November 2022 - Bear Market Traps and Midterms

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

In January of ‘76, the first Video Home System (VHS) was being prepped by JVC for sale in Tokyo’s famous Akihabara district. This cutting-edge technology was introduced at an enticingly attractive price of just $1,060 per system ($5,530 in ’22 dollars). What a bargain! That same month, the Dow Jones Index capped off a fantastic month – gaining 14.41%.

Why do I bring this up? Outside of my unabashed love of VHS systems, that’s how far you must go back to find a better month for the Dow.

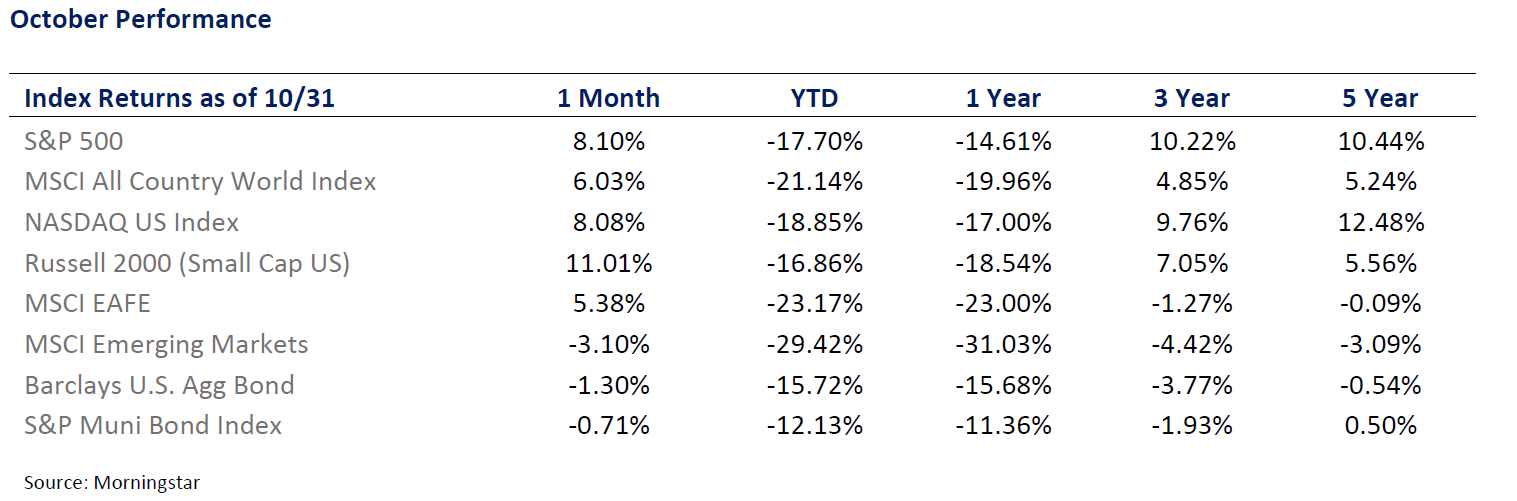

Mr. Market, in all his madness, felt a tinge of optimism in October. While bonds remain stuck, stocks made quite a comeback. The Dow Jones led the way, soaring 13.95%. Small caps also did exceptionally well – up 11% on the month. The S&P and Nasdaq gained about 8% and 3.9%, respectively. While the month provided plenty of positives, challenges persist. October’s gains occurred despite a somewhat mixed third-quarter earnings season. Especially noteworthy were the major disappointments from mega-cap stocks such as Amazon, Meta, and Google. Meta was especially walloped in October, falling by a whopping 32%. Also, as broader markets surged, Amazon and Google declined 11% and 4%, respectively.

So, how do we interpret such weak earnings from these heavyweights? Let me answer in a creative way.

In some ways, the market functions like an army – there are generals and soldiers. The generals are those big bad mega-cap stocks (think Amazon, Google, Apple, etc.), and the soldiers are the breadth of the market (your average stock, such as a bank or healthcare company). As expected, ugly earnings from the “generals” have provided fuel for market pessimism. Market bears expectedly exclaim aha, isn’t it obvious? Inflation and slowing growth are hurting everyone. Sell!

Surprisingly, poor earnings from the “generals” also provides fuel for market bulls. As the saying goes - in battle, as in a bear market, the generals are last to fall. Market bulls claim that weak earnings from the mega caps are a classic sign of a bear market on its last leg, on the cusp of a turn. They also point to the strength of the average stock and market breadth – think banks, healthcare, and other boring companies. These soldiers, many of whom populate the Dow and Small Cap Index, have had a tremendous two-week period to close the month– the best in two years. This a possible sign that traders expect the new bull market to be led by these sectors.

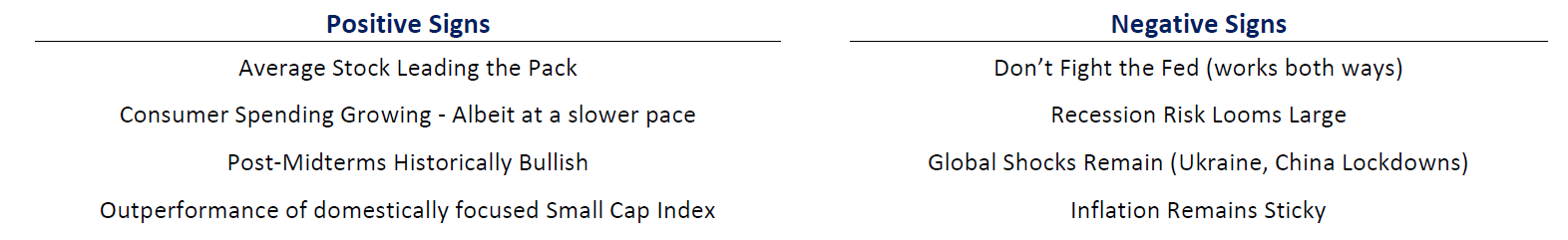

Therein lies today’s debate – is October’s rally a simple bear market trap, or is it the start of something more? As usual, there are conflicting storylines:

The truth is, of course, one never knows. History tells us that it is impossible to say in real time which rallies will last and which ones won’t. In jest, I tell clients that my knee throbs in pain when markets hit bottom (I should really get that checked out 😊). Simply put, no bell rings at the top, and there is undoubtedly no bell at the bottom. Yes, there are some historical patterns that we can point to that suggest a market bottom (many of which we are not seeing), but it is never that easy. Market bottoms are littered with contradictory data points and narratives.

Still, we are in the business of doing our best to manage risk in client portfolios. We continue to see some downside risk ahead. Fed Chair Jerome Powell reminded us of this, as he clearly communicated the Fed is willing to push the economy into restrictive territory to quell inflation. As we set forth in our last newsletter, we still believe that more time needs to pass before a new bull cycle begins. Bottoming is a process and will likely take some time. Markets can (and will) be very painful for months or perhaps years. On the other hand, if you had sold most of your stock at the end of September, you would have missed out on October’s gains. Our job is to help clients through trying times and avoid financial mistakes that can derail a long-term financial plan.

Final Midterm Update

As I write this, election day is just five days away. Have you heard? Probably not, as it hasn’t been on the news much. In our view, markets focus more on the Fed and inflation, but with elections around the corner, it is worth a quick review. Before I dive in, I realize that politics is currently a third rail in our society. I do my best to be objective, but as a reminder, I am simply a humble messenger.

Stocks historically rally leading up to and post-midterm elections. Why is that the case? Perhaps it is because it typically ends in a split government (which markets love), or it gives investors short-term optimism. However, the most likely answer is simple - because it’s over. Markets hate uncertainty, and midterm elections can provide much of it. This is especially true at an individual stock and sector level.

A Summary of Where We Are

Dan Clifton, Head of Washington Research at Strategas, recently astutely stated, “this remains one of the craziest election cycles in my 25 years of politics.” As Mr. Clifton explains, it is rare for the story to “change” once in an election cycle, let alone twice.

At the end of ’21, a “Red Wave” appeared well on its way. This isn’t surprising, as the party out of power almost always gains in the midterms, a true American tradition. This quickly shifted, however, after the overturning of Roe v. Wade by the Supreme Court. Suddenly, Democrats had a wave of momentum, rare for an incumbent party heading into midterms. This “rally” has since appeared somewhat short-lived, as betting odds now swing Republican – helped by sticky inflation and economic pain. Below is a good illustration of how momentum has moved around in the battle for the Senate:

Today, the betting markets give Republicans odds to win both the House and Senate, albeit with a slight majority in the Senate. This, of course, is purely an educated guess, as PredictIt, like any polling method, is imperfect and has been proved incorrect plenty of times. Nevertheless, I have found that PredictIt serves as an effective indicator of momentum more than anything else. It does an excellent job of showing which way the winds are blowing. As we enter election night, Republicans seem to have the winds at their backs. Time will tell if this is true

.

What Does It Mean for your Portfolio

If the above scenario plays out, or if the Republicans can only regain the House, the elections will result in a split government. Markets certainly don’t mind this arrangement. I suppose it speaks to the market’s distrust of politicians regarding economics. A divided government reduces the chances of any large-scale policy reform. Any sweeping tax hikes or regulatory changes are likely off the table, at least in the short term. Will Republicans try to impeach President Biden? We will see.

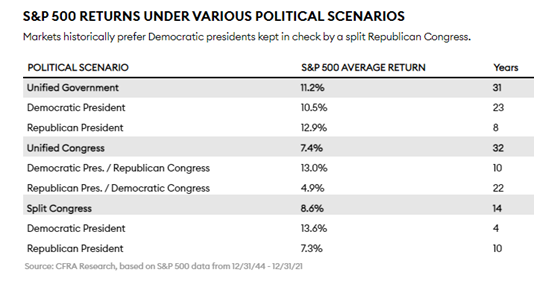

As you can see below, the market is historically agnostic on who is in charge and has traditionally done well with a Democratic President and Republican Congress.

Our experience has been that elections have more of an impact at a sector and individual stock level. The results will likely alter our tilts within client portfolios. Here is how we see the three scenarios playing out:

Divided Government – This scenario should be a real benefit for healthcare stocks. These stocks are significantly correlated to a Republican House. As such, healthcare stocks had a strong October – rallying 9%. Divided Government brings a more favorable environment for pharma pricing and alleviates the risk of price controls for biotech stocks.

Republican Sweep – This will likely improve the outlook for energy producers, energy infrastructure, and Defense. If Republicans control both houses, expect more drilling, less regulation, and more oil exports. As it relates to Defense, according to Strategas, expect spending to go up even more.

Democrats Hold – With full control, expect Democrats to push the remaining parts of their tax and spending agenda. This will support renewable energy stocks, consumer staples (childcare tax credit), broadband, and utilities.

In closing, as we approach election night, first and foremost, breathe. Markets will quickly adjust to any of the above scenarios, and we will communicate any changes to our overall allocation.

Chart of the Month #1 – A Big October Could Mean Green Ahead

For Fun - Are You Sure You Want the Phillies to Win the World Series??

Previous World Series Victories by a Philadelphia Baseball Team –

1929 – The Philadelphia Athletics win the World Series, worst stock market collapse in US history takes place

1930 – The Philadelphia Athletics repeat. US markets officially enter a depression

1980 – The Philadelphia Phillies win for the first time in 50 years, US economy falls into the worst recession since WWII

2008 – The Philadelphia Phillies win, and well, I think most of us can remember what occurred in ’08 and ’09

Take it easy, Bryce!

**Editor’s Note - Crisis Averted

Allocation Update

Earlier this week, Fed Chair Jerome Powell left little doubt that he is prepared to push rates as high as needed to bring down inflation. No pivot just yet. If nothing else, it serves as a reminder that this process may take a while. While October provided plenty of positives, inflation and the Fed’s response remain the unquestioned backdrop. Pressure on markets will continue until this goes away.

Unchanged from last month, we remain underweight in equities. Within our underweight, we also maintain our preference for Value over Growth and more defensive tilts among equity sectors – healthcare, staples, and industrials.

Of course, we continue to tilt client portfolios to best take advantage of the current environment.

One noteworthy October adjustment was moving a small portion (2%) out of our large-cap US exposure into small-cap US – now bringing our tilt to smaller US stocks to overweight. We believe that this is prudent for several reasons:

Protection Against Strong Dollar – strong US Dollar hurts those who sell goods overseas; small caps are US-focused

Attractive Valuations – US small-cap stocks continue to be priced at a significant discount (historically cheap levels)

Value Heavy – US small caps contain less in tech and more in value-tilted sectors

So far, this move has worked well, as small caps led the charge in October – rallying 11%.

On the operational side, this is an excellent time of year to organize/execute end-of-year gifting, charitable donations, and tax planning. For those who have or are considering a Donor Advised Fund (a fantastic way to accomplish your philanthropic endeavors), we have a few more weeks to get it done. Because of the end-of-year rush, we highly recommend that everything be put in place by early December. Our team stands by, ready to help.

To my loyal readers, I hope that you enjoy our Halloween pictures attached to the email. It was another great holiday, as my wife’s enduring enthusiasm for Halloween brought a ton of fun into the house. Our Cooper, naturally, was a baby chicken, inspired by Teddy’s chicken costume last year. Our four-year-old Teddy decided to have two costumes – a NASA Astronaut and a Fire Department. Yes, you read that right, Fire Department. A full-service first responder, Teddy was both a fire truck and fireman, combined into one costume. His Astronaut costume, however, was the real winner. Quite literally, as he took home Dover’s top costume award. Forgive me, as I sigh contentedly. Things seem to come too easy to Teddy. He has that “cool” factor that I severely lack. As a father, I can only hope to keep him humble and unspoiled. I am open to ideas on how to accomplish that goal.

From our family to yours, as we look ahead, we wish you a warm and happy Thanksgiving. Thank you all for your kindness and trust. I extend to you one of my favorite sayings: may our collective diets start in January.

“Vegetables are a must on a diet. I suggest carrot cake, zucchini bread, and pumpkin pie.”

Jim Davis (Creator of Garfield)

As always, thank you for your support and readership.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index

CRN202511-3314098