January 2025 - Five Years & Counting

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

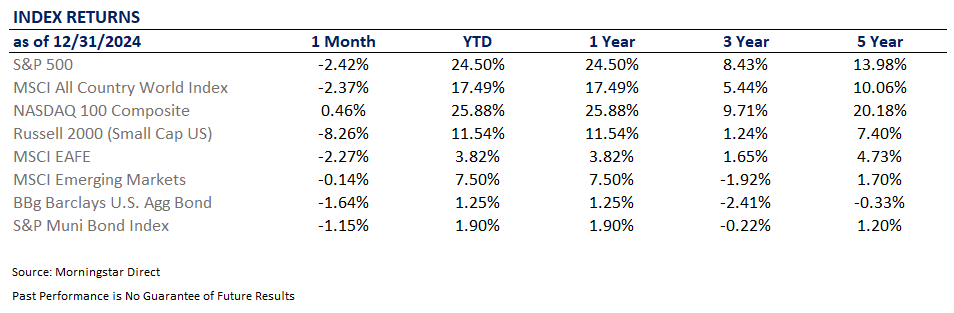

Despite a Scrooge-like December for stocks, the S&P 500 closed out 2024 with a 25% return—just shy of 2023’s impressive 26% gain.

Bah Humbug, indeed.

This finish also marks the close of the first half of the ‘20s. Somehow, the pandemic feels like it happened both yesterday and decades ago. Is that even possible?

The 2020s have been a whirlwind so far marked by extraordinary market swings that have tested the patience of many but rewarded those who stayed committed to their long-term strategies.

Let’s take a moment to revisit the journey (data courtesy of Morningstar Direct):

2020: A sharp spring crash triggered by pandemic fears gave way to an astonishing recovery, with the S&P 500 finishing up 20%.

2021: Momentum surged, delivering nearly 30% returns and exuberance.

2022: A very challenging years for investors as stocks and bonds were battered by inflation and higher rates.

2023: A mid-year correction didn’t stop the market from rebounding with a 26% gain.

2024: Another stellar year, it was capped by a 25% return despite a lackluster December.

No two years have been "average," and the swings—both up and down—have been striking.

What’s even more notable is the speed of these cycles. Market movements that once took years now seem to unfold in months—or even weeks. Perhaps it’s the rapid flow of information and social media. Maybe it is just a coincidence. Whatever the reason might be, this speedier pace is likely here to stay, bringing both exciting opportunities and heightened risk.

Calendar year 2025 is special for another reason. Five years ago, Troy and I began to piece together the foundations of Highland Peak Wealth. While Highland Peak the name was still percolating, calendar year 2020 marked the start of the journey that would lead us here—a move that I will be forever grateful for.

We often joke that if we were as good at forecasting markets as we like to think, Highland Peak might never have opened its doors. After all, we launched just two months before one of the most dramatic global upheavals in history. Timing, as they say, is everything—and yet, somehow, it all worked out beautifully.

With clarity that only hindsight can provide, our vision was a quick success. The flexibility of our model allowed us to capture returns and tax efficiencies that other, larger, more rigid groups may have missed out on.

Change is life’s only constant—it’s a cliché because it’s true. At Highland Peak, we’ve embraced that reality by staying focused on the principles that guide our mission:

1. Humbly striving to understand future market movements and recognition of the unknown.

2. Identifying the key themes shaping the investment world.

3. Tirelessly speaking with market experts to stay in tune with the investment consensus.

4. Sharing clear data and insights to keep you informed and confident in a noisy world.

Today, we’re proud to have a strong team with connections stretching from Maine to Honolulu. The sun may set on the Highland Peak realm, but only just barely—not quite the British Empire (yet).

Most importantly, we’ll never forget the people who believed in us and our vision. Your trust and support are the foundation of everything we’ve built, and we treasure it deeply.

As we move into the second half of the decade, let’s embrace optimism, maintain perspective, and seize the opportunities ahead.

2024 - A Year of Gains

It still amazes me just how far we’ve come since the depths of 2022. With 2024’s strong returns, that challenging year feels further and further in the rearview mirror. I keep coming back to the old saying, “it’s always darkest before the dawn,” and in hindsight, it fits perfectly. Back in October 2022, market sentiment hit rock bottom. Since then, the S&P 500 has rallied an incredible 60%, according to Reuters.

This year, U.S. stocks wrapped up another remarkable run, fueled by surging demand for artificial intelligence, a surprisingly resilient economy, and the Federal Reserve’s pivot to cutting interest rates. These factors propelled major indexes to record highs and kept investors engaged throughout 2024.

The S&P 500 posted an impressive 25% gain, closing the year at 5,881.63. Building on 2023’s 26% return, it marked the best two-year stretch for the index since 1998—a testament to the rewards of disciplined investing, even in volatile times.

Meanwhile, the Nasdaq Composite climbed 26%, finishing 2024 at 19,310.79. Over the past two years, Bloomberg reports the index has surged 84.5%, its strongest two-year performance since the pandemic recovery.

Artificial intelligence, economic resilience, and a more accommodative Federal Reserve were a powerful trio driving markets higher this year. These forces also highlighted the speed at which today’s investment landscape continues to evolve.

In hindsight, 2024’s rally wasn’t entirely unexpected. Election years tend to bring economic optimism, and 2024 was no exception. With over 40% of the global population heading to the polls, policymakers around the world—and particularly in the U.S.—pulled out all the stops to keep their economies humming. The Biden Administration leaned on every available tool, from leveraging the Treasury General Account (TGA) and the Strategic Petroleum Reserve (SPR) to pushing forward student loan forgiveness.

Simply put, it worked. By Bloomberg’s estimates:

1. Real GDP Growth: ~3% annualized

2. Inflation: Fell to 2.9%

3. Corporate Earnings: S&P 500 operating earnings rose 9%

Combine these numbers with near-full employment, and it’s no surprise the S&P 500 delivered its strongest back-to-back annual performance since 1998, the year Titanic was released.

Not everything was rosy, though. While market breadth improved, it remained narrow, with much of the gains still concentrated in a select group of AI-driven growth stocks. It’s a bit like the famous Seinfeld episode in which Jerry dates Gwen, a woman whose appearance changes dramatically depending on the lighting—impressive in some moments, unrecognizable in others. Without the contributions from those standout tech and AI names, market returns look far more ordinary. Meanwhile, the Bloomberg Aggregate Bond Index posted a modest 1% gain, underscoring the persistent challenges in fixed income and the ongoing pressures from interest rates.

What Has our Attention Heading Into 2025

The big question on everyone’s mind: after two stellar years for stocks, can this market keep going?

History urges caution. Periods of extreme bullishness often precede corrections. That said, momentum can persist, especially when supported by strong economic fundamentals. While we don’t see clear signs of an imminent downturn, it’s fair to expect more tempered returns moving forward.

Momentum like this is rare, but not unheard of. The S&P 500 has posted back-to-back 20% gains—a feat that hasn’t happened since 1990. Could we see a third? It’s unlikely, but not impossible. Ryan Detrick at Carson Group highlights an interesting stat:

Since 1950, there have only been four instances where the market had consecutive +20% years. The kicker? Year three was positive in all four cases, averaging another 20% gain.

Now, does this mean we should dive in headfirst? Of course not. But it’s a comforting data point amidst the uncertainty.

Speaking of uncertainty, the new administration offers both hope and questions. Policies like lower taxes and deregulation are generating optimism, but Washington’s fiscal challenges could ultimately push interest rates higher. And as President Kennedy famously quipped, D.C. remains a place of “Southern efficiency and Northern charm”—a description that still makes me chuckle, with all due respect to both parties.

For now, investors seem to be in a holding pattern, concerned mostly about trade and tariffs. But as risk managers, there’s always plenty to keep us up at night. That brings me to what I see as the top concern heading into 2025.

Is this Market too Frothy?

By all traditional metrics, markets are about as expensive as they have ever been. The only other comparable time periods are ’00 and ’21—not exactly comforting company.

No matter how you look at it, the market feels... a little toppy to us. There’s no precise science to this, just observations. There are some echoes of exuberance that remind us of ’21, giving us pause. Imagined or not, investors should take stock of where we are.

Bullish sentiment is everywhere. Bears? Hard to find. Surveys and sentiment indicators are showing levels of optimism rarely seen. According to Citigroup, investors haven’t been this euphoric since the post-pandemic SPAC craze or the dot-com bubble of 1999-2000. Historically, when everyone’s optimistic, there’s less fuel for the market to run—and more risk of a stumble.

The signs of exuberance don’t stop there. Fund managers are heavily overweight U.S. stocks, with allocations at decade-highs, according to Bank of America.

And valuations? They’re being sidelined in the excitement. AI and the U.S. economy are dominating the narrative, and while the potential is undeniable, price still matters. Cheap stocks, or value stocks, are underperforming significantly, even hitting a record 11-day losing streak.

Interestingly, insiders—corporate executives with the clearest view of their companies—aren’t buying the hype. According to filings, they’ve been selling more stock than they’re buying, which raises questions about how sustainable these high valuations might be.

None of this is definitive proof that a downturn is imminent. Markets are complex and influenced by countless factors. But when optimism runs this high, valuations this stretched, and insiders pull back, it’s a good time to reflect on how your portfolio aligns with your long-term goals and remains balanced.

Will Inflation Make a Comeback in 2025?

Let’s hope not. This week’s ISM Services report brought inflation back into focus –

Source: Strategas

For the 91st consecutive month, services organizations reported rising prices for materials and services, with 15 out of 18 industries seeing price increases in December alone (and not one reporting a decline). Higher readings increase the risk of inflation.

The market didn’t take the news well. Risk assets struggled as the 10-year Treasury yield crept closer to 4.70%. Historically, when the 10-year yield moves above 4.5%, it hasn’t been great for equities—something we’ve mentioned before in past Trail Guides.

Now, this is no reason to panic. Back in January, we saw a similar jump in prices paid, but it didn’t lead to an actual uptick in inflation. It was just a one off. Still, the fact that these services prices often precede changes in CPI is likely what spooked investors this time around.

For now, it’s something to watch closely. Inflation can cast a long shadow over both the economy and the markets, and it’s clear the market is a little jumpy.

Fed Talk

Speaking of inflation, the Federal Reserve is doing all that it can to avoid a reacceleration. That’s why the Federal Reserve’s path for 2025 remains a wildcard. Markets are pricing in 50 to 75 basis points of rate cuts, but the Fed’s laser focus on inflation and price stability could temper these expectations.

Earlier in 2024, the Fed appeared ready to ease rates more quickly. By September, they projected a full percentage point of cuts for both 2024 and 2025, driven by cooling inflation and a strong labor market. But as we close out the year, the brakes are back on.

So, what changed? Inflation is still above target, GDP growth is still strong, and the labor market remains resilient. And then there’s the incoming Trump administration (not sure if you heard).

Policies such as increased tariffs, tax cuts, and deficit spending are all on the table, but until President-elect Trump takes office, the details—and their potential impact on inflation—remain a question mark, bigly.

Add it all up and the Fed is in a tough spot. As Don Rissmiller, chief economist at Strategas, puts it: “The range of policy outcomes for next year is wide.” Right now, the Fed seems reluctant to commit to any major moves until it has a better handle on how fiscal and trade policies will shake out. For portfolio managers, that uncertainty makes anticipating Fed actions tricky, to say the least.

According to the CME FedWatch Tool, two rate cuts are still the most likely scenario for 2025. The market’s forecast sees the first rate cut in March. While the Fed’s balancing act could ultimately support both stocks and bonds, some volatility along the way is almost guaranteed. As always, keeping the focus on the bigger picture will be key to navigating whatever comes next.

Chart of the Month – You have nothing to fear in year one of a presidential cycle (even better recently).

Source: Strategas

Reminder of the Month – A reminder that things can get choppy after inauguration day.

Source: Strategas

Allocation Update

As we step into 2025, our approach remains balanced yet opportunistic, reflecting both the market’s elevated valuations and undeniable momentum. While equities continue to show long-term promise—especially in sectors driven by secular growth trends like AI, healthcare, and energy—we’re mindful of the challenges that come with historically high valuations and the unknowns surrounding the new administration’s policies.

The market’s momentum remains strong, with significant inflows into equities fueled by optimism around potential tailwinds like lower taxes and deregulation. Our tilts from 2024 remain mostly in place, such as domestic over international, as corporate earnings continue to be stronger than expected, easing economic fears.

Fixed income, after facing headwinds in recent years, is regaining its appeal, somewhat. Stabilizing yields make bonds an attractive hedge against equity volatility, offering portfolios a much-needed layer of balance.

Alternatives—such as private credit, private equity, and hedge strategies—are also taking on a more prominent role, providing the potential for uncorrelated returns and enhanced diversification.

As we look ahead, we recognize the opportunities but also the need for caution. By focusing on quality, managing risk, and strategically diversifying, we aim to position portfolios for sustainable, long-term growth—no matter where the market takes us next.

Here's a snapshot of our perspective:

Equities – Overweight Approach Remains for Now:

U.S. Stocks Still Preferred: Our inclination towards U.S. equities over international markets is still in place

Small Caps Tilt: Post-Election performance was strong, but can it recover recent losses?

Developed International: Some serious, and growing, political and geopolitical risks give little room for optimism. But has the pendulum swung too far? Were waiting for a trend to emerge.

Fixed Income – Underweight Still in Place:

Core Bonds: We remain balanced and are taking a “wait and see approach” regarding tilting towards short or longer dated bonds. Fed and fiscal policy will provide clues.

Floating Rate Bonds and CLOs: Yields remain strong, and a nice hedge against the possibility of higher rates.

Alternatives – Neutral

Gold Overweight: As with stocks, Gold had a strong ’23 and a fantastic ’24

Growing Interest in Private Alternatives: Where applicable, our team expects to utilize private investments more meaningfully moving forward.

Cash – Neutral

Strategic Use of Cash: Yields have become less attractive as rates fall and equites have become more enticing.

OK, enough of that —drumroll please….

Breaking News: Our family is expanding—again!

We’re excited to announce that Player 3 is entering the game in March 2025! Teddy and Cooper are each gearing up for his new role as big brother, and we’re brushing up on our "zone defense" skills for life with three kids.

Let the countdown (and extra caffeine) begin! Bring on the chaos.

Cheers to another fantastic year ahead.

Kyle M. McBurney, CFP®

Managing Partner

CRN202801-7874462

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

The Nikkei Index is a price-weighted index composed of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information