January 2023 - A Look Back and ‘23 Outlook

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

To paraphrase the movie The Truman Show – Hey ’22, in case I don’t see ya, good afternoon, good evening, and good night!

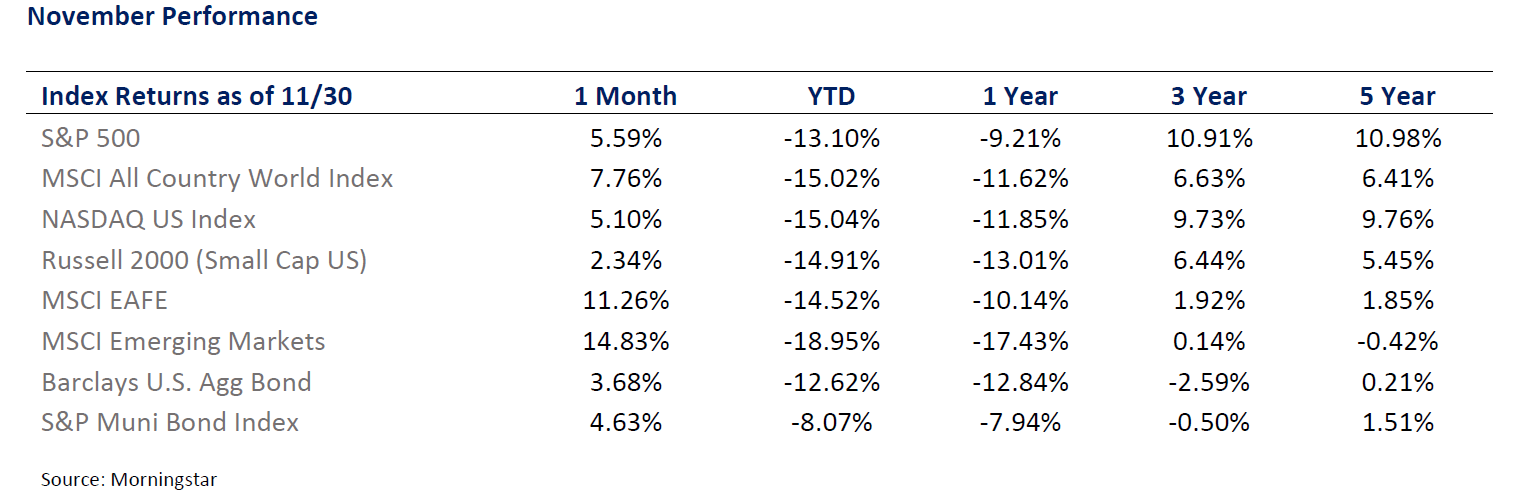

As investors, let us collectively say good riddance to 2022. From a market perspective, it was truly a historic year, but not for the reasons investors would appreciate. The year 2022 closed as the 7th worst year for U.S. Stocks. Even more challenging, this was the worst year ever for Fixed Income. Professional money managers and individual investors found few places to hide aside from a handful of commodities, energy stocks, and cash.

2022 was also a year full of contradictions. There was an energy crisis, yet oil was up only 2.8%. There was a war, but gold was down 1%. Oh, and that war was in Europe, yet European stocks outperformed U.S. stocks. Investors were fearful, yet treasuries had the worst year in recorded history. This year of contradictions represents an agonizing reminder that investing is complicated and timing the market is impossible.

So, if you are reading this newsletter, congratulations, you survived the worst market year since 2008! I say that with complete sincerity, by the way. Yes, a well-diversified portfolio took it on the chin in 2022 but lives to fight another day. Unfortunately, this isn't the case for some investors, especially those “geniuses” during the '20 and '21 run-up in untraditional investments. For some, ’22 was an unrecoverable bloodbath.

Fueled by low-interest rates, pent-up demand, and money being dropped from the sky, the post-Covid rally saw furious rallies in some strange corners of the market. Cryptocurrency went crazy. NFTs, “digital art” claimed by some, exploded for no fundamental reasons at all. Previously ignored SPACs, also known as “blank check companies,” went through the roof. The list of foolishness goes on and on. But, of course, we know how this story ends. Echoes of Robert Louis Stevenson, who once said,” sooner or later we all sit down to a banquet of consequences.” In 2022, crypto went belly up, NFTs cratered, and SPACs tanked – with most down by +90%. As an important reminder, HPW does not offer or own any of these investments.

Years from now, I am optimistic that 2022 will be seen as a reset year - and it is a much-needed one at that. U.S. stocks entered the year at an inflated 22x Forward P/E ratio – indicating that stocks were about as expensive as ever. The end of ’22 was a different story. U.S. stocks now rest at 16.5x Forward P/E. This is far more reasonable and just a tick below the 25-year average of 16.8x. Fixed income told a similar story – starting the year at historically low levels but ending near the historical norm. The two-year Treasury bond was especially noteworthy as yields jumped from 0.7% at the start of ’22 and closed at 4.4%. It was a painful ride, but these levels now offer investors attractive income with minimal risk. This a reminder that higher interest rates, over time, are a good thing for fixed-income investors and savers.

With perfect hindsight, sitting out in 2022 would have been fantastic. But, of course, we all know it doesn’t work that way. History affirms this is a dangerous way to think about wealth creation and preservation. After all, missing the past few years would have been a major mistake. Nevertheless, years like ’22 are part of the deal and will indeed occur more times over my career. Even with the ‘22 decline, U.S. stocks have still provided investors with a 7.14% and 8.85% annualized return over three and five years, respectively.

As we enter 2023, we firmly reiterate our fundamental belief to stay diversified, focus on tax efficiency, and stay invested.

Market Outlook for 2023

‘Tis the season when investors are inundated with calendar year predictions and prognostications. As a public service announcement, I ask that you take these “guesses” with a grain of salt. As history reminds us, market forecasts are entertaining but provide little else. Last year’s predictions are a perfect example – here is an early 2022 tweet from Bloomberg’s Jonathan Ferro (who is excellent, by the way):

With hindsight, last year's predictions were quite comical. Of the world's 14 largest banks, none came close. For those who abide by the Price is Right rules, all lost! I suppose that Morgan Stanley's outlook won the loser's bracket but still overshot the S&P 500's close of 3,865 by a not-so-small 535 points. Hard to call much of a win.

This is not to embarrass the analysts at these respective firms. This is part of their job, and a lot of effort goes into these predictions. Instead, this is a reminder of how inherently unpredictable the stock market is in the short term. The world is unpredictable, and markets reflect this

As we look ahead to 2023, we will save you price guesses and instead focus on three important topics for investors:

1) A potential recession in the U.S.

2) International vs. U.S. Stocks

3) Allocation changes as we enter ‘23

Will a Recession hit in 2023?

Over the last few months, this is the one question we often hear. After all, a recession is a scary word, especially for stock market investors. The U.S. economy has avoided a recession so far, but the odds of having one in ’23 are rising. This is evident in both the stock and bond markets as investors remain skeptical that the Federal Reserve will be able to execute a “soft landing” – triumphing over inflation without creating economic pain.

The exact timing of a recession is hard to predict. If you ask the stock market, we are long overdue. Then again, the stock market isn’t always an accurate marksman, either. MIT Professor Robert Samuelson’s famous wisecrack comes to mind: “the stock market has predicted nine out of the last five recessions.”

Interestingly, Economists have never been as worried about a recession as they are today. A recent survey of professional forecasters shows a whopping 44% expect negative GDP growth over the next twelve months. To give some perspective, that number only hit 25% at the onset of the pandemic. But, again, these are simply estimates, and we all know how accurate these can be. Also, like March Madness, the consensus isn’t always a good thing regarding markets and economic forecasting.

Do we think we are going to see a recession in ’23?

Twist our begrudging arms, and we say probably, albeit a mild one. While this contrasts Goldman Sachs's recent call that the U.S. avoids recession, it’s hard for us to ignore what the stock market is telling us, along with the extreme inversion of the yield curve. At Highland Peak Wealth, with a never-ending eye on risk management, the odds of a recession are high enough to garner our attention. As such, we are preparing client portfolios accordingly. A more detailed overview can be found in our "Allocation Update" later on in this newsletter.

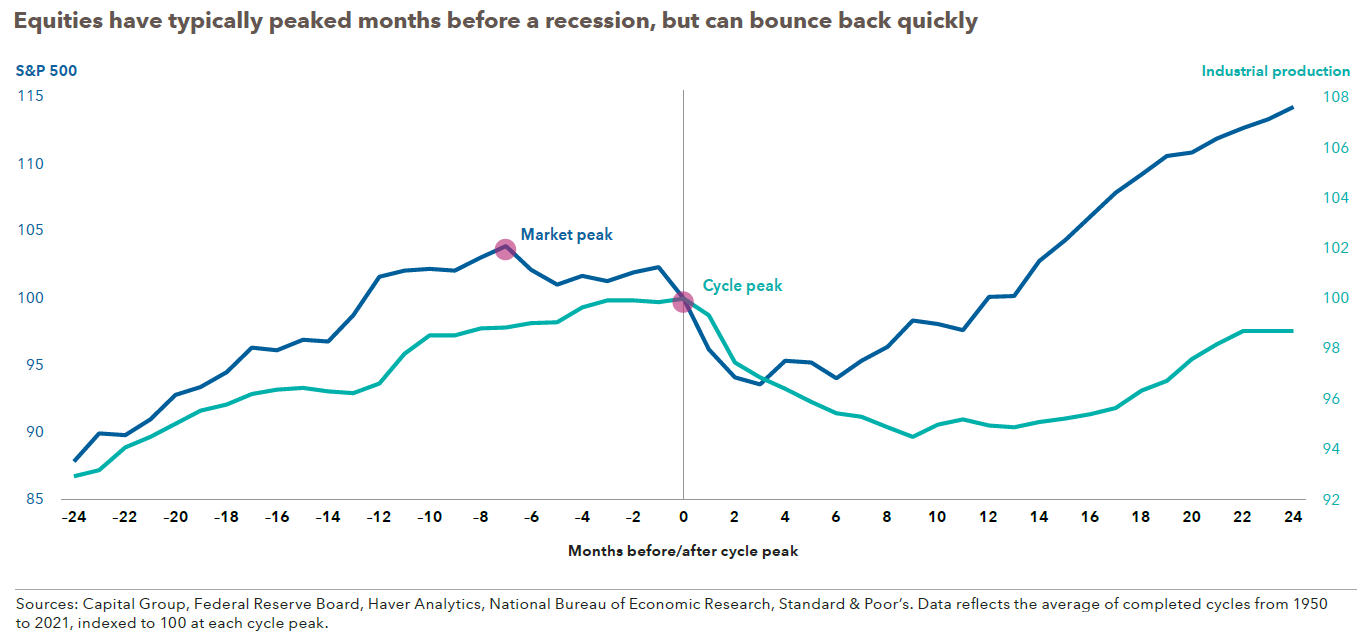

So, what exactly will a recession mean for stocks? The answer is complicated. Below is a great chart from the Capital Group that illustrates the relationship between stocks and industrial production (think economic growth).

Reviewing the above chart, a few things jump out at me:

1) Markets are ahead of the economic cycle by 6 to 7 months – on the way up and the way down

2) Stocks tend to recover roughly 2 months into recession – a reminder of the perils of a cash-heavy approach

3) Stocks traditionally roar higher even as the economy is regaining its footing

I highlight this chart to also bring down collective blood pressure around the recession word. Yes, we all know that recessions are painful and tend to upend the job market, but looking at it purely from a stock perspective, this chart illustrates a fascinating concept. In part, markets being ahead of the economy explains 2022’s market decline but also paints an interesting picture for 2023. As expressed by David Bailin at Citi Global Wealth – markets in 2023 will lead the economic recovery we foresee for 2024. Let’s see if that plays out.

U.S. vs. International Stocks: A Sea Change?

While not technically in a recession, 2022 brought forth a new bear market for stocks worldwide.

Bear markets, as unpleasant as they may be, exist for a reason – to transfer the leadership of one group of stocks to the next. The landscape is evolving, and once we are on the other side, leadership will look different from the past +13 years.

Coming out of the global financial crisis in ’09, leadership appeared in the form of the BRICs (Brazil, Russia, India, China). Then, a short bear-ish market in ’11 transferred leadership to all things U.S. tech, especially those famous FAANG stocks. Over the next ten years, markets didn’t look back. These giant tech companies became the undeniable generals of the stock market army. This year, however, these behemoths were some of the worst performers.

In bear markets, an investor needs to look for outperformance in real-time. So, what are we seeing?

1) Value Stocks over Growth Stocks

2) The Average Stock over U.S. Tech Giants

3) International Stocks over U.S. Stocks

This last one, especially, has our attention.

International stocks, trailing U.S. stocks through much of ’22, caught considerable momentum in closing the year. In the 4th quarter alone, the MSCI EAFE Index (developed international) roared 17.3% higher as the S&P 500 index gained 7.42% by comparison. Emerging Markets also outperformed U.S. stocks, rising 9.70% as China, the world’s second-largest economy, continues its reopening process.

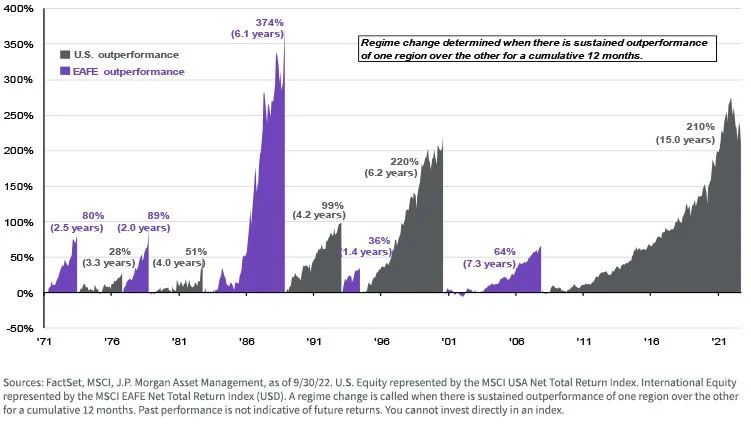

To summon my inner Bob Dylan – are times a-changin? The below chart from JP Morgan is well-known and shows how dominant U.S. stocks (dark gray) have been over international stocks (purple) over the past 15 years.

Like a slumping baseball player, are international stocks due?

When it comes to investing, this should never be the sole reason. But, despite obvious recessionary risks, there are growing winds behind the sails of international stocks. First, as interest rates rise, valuation becomes more and more critical. While U.S stocks sit at a reasonable 16.5x forward P/E, developed international sits at 12.2x, and emerging markets at 11.5x. In Europe, unlike the U.S., fiscal spending is likely to increase. In addition, a reopening of China is more impactful outside the U.S. than within. Finally, an easing Federal Reserve and a weaker U.S. dollar also point to better days ahead for emerging market economies.

When in a bear market, you look for the new bull market. If recent trends continue, the opportunities appear to lie abroad.

Allocation Update

If nothing else, our decade-plus love affair with easy money has ended. We believe that bottoming is a process and that this sorting-out period still has some bumps ahead.

Unchanged from last month, we remain underweight in equities. Within our underweight, we also maintain our preference for Value over Growth and more defensive tilts among equity sectors – healthcare, staples, and industrials. This worked fabulously in ’22 and has led to outperformance within U.S. stocks. In addition, over the last 6 months, we have increased exposure to those stocks that throw off large amounts of cash (dividends) to investors. The way we see it, if we get a redux of the post-WWII stock market, we can increase yield as we wait for market valuations to reset.

Below is a summary of our current portfolio positioning –

- Equities – Underweight

o Continue to tilt portfolios more into value and dividend-paying stocks (and out of tech/growth)

o Leaning more into international and emerging market stocks

- Fixed Income – Slightly Underweight (But getting closer to neutral)

o We continue to take advantage of more attractive bond yields

o With the interest rate hiking cycle possibly coming to an end, longer-term bonds are more appealing

- Alternatives – Neutral

o For suitable investors, alternative investments can increase income and long-term returns

o A reopening of China has the potential to boost commodity prices in the short-term

- Cash – Overweight

o Maintaining above-average cash position for short-term defensiveness and dry powder

o One-year Treasury bond yielding +4.5% provides investors a phenomenal cash alternative

**Treasury yields are very interesting right now. As I write this (1.5.23), the one-year Treasury bill yields 4.6%. So, for those investors with cash on the sidelines, this is an excellent cash alternative and provides some tax benefits/flexibility compared to traditional CDs or money market accounts. If interested, please reach out to us to discuss this.

We hope that you all had a wonderful holiday season and new year. From a market perspective, 2022 was a challenging year. However, 2022 also ushered a return to normal, including more face-to-face interactions with our clients, which Troy and I loved. We saw pictures of pudgy new grandkids, weddings, beautiful trips, and exciting life updates. It was a humble reminder that despite uncertainty in our world, life goes on and stops for no one. As we enter a new calendar year, our Highland Peak Wealth family is so thankful for all your support and appreciation. Cheers to a fantastic ’23.

And for yours truly, I still have 78,689 Lego pieces to put together – forever a recession-proof industry.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index CRN202601-3674210