March 2021 - The Fed and Fairy Tales

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

Despite the noise, we see rising interest rates as a positive sign for now. One reason for the move higher in yields is likely from a very positive development - markets now see an end to the pandemic. With yet another vaccine on the menu (the one-shot J&J), markets are more confident than ever that re-opening, and all its economic benefits, lies ahead. Yes, inflation is a concern, but we are a long way away from serious problems that require allocation shifts. For the time being, inflation projections are pure guesswork, and the Fed remains resolute in keeping rates low.

Small-cap stocks continue to lead the way. Remember, this is a good sign. Shares of small companies are outpacing their larger counterparts by the widest margin in more than two decades. The reason for the rise: confident optimism that stimulus and vaccine deployment will boost economic growth.

So, if you are looking for a TLDR message – stay the course and allow us to keep an eye on rates and an ear on Fed policy. In our view, the bull market is in full swing.

Goldilocks and Stocks

It was common throughout the past decade to hear that the U.S. stock market was in a goldilocks environment – neither too hot nor too cold; it was just right. Sound familiar? Well, it should. You don’t have to have a mercurial toddler (as I do) to recall the story of Goldilocks and the Three Bears. I won’t bore you with the details of the story, but this popular children’s tale has many parallels to our stock market, particularly as it relates to February trading.

Like Goldilocks and her porridge, markets prefer an economy when things are just right – not too hot and not too cold. More specifically, not too much growth to overheat the economy and force the Fed’s hand, and not too weak economic slowing to bring us back to a recession.

February was full of good news. Vaccine progression has boosted optimism, stimulus talks are still progressing, and 79% of companies in the S&P 500 reported positive earnings surprises.

So why, then, did the stock market sell-off so aggressively last week?

To a certain extent, it’s the speed with which bond yields have increased – the yield on the benchmark 10-year Treasury jumped from 1.08% to 1.52% during February. While yields remain historically low, the relative increase is what matters to stock traders. Even small shifts in bond yields can cause investors to ring the register and take profits. What’s more, rising interest rates make stocks somewhat less attractive because bonds now are paying more than the S&P 500’s dividend yield.

As the final week of February reminded us, even positive events can rattle investors. It is another cue to remind readers that the market and the economy don’t always move in sync. It is counterintuitive but important to recognize that good news can be interpreted negatively, as well as positively. And it is yet another reason why it is nearly impossible to succeed with market timing.

There are three primary reasons why stocks can fall with good news –

1) A more robust economy means higher treasury yields (rates go up, more expensive to borrow)

2) Stocks are less competitive when yields rise

3) Fear of inflation causes the Federal Reserve to shift policy

It may seem bizarre to worry about what will happen to rates and inflation, given how bad investors are at predicting the future, but there is growing concern that prices may be increasing.

Ultimately, we believe that it is way too early to be concerned about the inflation monster. Please don’t make me quote Mark Twain again! While we don’t rule out an inflation “scare” further down the road, we believe that such concerns are currently overblown. Higher inflation in and of itself is no Achilles heel to a sustained bull market, but a Fed aggressively fighting inflation often is. And, as the Fed has reminded us ad nauseum, the central bank is not even thinking about altering its strategy any time soon.

What We are Watching: In-Person Learning

Those readers who have kids at home may find this section particularly interesting.

Correct or incorrect, schools remain one of the last components of our society to re-open. Schools, therefore, have become an excellent barometer of how “open” our economy is. As other parts of our economy awaken from hibernation, there is undoubtedly growing pressure on schools to re-open. When schools are fully open, we can assume that most other economic restrictions have been lifted.

There is good news on this front. Schools are reopening, albeit slowly, and last week hit a new post-COVID high. Huzzah!

Source: Strategas

We remain under 50% for now, but the upward trend is hard to deny. This positive trajectory has significant ramifications for our economy. As schools re-open, the economy will benefit - employment will improve, consumer spending will be boosted, and more productive parents will likely increase workplace productivity.

Allocation Outlook

Despite another noisy end to the month, we remain slightly overweight on stocks. We continue to believe that 2021 will provide markets with the necessary level of economic growth. After a near-term pause, a combination of easy money, additional fiscal stimulus, and a full reopening of the economy in 2021 could lead to a boom in economic activity. Healthy savings accounts and robust government spending this year will likely make any short-term softness or uncertainty short-lived. This was true last month and will likely continue to be the driving factor in the first half of 2021.

Allocation Change Update

We have, however, made an important adjustment within our equity allocation – adding to value stocks.

As vaccine rollout builds steam, with reinforcements on the way, investors will likely continue to focus on cyclical and value stocks. Sectors like banks, energy, and materials may continue to outperform the broader market. Our noteworthy tilt to growth stocks worked tremendously well in 2020, of course, but we are “declaring victory” and getting things back in line. As economies reopen, we are adding even more to value stocks.

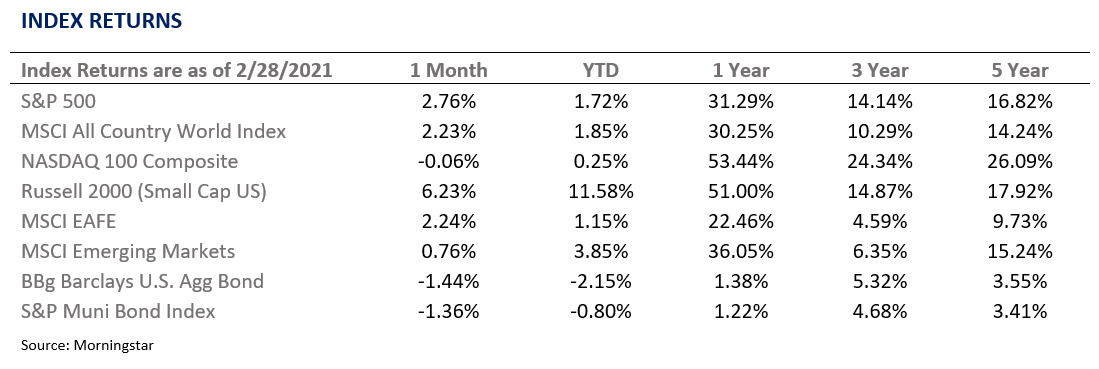

This move shouldn't be all that surprising. There has been a noticeable shift within the stock market over the past few weeks. Investors have begun to flock to those previously beat-up stocks that should benefit most from economic reopening – airlines, travel-related, entertainment. We are seeing continued selling pressures on tech stocks and pandemic darlings such as Peloton, Etsy, and Zoom (to name a few). We believe that the tech sector has disproportionately benefitted from the lockdowns in response to the pandemic. While the S&P 500 ended February up 2.76%, the tech-heavy Nasdaq 100 Composite Index fell 0.6%. It certainly would not surprise us to see these high-flying tech and growth stocks continue to take a breather in the short-term.

Tax Reminder

Otherwise, March brings spring training, warmer weather, and tax preparation. All these subjects, in my opinion, are equally enjoyable! You should have all the necessary tax forms by now, but we are standing by to help if you do not. We are here to provide all needed information to you and your tax advisors.

As for the McBurney clan, the winter swing has continued. Over the school holiday week, we spent some time in Okemo, VT, as Heather and I remain stubbornly determined to get Teddy into the skiing habit. Compared to the January disaster, we had better success this time around. With the help of added patience and something called the “Edgie Wedgie” (a band of rubber that helps to keep the skis parallel), Teddy gleefully tackled the bunny hill. Despite having no ability to stop or turn, Teddy at one point turned to me and said, “Dada, big hill please,” as he pointed at the blue trail above. Funny kid. While I believe he possesses some of my better traits, I am not sure that the trademarked McBurney over-confidence is a good one.

One final note – we at Highland Peak Wealth have begun to see a strong increase in new business opportunities and referrals, predominately from our tremendous clients. We are thankful for all your support and trust.

As always, I welcome any and all thoughts and criticisms.

Best,

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index

CRN202303-279443