March 2022 - Markets and Conflict

By: Kyle McBurney, CFP

Managing Partner at Highland Peak Wealth

A well-known Russian of the early 20th Century by the name of Vladimir Lenin gets credit for the quote below –

“There are decades where nothing happens, and there are weeks where decades happen.”

I have come across this quote often over the past month. How fitting it is! Unfortunately, an increasingly nefarious, unpredictable, present-day Vladimir is proving this statement to be quite foretelling.

Despite Russia telegraphing an attack for numerous weeks, markets remained hopeful that their respective actions were a simple case of military posturing for political gain. Regrettably, this was not the case. Early in the morning on February 23rd, Ukraine’s government reported that it was facing “a full-scale attack from multiple directions.” Thus, the most significant military engagement began in Europe since World War II. Global equity markets quickly declined as volatility spiked, oil prices shot higher, and the odds of European recession increased dramatically. Markets hate uncertainty, and at this moment, uncertainly is plentiful.

So, what now?

In the short term, investors will experience confusing and noisy times – stay focused on long-term principles. Predicting the ebbs and flow of markets around geopolitical uncertainty is impossible. These events tend to be more emotional than financial, and trading activity typically jumps from one headline to the next. Moreover, each geopolitical scenario is unique, and much of our collective response depends on the specific situation. To put it another way: even if we knew how the Ukraine/Russia conflict would unfold, it likely wouldn’t be helpful from a short-term investing perspective.

In the long term, the market’s response to war and crisis can be quite counterintuitive. Readers will likely be surprised to know that the Dow Jones Industrial Average gained 43% during World War I and 50% during World War II – a collective gain of 115% during the two worst wars in modern history. The Dow gained 60% during the Korean War and 43% during the Vietnam War. I can keep going, but I think you get the point.

Regarding Russia/Ukraine, looking at it purely from a market perspective, the worst of the volatility and market shock might be over. Given the small size of the Russian and Ukrainian economies, there is certainly a chance of a quick bounce back in U.S. stocks as the direct impact on corporate earnings is minimal. Russia makes up only 3.2% of the Emerging Market Index, and Ukraine’s GDP is roughly the size of Nevada’s. However, the true force of the conflict is occurring in higher commodity and precious metal prices – especially around food and energy prices. This dynamic will, in all likelihood, add fuel to inflationary pressures and consumer challenges in the form of even higher costs (especially at the pump).

As I mentioned in last month’s email, these types of markets are excellent opportunities to harvest tax-losses and utilize the power of portfolio rebalancing. More on this later in the newsletter. Otherwise, our team will monitor markets closely, and we will look to modestly adjust portfolio tilts where appropriate.

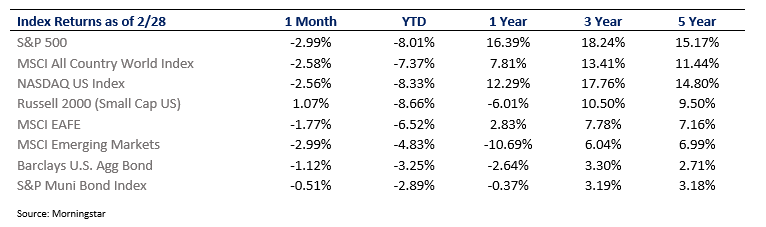

February Performance

Yet Another McBurney History Lesson

Yes, I know – another one. It is, of course, helpful to understand how past markets have reacted to specific military and geopolitical events. Each event has its own pulse and heartbeat, but some overall themes come to light. Below is a fantastic illustration from our research partner Strategas:

Source: Strategas

This chart helps to demonstrate a few interesting points:

After an initial shock, 12-month numbers are exceptionally strong

The only negative returns over 12 months occurred while the economy was already in recession (unlikely for ’22)

Unless in a recessionary environment, markets tend to bounce back quite quickly

Simply put – markets have always found a way to recover, especially when the underlying economy is sound.

Daken Vanderburg, Head of Investments at MML Investor Services, eloquently discussed this subject in his most recent market update:

We, as a country, and more specifically as an economy, have experienced pandemics, wars, supply shortages, consumer crises, supply shocks, and many more events over the past several hundred years.

While each event had its own circumstances and storyline, it was also deemed to be a crisis in some shape or form. And yet…

Each time, regardless of the severity, the event was resolved, the market recovered, and capital markets continued to generate long-term returns in excess of inflation.

Is the Russian escalation different? Well, yes, of course it is. But so were the World Trade Center bombing in 1993, the Cuban Missile Crisis, and the assassination of President John F. Kennedy. Each event had rampant speculation, analysis, and predictions, and yet, on average, markets found a way to recover.

Further geopolitical and military surprises will certainly increase short-term volatility, but it is unlikely to alter the previous market course in the long run. After all, we have been in a challenging market environment since early January. Before Putin stuck his nose out, markets were battling inflation risks and rising interest rates. Speaking of rising interest rates….

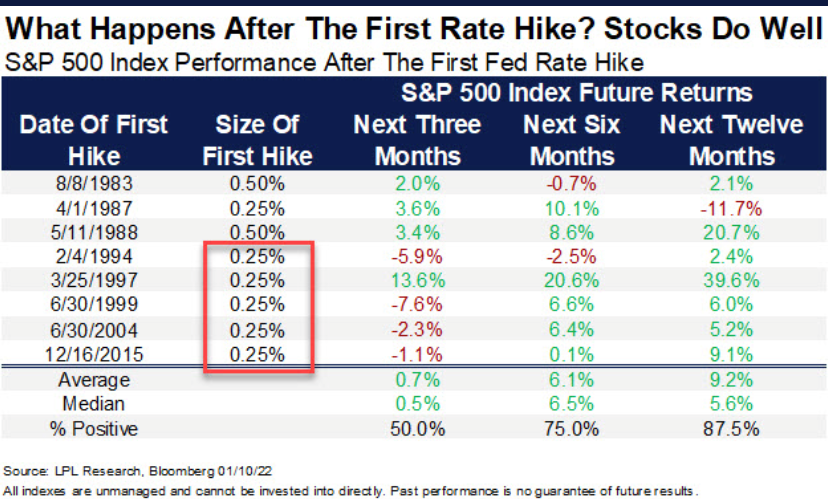

The Initial Rate Hike and Stock Market Reaction

As I write this newsletter, Fed Chair Jerome Powell has said that he supports a traditional 0.25% rate increase when the Fed meets later this month.

So, what does this mean for markets? In the short term, more volatility is possible (as if we need any more), but this is not necessarily bad for stocks in the long run. After all, it’s not the first rate hike of the cycle that kills a bull market; it’s the last one.

Below is an excellent graphic that highlights the return of Large Cap US stocks after the initial rate hike -

While this isn’t a huge sample size, it confirms what markets already know. While the first interest rate hike can jolt markets in the short term, it isn’t necessarily a negative in the long run. After all, rate increases typically validate Fed confidence in the strength and sturdiness of the U.S. economy. The data backs this up. For example, in the fourth quarter of last year, the U.S. economy grew by an annual rate of 6.9%, capping the strongest year of economic growth in almost four decades. For 2022, forecasters predict a strong, albeit more moderate, pace of growth. Goldman Sachs, for example, recently adjusted its ’22 GDP forecast to 3.2%.

Of course, we all know this. Our current economic anxieties aren’t around lack of growth; it is around the fear of growing too fast and too soon, thus magnifying inflationary pressures.

Expect more rate hikes throughout ’22, but don’t be surprised to see stocks recover.

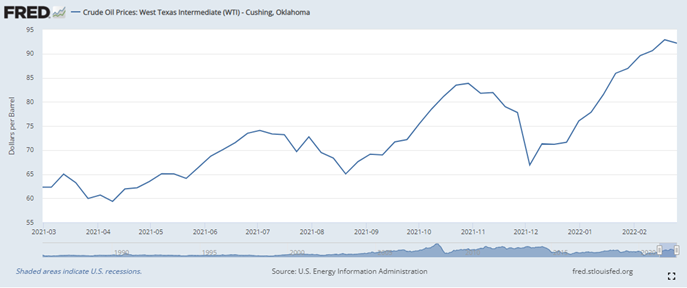

A Quick Look at the Price of Oil

The late John McCain famously described the Russian economy as “a gas station masquerading as a country.” He isn’t wrong. Russia’s economy is highly dependent on crude oil, petroleum products, and natural gas exports. These energy-related commodities account for almost half of Russia’s federal budget and 60% of exports (Dec ’21). Simply put, Russia is a major exporter of oil and gas worldwide. As the third-largest oil producer, they account for 10% of global supply. Thus, this spike in oil and gas prices should come as no surprise. Unfortunately, with the potential supply disruptions reverberating through markets, volatile energy prices are likely to stick around for some time.

Below is a one-year price chart for WTI Crude (WTI Crude is the primary global benchmark) as of 2/25/22 –

The upward trend will likely continue and further hurt consumers at the pump. WTI Crude has jumped to $111 over the past few days as NATO affiliated economies will take more Russian fuel off the market.

At an individual level, this means that more discretionary money gets spent at the pump, with less available for other goods and services. It is a drag to consumers and the broader economy – everything is more expensive, from travel to logistical costs. High prices are beneficial for oil and gas stocks but bad for just about everything else.

Back in 2011, the price of oil experienced a similar shock. At the time, $125 per barrel was the proverbial “line in the sand” of what the economy could handle. Interestingly, this still appears to be the case. According to top commodities strategist at Goldman Sachs, Jeffrey Currie, “we see a clear risk of $125 per barrel in crude.” With oil today (3.7.22) hovering at $123, the economy will undoubtedly suffer some damage if oil markets continue to hang at these elevated levels. As a result, we will be paying close attention to oil prices over the coming weeks.

Market Outlook

The reader should be picking up a similar theme throughout this newsletter. Whether it is a review of geopolitical events, interest rate hikes, or last month’s mid-term election year analysis, they all tell a similar story – expect short-term volatility with long-term return expectations still intact. We remain optimistic for calendar year ’22 but believe that much of the positive return will occur in the back half of the year (especially following mid-term elections). As mentioned in last month’s letter, the successful long-term investor does not try to evade dips but instead endures them.

Allocation Update:

Aside from tax-loss harvesting within client portfolios, we have continued to use this opportunity to rebalance stock allocations vs. fixed income. The power of rebalancing is essential – it can increase potential return by “buying low” and keep investors “in the right lane” related to long-term targets. In addition, our team has fine-tuned our sector allocations (such as Financials, Energy, industrials) to better prepare portfolios for what should be a more volatile, challenging year for stocks.

We have similarly made changes within our fixed-income allocations. As a quick reminder, as interest rates rise, the price of bonds falls. Also, the longer the maturity, the further prices will fall. However, the opposite is true – shorter maturities provide better price stability. Of course, rates will be rising very soon. Therefore, we have adjusted client fixed-income portfolios to focus even more on shorter maturities in preparation for a higher interest rate environment. These changes will better insulate client portfolios against rising rates, with minimal overall yield reduction.

We continue to build out our alternative allocation outside of traditional stocks and bonds. This sleeve includes commodities, structured solutions, and short-term real estate investment trusts (REITs). Alternatives have done a tremendous job of providing a cushion within client portfolios thus far in ‘22. These asset classes, while volatile, provide a hedge against inflationary pressures and geopolitical uncertainty – of which we have had both. In addition, commodities (think oil, gold, wheat, etc.) have done exceptionally well, providing positive returns to start the year.

Otherwise, the joys of tax season are upon us. According to our last communication with NFS, all 1099s and other tax documents should be ready by March 6th. Our team stands by, waiting to help. Please do not hesitate to reach out if you have any questions or you would like us to email your respective forms to your CPA via secure email.

As a final note, our thoughts and prayers go out to the victims of this conflict. It is always challenging to discuss stock market returns and outlook amidst suffering and pain. Nevertheless, we hope this newsletter provides level-headed market insight in an otherwise noisy world. The fact is no one knows what tomorrow will bring, but we will always let you know our thoughts and outlook.

And that, a close friend likes to remind me, is why you always order dessert!

Don’t worry – we will resume with Teddy updates and regular programming next month.

We at Highland Peak Wealth continue to see an increase in new business opportunities and referrals, predominately from our tremendous clients. Again, we are thankful for all your support and trust.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202502-1944534