February 2025 - The Three Ts (Trade War, Tech & Touchdowns)

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

It’s been a noisy start to the year in Washington, D.C.—a new leader, a fresh game plan, and a jolt of energy have made things exciting again.

Finally.

I am, of course, talking about Jayden Daniels and my Washington Commanders. What did you think I meant?

I joke, of course.

The buzz around tariffs and the new administration has dominated headlines, overshadowing what has been a strong start for the markets. Much like an episode of Game of Thrones, 2025 has kicked off with political maneuvering, bold strategies, and unexpected twists. A new trade war potentially looms, AI giants are facing a formidable challenger, and yet, the stock market continues to climb. The S&P 500 gained 2.7%, while the Dow—less tech-heavy—rallied 4.7%. Overseas, the MSCI EAFE Index (Developed International) surged 5.26%, surpassing its entire 2024 return in just one month.

As I’ve mentioned in past newsletters, a good January often signals good things ahead. Yale Hirsch, creator of The Stock Trader’s Almanac, identified this as the "January Effect"—a simple yet historically reliable indicator. More on that later.

For now, as we start February, tariffs and trade wars are taking center stage. The White House’s newly announced tariffs—25% on imports from Canada and Mexico, and 10% on goods from China—have reignited discussions reminiscent of the 2018-2019 trade disputes. Back then, tariffs disrupted supply chains, squeezed profit margins, and fueled uncertainty. The expectation was that this round would deliver a similar jolt to markets.

And yet, the market reaction? More shrug than shock.

Yes, stocks initially sold off on the news, but losses were modest and quickly reversed. The bond market—which often serves as the canary in the coal mine—barely flinched. Interestingly, it was DeepSeek’s January surprise that made a bigger splash.

Merriam-Webster defines muscle memory as "the ability to repeat a specific muscular movement with improved efficiency and accuracy through practice and repetition."

Practice and repetition. Or, as Douglas Adams once wrote, “Been there, done that, got the t-shirt.”

Markets have been here before. They’ve heard the trade war rhetoric, seen the headlines, and adapted. That doesn’t mean tariffs aren’t a real risk—markets never like the word tariff, and for good reason. Trade restrictions can indeed disrupt supply chains, squeeze margins, and create uncertainty. But so far, the reaction has been measured, not panicked. Investors seem to be taking a wait-and-see approach, and that’s the right mindset. History doesn’t repeat itself, but it does rhyme—and if the last trade war is any indication, short-term turbulence often settles. Until more details emerge, there’s no need to overreact.

The key takeaway? Stay calm and let things develop—there’s no need to chase (or tackle) every headline. Investors who resist the urge to react impulsively (as in in 2018) will likely be rewarded over time.

As we sail into 2025, we’re navigating shifting tides and noise —renewed trade tensions, a resilient market, and a potential AI disruptor in DeepSeek. Let’s break it all down and explore what it means for the road ahead.

January Revisited

No complaints here—January delivered a solid start, with stocks in the U.S. and abroad finishing in the green. Bonds held steady, and gold continued its impressive run. Several key factors contributed to this positive momentum:

Strong Corporate Earnings: Per Bloomberg, over 75% of S&P 500 companies that have reported earnings beat Wall Street expectations.

Tech Resilience: Despite Nvidia's downturn, Meta and Apple posted strong earnings, reinforcing investor confidence.

Animal Spirits Are Alive and Well: Optimism remains that the new administration will bring a more business-friendly approach.

A good start is rarely a bad thing.

According to Sports Illustrated, the team that scores first in the super bowl wins approximately 68% of the time. Keep this in mind on Sunday.

The stock market has a similar playbook. Historically, January tends to set the tone for the rest of the year. Per Strategas, when January finishes in positive territory, the next six months return an average of 6.9%. What happens when January is negative? The same return just 0.6%, well below the norm.

Source: Strategas

Of course, no indicator is perfect. Take 2021, when a sluggish January gave way to big year for markets. But there is practical value here—January often reflects how investors, institutions, and fund managers are repositioning for the year ahead. It offers early clues about where capital is flowing, and which trades are gaining momentum.

This past month was no exception. We noticed a few key shifts:

International stocks outperformed U.S. stocks

Mid-cap U.S. stocks outpaced large-cap stocks

Value stocks led over growth stocks

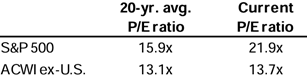

For those paying attention, this is a complete reversal from what has driven markets for the past two years. The strength of international markets, even in the face of new tariffs, is particularly interesting. U.S. stocks have dominated for years, leaving international equities in the shadows. But as we head into 2025, the valuation gap between international and U.S. stocks remains near historic extremes.

Source: FactSet, MSCI, S&P, J.P. Morgan Asset Management

Per the above, non-U.S. stocks trade at a 37% discount to U.S. stocks—one of the widest gaps on record.

While valuation gaps alone don’t dictate short-term performance, history suggests that markets eventually revert to more balanced levels. For years, this disparity has been driven by the dominance of U.S. tech and AI companies, higher earnings growth, and superior profitability metrics.

But recent developments suggest this could be shifting. Per Reuters, the Stoxx Europe 600 index rose 5.5% in January, compared to the S&P 500’s 2.7% gain—not a definitive trend, but certainly worth noting.

Still, the month didn’t end without some turbulence. As markets began to digest tariff risks, a bigger shock came from China—one that could shake the foundations of the AI sector.

DeepSeek: A New Contender in AI?

On January 27th, the financial and tech worlds were rattled by the emergence of DeepSeek, a Chinese AI startup that may have just reshaped the competitive landscape. The news didn’t just shake up tech stocks—it shook the entire market. Even the otherwise complacent bond market took note. The 10-year Treasury yield dropped 0.12% that morning—a meaningful move.

The biggest casualty? The previously invincible Nvidia. The stock plunged 17%, marking its worst single-day loss since the early days of COVID. According to Forbes, Nvidia lost $589 billion in market cap, the largest one-day market value wipeout in history. Ouch.

Given Nvidia's dominance in the AI space, the reaction was swift and sharp. The Nasdaq, home to many of the most AI-exposed companies, took a hit as well. Investors were forced to ask: Is this a turning point for AI dominance, or just another overreaction?

DeepSeek has developed an AI model, R1, that rivals leading U.S. models at a fraction of the cost. I thought Tom Keene at Bloomberg did a nice job of explaining what this means in simple terms:

DeepSeek’s dramatic rise exposes the greatest risk facing Nvidia: that the intense demand for its advance chips could fade. DeepSeek’s announcement wasn’t just about a new AI model—it was about what that model represents: a lower-cost alternative that performs at the highest level.

Here’s why the market took notice:

Cost-Effective Innovation: DeepSeek's AI models have achieved top-tier performance despite U.S. restrictions. The company's open-source approach fosters innovation among smaller startups.

Global Implications: DeepSeek's advancements highlight China's rapid progress in AI, challenging previous assumptions that the US was the only player involved.

It’s too early to declare whether the market’s reaction was an overcorrection or the start of a bigger shift. As of this writing, Nvidia’s stock has neither fully recovered nor continued to fall. That tells us one thing: the market is uncertain about how much of a real threat DeepSeek poses moving forward.

Either way, a 17% single-day drop is no small move—and when a stock of Nvidia’s size moves that much, it’s worth paying attention.

Here’s what we believe the market is signaling:

1) Profit-taking in the Magnificent 7. With so much concentrated wealth in a handful of companies, investors are quick to lock in gains at the first sign of trouble.

2) Managing concentration risk will be key in 2025. AI’s growth story is still intact, but the leadership within the space may be more fragile than investors assumed.

3) Volatility is part of the ride. AI is undoubtedly one of the most exciting themes in the market, but investors should expect sharp moves—both up and down—as the landscape evolves.

DeepSeek may have delivered a wake-up call to AI investors, but the broader market remains resilient.

Corporate Earnings Remain Strong

The U.S. stock market has run a reverse to start the year. After Tech dominated in ‘23 and ‘24, it’s now the worst-performing sector out of the gate in 2025. The “Magnificent Seven” stocks—last year’s market darlings—have been notable drags on performance. According to J.P. Morgan, those high-flying tech names (especially Nvidia) have collectively pulled the S&P 500 down by 0.90%. Much of this can be attributed to DeepSeek’s emergence, but outside of Tech, the broader market is showing signs of strength.

Earnings season is now in full swing, and while there have been a few disappointments, the overall picture looks solid. So far, 77% of S&P 500 companies that have reported have beaten fourth-quarter earnings estimates, according to Bloomberg. Even more impressive, the blended earnings growth rate is tracking at 13.2%—on pace to be the strongest year-over-year earnings growth since late 2021.

With earnings holding up this well, it’s hard to see markets in pain—tariffs or not. That said, lofty expectations can be tough to meet, and the market tends to be unforgiving when companies fall short. As always, we’re keeping a close eye on corporate earnings and, perhaps more importantly, what CEOs are signaling about the road ahead.

Chart of the Month –If there is concern in the market, you aren’t hearing about it on earnings calls.

Fun Stat of the Month – How does your team do when they win the big game? For those wondering, stocks average 16% when the Chiefs win and were down when the Eagles won in ’18.

So…Go Chiefs?

Allocation Update

Yes, tariffs have the potential to throw a wrench in the rally—but let’s not get ahead of ourselves.

Yes, inflation is still a concern—but the bond market isn’t flashing any warning signs (yet).

And yes, valuations remain high—but they can stay that way as long as earnings growth holds up.

Add it all up, and our outlook remains steady. Our approach continues to be balanced yet opportunistic, recognizing both the market’s elevated valuations and its continued momentum. While equities still present long-term opportunity—especially in areas of secular growth like AI, healthcare, and energy—we’re also mindful of the risks of high valuations and emerging competitors like DeepSeek shaking up the landscape.

That said, we are turning more optimistic on mid-cap stocks, and for good reason:

1) Attractively valued relative to large caps (15% discount on a forward PE basis per FactSet)

2) Projections suggest a strong earnings acceleration

3) Less volatile and higher quality than small caps

4) With more tech IPOs expected this year, mid-caps could benefit from capital flows

So far, so good. Mid-cap stocks have outperformed their larger and smaller counterparts by roughly 1% year-to-date.

After a tough few years, bonds are finally regaining some appeal. Stabilizing yields make fixed income a compelling hedge against equity volatility. While rates remain a wildcard, the broader setup for bonds looks far better than it did a year ago.

Alternatives—such as private credit, private equity, and hedge strategies—are also taking on a more prominent role, providing the potential for uncorrelated returns.

A quick note on gold: we still believe in the shiny metal. Gold has been a tremendous performer the last two years and very additive to client portfolios. It is a natural hedge against inflation and geopolitical risk. We also see it as a haven for those concerned about the fiscal budget deficit and the state of the dollar. While we recognize gold’s run, momentum remains. The market agrees as gold has climbed ~6.5% in ’25 (per Koyfin).

Opportunities exist, but so do risks. As always, we’re focused on quality, risk management, and strategic diversification to help portfolios navigate whatever comes next—trade war or not. By staying disciplined and adaptable, we aim to position portfolios for sustainable long-term growth, no matter where the market takes us.

Here's a snapshot of our perspectives:

Equities – Overweight Approach Remains for Now:

U.S. Stocks Still Preferred: Our inclination towards U.S. equities over international markets is still in place. But the strong start in international stocks has our attention.

Mid-Cap Tilt: Earnings growth, cheaper valuation, and AI exposure are noteworthy.

Developed International: A 5% start, and a +2% outperformance vs. US stocks is interesting, but one month does not constitute a trend. If this continues, we may become believers.

Fixed Income – Underweight Still in Place:

Core Bonds: We remain balanced and are taking a “wait and see approach” regarding tilting towards short or longer dated bonds. Fed and fiscal policy will provide clues.

Floating-rate Bonds and CLOs: Yields remain strong and are a nice hedge against the possibility of higher rates.

Alternatives – Neutral

Gold Overweight: Gold continues to perform fantastically well and serve as a nice hedge against inflation risk.

Growing Interest in Private Alternatives: Where applicable, our team expects to utilize private investments more meaningfully moving forward.

Cash – Neutral

Strategic Use of Cash: Yields have become less attractive as rates fall.

No big update here! Our 2.5-year-old is in full terror mode, earning the well-deserved nickname The Hydra—clean up one mess, and two more instantly appear. It’s an exhausting yet impressive skill set.

Meanwhile, Teddy just celebrated his 100th day of kindergarten—a milestone that came with an assignment to bring in 100 of something. True to form, he proudly marched into class with 100 Lego figures. It was a success, though I’m certain his teacher now has some questions about our household’s consumer habits. But hey, anything to stave off recession!

Wishing you and your family a great February and a warm, happy Valentine’s Day.

Thank you, as always, for your readership and trust.

Kyle M. McBurney, CFP®

Managing Partner

CRN202802-8084555

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

The Nikkei Index is a price-weighted index composed of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information