February 2024 - Market Highs & Snowy Skies

By: Kyle M. McBurney CFP

Managing Partner at Highland Peak Wealth

I venture to say that we are all familiar with the popular English proverb, "You can't have your cake and eat it too."

The earliest recording of this phrase came in the year 1538, in a letter from Thomas Cromwell, the chief minister to King Henry VIII, to the infamous king. Thomas, Duke of Norfolk, wrote, "wolde you bothe eate your cake, and have your cake?"

Admittedly, Old English had its own whimsical charm regarding spelling. Yet, the message has stood the test of time: often, one must choose between two mutually exclusive options. Other cultures have a similar expression. For instance, in Japanese, the proverb goes: if you chase two rabbits, you will end up catching none. The ancient Greeks quipped: you want the entire pie and the dog full. And my absolute favorite, from Yiddish wisdom: you can't dance on two weddings with one ass. I can keep going but let’s move to markets.

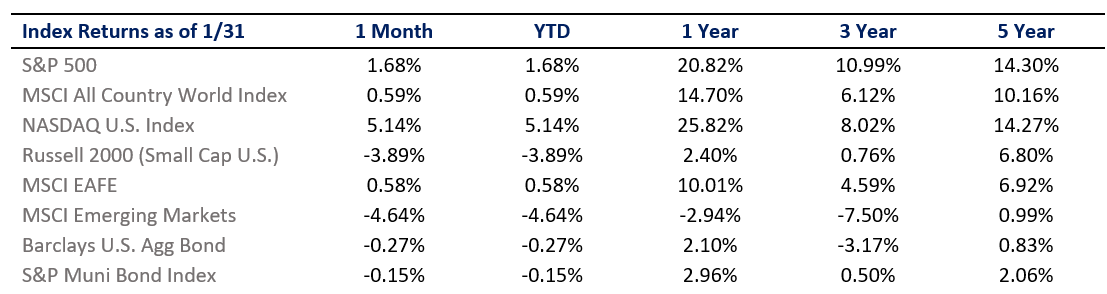

Despite early bumps, January eked out positive gains for the month. This was a welcome sign, as a positive stock market in January historically foreshadows a good year ahead. After a bumpy start, markets gained some traction, notably with the S&P 500 hitting an all-time high (more on this later). However, a dramatic twist unfolded on the last trading day of the month following Jay Powell's testimony, effectively shelving the possibility of a March rate cut.

And herein lies our hesitation. In countless discussions, Troy and I, as seasoned risk managers, have discussed this predicament thoroughly. The adage “you can't have your cake and eat it too” resonates well with the current market sentiment. It's challenging to reconcile the market's expectation of a substantial Federal Reserve rate cut, ranging from 125 to 150 basis points, with an economy (and stock market) simultaneously scaling new heights. These two scenarios usually represent a contradiction. As we all know, rate cuts are typically reserved for economic downturns or crises, a trend starkly reminded by the actions during COVID-19.

This is not at all cause for alarm. We're merely advising caution as the market's enthusiasm intensifies.

Currently, the economy's pulse is strong, as evidenced by Bloomberg's latest reports: robust GDP growth, a surge in consumer spending in December, an uptick in new home sales, consumer confidence reaching a two-year peak, and another strong jobs report. Nonetheless, markets are inherently anticipatory. Entering 2024, futures markets were factoring in six rate cuts, while, according to Jurrien Timmer at Fidelity, corporate earnings growth projections are quite lofty for both '24 and '25. All this occurs as stocks are trading at +20x forward P/E – well above the 25-year average.

In essence, the markets are painting a very rosy picture. After a fantastic 2023, stocks appear to have little room for error. Now, not attaining these lofty goals doesn't spell doom for markets; that is not our outlook. But the economy has some work ahead of itself to align with the bullish forecasts suggested by the stock market's current trajectory.

That said, opportunities are out there. We continue to be very interested in the A.I. space. Valuations are high, but energy remains as NVIDIA and Juniper Networks were the top-performing stocks in January. Outside the U.S., we continue to pay close attention to Indian and Japanese equities. And finally, fixed income, especially longer-term bonds, remains well positioned as rates continue to move lower. Put it all together, we are happy with where we are, but our job is to stay balanced and keep an eye on risk.

Source: Morningstar Direct℠

Past Performance is No Guarantee of Future Results

The January Barometer

Let's dive into the intriguing January Barometer, a gauge that gives us a sneak peek into how the S&P 500's performance in January might predict the market vibe for the entire year. Conceived by Yale Hirsch back in 1972, it operates on a straightforward principle: a positive January could herald a prosperous year, while a slow start might signal caution.

This January, with the S&P 500 marking a 1.7% uptick despite a few stumbles, the barometer is subtly nudging us towards an optimistic outlook. The track record for relying on January’s performance? It’s pretty solid, with an 86% accuracy rate since 1950. However, it's worth mentioning that it's not infallible — recently, 2021 threw us a curveball when a sluggish January was followed by a 27% stock surge.

Source: Schaeffer Research

January's positive return wasn't without its turbulence. Stocks took a nosedive on the month's final day, prompted by Federal Reserve Chair Jerome Powell effectively closing the window on a March rate cut. Despite this jolt, the resilience of the markets shone through, with the S&P 500, Dow, and Nasdaq each wrapping up January on a positive note.

Turning our gaze to the smaller players – the Small and Mid-Cap stocks – the tune changes. More susceptible to the economic and market tremors, these smaller companies have felt the sting of interest rate uncertainty and borrowing costs that have climbed significantly over the past year and a half. To start 2024, mid-caps shed 1.74%, while small caps took a 3.89% decline. But remember that these smaller companies had a furious Q4 rally, up nearly 20% over the past few months.

Looking outside the U.S., international stocks continue to trail. Developed International Stocks (EAFE) gained an uninspiring 0.58% in January. Emerging markets lagged even more, losing 4% for the month. However, according to Bloomberg, India's market continues to be strong, gaining 5% at the start of the year.

After relief in November and December, rates took a breather and stayed mostly flat for the month. The Bloomberg Aggregate bond index fell a modest 0.27% in January as the 10-year treasury bond stayed at 4.8%.

Summing it up: The bullish wave of 2023 has led to some market optimism carrying over to 2024. Investors are eyeing a hopeful “soft landing” scenario, seeing minimal inflation and recession risks. Although Small-Cap stocks haven't quite matched the momentum, it's crucial to view this in light of their recent December rally.

As I speak with more and more clients, two questions seem to dominate:

1. Is it too late to buy stocks at all-time highs?

2. Aren't rate cuts bad for stocks?

Let's tackle each question, one at a time.

Stocks and All-Time Highs

As George Costanza would say, “I’m back, baby!”

It wasn’t a fun ride, but the S&P 500 has officially reclaimed its very early 2022 highs. All markets had to overcome was a ho-hum cocktail of war, inflation, bank failures, and an aggressive Fed. Yawn.

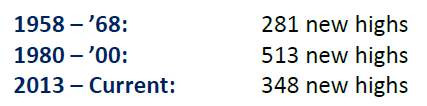

Source: Bespoke Investments

But with stocks at all-time highs, is now a good time to buy stocks? I have heard this question from a few clients. This concern is totally understandable. Buying near or at all-time highs can feel like a bad decision – in a belief that all the bargains are gone. Of course, this assumes it's easy to buy stocks in a downturn (we know it isn't). The old Joe Lewis quote comes to mind,

“everyone has a plan until they get hit.”

Of course, only hindsight will give us our answer, but, to be clear, stock market all-time highs are nothing to fear. New all-time highs happen a lot. In fact, according to Carson Research, since 1957, markets average a new high every 14 trading days – or roughly one every two to three weeks. Yes, they tend to happen in clusters, with some periods lasting decades. Since 1957, most of the new highs, all 1,186 of them, occurred during three major bull runs (the following is courtesy of Carson Research):

Regarding returns, once more, there is nothing to fear here. There is a misconception that new all-time highs typically precede '87, '00, or '07 type events. This just isn't the case. Looking back at historical returns, once again going back to 1957, market returns have been perfectly average. So, while not a massive green light, new highs are by no means a signal to sell.

However, not every peak is equal. Diving into a compelling analysis by Ned Davis Research, it's evident that "fresh" all-time highs, or those occurring after a 12-month gap, paint a bullish picture.

One year on, markets have shown positive returns 92.9% of the time, boasting an average return of 14.0% – figures that comfortably surpass historical averages. Despite the notable outlier of May 2007, these patterns attest to the market's inherent momentum, echoing Newton's law that an object (or market) in motion tends to stay in motion.

Stocks and Interest Rate Cuts

When it comes to interest rate cuts and the impact on the stock market, not all cuts are the same. With the market anticipating six rate cuts in 2024, the question is not whether there will be a cut but when it will happen? [Powell said yesterday on 60 Minutes earliest is likely June in light of strong jobs report]

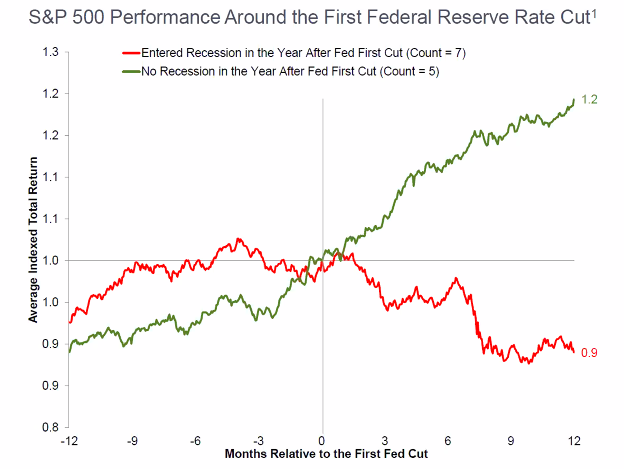

Analyzing Federal Reserve rate cycles since the 1980s, we find that rate cuts fall into three categories:

1) Panic Cuts (e.g., during events like COVID-19 and the 1987 crash): These are unexpected and driven by market crises. Short-term returns may be mixed, but long-term returns tend to be excellent, averaging an impressive 17.4% a year later, as per Carson Investment Research.

2) Recession Cuts: Rate cuts implemented to combat an impending recession. These can have varied effects on the market, depending on the severity of the economic situation.

3) Normalization Cuts: Rate cuts aimed at gradually bringing interest rates back to reasonable levels in response to falling inflation, not necessarily tied to a recession.

We are currently not in a panic environment. The prevailing question revolves around whether rate cuts will be necessary to ward off a recession or if they are merely part of a normalization process to align rates with falling inflation.

Historically, interest rate cuts without a recession have been bullish for stocks, represented by the green line in the chart below. Bloomberg data shows that stocks have averaged a 13.2% return 12 months after the first rate cut. However, when a recession is involved (as indicated by the red line in the chart), the story takes an adverse turn, with markets averaging an 11.6% decline a year after the first rate cut during a recession. Below is a fantastic chart from Goldman Sachs:

Source: Goldman Sachs

While rare, there is precedent for cutting rates in a strong economy. Jurrien Timmer of Fidelity explains that when the Fed shifts policy due to an impending recession, earnings may decline, potentially leading to a market downturn. However, history reminds us that a recession doesn't always follow. An example is the 1994-1995 period when the market outlook remained positive.

In 1995, the Fed made a significant pivot, ending a period of rapid rate hikes as inflation eased to 2%. This move laid the foundation for an impressive stock market rally, with the S&P 500 surging by 34% in 1995, marking its best annual performance since the 1950s.

The parallels between the mid-90s and now are interesting and worth our attention. Fewer beanie babies and pogs, of course, but a very similar economic backdrop is in place.

With core inflation dropping below 2% and the Fed signaling a potential end to rate hikes, investors anticipate a series of rate cuts. In the six months following the Fed's final hike in February 1995, and during a similar period in March 1997, the S&P 500 recorded gains of 19%, while the Nasdaq soared by over 30% in both instances.

Let’s pause here. These are big numbers, and this type of market explosion is not our market call. But it should ease the reader’s concern regarding stocks and interest rates.

In summary, the impact of rate cuts on the stock market varies depending on the economic context, and while rate cuts during a recession can be challenging for stocks, rate cuts in a strong economy have historically been favorable for investors. If this story changes, and the recession scenario comes into play, we will make sure to communicate our thoughts.

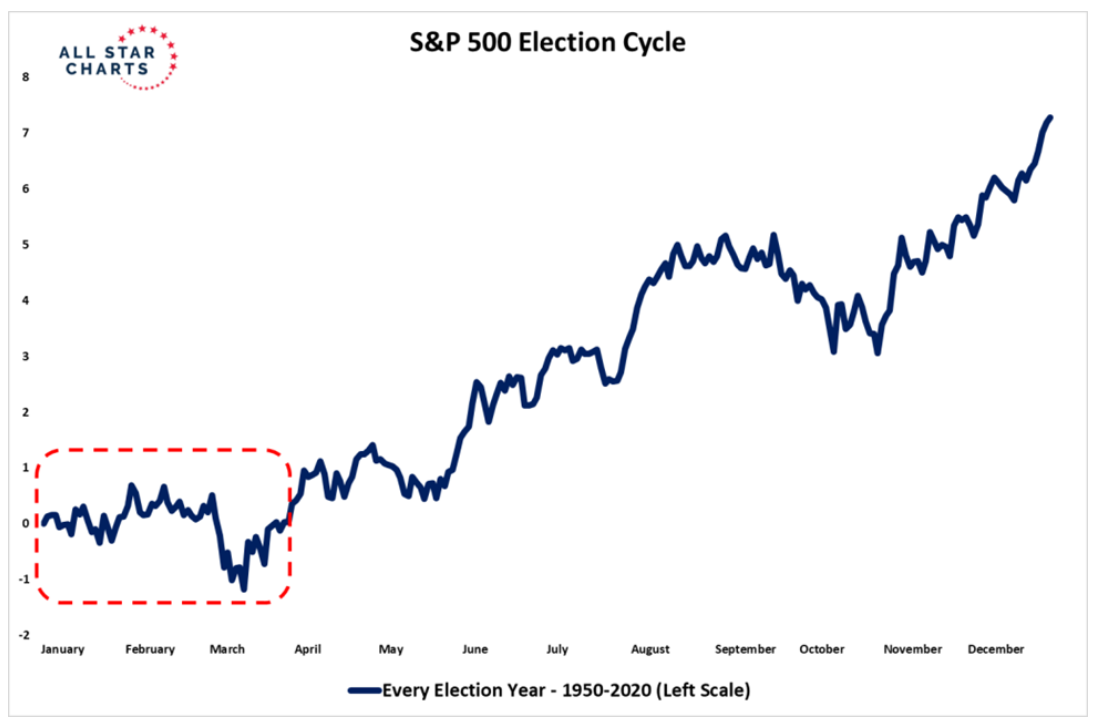

Chart of the Month – This chart is a reminder that February, like our beloved weather, has been cruel to stocks. This cycle is admittedly different, as the primary election cycle appears priced in, but it is worth remembering.

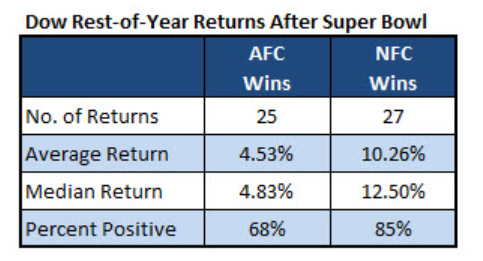

Bonus Chart of the Month – go Niners?!?

Source: Schaeffer Research

Allocation Update

For those of you who have made it thus far in the newsletter, you might suspect that Troy and I are in a state of bullish jubilation. However, the reality is a bit more measured. While we acknowledge and appreciate the current macroeconomic landscape, diving headfirst into the market after a robust rally gives us pause. To put this into perspective, the S&P 500 has surged by an impressive 38.4% from the lows of October 2023, as per Bespoke Investments.

Moreover, the economic climate, though seemingly favorable, presents its own set of challenges for stock market performance. Robust job markets, consumer confidence, and strong household finances could prompt the Federal Reserve to maintain higher interest rates for an extended period. The scenario dims further if the Fed opts for fewer rate cuts than the six anticipated.

Given these dynamics, aligning with the “short-term pullback” perspective seems judicious. The markets have experienced a remarkable phase, rallying positively for 13 out of the last 14 weeks since October. However, a market breather at this stage wouldn't be out of the ordinary and might even be regarded as a healthy market correction. It's also noteworthy that recent trading dynamics haven't been overwhelmingly positive, with January witnessing more declining stocks than advancing ones.

That said, should a market pullback materialize, it might present a prime opportunity for those holding cash reserves or funds in money markets, to capitalize on potential investment prospects.

Here’s a snapshot of our current outlook:

· Equities – Balanced Approach:

U.S. Stocks Preferred: Our inclination continues towards U.S. equities over international markets.

Emerging Markets: We maintain a selective approach, with an increasing focus on Indian markets (so far, so good).

Sectoral Watch: Special attention is being given to the Artificial Intelligence sector, particularly in Technology and HealthTech, due to the innovation potential and growth opportunities for both sectors.

· Fixed Income – Slightly Underweight (with increased focus):

Long-Term Bonds: We are actively seeking longer-term bonds to lock in the higher yields currently available.

Floating Rate Bonds and CLOs: Our outlook remains positive for these options, offering · attractive yields and returns, particularly when compared to Treasury Bills.

Opportunistic Strategy: With lower returns from cash, we are exploring more strategic opportunities within fixed income.

· Alternatives – Slightly Underweight

Private Markets: These offer additional diversification benefits during uncertain market conditions.

Gold Performance: Gold had a strong ’23 and provides a good hedge against stocks

· Cash – Getting Closer to Neutral

Current Trends: The appeal of money market funds and Treasury Bills has diminished with falling rates.

Strategic Use of Cash: Our strategy involves using this excess cash to seize market opportunities in fixed income.

Winter months brings the annual trek to Ludlow, Vermont, our stomping grounds for skiing and winter fun. For those unfamiliar, I learned to ski late in life – post-college. After years of humbling practice and a healthy respect of gravity, I now consider myself a decent skier. And today it's my turn to pass the torch to my enthusiastic 5.5-year-old apprentice, Teddy, whose newfound ski motto is, "to the top!"

This January's white powder escapade was a memorable mix of triumphs and trials. The ascent was a breeze, with the heated bubble lift earning Teddy's enthusiastic stamp of approval. However, the descent was where our adventure took a twist (and a few tumbles). With Teddy's budding skills and my own work-in-progress expertise, the McBurney duo might have inadvertently set a record for the most leisurely descent of a slope. But we made it, and Teddy remains undeterred and seems to recognize that it’s all part of the process.

Perhaps he is already aware that he can’t bothe eate his cake, and have his cake!

As always, thank you for your support and readership.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

CRN202702-5872458