Year End 2022 Market Update

Kelly Kowalski, Cliff Noreen, and Bronwyn Shinnick

MassMutual Investment Management

One of the most disappointing years in history for investors has finally come to a close. Multiple shocks upended equity and bond markets in 2022, leading to the worst year since 2008 for the S&P 500 and NASDAQ and one of the worst years on record for U.S. Treasurys with the U.S. ten-year Treasury posting an exceptionally poor total return of -16% in 2022. The year 2022 was supposed to be a period of temporarily high, but manageable inflation, very modest increases in short-term interest rates, and a constructive growth backdrop. At the beginning of 2022, the U.S. consumer price index was expected to be only 4.5% at the end of 2022, and the Federal Reserve was expected to enact three, 25- basis point interest rate hikes over the course of the year. Recession risk was relatively low on the heels of a strong 2021, healthy consumer balance sheets, and a robust labor market.

Nevertheless, Russia invaded Ukraine in late February, exacerbating global commodity market and supply chain dysfunction. Oil prices surged to as high as $130 per barrel in early March. U.S. inflation as measured by CPI skyrocketed to a forty-year high of 9% in June, and though it is finally starting to ease, is still an uncomfortably high 7.1%. Fifteen years of very accommodative monetary policy came to a screeching halt as policymakers sought to tame record inflation. The Fed hiked short-term interest rates aggressively, with total hikes of more than five times what consensus expected as the target Fed funds rate rose from 0.0-0.25% to 4.25%-4.50% in one year. The worldwide stock of negative-yielding debt has fallen to less than $300 billion, down from over $18 trillion in late 2020.

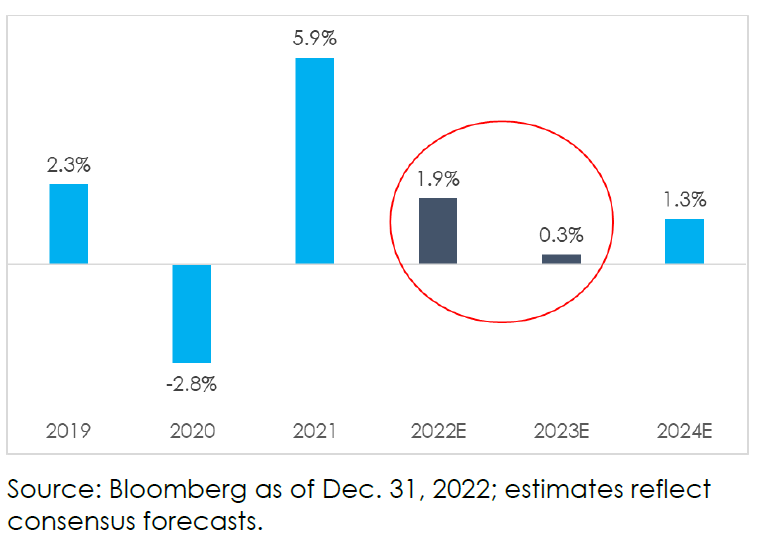

Despite an abundance of recession headlines in 2022, the U.S. economy has managed to evade one thus far and is expected to have grown just under 2% in 2022. As we look to 2023, the principal worry has shifted from inflation and higher interest rates to recession. A consensus of Bloomberg economists pegs the current probability of U.S. recession this year at 65%, though the recession most economists project is expected to be short and shallow, unlike the deep recession following the Global Financial Crisis. Unlike this past year, will consensus finally get it right? Are we in for a deeper and longer-than-expected recession? Could it happen sooner or later than anticipated?

Source: Bloomberg as of Dec. 31, 2022.

Commodities = Bloomberg Commodity Index; Oil = Brent Crude Oil Spot Price; U.S. Dollar = DXY Dollar Index; U.K. Equities = FTSE 100 Index; Gold = Gold Spot Price; Euro = Euro Spot Price; U.S. 10-Year Treasury = S&P U.S. Treasury Bond Total Return Index, Investment Grade Credit = Bloomberg U.S. Corporate Investment Grade Bond Index; German Bund = Euro Bund Futures Price; Yen = JPY/USD Spot Exchange Rate; Chinese Equities = Shanghai Shenzhen CSI 300 Index; Copper = CME Copper Futures Price; S&P 500 Index = S&P 500 Index; Emerging Markets Equities = MSCI Emerging Markets Index; Nasdaq Comp Index = Nasdaq Composite Index.

The most anticipated recession in over fifty years

In the last fifty years, we have never entered a year with so many people expecting a recession. The idea that monetary policy affects the economy with “long and variable lags” is probably the main reason why most economists expect a recession in 2023. We are already seeing higher interest rates impact certain parts of the economy, particularly the housing market. However, the complete impacts of monetary policy can take up to two years to affect the real economy, driving expectations for further economic slowdown.

Overall activity has proven resilient to higher interest rates and record inflation, outside of a few interest-rate-sensitive sectors like housing and commercial construction. Extra savings that households accumulated during the pandemic has helped them to weather painfully high inflation, and households are still sitting on approximately $1.6 trillion in excess savings.

U.S. annual GDP growth

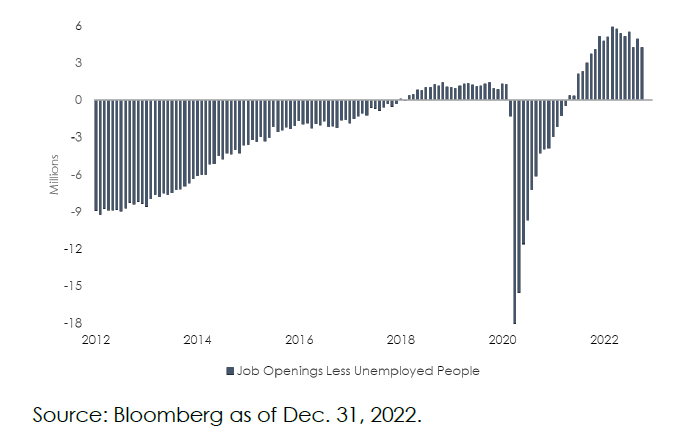

Although the unemployment rate sits at a historically low 3.5%, the Fed is now forecasting a 4.6% unemployment rate by December 2023, a 1.1% increase. Historically, there has never been this much of an increase in unemployment without a recession. Though there have been layoffs over the past several months, they have been concentrated in the construction, technology, and real estate sectors. The civilian labor force is around four million workers below its pre-pandemic levels, and there remains more job openings than available workers to fill them. A decline in openings, or a cooling of the labor market and wage pressure without anyone actually losing their job, is the ideal outcome for the Fed and broader economy. Job vacancies in addition to monthly payrolls will be a key data point to watch over the next several months.

Excess job openings

Finally, some inflation relief

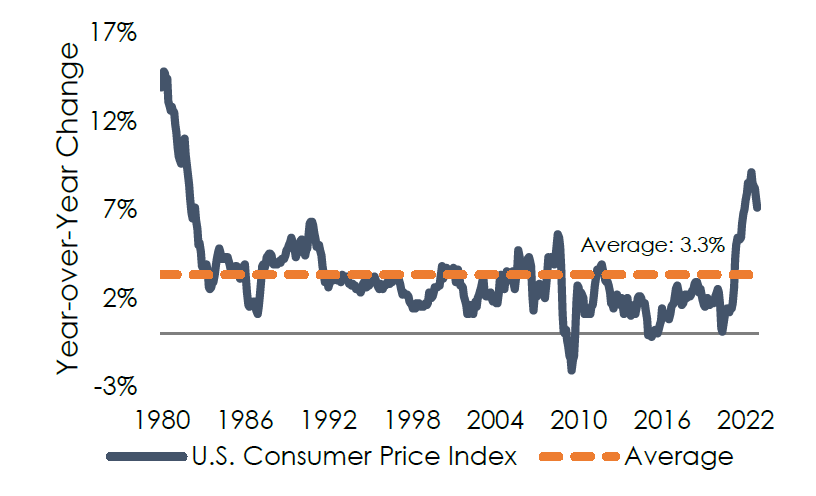

While consumers are still paying much more for goods and services compared to one year ago, the pace of increase is slowly subsiding. After peaking at 9% in June, the U.S. Consumer Price Index (CPI) has eased to 7.1% year-over-year in November. The price of gasoline at the pump is down almost 40% since June, and we are finally seeing cooling in certain categories like used cars and trucks, which saw prices skyrocket post the pandemic. The rent and shelter components of CPI continue to be the most significant positive contributors, but more real-time data such as the Zillow Rent Index, which has slowed to 8.7% year-over-year after peaking at 17% year-over-year in March, is showing signs that rent pressures are easing. Despite solid progress across these categories, food prices are still weighing heavily on consumers, having continued to increase in November, eroding some of the savings from the gas pump. Food rose by 10.6% year-over-year according to the November CPI report, with prices of some grocery staples like bread, milk, and eggs up between 15% and 49% in just a year. Fortunately, it seems that the worst may be behind us, with the consensus expectation for the overall inflation rate to fall to 3.0% by the end of 2023.

Headline CPI

Source: Bloomberg as of Dec. 31, 2022.

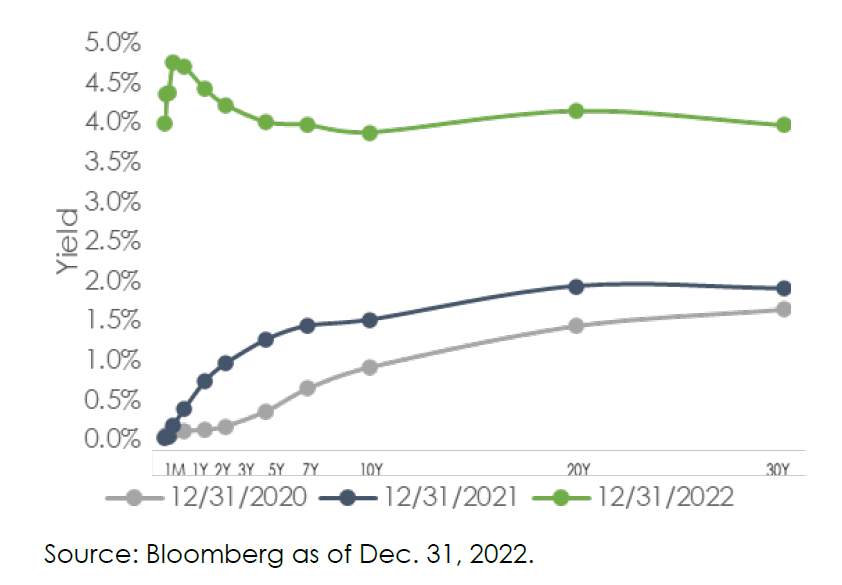

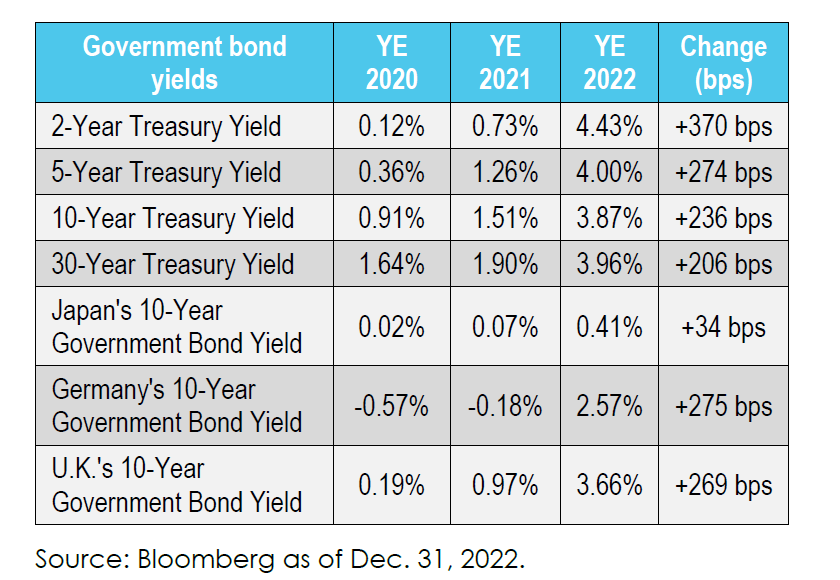

As inflation has slowed, so has the pace of the Fed’s interest rate hikes. The Fed finally downshifted to a 50 basis point hike at its December meeting after a series of 75 basis point hikes, which led to one of the most extreme years for interest rate movements in history. At the end of 2020, one had to buy a 30-year Treasury bond to earn a modest 1.64% yield; as of the end of 2022, an investor could earn a 4.65% yield on a 6-month Treasury bill! We believe that cash instruments like short-term Treasurys and certificates of deposit (CDs) have become attractive asset classes that offer stable yield and lower risk of principal, especially in a more volatile and uncertain market environment.

U.S. Treasury yield curve

As we look to 2023, the expectation is that a few more hikes are on the way. Markets are pricing in about 60 basis points more in interest rate hikes, resulting in terminal Fed funds rate of around 5% by June 2023. The path of interest rates thereafter will depend on inflation and the economy. Consensus expects that the Fed will have to begin cutting interest rates in the second half of the year due to recession. In fact, there is quite a disconnect between the Fed’s own forecast, the “dot plot”, and what is currently priced into interest rates. The Fed is forecasting a Fed funds rate of 5.1% by the end of 2023 versus the market’s expectation of 4.5%. Who ends up being correct will depend on the U.S. economy and inflation, both of which have proven exceptionally difficult to project and are subject to global forces.

U.S. equity markets suffer worst year since 2008

2022 saw historical cross-asset weakness. Equities were no exception. According to Morgan Stanley, U.S. equities recorded their fourth-lowest annual returns in the last 50 years, and it was the first time in about 150 years that both U.S. stocks and long-term bonds were down more than 10%. As we have pointed out before, higher interest rates in 2022 most adversely impacted growth and technology companies priced at extreme valuations and generating little or no profit. The most expensive markets were Nasdaq and S&P 500 at the start of the year, and they have underperformed other equity markets.

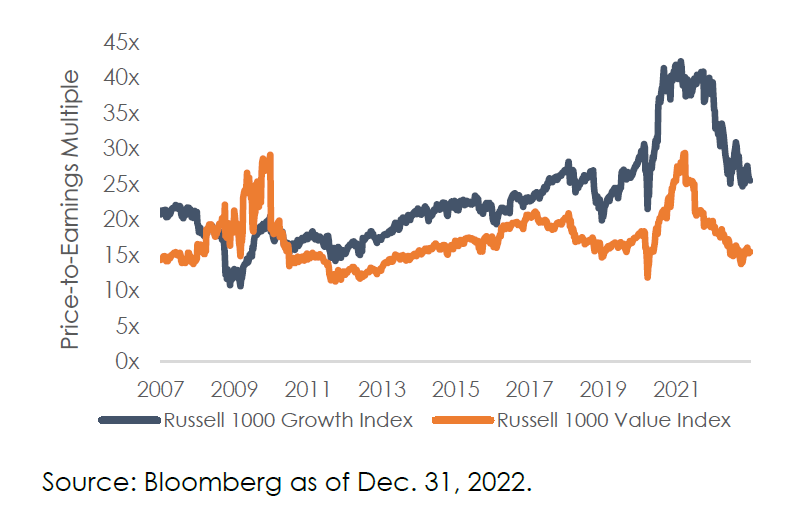

The same has been true of sectors, with technology being the worst performer (and most expensive to start the year) and energy being the best performer (and cheapest to start the year). The growth-heavy NASDAQ declined over 30%; in contrast, the Russell 1000 Value Index was down around 10% on the year. Despite the relative performance, growth stock valuations remain elevated relative to history (21.5x forward price-to-earnings ratio) while value stocks (14.9x) sit at more reasonable valuations.

Growth versus value valuations

The correction in overall equity valuations is a market positive going forward, but many investors are fearful of 2023 looking a lot like 2022 given that a recession is expected. S&P 500 earnings per share are expected to have grown over 5% in 2022, meaning that most of the reduction in value in 2022 was valuation versus earnings driven. The bottom line is that valuations matter.

As we look to 2023, the key question is around earnings and especially profit margins. Bottom-up analyst consensus (the aggregation of Wall Street analyst estimates for individual companies) expects earnings per share on the S&P 500 to grow just over 4% in 2023, which appears optimistic if there is a recession. Interest rates will continue to be a significant driver for equity markets, but earnings downgrades and recessionary risks are certainly at the forefront of investors’ minds in 2023.

2023 outlook

Perhaps a more important question than “will there be a recession in 2023?” is “are assets fully priced for a recession?” One would argue that corporate earnings projections showing positive growth do not fully reflect recession. If there is a recession, we will certainly get a different policy response than in past years where the

“Fed put” placed a floor under asset prices because of inflation risks. The absence of a policy backstop makes fundamentals and active management extremely important for investors. For example, there are companies that have survived over the past fifteen years due to zero interest rates and the ability to borrow very cheaply and extend maturities. As the economy decelerates or contracts and the cost of capital remains well above zero, the survival of these companies will depend heavily on the fundamentals of their respective businesses.

Although the past year generated negative returns across most asset classes, it did bring fixed income yields back into income-generating territory, which is a significant change from the past several years. A short time ago, one had to take significant risk to earn the same yield that U.S. Treasurys now offer. Corporate bonds and loans also now offer competitive returns relative to equities due to the rise in interest rates and credit spreads. The direction of interest rates remains difficult to predict, but with inflation still running at 7%, we do not expect to see short-term rates going back to zero anytime soon.

Looking to the year ahead, we will be closely watching inflation, the labor market, consumer spending, and corporate earnings. While inflation is trending down, the world has changed permanently due to the COVID pandemic. The labor market has shrunk. Onshoring and deglobalization are becoming more prominent due to mounting tensions with non-democratic countries like China and Russia. As a result, the return to the days of 2% inflation could be a long way away. Moreover, the economy is global. Developments overseas will play a significant role in the performance of the U.S. economy and equity market. Europe and the U.K. have fared better than anticipated but still look to be in or headed for recession. China’s easing of COVID restrictions is a medium-term positive for the global economy, but the reopening could put pressure on commodity prices.

We continue to encourage you to work with a financial professional to help navigate these complex waters and wish you a happy and prosperous 2023.

Kelly Kowalski, Cliff Noreen, and Bronwyn Shinnick

MassMutual Investment Management

Past performance is no guarantee of future performance or market conditions. Investing involves risk including the possible loss of principal. Investment return and principal value will fluctuate so that when sold may be worth more or less than the original cost.

Use of political figures or statements is solely for reference and relevance to financial markets and is not meant to be an endorsement or a reflection of the company’s opinion or position.

This material is intended for informational purposes only and does not constitute a recommendation to engage in or refrain from a particular course of action. The information within has not been tailored for any individual and is not intended as tax, legal or investment advice.

The views and opinions expressed are those of the author as of the date of the writing and are subject to change without notice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should be relied upon when coordinated with individual professional advice. Clients must rely upon his or her own financial professional before making decisions with respect to these matters.

This communication may include forward-looking statements or projections that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied.

Investments discussed may have been held in client accounts as of Dec. 31, 2022. These investments may, or may not be currently held in client accounts