May 2023 - Here Comes the Debt Ceiling

By: Kyle McBurney, CFP

Managing Partner at Highland Peak Wealth

During a recent conversation with a client, the client asked Troy and I a simple yet insightful question: "How can this market keep going up? It makes zero sense." As financial advisors, we sympathized with the client’s confusion – this year's tape has been confounding in many ways. We reminded the client that a confusing market is the norm, not the exception. Lest we forget our old friend Mr. Market – the unpredictable character whom no one can figure out. "Also,” I added to the client, “the market tends to climb a wall of worry." Understandably, I received from the client a bit of a dumbfounded look.

“Markets climb a wall of worry?,” the client asked.

The phrase “climbing a wall of worry” was coined in the 1950s, and it remains a popular term in finance today. It describes a sustained rise in the stock market during economic, financial, or political turmoil. It's as if the market is climbing a seemingly insurmountable wall of worry and coming out with gains. Despite a long list of economic obstacles, that's precisely what we saw in April.

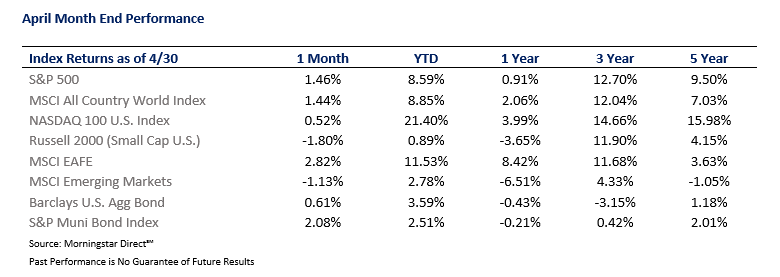

Historically, April has been the best calendar month for stocks. This past April, markets did perfectly fine. A diversified portfolio gained roughly 1% as both stocks and bonds rose. While 1% may sound ho-hum, this came in the face of plenty of worries – another big bank failure, rising interest rates, a loosening job market, and a looming debt ceiling debate, to name a few. Developed International did exceptionally well, as outperformance against US stocks continues.

April was also very calm. Where March felt like a rollercoaster, the past month was remarkably stable. There were no drastic pivots, no big surprises, and in many ways, business as usual. So far, the ripple effects of the Silicon Valley Bank collapse have been muted. But, of course, if early May is any indication, we are not yet out of the woods. Either way, April's quiet was a welcome respite.

The quiet, however, is unlikely to last.

Looming large is the upcoming debt ceiling debate. More on this in the next section, but it appears that President Biden and the Republicans in Congress are on a collision course, and the clock is ticking. So far, markets have largely ignored this issue. After all, even today, the outcome remains heavily guesswork. But have no doubt that the news cycle and corresponding headlines will get very noisy over the coming weeks. So, during the inevitable wave, let's remember to take a deep breath, relax, and come to us with any questions.

Ultimately, the full extent of the issues plaguing the banking system, including those faced by First Republic Bank and other similar institutions, is yet to be determined. Accordingly, we continue taking a defensive approach at Highland Peak Wealth and are happy to let the ripples ebb and flow. We have been pleased by this year's return but do not feel compelled in any way to "chase" market return at this time. Instead, we are happy to cheer the market on from a more defensive stance.

As always, rest assured - we will keep our clients informed of any pertinent updates as they arise.

Quick Thoughts on the Debt Ceiling

To avoid confusion, we wanted to clearly summarize our thoughts on the debt-ceiling debate. Like so many politically charged issues, the debt ceiling carries more emotion and uncertainty than usual. As such, we wanted to be super clear as to our thoughts and outlook. Here are some of our thoughts:

- Last week’s passage of the House bill is a positive first step – working on the how, not the whether

- The hard part is about to begin, and market volatility will react

- The Treasury has plenty of tools to keep the government funded and debts paid

- Markets will adjust to spending cuts – austerity and its impact on GDP is the real issue here

- We remain convinced that we are ultimately heading to a resolution, despite the partisan noise ahead

As always, we encourage you to, first and foremost, breathe. We will no doubt see plenty of political posturing on both sides. We view everything as it comes, as no other alternative truly exists. As investors, we will adjust accordingly.

So, What is the Debt Ceiling Anyway?

Before we jump into specifics regarding the debt ceiling debate, I am reminded of an old GEICO commercial.

The scene unfolds in a posh restaurant, where a group of diners are about to settle the bill. The waitress places the check on the table, prompting everyone to start fishing for their wallets. Just as the group is about to pay up, a loud voice interrupts the silence, exclaiming, "Whoa, whoa, whoa! I got this!" The camera then pans over to reveal an unexpected sight - an alligator dressed in a sharp suit and tie. Despite his confident proclamation, the alligator struggles to reach the check with his comically short arms, much to the annoyance of his fellow diners. "I can't reach it!" he laments, eliciting eye rolls and head shakes as if they have seen this scene before. The commercial ends with the GEICO narrator saying –“if you have alligator arms, you avoid picking up the check.”

While it may seem like a silly comparison, this light-hearted GEICO commercial featuring an alligator struggling to reach the check at a restaurant is a helpful metaphor for understanding the debt ceiling debate. At its core, the discussion is about the government paying for expenses that have already been incurred, like a restaurant bill that has already been racked up.

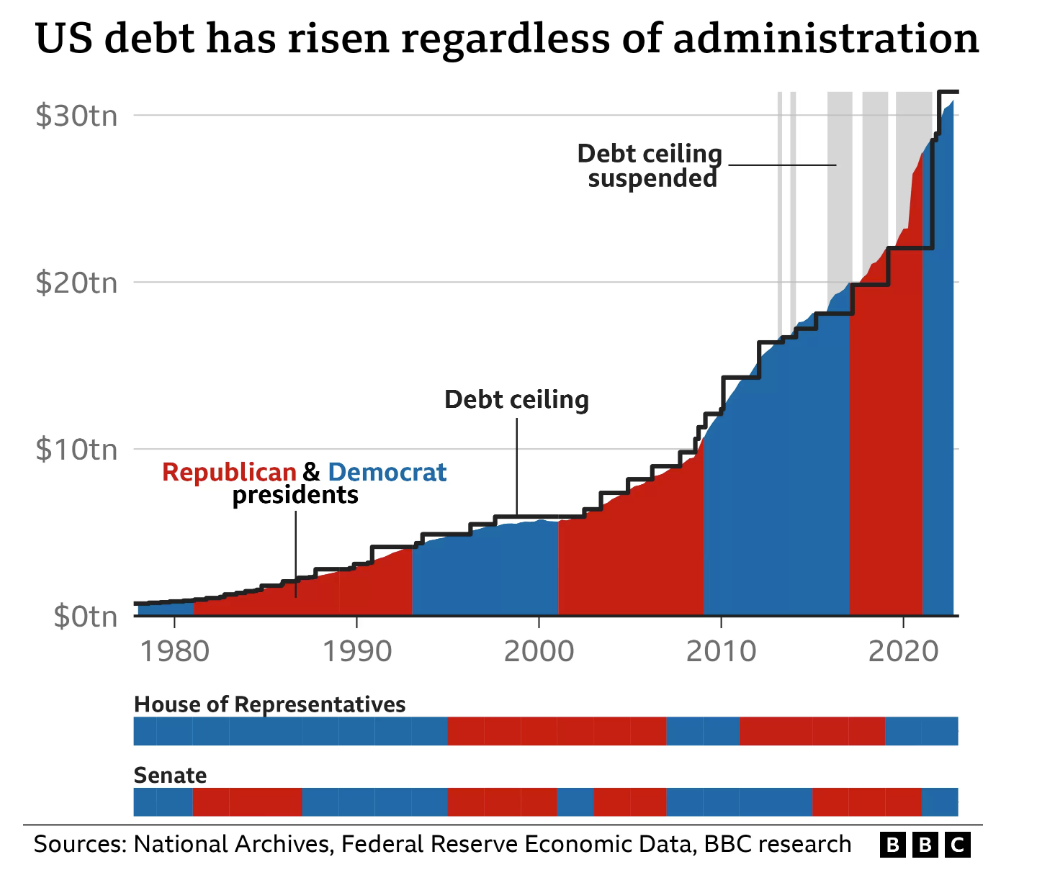

The debt ceiling is a term that may sound dry and wonkish, but don’t be fooled: it's a critical issue that can have significant implications for the economy and financial markets. Simply put, the debt ceiling is a limit on government borrowing. As seen below, government borrowing has increased regardless of administration but has exploded following the Great Financial Crisis and COVID responses.

Historically, the debt ceiling has typically been a non-event. First introduced during World War 1, Congress has raised the debt ceiling 78 times since 1960. However, in recent years, such as 2011, this debate has become increasingly contentious and partisan. Unfortunately, it has become one of the few bargaining chips for the minority party to negotiate spending and budget matters. Today, frustrated at the bloated size of government, Republicans in Congress are using the opportunity to negotiate a handful of spending cuts and budget reductions.

The risk, of course, is a deal doesn’t get done, and a debt default occurs – opening the door for a credit quality downgrade. A default could be an economic catastrophe and send shock waves throughout markets. Frustrating to all investors is that the government has temporary alligator arms when taking responsibility for dollars already spent. Of course, being a political tool falls in the category of “it is what it is,” but markets hope this isn’t a replay of 2011.

What Happened Last Time?

Like just about everything regarding markets, we have been down this road before.

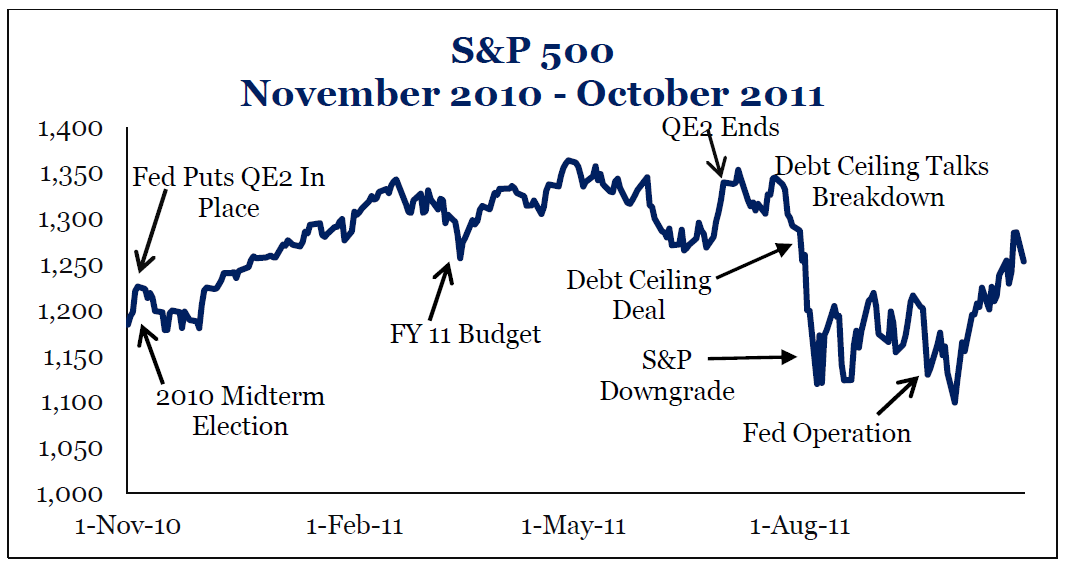

This year’s debt ceiling debate looks like it will be the most contentious since 2011, when it was used for similar spending bargaining. It was an ugly back-and-forth. Talks broke down, and many federal government employees went on unpaid leave. Even worse, the S&P downgraded the credit quality of US debt. Finally, with less than 72 hours left until the US would have defaulted on its debts, a deal was made – the debt ceiling was raised but with $900bn in spending cuts attached. Below is a chart of the S&P 500 during this ordeal:

Source: Strategas

A few interesting occurrences to note here:

1) Markets were already in decline from the end of quantitative easing (QE2)

2) The S&P downgrade of US Debt occurred around the bottom of the pullback

3) Markets quickly recovered once the Fed changed its game plan – a reminder to stay the course

While the chart looks scary, much of the market decline was not about the debt ceiling. Markets declined after a deal was reached due to uncertainty around the Fed and the attached spending cuts (reducing GDP outlook). It wasn’t a fun ride, but the market ultimately recovered with the S&P 500 posting three straight years of double digit returns in ’12, ’13, and ’14.

Where We Stand Right Now

Last week, in what Dan Clifton, head of policy at Strategas, called the “put up or shut up” week, House Republicans successfully passed legislation to raise the debt ceiling and cut spending. While unlikely to be enacted as is, it is a positive step forward. Now, all parties involved are working on the “how” instead of “whether” the debt ceiling will be raised. A long way to go for sure, but it’s a start.

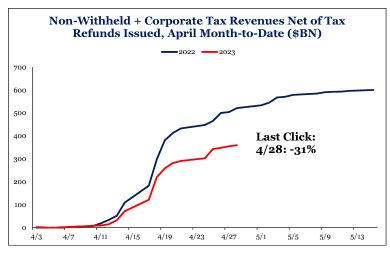

Unfortunately, there may be less time than anticipated. On May 1st, Treasury Secretary Janet Yellen announced that there is a risk that the US government will not be able to make it to June 1st without an increase in the debt ceiling. This is due to lower-than-expected tax collections – likely hurt by California’s weather-related state-wide tax extension. Whatever the reason, the government has less in its coffers than anticipated, which will bring forward the deadline. See below:

Source: Strategas

Given the expedited timeline, Biden has called on the four Legislative leaders – McConnell, Schumer, McCarthy, Jeffries – to meet on May 9th. The good news is that policy makers can now get started on the substance of the deal. The bad news, of course, is that the hard work is just beginning.

Dan Clifton and his phenomenal team of policy analysts at Strategas still see a pathway to a deal. The way they see it, there will be a last minute, negotiated bipartisan agreement that will include roughly $1.5TN of budget cuts. A big number, but on par with ’11 cuts on a relative basis. Their best guess is that COVID funds will likely end, with some modest changes to income and eligibility for social programs.

In the end, markets will be paying the closest attention to the austerity measures included in the deal. While the debt ceiling back and forth is a short-term concern, budget spending is a long-term driver of growth. The 2011 ordeal was a good reminder that stocks can fall more after a deal is made if austerity is above expectations. Of course, markets also don’t like runaway spending and reckless budgets. So, either way, we are watching closely.

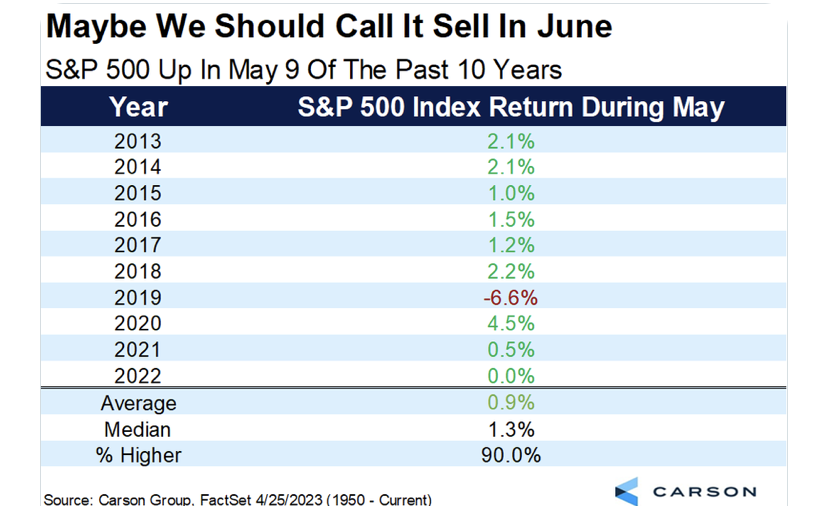

Chart of the Month – Does “Sell in May and Go Away” still work? Not Recently!

Allocation Update

At this time, we are advising our clients to adopt a more cautious approach to investing due to several factors that we believe increase risks and concerns. In particular, the uncertainty surrounding the debt ceiling and concerns over financial stability has led to increased growth concerns over the past month. Moreover, while markets have continued to perform well despite the pessimistic outlook, several significant obstacles could derail the upward trend.

Taking a broader view, stock prices are still vulnerable, and valuations may be too high, given the current inflation expectations and higher rates. Therefore, considering all these factors, taking a more defensive stance regarding asset allocation is prudent.

As always, we have summarized our current asset class recommendations below:

- Equities – Underweight

o While growth outperformed value in Q1, we still like value long-term

o We are increasingly optimistic about Developed International stocks

- Fixed Income – Slightly Underweight

o We have worked diligently to increase duration and lock in attractive yields

o We still like high yield, especially those companies that have strong fundamentals

- Alternatives – Neutral

o Alternatives can serve as a means of diversifying the portfolio allocation and a hedge against turbulence

o Gold continues to perform well – up 10% in ’23 – as a hedge against banking concerns

- Cash – Overweight

o Maintaining above-average cash position for defense and attractive yields (still +4%)

o Short-Term Treasury Bonds (+5% yield) continue to be an excellent alternative to traditional cash

Wishing you all a fantastic spring season and a very happy Mother's Day! The arrival of spring is finally upon us, and while the pollen and allergies may be a nuisance for yours truly, it's a small price to pay for the beauty and sunshine. With the days getting longer and the weather getting nicer, the McBurney family will no doubt enjoy the outdoors with absolutely zero pushback from our toddler (har, har).

And finally, please do not hesitate to reach out. We expect the next few weeks to be noisy and welcome any chance to calm the nerves. In times like these, communication is crucial.

As always, questions and comments are welcome.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

CRN202605-4363581

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information