February 2023 - Hell of Good Start

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

Does anyone remember the movie 300 from the mid-2000s?

Starring Gerard Butler as King Leonidas, 300 was a beautifully shot, CGI-filled movie loosely depicting the famous Battle of Thermopylae between the Spartans and Persians. I stress the word “loosely” here – the movie makes history buffs cringe. Interestingly, the film was based on Frank Miller’s comic series, which included few parallels to actual events. Still, it was a fun watch, and the movie did quite well at the box office.

The Spartans started strong as the movie kicked into gear and the Battle of Thermopylae began. Despite being heavily outnumbered, the well-trained army repelled wave after wave of the Persian forces while suffering very few casualties. As day one of the battle comes to an end, they are feeling optimistic. To end the scene, a tired captain, fully aware of the long struggle ahead, turns to a soldier and says: “Hell of a good start!”

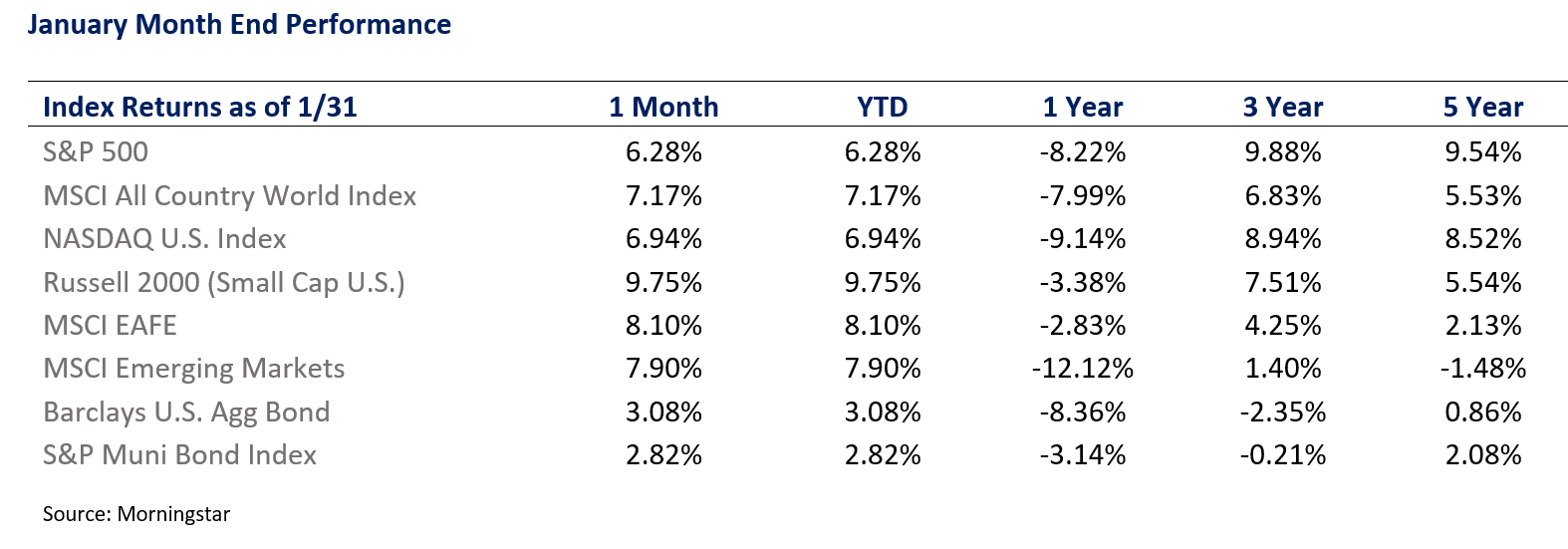

2023 has so far started exceedingly well for investors everywhere. Despite a rocky close to ’22, all major benchmarks finished January in the green with solid gains. Investors took solace in the near-term economic outlook looking less and less grim. Corporations, for example, have so far turned in a better-than-feared earnings season – not stellar, but not disastrous. In addition, inflation readings continue to show a downward trend (remember the second derivative?). Add it up, stocks were up, bonds were up, and even gold continued its shine (up 5% for the month). Even boring municipal bonds have had the best start in over a decade. After an agonizing ’22, January’s returns have been a welcome relief.

Or, to put it another way, Hell of a good start.

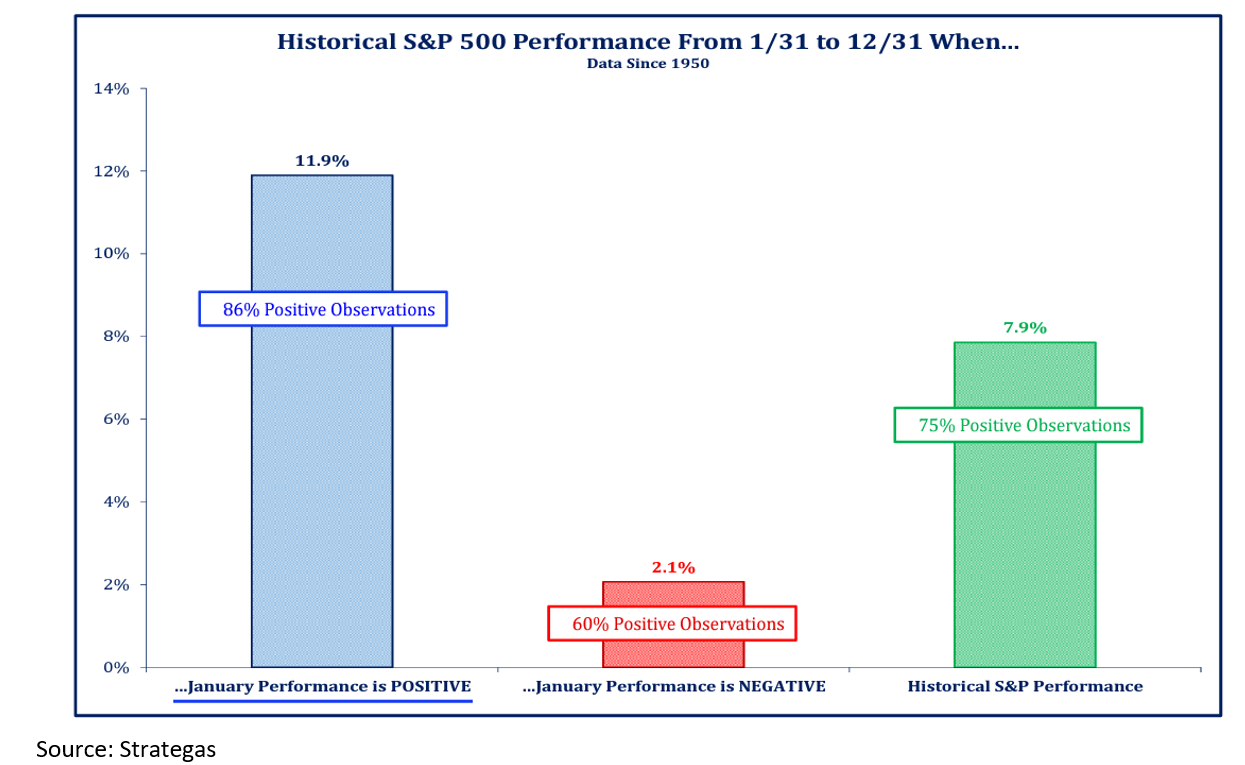

Market bulls are certainly feeling good. With January in the books, many investors are hoping for a replay of an old Wall Street saying, “as goes January, so goes the year.” After all, there is historical support here. If January’s performance is positive, the S&P 500 is positive the rest of the year 86% of the time – 9% above its historical average of 75%. So far, so good. More on this later in the newsletter. In addition, January’s strong performance provides bulls with confirmation bias that markets always go up in the third year of a presidential cycle.

Nevertheless, like the Spartan captain, we appreciate the start but remain fully aware of the struggle and potential pitfalls ahead. In many ways, the 2023 outlook is as cloudy now as it was when the year started. Whether the US economy can evade a recession this year remains total guesswork. Recent strength in stocks indicates growing optimism that a soft landing (beating inflation without recession) can be achieved. Yet, this notion is incompatible with multiple alarm bells flashing: a chronically inverted yield curve, weak money growth, decreasing consumer spending, lagging consumer confidence, and weakness in many other leading indicators. Speaking of the yield curve, it is now 100% inverted – historically a kiss of death for economic growth.

Of course, past indicators are imperfect. As famous investor Marty Zweig likes to remind us – every indicator eventually bites the dust. But these readings give us enough pause to tread carefully ahead. As risk managers, we err on the side of caution. After all, we don’t want to end up like the Spartans!

A few highlights from the past month:

A continuation of outperformance in international stocks over U.S

Small caps were the best performers; they experienced a much-needed bounce after a weak ’22 Q4

Last year’s most beaten-up sectors (tech, crypto, growth) had nice recoveries, but most remain in a downtrend

As goes January, so goes the year

Let’s hope so!

Yale Hirsh, the Stock Trader’s Almanac creator, devised the above Wall Street adage. The message is simple enough: there is a strong historical correlation between January returns and how the rest of the year performs. A good January portends good things ahead, whereas a weak January implies the opposite. The January effect, for example, proved true last year as a weak January (stocks down 9%) set the stage for an agonizing rest of ’22.

I tend to be skeptical about old Wall Street expressions. While entertaining, such idioms are typically overly simplistic. Markets, as we know, are inherently unpredictable, especially in the short term. But, market returns have a history of supporting the January effect. Also, I admit that there is some common sense behind the idea. In January, investors, institutions, and fund managers reposition their portfolios in preparation for the year ahead. In that sense, January can accurately reflect general sentiment and outlook ahead.

So, what does history tell us?

There is no question that past performance paints a nice picture for markets ahead. A positive January leads to a positive rest of the year more often (86% vs. 75%) and, even better, averages a much higher return (11.9% vs. 7.9%). It is also interesting to note that a strong January, defined as a gain of 5% or more, has provided even better historical returns – averaging 14.2% over its 14 occurrences. As a reminder, the S&P 500 was up 6% last month.

Then there is the issue of momentum. I've alluded to it many times before, but momentum matters in the stock market – in times of good and bad. In investors' minds, January clearly impacts outlook and optimism regarding the rest of the year. Let's remind ourselves of Newton's First Law of Motion: An object either remains at rest or continues to move at a constant velocity, unless acted upon by an external force.

To repeat: Unless acted upon by an external force.

We see two significant forces ahead – 1) The Federal Reserve and 2) the Threat of Economic Recession.

A More Gentle Fed?

Stocks and bonds rallied in unison in January on the widespread conviction that easing inflation and a cooling economy would clear the way for the Fed to tap the brakes on monetary tightening. Recent numbers have supported this belief, as measures of inflation released in January revealed a slowdown in everything from wage pressures to consumer and wholesale prices. At the same time, evidence mounted that prior rate hikes had the desired effect of curbing economic activity as weakness emerged in manufacturing, services, and consumer spending. So far, so good.

As expected, the Federal Open Market Committee (FOMC) met on February 1st and voted to raise the fed funds target rate by 25 basis points (bps). This move was in line with market expectations. In our view, there were several important themes to come out of the meeting:

25 bps hike reflects a good second derivative/milder pace (from 50 bps in December and 75 bps before that)

The Fed remains unwilling to “pause” as they are looking for more inflationary declines

The Fed believes it is still premature to declare victory over inflation

Add it all up, and investors welcomed a gentler rate hike, but uncertainty around future rate hikes remains. Markets were optimistically hoping for signs that the Fed would be ending the rate increases soon. But the statement provided no such signals. So looking ahead, markets expect two additional rate hikes of 25 bps in March and May. The Fed continues to walk a delicate line between fighting inflation and avoiding a recession.

Recession Watch

The skies are clear, for now.

If recent economic readings are any indication, the economy overall remains on solid ground. Vehicle sales popped, Q4 GDP came in strong, and average hour earnings (AHE) continues to grow. Then, of course, there was last week’s job number. As released by the Labor Department, nonfarm payrolls increased by 517,000 for January, well above the Dow Jones estimate of 187,000 and December’s gain of 260,000. The unemployment rate fell from 3.6% to 3.4% - about as tight a labor market as the economy has ever been. Also noteworthy, there are currently 11 million job openings for ~6 million unemployed individuals. Not a bad time to be looking for a gig!

This job number brings up an important concept. From our humble perch, employment matters. If the job market remains resilient, it is tough to imagine consumer spending taking a hit. And, as long as consumers are spending, the U.S. economy, with 70% of GDP tied to spending, should hang in there just fine.

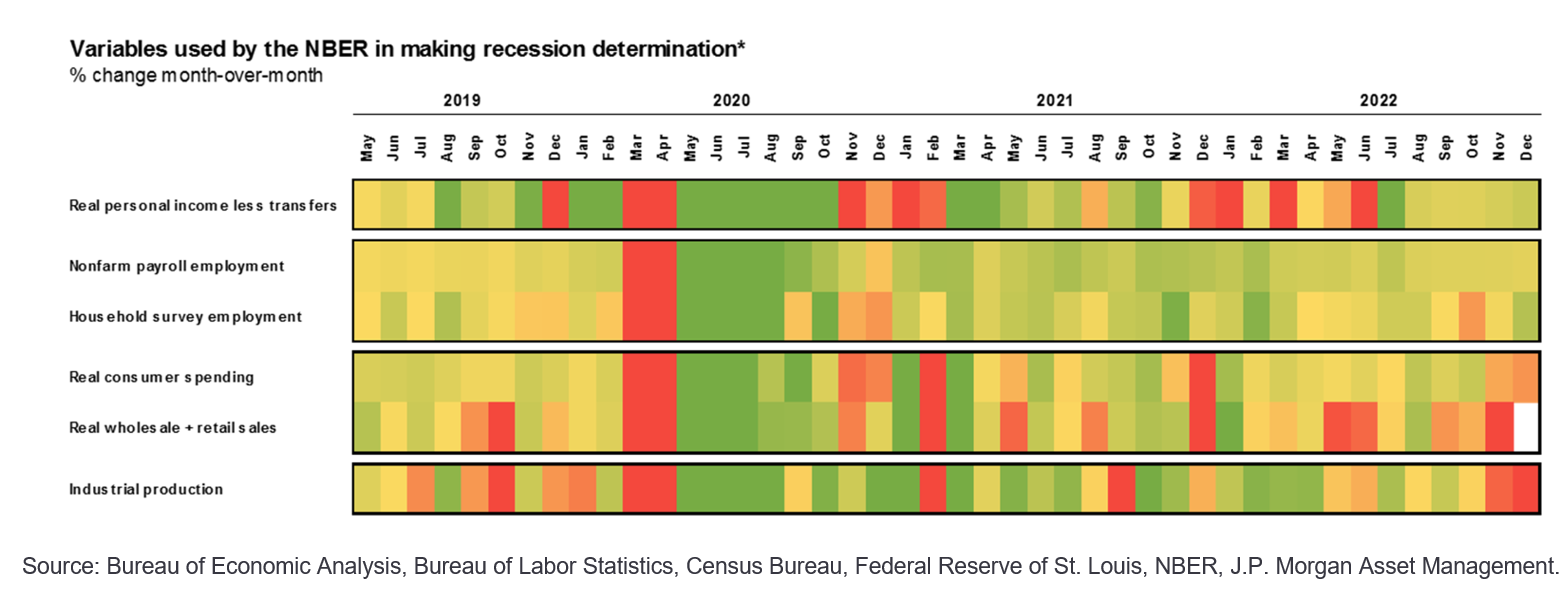

Of course, these indicators are backward-looking. Markets look ahead as they have always done. So where do we stand today? Below is a helpful chart from J.P. Morgan Asset Management:

As a reminder, the National Bureau of Economic Research (NBER) is the ultimate arbiter of whether the economy is in a recession. Above are the primary determinants they use – green is a positive trend, red is a negative one, with the shades reflecting something in between. But, as the chart illustrates, it's currently a mixed bag. Employment and personal income remain solid, but there is a noticeable weakness in industrial production and a slowing pace of consumer spending.

To harness my inner Yogi Berra, it ain’t a recession til it is. Put another way, when recessions do arrive, they arrive quickly. At this time, Wall Street is torn. Bloomberg Research sees a 100% chance of a recession over the next 12 months. I chuckled at this outlook, as nothing in our world is 100%. Either way, it does reflect a bearish sentiment prevalent across the industry. On the flip side, our oft-used research firm Strategas gives recession in '23 a 50% chance (gee, thanks), and Goldman Sachs recently decreased the odds to just 25%. Who is correct? Only time will tell.

A Quick Word on the Debt Ceiling Debate

This is a bit of a non-sequitur, but clients have been asking.

As of right now, it is too early to say if all this political posturing matters. The stock market would agree with us, as it has thus far totally ignored the subject. There is considerable guesswork around what will happen and if it matters. Historically, there has been bluster, but nothing has materially changed. Research firm Strategas notes that the debt ceiling debate will likely result in some reduction of spending somewhere, but hard to see a default on debt. And if the US does default, leading to a credit rating downgrade, 2011 should be a good comparison – short-term volatility, but stocks quickly recovered. More on this in later newsletters, should the need arise.

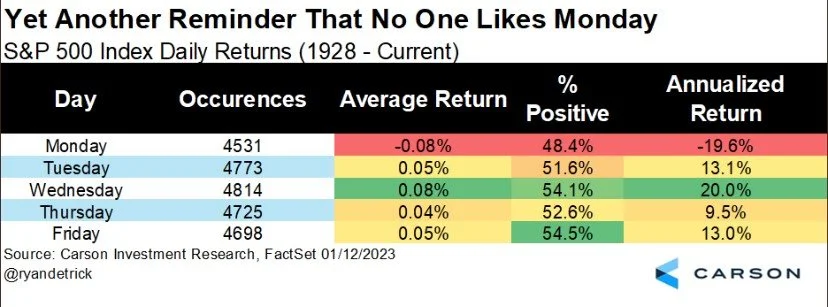

Chart of the Month (Just for fun) – Even the Stock Market has a Bad Case of the Mondays

Allocation Update

Our bottom line remains the same as last month: risks to economic growth continue to skew to the downside. The recession can be delayed, but threading the needle for a soft landing is still daunting. Also, while the Fed has become less aggressive, we remain in a period of restrictive policy. Eventually, the Fed should feel less urgency – essential to move past the downside risk of declining corporate earnings and economic growth. Simply put, we're just not there yet.

Unchanged from previous newsletters, we remain underweight in equities. Strong months like January can undoubtedly give any cautious money manager pause, but we continue to be focused on the long term. Our job as stewards of wealth is to err on the side of caution. As we have said, hope is not an appropriate risk management approach. We prefer to position ourselves with a defensive tilt as we march deeper into 2023.

Our shift within our equity allocation, however, is noteworthy.

As introduced in last month's newsletter, we have continued to look closely and monitor both developed and emerging international stocks. After all, they have gotten off to a fantastic start as last year's momentum has thus far continued into '23. To close January, developed international and emerging markets stocks outperformed the S&P 500 by 1.8% and 1.6%, respectively.

Of course, our outlook exists at odds with what we all see on the news – conflict, geopolitical risks, and energy struggles. This is all true and likely to persist. Still, it also ignores some of the headwinds that markets are taking note of 1) less restrictive monetary policy, 2) much more attractive valuations, and 3) a reopening Chinese economy in the face of low-interest rates (think U.S. economy in early' 21). Add it all up, and we have worked hard to ensure that client portfolios are geographically well-balanced and able to capitalize on overseas returns. We will continue to monitor this trend and communicate any changes along the way.

OK, onto lighter subject matters.

The winter months bring the McBurney family's annual pilgrimage to beautiful Ludlow, Vermont – home to Okemo Mountain. Lucky for us, our weekend in beautiful Vermont coincided with a unique polar vortex that brought historically low temperatures to New England and beyond. Upon waking up on Saturday morning, we were shocked to see a ground temperature of -20 degrees and a windchill of -45. Yikes! I was reminded of that humorous scene in Cool Runnings when an unbothered John Candy walks into a snowstorm saying, "It's not so much the heat, it's the humidity that'll kill you," as the terrified bobsled team is in shock from the bitter cold. Either way, I am proud to say that once temperatures returned to a balmy 1 degree, we braved the elements and enjoyed some fantastic skiing.

Teddy has been making real improvements in his skiing. After taking a handful of lessons, the kid can really ski! He was ready to take the first ski lift and tackle some modest greens this past trip. Not bad for a four-year-old. Forever cautious, he wasn't crazy about the idea, telling me repeatedly, “I'm too small, Dada.” Luckily, I have become an expert in the art of bribing. Thanks to my local dry cleaner, I always have small lollipops in my pockets (Dum Dums). This did the trick, and Teddy was rewarded as well. He did fantastically well on his first trip on the ski lift – and went 5 more times that afternoon. So, if you ever see me in person and are hankering for a small lollipop, you may be in luck!

We hope that you have had an excellent start to the year. As always, we thank you for your support, trust, and readership.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202602-3879633