December 2022 - Airport Thoughts

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

No creative opening here. I’ll save the wisecracks and mercifully give you all a month off.

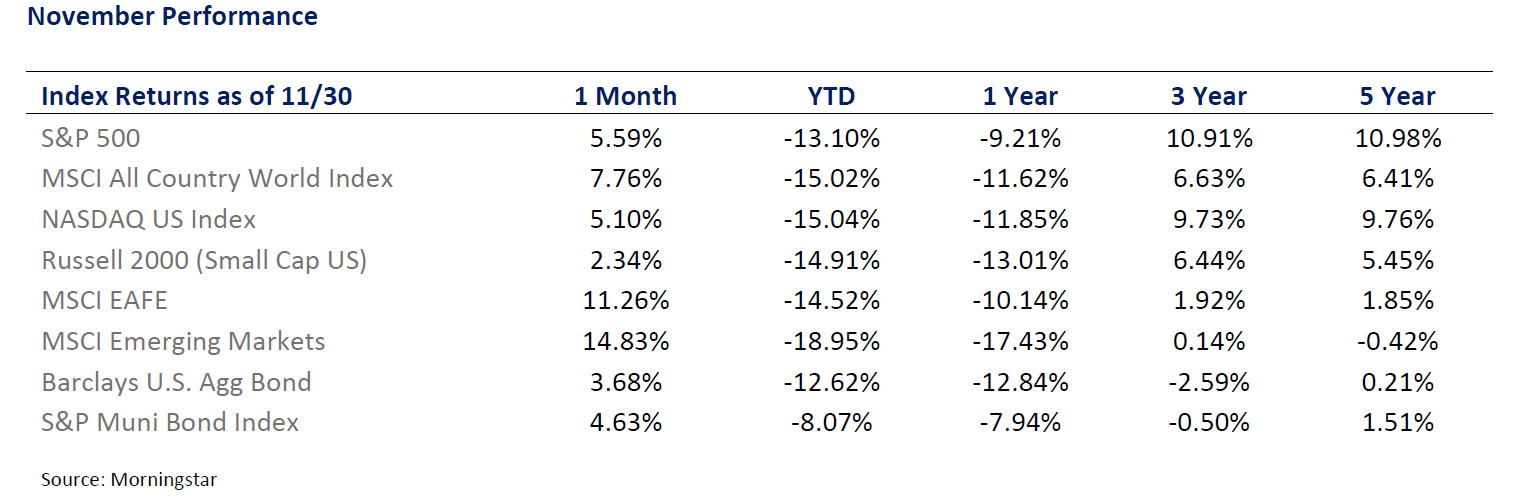

Coming off a strong October, November did not disappoint - investors had plenty to feel good about. Inflation, while still high, continues to trend lower. As a result, it is becoming increasingly likely that “peak inflation” is in the rearview. Jerome Powell and the Fed took note and have expressed a willingness to reduce the size of future rate hikes. In addition, midterm elections concluded with Republicans winning just enough seats in the House to constitute a majority when the 118th Congress is seated next January. This is a scenario stocks like – a split government offers investors stability and peace of mind. Put it all together, U.S. markets rallied for the second month in a row, with the S&P 500 up 5.6%. Bonds also enjoyed some relief amidst a tough year, gaining 4%.

International stocks had a tremendous November. Emerging market stocks did exceptionally well – gaining nearly 15% despite plenty of geopolitical noise. Specifically, markets reacted quite favorably to expectations that China is loosening its Zero Covid policy following protests and unrest. The Hang Seng Index, Hong Kong’s Stock Exchange, had its best month in nearly 25 years, jumping 27.3%. If China’s Zero Covid policy continues to soften, as we have seen recently, this should play a significant role in easing supply chains and reducing global inflation.

Heading into the final month of 2022, where does this leave us?

Markets are at a crossroads. After a couple of years of pandemic-induced stimulus, leading to overinflated markets at the end of ‘21, equity markets have gone from overvalued to undervalued and today sit near historical norms.

Driven by the conclusion that inflation has likely peaked in the U.S., the focus has shifted to economic growth. Much of next year’s success (or failure) will probably come the old-fashioned way – corporate earnings and consumer spending. The next durable advance in equities will be reinforced by improving fundamentals instead of easy money access.

As I write this, I sit in the bustling San Francisco Airport, waiting to board a cross-country flight home. I was lucky to find the last seat near my gate by the charging station - travelers are everywhere. It is hard not to notice that this flight is fully booked and that the surrounding restaurants are packed. This has been the story all year, really. As business travel has reopened in ’22, it’s hard to ignore the crowds and lack of empty airline seats and restaurant tables. While merely anecdotal, these everyday day-to-day observations have thrown cold water in the face of the economic doom and gloom we have heard all year. Whether the Fed can avert a recession, and keep these seats full, appears to be the Big Question going into ’23. If the economy does enter recession next year, history suggests more pain ahead.

If December markets are any indication, recession fears persist. And rightfully so. Corporate earnings came in so-so in Q3 and look even worse when energy stocks are removed. The yield curve remains heavily inverted, a common feature in previous recessions. Consumers are spending, but savings have come down. Some companies are announcing layoffs. Put it all together, we at Highland Peak Wealth are happy to let the market figure things out from an underweight position in equities. We will provide our ’23 outlook next month – stay tuned.

The Second Derivative

The second derivative is everywhere in finance and currently impacts how we view markets.

Simply put, the second derivative is the rate of change – it tells us whether the variable in question is increasing or decreasing.

For a moment, imagine a car driving down a long highway. The car is going 60 miles per hour. That’s the first derivative. This information tells us that the vehicle is moving in a positive direction at a certain speed. But wait, only 5 minutes ago, the car drove 65 miles per hour. So, here is your second derivative – telling us that the car’s rate of change is decreasing and slowing down.

Markets care far more about the second derivative and the direction of change than anything else.

Currently, equity markets are focused on two key drivers and their respective direction – inflation and corporate earnings.

The Good: Inflation Still Hot, but Second Derivative Continues to Show a Decreasing Trend

Yes, inflation clearly remains elevated. That isn’t disputed. But recently, investors have had plenty to cheer about in the fight against inflation. October’s headline CPI increased less than expected – up 7.7% yearly but below the expectation of 7.9%. Even better, it was a 0.5% decrease from September and a near 1.5% decrease from June’s 9.1% reading. October’s report is the 4th monthly release in a row of declining inflation, solidifying a significant trend.

Decreasing inflation is a huge positive –

The Federal Reserve may soon slow its aggressive pace of interest rate hikes

Lower prices help consumers spend more – which is crucial to corporate earnings

Lower rates make homes/big purchases more affordable

Markets surged higher last month on signs that inflation continues to cool and is returning to historical levels. Goldman Sachs, in fact, forecasts that core inflation will fall to 2.9% by December 2023 as supply chain clearing lowers good prices, rents moderate, and wage growth begins to cool.

The Not So Good – Direction of Corporate Earnings in Jeopardy

Earnings season has concluded, and corporate profits for the S&P 500 were ho-hum. According to Bloomberg data, the earnings growth rate was 3.42%. Not bad, and enough to support stocks at these levels, but slightly lower than expected. Also, if you remove energy companies, earning growth declined for the quarter. So the second derivative, at this time, isn’t moving in the right direction.

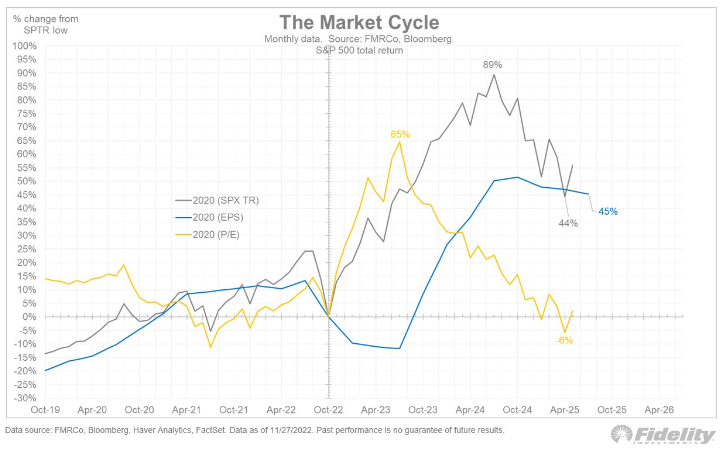

Looking at expectations for Q4 and beyond: expectations are coming down. Analysts have been steadily cutting their estimates – down more than 11% since mid-April. Below is an excellent chart from Jurrien Timmer, Director of Global Macro at Fidelity Investments. In his view, next year’s growth or decline will come down to the blue line, representing growth earnings per share.

As you can see, the second derivative isn’t great. While the growth of Earnings Per Share (EPS), the blue line, is still at decent levels, the direction of change is not ideal. Should that blue line continue to decline, equities will likely be limited in terms of how high they can go. Corporate earnings and the ability for profits and consumer spending to remain steady will be front and center as we enter ’23.

Put it all together, and markets are at an inflection point. Therefore, with an eye on risk management, we prefer to tilt defensively until a more focused picture is developed. We will communicate to you any changes in this view.

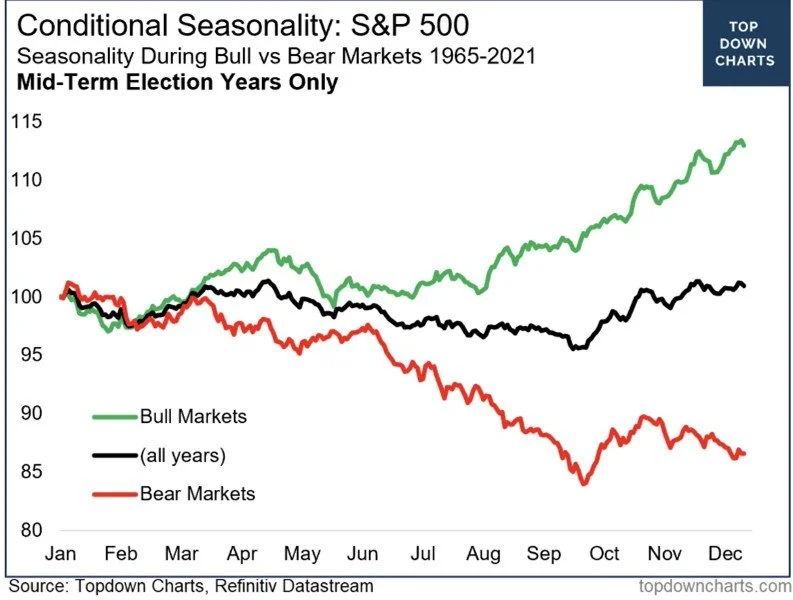

Chart of the Month #1 – Santa Claus Rally? Not always the case within a midterm year/bear market.

Chart of the Month #2 – As Americans, we gain all our weight in November and December. Embrace it!

Source: Phillip Pearlman, Prime Cuts Newsletter

Allocation Update

If nothing else, our decade-plus love affair with easy money has ended. We believe that bottoming is a process and that this sorting-out period still has some bumps ahead.

Unchanged from last month, we remain underweight in equities. Within our underweight, we also maintain our preference for Value over Growth and more defensive tilts among equity sectors – healthcare, staples, and industrials. This has worked fabulously in ’22 and has led to outperformance within U.S. stocks. However, as market volatility persists, we see no need to shift our defensive tilt. Yes, growth companies (think tech) can do well when economic growth slows, but we do not believe we are at that point just yet.

As explained last month, client portfolios are lighter on the “top of the market” – mega-caps such as Meta, Google, Apple, etc. – and instead focus more on the average stock. We are mindful of the unrest in China and the risk it can pose. As a result, we prefer to remain lighter on mega-cap stocks exposed to China’s supply lines.

It has been a painful year, but we see higher yields as a gift to investors who need income. Strategically, we continue to add to our fixed-income positions. More attractive income potential at better prices continues to make the space more appealing. We still like to keep our maturities on the shorter ends, but we are slowly adding longer-dated bonds.

On the alternative side, investments outside traditional stocks and bonds, we are neutral with a preference for a diversified approach. Alternatives can serve as a means of diversifying the portfolio allocation and a hedge against any inflationary surprises. It is important to note, however, that we are very light in real estate. Commercial real estate is in a precarious position without a light at the end of the tunnel in sight. We plan to be light here for some time.

End of Year Items

As a reminder, our team at Highland Peak Wealth is ready to help with your end-of-year “to-do’s.” This includes any last-minute gifting, charitable donations, tax payments, or required minimum distributions (RMDs). So, please do not hesitate to reach out.

The McBurney family had a great Thanksgiving full of food, family, and friends; but regrettably, it also ended with the flu. Now that we are somewhat recovered, we are in full December holiday mode. The lights are up, the tree is decorated, and my sugar intake has spiked. It is all part of the norm, of course. What is new, however, is a state-of-the-art parental assistant – Elf on the Shelf. For those unfamiliar, Elf on the Shelf is part Christmas tradition, part mind control. As we tell our little Teddy, the Elf is a spy for Santa’s workshop sent on a mission to observe and report back. As you can imagine, Teddy walks on eggshells whenever the Elf is around. He has been on his most angelic behavior. Who is this kid? Either way, the parents rejoice! It’s a big win for mom and dad thus far. Fingers crossed!

Our Highland Peak Wealth family hopes you and yours have a safe and happy holiday! Thank you for being such fantastic clients and colleagues. Cheers to a prosperous and healthy 2023 ahead!

And for those who ask about New Year’s resolutions, I like Calvin’s answer. I have no doubt that my spouse would fully agree 😊.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index CRN202512-3497441