading up to the Midterms. It is far too early to effect, of course, but thought-provoking. More on this in the coming months, I am sure.

A Review of Market Corrections

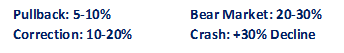

Market corrections are far more common than we probably realize. As a reminder, set forth below is a guide to definitions used in stock market selloffs:

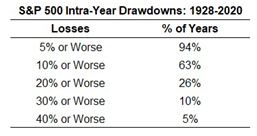

US stocks ended the month in pullback territory, but only barely (S&P Decline of 5.17%). Following 2021’s tremendous rally, it would be far more uncommon if stocks did not experience a market correction of some kind. Over the last 100 years, the US stock market has declined at least 10% on average once every 11 months. (This does not mean that overall, the year is down.) So, when a talking head goes on CNBC and says, “I expect a correction in 2022,” what they should really say is I expect 2022 to be a typical year. Here is an excellent graphic from Ben Carlson at Ritholtz Wealth Management on the historical likelihood of various market declines:

Source: Ben Carlson, A Wealth of Common Sense

Looking deeper, the average drawdown for US stocks has been roughly 17% each year. I realize that’s a tad confusing, so I will try to phrase it differently: the typical stock market year experiences a 17% decline from its peak at some point during the year. Volatility is part of the game and should be considered the accepted “fee” for long-term returns.

Each weekend, I make it a point to read Jason Zweig’s column, The Intelligent Investor. I have always enjoyed Jason’s writing and believe he has a good pulse on investor sentiments. I recall one particularly entertaining article in late ’21. Jason joked that his job is to write the same idea in 50 different ways, and I am paraphrasing. His reasoning was simple, good advice is good advice, and over time, it really doesn’t change that much.

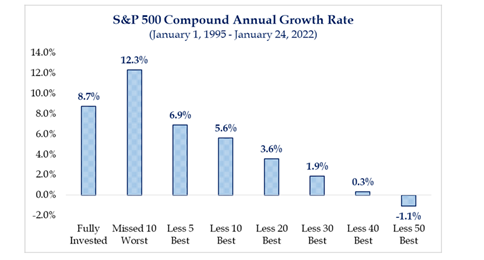

I bring this up because I recognize that this newsletter is heavy on correction speak. It is a subject I have broached before and in various ways using different language. But the point remains the same – timing the market is terribly difficult, and often, far more damage is incurred. Studies of market returns have verified that an investor’s biggest mistake is not having too much in stocks when markets decline; rather, it is not having enough in stocks when markets recover. The below and oft-used graphic reminds us of this. It is great to miss the worst days, but unrealistic, and more often, you miss the best days, as the “best” days tend to follow the sharpest declines.

Source: Strategas

Allocation Update:

Of course, we are not idly sitting by as markets oscillate. This type of environment provides us with the opportunity to make some sensible portfolio adjustments. As the industry saying goes, “never waste a good downturn.”

Aside from tax-loss harvesting within client portfolios, we have used this opportunity to rebalance stocks vs. bond weighting and sector allocations to better prepare portfolios for what should be a more volatile, challenging year for stocks. Moreover, given recent market declines, we have accomplished these rebalances with minimal adverse tax implications.

Our recent rebalancing accomplished two primary goals:

1) Realign portfolios to long-term targets following 2021’s +20% equity rally

2) Reduce our exposure to Mid and Small Cap US Stocks and increase exposure to Developed International

a. Developed International = Europe, Australia, New Zealand, Japan, Hong Kong, Singapore

The second point is particularly important to discuss. Last year, we did tremendously well. Client portfolios benefitted by being extra heavy in US Stocks (up 25%) and extra light in Developed International stocks (up 11%). This was the primary driver for our significant outperformance verse the MSCI All Country World Index – the benchmark that best mirrors our diversified portfolios.

However, as we move deeper into 2022, we have increased our exposure to International Developed stocks. While we are still underweight (another word for “lighter”) compared to the benchmark, we have closed the gap and may do so even further later this year. We are becoming more optimistic around international stocks for three primary reasons:

1) Cheaper valuations – Forward PE of 14.4 vs. US Forward PE of 19.9 (as of 1.27.22)

2) Tilt to Value Stocks – More exposure to companies better suited to higher rates and higher inflation

3) European Central Bank (ECB) growing more dovish relative to US Federal Reserve

International stocks have outperformed US stocks for the previous two months. While US stocks have had the upper hand since the ’08 downturn, it is only a matter of time before international equities take charge. Early in ’22, this has been the narrative. As a result, we expect to keep a close eye on respective performance and communicate any allocation changes.

For a quick McBurney family update – I am happy to announce that we are expecting lil’ McBurney #2 in June 2022. Mom and Dad are both very excited and ready to hit “replay” on those chaotic early days. While we don’t plan on finding out the gender (as we did with Teddy), I have no doubt that he/she will be the best baby at everything and lord of the manor in no time. As far as Teddy is doing, he is very accustomed to being the one and only. But we are making progress. Teddy is getting more excited to share his infinite and never-ending number of trucks with baby “Buzz” – named after his action-figure hero, Buzz Lightyear.

We hope you are well and having a good productive start to the year. While it has been a pleasure seeing you all on Zoom calls, we very much look forward to seeing everyone in person. May the summer of ’22 provide us that opportunity.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202502-1731444