First Quarter 2021 - Market Update

Kelly Kowalski, Robert Lindberg, and Cliff Noreen

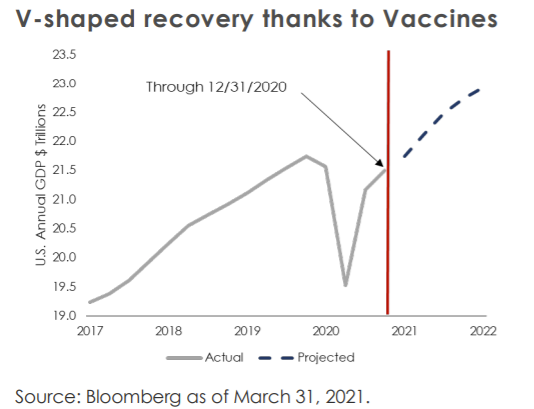

As we pass the one year anniversary of the most volatile and uncertain time of the COVID-19 pandemic, we stand in awe at the vigor of the equity market and economic recovery, the level of monetary and fiscal policy support, and most importantly, the extraordinary scientific breakthroughs that have brought us three highly effective vaccines available here in the United States. Especially for the U.S. economy, things are going pretty well. The Biden administration just delivered a $1.9 trillion fiscal package, and the U.S. is vaccinating over 3 million people per day. With vaccinations accelerating, re-openings underway, and stimulus checks out the door, it is no surprise that the U.S. economy is forecast to grow this year at its fastest pace since the 1980s.

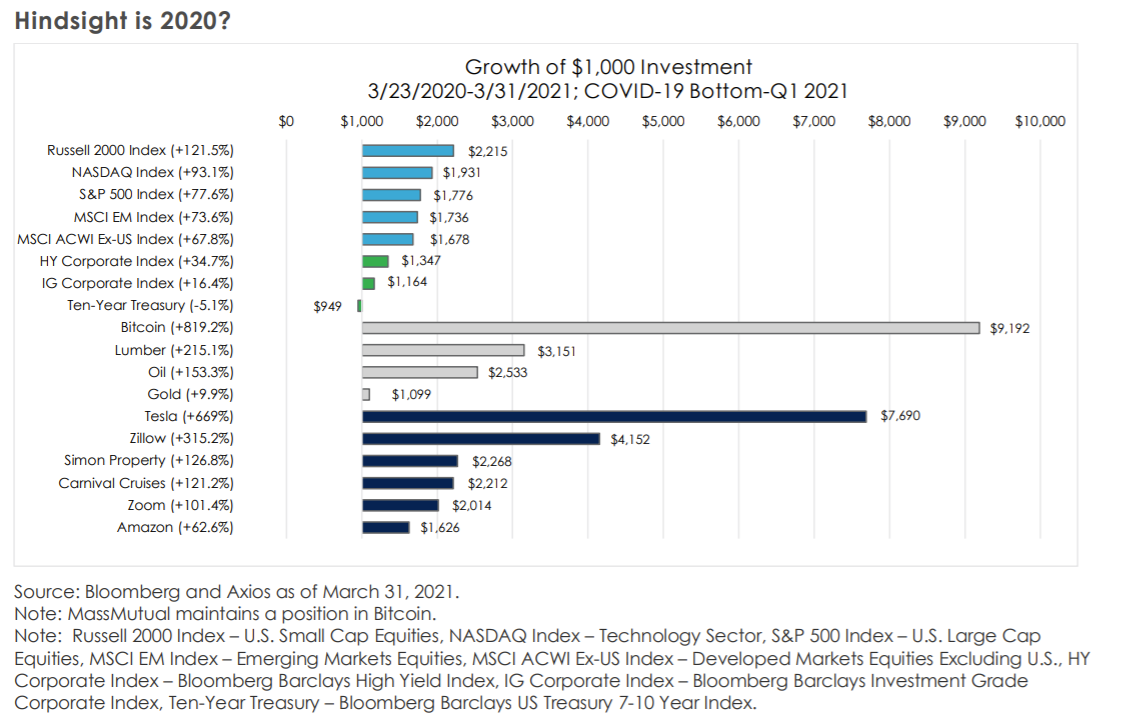

It should also not be surprising that interest rates have perked up from historical lows over the last few months. In the first quarter the U.S. ten-year Treasury yield rose 83 basis points (bps) and is up more than 143 bps from its lowest point in history (0.31%) on March 9, 2020. Through the first quarter of this year, the S&P 500 has risen more than 77% from its low on March 23, 2020. We continue to see a rotation in equity markets away from growth stocks and into value stocks as investor interest shifts away from lockdown winners to re-opening beneficiaries. Concerns of recession have been replaced by fears of inflation and higher interest rates despite guidance from the Federal Reserve that inflation will be transitory and short-term interest rates will remain at zero for another two years. Lastly, we are likely getting another economic stimulus package from Washington, but this time with a price tag of higher corporate taxes. Though the economic outlook is brightening, fiscal and monetary policymakers are keeping investors on their toes.

2021 U.S. growth forecasts—up, up, and away

2021 U.S. GDP growth forecasts were revised up meaningfully in the first quarter as fiscal stimulus was enacted and vaccinations ramped up. The U.S. economy is currently expected to grow 5.7% this year, according to a Bloomberg survey of economists, which would mark its fastest pace of growth since 1984 and mean a remarkable return to pre-pandemic levels of output by the end of the first quarter. Manufacturing activity remains exceptionally strong and supply chains continue to be stretched as they catch up to rebounding economic activity.

With restrictions being lifted and vaccinations continuing, we are already seeing services sectors begin to rebound in earnest. Travel, eating out at restaurants, and overall mobility is swiftly picking up. Furthermore, recent economic data is reflective of a healthy start to 2021. In March, consumer confidence surged to levels not seen since March 2020 as stimulus checks were dispersed and the COVID-19 picture improved. During the month of March, the U.S. Treasury distributed over $400 billion of stimulus payments and tax refunds to U.S. consumers, after distributing more than $200 billion during January and February. We are also already seeing the impact of stimulus in consumer spending data. According to Bank of America credit card data, card spending increased 82% year-over-year and 20% relative to 2019 for the seven days ending March 27. Last, but certainly not least important, the U.S. economy added 916,000 jobs during March; if this pace of job growth continues, the U.S. could return to its pre-pandemic employment level by year-end!

NASDAQ experiences mid-quarter correction

U.S. equity markets remained resilient in the face of rapidly rising Treasury yields during the first quarter, setting new record highs as economic and earnings growth momentum prevailed over fears of tightening financial conditions. 2021 S&P 500 earnings per share are expected to grow 25% over last year. The NASDAQ, however, has not reclaimed its record levels set in midFebruary as the rise in long-dated Treasury yields, which has been a significant headwind for growth and momentum stocks, accelerated through March monthend. Higher yields reduce the present value of future cash flows of any investment and in particular the valuations for many of the high-flying growth stocks of the NASDAQ, leading to what many strategists see as a long overdue rotation out of growth and into value stocks. Rising yields remain a risk to fully valued “growth” companies with the NASDAQ still trading at over 30x forward one-year earnings compared to the S&P 500, which trades at 22x forward one-year earnings.

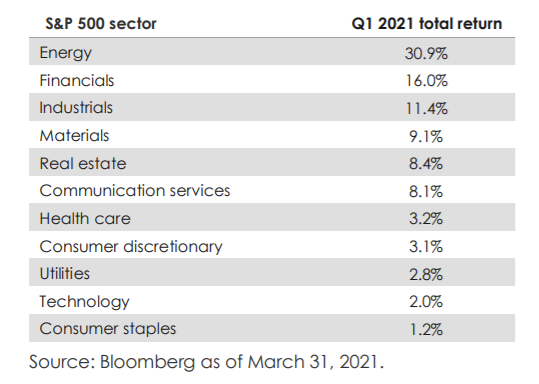

2020 laggards continue outperformance into first quarter 2021

As technology and consumer discretionary sectors continued their underperformance from the end of 2020, the shares of financial, energy, and industrial companies have been major beneficiaries of the reflation trade (i.e. rising bond yields, higher inflation expectations, and rising oil and commodity prices). After a decade of fast growing technology stocks dominating markets, we believe value stocks are poised to outperform. Record fiscal stimulus, the U.S. vaccinating over 3 million people each day and a significant buildup in savings collectively underpin earnings growth potential for many value companies which tend to be more sensitive to changes in the economic cycle. The rotation and sensitivity of different sectors through different parts of the economic cycle reinforce the importance of a diversified p

Interest rates rise sharply in first quarter

U.S. Treasurys had their worst quarter for total returns since 1981 as yields soared on higher economic growth and inflation expectations. In February an auction of seven-year Treasury bonds saw the weakest demand since 2009, rousing concerns about demand for U.S. government debt in light of record stimulus spending programs and deficits. According to Strategas Research, the U.S. fiscal deficit as a percentage of GDP is growing at its fastest pace since World War II, and total U.S. government debt now exceeds $28 trillion or around 130% of GDP. While subsequent Treasury auctions saw improved demand, the ballooning size of the U.S. debt remains a long-term concern.

Amid the rise in Treasury yields, the Federal Reserve has reinforced its intention to maintain accommodative policy until the labor market fully recovers. The Fed expects to hold short-term interest rates at zero through 2023; however, the bond market is pricing in the possibility that an interest rate hike could come much sooner if the economy rapidly recovers. The Fed also continues to dismiss concerns of inflation, despite indicators such as the ISM manufacturing prices paid index reaching decade highs recently. We expect to continue to see inflation pressures over the next several months as the recovery accelerates. The most pressing question for the bond market is whether meaningful inflation can sustain beyond a few months. The Fed maintains that it will not, but with the U.S. money supply growing 25% year-over-year, many investors are not comforted by the Fed’s prediction as inflation expectations continue to rise.

Rosy economic outlook tempered by valuations, monetary policy uncertainty, and higher tax rates

At this juncture, it is difficult to be anything but positive on the economic outlook, particularly for the U.S. where vaccines will be available for everyone very soon and where consumers are sitting on record savings available to be spent. Amid an exceptionally positive economic growth backdrop, financial markets are weighing the risks of tighter monetary policy if inflation/growth surprise further to the upside, and now higher taxes with President Biden’s latest infrastructure plan. The $2+ trillion infrastructure spending package includes approximately $1.7 trillion investment in physical infrastructure and research and development and approximately $500 billion toward worker incentives and Medicaid benefits. It is expected to pass sometime in the next few months and will likely benefit companies exposed to infrastructure, particularly clean energy, broadband, and digital. The White House expects the package to boost economic growth, investing around 1% of GDP per year over eight years. To pay for the infrastructure spending, the Biden administration proposed raising the corporate tax rate from 21% currently to 28%. Many strategists believe that to get moderate Democrats on board, the corporate tax rate may rise to only 25%. Although the infrastructure proposal was limited to corporate tax increases, there are expectations that the Biden administration will propose increased capital gains and individual tax rates later this year.

As we finally enjoy a “return to normal” and the great economic reopening we have all been desperately awaiting, we still have many questions as to what a post COVID-19 world looks like. One thing that is certain, however, is that fiscal and monetary policy will continue to be extremely influential to markets. As we watch the reopening unfold and assess its impact on economic growth and corporate earnings, we will be equally focused on how policymakers respond. Even with a bright economic outlook, policy uncertainty and elevated valuations will be the biggest challenges for investors over the next several months and are likely to create periods of volatility. Looking further out, a key question as we think about 2022 and 2023 is how much the economy can grow with potentially higher taxes and less stimulus relative to 2020 and 2021?

We wish you smooth sailing in the second quarter and look forward to a mid-summer update.

Kelly Kowalski, Robert Lindberg, and Cliff Noreen

Disclosures

Market Indices have been provided for informational purposes only; they are unmanaged and reflect no fees or expenses. Individuals cannot invest directly in an index.

Past performance is no guarantee of future performance or market conditions.

Use of political figures or statements is solely for reference and relevance to financial markets and is not meant to be an endorsement or a reflection of the company’s opinion or position.

This material is intended for informational purposes only and does not constitute a recommendation to engage in or refrain from a particular course of action. The information within has not been tailored for any individual and is not intended as tax, legal or investment advice.

The views and opinions expressed are those of the author as of the date of the writing and are subject to change without notice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should be relied upon when coordinated with individual professional advice. Clients must rely upon his or her own financial professional before making decisions with respect to these matters.

This communication may include forward-looking statements or projections that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Investments discussed may have been held in client accounts as of Dec. 31, 2021.

These investments may, or may not be currently held in client accounts Securities and investment advisory services offered through registered representatives of MML Investors Services, LLC. (member FINRA/SIPC).1295 State Street, Springfield, MA 01111-0001.

CRN202304-281198