May 2021 - Market Highs and the Inflation Boogeyman

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

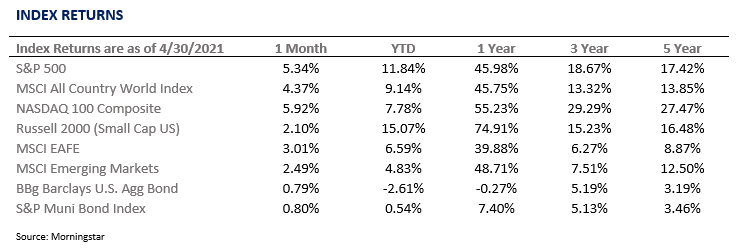

Global stocks delivered yet another strong performance for the month of April – with all benchmarks solidly in the green.

Despite some volatile days, Investors responded positively to strong corporate earnings growth, the quickening pace of COVID-19 vaccinations, dovish messaging from the Fed, and continued fiscal stimulus revving the economic engine for investment and retail consumption. The NASDAQ 100 Composite Index led the charge, rising almost 6% in April, boosted by strong corporate earnings from the mega-tech darlings (Amazon, Apple, and Facebook). Amazon, especially, had a robust quarter, as the stock jumped to record highs after its blowout earnings report. The S&P 500 index was close behind the NASDAQ, up 5.34% for the month.

Tech companies were not the only ones who were celebrating. Upward corporate earnings surprises came from every corner of the economy. With over 300 companies in the S&P 500 reporting, a record 86% of companies reported a positive earnings surprise. We knew that Q1 earnings was going to be good, but not this good.

April also reaffirmed the notion that we are amid a massive economic re-acceleration. The preliminary estimate of Q1 real GDP flashed an annualized growth rate of 6.4% - the 2nd highest reading since 2003. At the current pace, the economic slowdown caused by the pandemic will be behind us later this year. Looking at the details of the GDP report, there is even more to like. Personal consumption, by far the most significant component of our economy, jumped more than 10%. Simply put, there is a ton of capital and pent-up demand from stimulus packages and COVID-related lockdowns.

In addition to a strong GDP reading, household income continues to be strong. Figures released on 4/30/21 indicate that U.S. household income surged by a record 21% in March, fueled by a fresh round of federal stimulus checks.

Below are some impressive returns thus far for 2021 –

This isn’t to say that April didn’t have its set of concerns – inflation also increased. The personal-consumption expenditures index (PCE), the Fed’s preferred measure of inflation, rose 1.8% in March from a year earlier. The increase is still below the Fed’s 2% target, but it is rising. For now, investors remain resilient and have made it clear that any inflationary concerns are still a little too early. However, it is on our radar, and I wanted to address these anxieties in this newsletter. As mentioned in the past, the purpose of this newsletter is to help discern noise from a signal – and there is a heck of a lot of noise around inflation.

The Inflation Boogeyman

As an alternative to the usual format, Troy and I wanted to put forth our thoughts around inflation and proactive management of your investment portfolio. We have had many client conversations on this exact subject. With lumber costs exploding, shortages of semiconductors, and higher wages eating into revenues, it’s hard not to be somewhat concerned.

In England, the Boogeyman refers to a sinister ghost who hides in the dark to frighten and scare unsuspecting children. As legend has it, the Boogeyman is more of a nuisance than a threat, and its evil nullified by bright light.

Inflation has always played the role of Wall Street’s Boogeyman. It lurks in the shadows, ready to halt even the strongest of market rallies. However, like the myth, inflation can sometimes be more of a noisy nuisance than a genuine threat.

What is Inflation

“Inflation is caused by too much money chasing after too few goods” – Milton Friedman.

The above quote from famed American Economist, Milton Friedman, is something that I often repeat. It is a simple explanation of a very complex topic. In addition, the phrase “too much money” has a special meaning following roughly $5.3 trillion being pumped into the financial system over the past couple of years.

Inflation measures the rate at which the purchasing power of money erodes over time. As prices of goods go up, each unit of currency becomes less valuable. For many, inflation fears are less about an uptick in today’s prices than they are about erosion in the value of tomorrow’s savings. The adverse effects of inflation are easy to grasp – both as it relates to personal spending power and consumer demand.

History of Inflation and Returns

To be clear, the relationship between asset class returns and inflation is complex, and there is no straightforward summation that we can apply. Any simplistic conclusions, especially around inflation and stocks, are thorny at best.

Below is a decade-by-decade breakdown of asset class returns and corresponding inflation rates:

Some takeaways from prior decades –

1) There is no clear-cut relationship between inflation and stocks.

2) Moderate inflation is a positive for stocks – deflation is the larger concern.

3) Rates and Valuations are arguably more important to stock market returns.

4) While Bond income loses purchasing power, inflation has not diminished returns in the past.

Inflation Today

Inflation has been absent from the American economy in recent memory. As measured by the Consumer Price Index (CPI), inflation has remained below 4% since 2008. Over the past ten years, CPI has averaged just 1.74% annually. Following the global financial crisis and all the stimulus involved, we have been waiting for inflation to rise, but it just hasn’t happened. CPI in 2020 came in at a lukewarm 1.36%.

The tide, of course, might be ready to shift. With the end of the pandemic hopefully near, and the economy bouncing back, inflationary concerns are at the forefront of investor minds. In fact, Google searches for “inflation” have surged to all-time highs. As mentioned previously, the PCE Index, the Fed’s preferred measure of inflation, rose to its highest level since 2018, up 1.83% year-over-year. As you can see below, the numbers are still within the Fed’s 2% target, but the trend is hard to ignore.

Inflation will likely edge higher in the coming months. When you see inflation projections, I ask that you take a deep breath and don’t take them too seriously. Many economists predict a surge over the next few months, magnified by the fact that this time last year, all inflation readings were negative.

The Federal Reserve, it should be noted, is not overly concerned at this time. These price pressures, according to Fed Chairman Jerome Powell, are likely to be temporary.

“An episode of one-time price increases as the economy reopens is not the same thing as, and is not likely to lead to, persistently higher year-over-year inflation in the future,” Chairman Powell said.

We certainly hope that he is right, but we will continue to monitor the situation closely.

Inflation and Stocks (Generally speaking)

In the long run, stocks can act as an imperfect hedge against inflation. While past performance is no guarantee of future results, stocks have historically provided higher returns than other asset classes when inflation is north of 3%. Once businesses and companies have had enough time to adjust to the inflationary pressures and adjust their prices, revenues will improve, and profits remain steady. The higher costs are simply passed on to the consumer. Suitable for companies but bad for the individual.

In the short term, inflation provides a less favorable outlook for stocks. This shouldn’t come as a surprise. As inflation picks up, markets fluctuate around concern over changes in corporate earnings, consumer demand, and monetary policy responses from the Federal Reserve. Markets become a little more volatile as all these variables come into play. Also, some stocks will oscillate far more than others. Thus, a well-diversified portfolio is even more important to minimize individual stock risk.

How to Hedge Against Inflation

This is a common question from clients. While there are some changes that can be made, dramatically altering a long-term investment plan will likely cause more harm than anything else. In our view, it is best to make some modest changes around the edges to make your portfolio more resilient against rising costs.

Once again, looking at history, a few strategies stick out:

1) Value stocks tend to outperform growth and income stocks during times of higher inflation.

2) Commodities are a traditional inflation hedge. Look for our team to increase exposure should inflation move higher.

3) Real estate investments (REITs) serve as another potential hedge. Rental and lease rates are highly correlated to inflation.

As it relates to these hedging strategies, we have already implemented strategy #1 and have plans to increase our tilt to value stocks further. Commodities and Real Estate performed very well in April, and we expect to increase our exposure to these alternative asset classes soon. We will provide an update in next month’s newsletter.

Our Views Summarized

Inflationary concerns have not altered our overweight to stocks. While we expect to see higher CPI readings over the coming months, we do not believe that a 1970s-style inflationary cycle is likely. For one thing, the U.S. economy still has a way to go before fully recovering from the pandemic. Unemployment remains above 6%, and GDP is still below its pre-pandemic level. We are still a long way away from hyperinflation, and the Fed has plenty of room to raise rates to kill inflation quickly (should it jump).

Investors are expecting inflation in coming years to average about 2.5%. This 2.5% is derived from the difference in yields between normal bonds and inflation-protected bonds. While 2.5% is an uptick from recent history, it is still a far cry from a repeat of the ‘70s and ‘80s.

Our primary inflation concern is less about inflation itself and more about the corresponding response from the Federal Reserve. After all, a less accommodative Fed is far more concerning in the short-term. Our current stock level valuations are only justified if interest rates stay extremely low. Coincidentally, Fed Chair Powell has been abundantly clear that rates will be down for some time. Even more, the Fed appears willing to let inflation run above the Fed’s 2% target for a period.

Allocation Update

We remain bullish and overweight stocks in the near-to-intermediate-term. Nothing that transpired over April (including inflation concerns) has dislodged us from our optimistic view for stocks and the strength of the underlying economic recovery. The cocktail of extraordinary stimulus and a reopening economy continues to drive markets higher. Our focus this past month has been the continued build-out of value stocks within client portfolios – migrating from tech highflyers and stay-at-home stocks to more cyclical stocks. We believe that value stocks are better situated to take advantage of economic reopening and can provide clients a hedge against rising inflation. As we mentioned last month, we will use any short-term correction as an opportunity to rebalance portfolios and potentially increase our equity targets. Of course, we will communicate these changes sufficiently in advance.

As is tradition, the McBurney family followed the New England seasonal pilgrimage down to Florida for part of the month of April. It was a pleasure enjoying some sunshine, being humbled in tennis, and appreciating the benefits of remote work. The highlight of the trip, however, was a last-minute decision to spend a weekend at Disneyworld. While it wasn’t quite the same (all the characters were behind barriers, and many playgrounds were closed), Disneyworld still possessed its magic and had no shortage of money-waving customers.

Armed with sunscreen and face masks, the McBurney family had a fantastic time exploring the park and introducing Teddy to his hero – Buzz Lightyear. His pure awe and associated stage fright were very endearing. Even cooler, Teddy totally fell in love with rollercoasters. This discovery occurred on the Pirates of the Caribbean ride. For those unfamiliar, the ride begins in a dark cavern followed by a drop in the darkest dark. Totally unfamiliar with this part of the ride, Heather and I were worried that we were now in contention for the Worst Parents of the Year Award. Alas, we were wrong. Only seconds later, we heard a giggling toddler proclaim, “Mama, mama that was fun. Can we go again?” And so, we did, and four more times after that. Oh, the things we do for the little uns. On the bright side, Teddy’s evident love of ups and down may make him a stout investor for years to come.

I recognize that this month’s newsletter is a tad different from the month’s past, but I hope you find it useful. As is the norm, bombastic headlines can make inflation sound scarier than it truly is.

Cheers to a sunny, healthy, and fulfilling spring ahead.

As always, I welcome any and all thoughts and criticisms.

Best,

Kyle

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index