July& August 2024 - A Bullish Surge and Olympic Spirits

By: Kyle McBurney, CFP

Managing Partner at Highland Peak Wealth

With so much happening these days, it's easy to forget that the Olympics are just around the corner. As I write this, the torch has arrived in Paris, heralding a season that turns us all into couch experts on everything from gymnastics to badminton. Go USA!

Speaking of the Olympics, one athlete stands above the rest: American swimmer Michael Phelps. With 28 medals—23 of them gold—Phelps is by far the most decorated Olympian of all time. No one else even comes close.

Phelps’s final race at the Rio 2016 Olympics, the 4x100 meter medley relay, captured the world’s attention. Swimming the butterfly leg, Phelps led the U.S. team to a triumphant victory. But, as I remember, while the race was a success, it was a blowout from the jump with little drama.

But a win is a win!

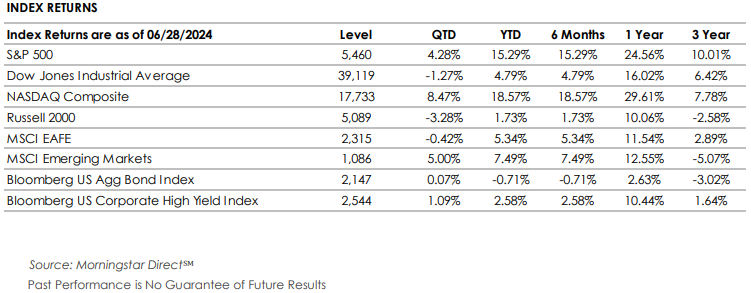

In true Phelpsian style, the stock markets have started 2024 with a powerful surge, albeit without much excitement or nail-biting moments. The S&P 500 and Nasdaq 100 have risen over 15% and 18.5%, respectively. The S&P 500 reached its first all-time high in two years this January and has hit 38 more since then. At halftime, the S&P is experiencing its fifth-best start in the past 25 years, driven by cooling inflation and robust economic data. Global growth is proving more durable than expected. And, of course, the biggest market driver – rate cuts from the Fed – are still on track. Markets appear to be in fine fettle.

This remarkable start has solidified the ongoing bull market that began in late ’22. According to Bloomberg, the S&P 500 has surged nearly 60% since October 12, 2022. It's a truly impressive return for those investors who stayed the course. It’s easy to forget now, but October 2022 was full of pessimism and anxiety.

Despite these gains, the markets have been decidedly uneventful. Per FactSet, it has been over 500 days since the last 2% drop on the S&P 500. On the flip side, there has been only one market day +2%. This year’s market calm evokes the wisdom of Nobel Prize-winning economist Paul Samuelson, who once said, “Investing should be more like watching paint dry or watching grass grow.” It’s been a year of small moves and little drama. But remember, bull markets are supposed to be boring. Low volatility environments are typical of bull market cycles. Market uptrends are the steady, methodical counterpart to volatile bear markets, which are marked by dramatic swings both up and down. The painful market of 2022 is a good reminder of this—filled with big down days and big up days.

As we all know, markets won’t stay boring forever. Excitement and volatility are natural parts of the economic cycle. Looking ahead, the upcoming election will likely cause some market fluctuations throughout the summer and early fall. Rest assured; we’ll dedicate a full Trail Guide to this important topic as we approach November. In the meantime, remember an old industry adage: people care about elections, but markets don’t.

This edition of our newsletter serves as a halftime check-in, highlighting the key themes that have driven a strong start to 2024. We discuss the continued rally in big tech, gold’s bounce, and corporate earnings. While the future remains uncertain, stock market history and election year patterns may offer some guidance, which we revisit. Finally, we provide an allocation update to inform you of our current portfolio positions and areas of focus.

As always, we hope you enjoy the read.

First Half Recap

Like a Michael Phelps race, stocks have performed well from the jump. Global markets certainly got the strong beginning we all hoped for. According to Morningstar Direct, the S&P 500 and Nasdaq 100 are up over 15% and 18.5%, respectively. As of this newsletter's publication, the S&P stands at a breathtaking 5,700, a remarkable run from October 2022's low of 4,100. To justify this surge, here are the key drivers we've identified:

Earnings growth after a flat ‘23

Optimism around Fed easing

Spending Surge on AI

10-year Treasury peaked at 5%

Sound familiar?

In many ways, the themes in 2023 that carried markets higher and fueled portfolio returns were alive and well in the first half of 2024:

1) US stocks outperforming International

2) Large stocks outperforming small

3) Growth stocks beating value

4) Return heavily concentrated in a few names

5) Stocks soar as bonds remain stuck

This reminds me of the famous quote from novelist Jean-Baptiste Alphonse Karr, “The more things change, the more they stay the same.”

The third bullet point is particularly interesting. It’s no secret that market returns, up until very recently, have been concentrated in a small number of tech stocks – whether you call them the Fantastic Four or the Magnificent Seven. In fact, just four stocks – Nvidia, Microsoft, Google, and Amazon – have accounted for more than half of the S&P 500’s gain. Per Strategas, remove the Magnificent Seven and the S&P 500 is “only” up 6.27%. Not ideal, but also not unusual. Markets have seen similar dynamics in previous decades. According to Morgan Stanley, markets saw similar, if not even more extreme, dynamics during the late ‘50s and early ‘60s, and stocks performed well. Moreover, market concentration has not historically triggered significant declines.

In the spirit of the Olympics, our team wanted to bring this year’s top first half performers to the stage. So, without further ado, here is ‘24’s first half podium.

· Gold Medal – Nvidia

As an old mentor would say, “no duh”.

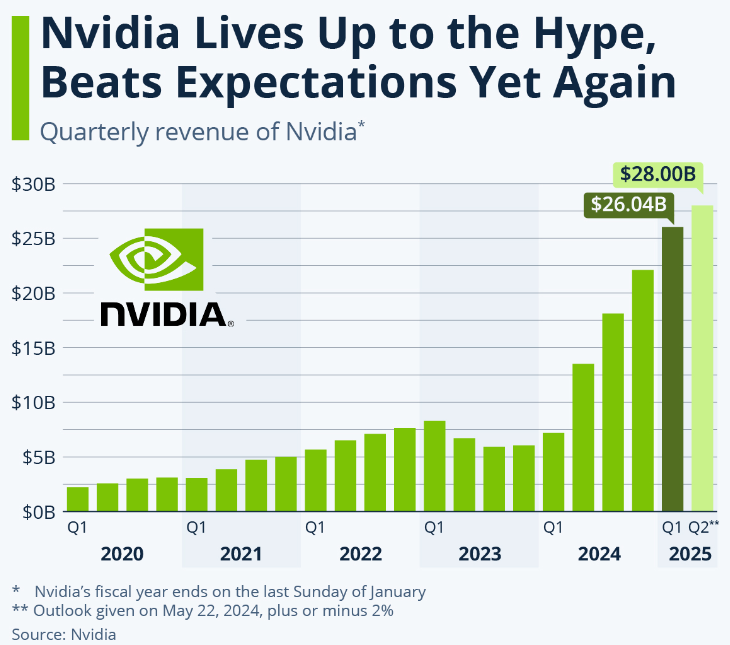

In the first half of 2024, just like in 2023, Nvidia (ticker NVDA) was the “it” stock and company. Excitement around Artificial Intelligence (AI) is everywhere. AI has captivated the attention of investors globally. Once a humble chipmaker for gaming devices, Nvidia has found seemingly unrelenting demand for its chips. The stock delivered a stunning total return (including dividends) of 149.5% , according to S&P Global Market Intelligence. Nvidia alone contributed almost 5% of the total return to the S&P 500, echoing Cisco’s impressive run in the ’90s and early ‘00s.

The excitement reached even higher levels with the announcement of a new chip release slated for later this year and a 10-for-1 stock split last month. The chart below, from Nvidia, illustrates the amazing actual and projected revenue growth:

With this type of revenue generation, and AI excitement, the continued rise of NVDA comes as no surprise. Nvidia briefly became the most valuable company in the world on June 18, surpassing Microsoft in market cap before settling into a close third place.

It will be interesting to see how and where AI continues to develop. Ask those in the industry, and they believe that we are still in the early stages.

Time will tell, but we will keep a close eye on Nvidia and all things AI.

Silver – Gold

Gold won silver? Gold won silver! Who’s playing first? Who is on first!

For reasons we don’t like, and for reasons that rattle markest, gold has proven to be an exceptional addition to portoflios thus far in ’24. Per Koyfin, gold is up nearly 20% this year and 25% over the past 12 months.

Gold, the metal that doesn’t rust, tends to do well when nerves are high. This is especially true as it relates to –

1) Geopolitcal Risk (War, conflict, disruption)

2) Inflation

3) Bank Failures (hello Silicon Valley Bank)

The chart below illustrates gold’s tremendous return over the last 12 monhts. Unsurprisngly, and regretably, this performance took off following the Israel-Hamas conflict last fall.

But this is exactly why we own gold. As indicated in previous newsletters, we gained interest in gold following Silicon Valley Bank and First Republic’s collapse. We are not thrilled as to why gold is rallying, but happy to own it.

Moving forward, we will keep an eye on our gold allocation. We view it as more of a “trade” than a long-term “investment” as gold has no earnings and kicks off no dividends. We will express any changes in our views in future communications.

Allie Newman Bronze – Corporate Earnings

Troy’s talented daughter, Allie, heroically led Trinity’s women crew team to a Bronze Medal at D3 Nationals. For her grand achievement, she gets recognition in this newsletter (better than the trophy itself?).

Yes, big tech has been the primary driver, but don’t ignore the recovery of corporate earnings since ’22. Consumers continue to spend and corporations are reaping the benefits.

So, why are stocks up so much this year? Look no further than corporate earnings growth and where expectations are. Below is a great chart from Carson Investment Research highlighting how strongly corporate earnings have recovered from ’22 and ’23.

As you can see, forward expectations are sky high. According to Strategas, expectations for 2Q earnings and revenue growth now stand at +9.6% y/y and 4.5% respectively. That’s up there.

Unsurprisingly, investors will be keeping a close eye on second quarter corporate earnings, as will we. We are interested to see if 1) the US consumer is still healthy, 2) spending on AI continues, and 3) the upcoming election changes anything.

Whether or not stocks continue their rise is likely dependent on these questions. The pressure is high.

To paraphrase Spiderman, with great power expectations comes great responsibility.

Enough of that, time to look ahead.

Saying Hello to the Second Half

No one knows the future and no guarantees exist. I don’t have to remind you of that. But, in an election year such as this one, this simple concept has even more meaning.

Despite the uncertainty, stock market history does remind us of two important things –

1) An Object in Motion Stays in Motion

Are there any law of inertia fans out there?

Momentum is a powerful force, and it works both ways. In 2022, fear and nervousness perpetuated more of the same, creating a downward spiral. However, with stocks off to a fantastic start in 2024, the momentum now favors the bulls. History shows a positive track record here: when the S&P 500 is up 10% or more in the first six months, the short-term market performance is typically very strong. The great team at Carson Investment Research compiled the data below:

With a decent sample size, that's about as strong of an indicator as you see in this business. The far-right column is particularly interesting. A strong first half of the year modestly above 10%, which is where we stand today, has historically been positive for second half returns. It's never guaranteed, but the trend is certainly noteworthy. And, if July's market activity is any indication, markets continue to feel good.

2) Election Years are Just Fine

We should know this by now, but a reminder is always helpful. There's a common misconception that elections spell doom for market performance, but the data tells a different story. While presidential election years trail the average stock market return, it is only just barely.

However, election years when an incumbent president is running for re-election (hello Biden) tend to be very kind to the stock market. Incumbents often utilize every available measure to guarantee that the economy looks nice and shiny by November, contributing to a strong market track record. According to Strategas, since 1952, during the last 15 elections, the S&P 500 has not experienced a decline in any re-election year, averaging an impressive return of 12.70%.

To be clear, our team plans to release a more detailed election update closer to November. We expect a noisy and uniquely negative campaign season. Our goal is to bring down our collective blood pressure and frame the upcoming election from the perspective of markets. We expect some bumps, but market history reminds us to be patient.

Speaking of which, a market reset or pause wouldn't surprise us. The S&P 500 has risen nearly 10% since our last newsletter. Additionally, election year summers tend to bring increased volatility, and we expect that trend to continue. This reminds me of J. Pierpont Morgan’s famously succinct answer about the stock market’s future: markets will fluctuate.

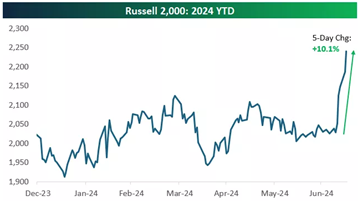

Despite this, we like where we are. There is real momentum as markets see a more accommodating Federal Reserve open to rate cuts. Small caps and value stocks have rallied; finally, we are seeing strength outside Magnificent Seven and related stocks.

Chart of the Month – Is this the Small-Cap rally that we have all been waiting for?

Source: Bespoke Investment Group

Allocation Update -

Currently, we like the idea of having more offense on the field.

If July’s trading is any indication, stock market winds may have shifted. So far this month, it has been a complete reversal from ‘24’s (and 23’s) trends of large-cap tech. Over the last couple of weeks, as markets have begun to price in rate cuts, we have seen more stocks hitting all-time highs, more market breadth, and previously beaten-down sectors rallies. This all while tech and the Magnificent Seven have somewhat faltered. Ten days do not make a trend, of course, but consider us very intrigued.

Small-cap stocks are especially intriguing. After a slow start to the year, small-cap stocks have rallied furiously over the past couple of weeks. In fact, as I write this, the U.S. small-cap index, the Russell 2000, is up 1% for four days in a row. This is noteworthy. Per Ryan Detrick at Carson Research, this has occurred 13 other times since 1979. A year later, small-cap stocks averaged a return of 25.3%. Once more, an object in motion stays in motion.

As always, here’s a snapshot of our current outlook:

Equities – Balanced Approach:

U.S. Stocks Preferred: Our inclination continues towards U.S. equities over international markets.

Small Caps Rallying? As discussed above, small-cap stocks have been impressive of late and deserve our full attention.

Developed International: While the Eurozone remains underwhelming, we have become more focused on Japanese equities.

Emerging Markets: We maintain a selective approach, with an increasing focus on Indian markets (outperforming the respective benchmark by +11% per Koyfin)

Fixed Income – Slightly Underweight (with increased focus)

Long-Term Bonds: We continue to seek longer-term bonds to lock in the higher yields currently available. This notion has increased as rate cuts are more evident.

Floating Rate Bonds and CLOs: Our outlook remains positive for these options, offering attractive yields and returns and hedging against higher rates.

Alternatives – Slightly Underweight

Gold Overweight: As with stocks, Gold had a strong ’23 and is off to a strong start in ’24 (up ~20% per Koyfin).

Growing Interest in Private Alternatives: Where applicable, our team expects to utilize private investments, such as Private Credit and Private Equity, more meaningfully moving forward.

Cash – Getting Closer to Neutral

Strategic Use of Cash: Yields are less attractive, and we see opportunities in equities.

Summer is in full swing in the McBurney household, and aside from the unusually humid start, we have zero complaints. This is especially true for Teddy, who has fully embraced the joys of “kid summer.” Between running around with cousins and going to summer camp, he has heroically learned to swim and ride a bike. Consider me one proud papa! I’m sure any parent or grandparent can relate. And don’t worry, Teddy is equally proud. Any guest who visits is promptly whisked away to watch him, the star of the show, do a few laps around the driveway. That kid has the Olympic spirit! Get him to Paris!

Meanwhile, Cooper, our active two-year-old, has already mastered the scooter. Watching such a tiny creature in diapers with chaotic curly hair bobbing in the wind as he also does laps around our driveway is truly a sight to behold.

From our family to yours, we hope you have a wonderful summer ahead.

As always, thank you for your support and readership.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

The Nikkei Index is a price-weighted index composed of Japan’s top 225 blue-chip companies traded on the Tokyo Stock Exchange.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information