April 2021 – In Like a Lion, Out Like a Lamb

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

"In like a lion, out like a lamb" was a saying I often heard while growing up in the D.C. area. While the expression most likely started in the field of astrology, referencing the position of the constellations Leo (a lion) and Aries (a lamb) in the night sky, it grew into a concise summary of March's changing weather. It is a simple enough proverb – March starts cold and stormy, but by the end of the month, spring has sprung. I recognize that this isn't always the case in temperamental New England, but I think you get the idea. My favorite version of this comes from our Scottish friends across the pond, "March comes in with adders' head and goes out with peacock tails." I wish I could write that with a Scottish accent. Either way, the Scots certainly have a way with words.

Markets did their very best to mimic the month’s reputation for changeable weather patterns. March started with a roar of a lion (or an adder head), with the S&P 500 pulling back 4% from the February highs (and down four days in a row to begin the month), only to end the month and first quarter like a lamb - rallying to near-record highs amidst lower volatility.

Stocks encountered some volatility early on when four consecutive days of selling began the month. Investors remained wary of any sign of a decrease in the stimulus that has supported markets during the pandemic. These concerns are still prevalent (and remain on our radar), but the Fed went a long way in uplifting investors and ensuring them that no changes are on the horizon. Even more, Chairman Powell assured markets that the Fed stands ready to “provide the economy the support that it needs for as long it takes.”

After the Federal Reserve pledged to maintain its easy-money policies, markets quickly recovered from the late February/early March selloff. The recovery was so quick, in fact, that the Dow Jones Industrial Average gained 1,000 points and closed above 33,000 in just five trading days – the index’s quickest 1,000-point milestone on record. Markets have remained somewhat tranquil following this recovery. The volatility index, a measure of investor expectations of volatility in the stock market, reached its lowest level in almost 13 months, reflecting a much calmer market (for now).

Market strength continues to be notable, but not all sectors are keeping pace. Those “darlings” of the pandemic, names like Apple, Amazon, Peloton, etc., continue to take it on the chin as investors rotate out of these growthier names and into sectors/stocks that stand to benefit most from the economy reopening. The Nasdaq 100 Composite Index continues to be a relative underperformer as rising interest rates disproportionately impact tech stocks. While it led last year’s recovery, climbing +40% in 2020, the tech heavy index is up just 1.76% to begin the year.

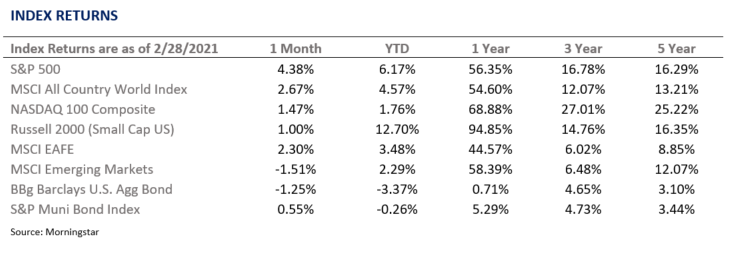

And finally, March completes the 1-year anniversary of the historic pandemic-induced market lows. It has been a wild ride, with a breathtaking, remarkable recovery. Through it all, every one of you should appreciate where we stand today – a stable economy on the precipice of reopening and herd immunity. The below “1-Year” benchmarks are genuinely spectacular –

First Quarter is in the Books

The first quarter of 2021 was a lot of things, but certainly not dull. Far from it! Despite all the noise and muddle, the S&P 500 and Dow Jones Industrial Index boasted solid gains to start the year, up 5.8% and 7.8%, respectively.

If there is one theme to draw from the first quarter – risk appetite is very much intact. Despite political unrest, inflation concerns, and a frenzy of trading, markets climbed higher to kick off the calendar year 2021. Investor confidence improved throughout the quarter. Encouraged by vaccine rollout programs, fresh stimulus, and a friendly Federal Reserve, investors continue to pour money into risk assets. Thus, our core themes remain intact, and in our view, will push markets steadily higher through 2021. As a reminder, here is a summary of our views:

1) There is still a ton of money on the sidelines

2) This liquidity rally still has legs (with yet another round of stimulus)

3) While markets may pull back, plenty of opportunistic buyers remain

On a more micro level, sector rotation was a key theme in the first quarter. In one of the most interesting market rotations in some time, investors shifted money out of growth/technology stocks and into previously beaten-down value stocks. As noted in our previous newsletter, we made a big move back into value stocks (brick and mortar, economically sensitive stocks) in February as optimism around economic reopening improved. We see value’s outperformance continuing into the second quarter as economic indicators continue to point in a very positive direction.

A Look at Upcoming GDP Numbers

The month of March witnessed a handful of financial institutions adjust their 2021 forecasts for economic growth. Optimism abounds as our economy gains solid footing. Just as a quick refresher, we refer to increases/decreases within U.S. Gross Domestic Product (GDP) when we say economic growth. Think of GDP as the total value of all goods and services produced within our borders.

Strong GDP numbers should not come as a surprise given last year’s incredible weakness. There is some mean reversion at work here. However, it is hard to ignore some of the projections around the industry. Bank of America recently raised their 2021 U.S. GDP target to 6.5% - proclaiming that the U.S. economy will experience “stellar” growth as the pandemic subsides. Economists at Goldman Sachs are even more optimistic, raising their U.S. GDP forecast to expect 8% growth in 2021.

To put that into perspective, the last time we had real GDP growth above 8% was in 1951.

Of course, the reason for this is no secret – an abundance of stimulus sent to individuals, businesses, and municipalities has kept markets resilient and encouraged economic growth. In just 12 months, our collective psyche has transitioned from worries of the Great Depression 2.0 to concerns of inflation and the Fed's potential moves to cure an overly hot economy. What a ride the past 12 months have been!

GDP and the Stock Market

GDP and stocks are less correlated than you think. Because stocks are forward-looking, while GDP is backward-looking, there is very little predictive power in GDP growth and stock market performance. GDP tells you very little about what markets will do next. The joke within the industry is that rainfall has proven to be a better predictor of S&P performance than GDP (from a famous Vanguard study).

So why am I bringing this up in the newsletter?

History tells us that GDP growth at these levels may be too much for stocks to ignore.

Again, the stock market is not the economy, but stocks generally jump on the bandwagon with GDP at such high levels. Here is an excellent breakdown from Ben Carlson in his recent Fortune article –

Source: Fortune Table: Ben Carlson – Source BEA

This relationship between economic growth and the stock market is certainly not perfect, but it is hard to ignore these impressive numbers. Overall, stocks have seen solid annual returns when economic growth surpasses 4%. A further review does find some outliers, but the trend is a strong one. When GDP hits 8%, the S&P 500 produced double digits returns 7 out of 11 years.

Simply put, it is somewhat rare for the stock market to fall alongside a roaring economy. There are, of course, several risks to consider. After all, we are in unchartered waters in a handful of ways. However, history tells us that betting against the most robust economic environment in 30 years is an even riskier proposal.

What We are Watching: Q1 Earnings

First quarter earnings season is around the corner, and our expectations around corporate America are high. So high that many companies are raising their expectations. So far, 60 companies in the S&P 500 have issued positive earnings guidance. This number may seem small, but this is the highest number since FactSet began tracking this metric in 2006. So why is this important? Companies issuing positive earnings guidance before releasing their final numbers are very very confident in their ability to beat expectations. With a record number of companies exuding this confidence, it is reasonable to conclude that earnings will be strong across the board.

Specifically, economically sensitive sectors and stocks, those that were battered this time last year, have the easiest path for an upside surprise. Partly because of previous year’s paltry numbers and economic reopening have given these sectors new life. Either way, this supports February’s rebalance back into value stocks. The below chart from Blackrock reflects earnings momentum for industries such as energy, materials, and banks –

Stock prices are generally susceptible to quarterly earnings results. While corporate earnings may take a temporary back seat to stimulus measures and infrastructure bills (more on this next month), they will undoubtedly play a meaningful role in determining short-term direction. If first-quarter earnings are as strong as anticipated, expect markets to move higher. We will be watching closely.

Allocation Update

March’s trading activity has been a continuation of February’s transition from growth stocks to value stocks. So far, so good, as value stocks continue to lead the way.

The story is simple enough - as vaccine rollout builds steam, investors will likely continue to focus on cyclical and value stocks. As mentioned last month, our noteworthy tilt to growth stocks worked tremendously well in 2020, but we are “declaring victory” and continue to realign client portfolios back into value stocks. Any economic reopening will likely accelerate the shift from growth stocks toward real-economy stocks such as banks, materials, and retailers.

Tax Reminder

Just a quick reminder to all – on March 17th the IRS announced that the federal income tax filing due date for tax year 2020 for individuals was extended from April 15, 2021 to May 17, 2021. For those CPAs who receive this newsletter, I know that this came as a huge relief. The extension applies to individuals, but not to corporations or trusts and estates. In addition, estimated taxes for the first quarter of 2021 are still due on April 15. In any event, we are ready to help in whatever way that we can.

Otherwise, longer days and warmer temperatures have helped us escape our winter hibernation and have reintroduced afternoon walks/park visits into our routine. This change is more than welcome. What’s more, Teddy has entered his “bug” phase of toddlerdom. Afternoons have morphed into enthusiastic bug and spider hunts. I have been told by many that kids reintroduce you to the little things of life. I couldn’t agree more. Nevertheless, looking for spiders in my free time isn’t exactly the reintroduction that I was hoping for.

Fear has turned to cheer in the McBurney household. My wife, the teacher, received the famous one-shot JNJ vaccine in early March and is now fully vaccinated. She referred to it as a psychological inoculation, enjoying the emotional relief as well as the physical benefit that accompanies those shots. While she had some flu-like symptoms for a day or so, she was able to shake those off rather quickly. However, since her shot, a strange side effect persists – the incessant desire to tell everyone about her vaccination. It is medically perplexing, and the path to recovery unknown. One can only hope that this, too, shall pass.

Jokes aside, it has been fulfilling to learn of so many clients and colleagues who have received the vaccine. On a purely anecdotal level, we seem to have turned an important corner. For those still waiting, I wish you well as you navigate sporadic appointment openings and hitting “refresh” on the CVS website.

Cheers to a sunny, healthy, and fulfilling spring ahead.

As always, I welcome any and all thoughts and criticisms.

Best,

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index

CRN202304-281018