MassMutual Market Update: Year End 2023

Kelly Kowalski, CFA, Bronwyn Tierney, CFA, and Cliff Noreen

MassMutual Investment Management

At the beginning of 2023, the consensus amongst Wall Street economists and strategists was an imminent U.S. recession to be triggered by the economy finally buckling under the weight of higher interest rates and the end of government pandemic support programs. Instead, the bears went hungry this year, and the bulls dominated in the fourth quarter. U.S. equities were projected to have a dismal year, and bonds were favored by many strategists. China was the region favored by consensus, with strong growth forecasted as the country was to emerge from COVID lockdowns. The Fed was expected to begin cutting interest rates by the third quarter as the U.S. economy contracted. In sharp contrast, the U.S. economy grew nearly 5% in the third quarter, and interest rates soared to their highest levels in decades. China disappointed, with Chinese equity markets underperforming, while American exceptionalism remained an investment theme throughout 2023.

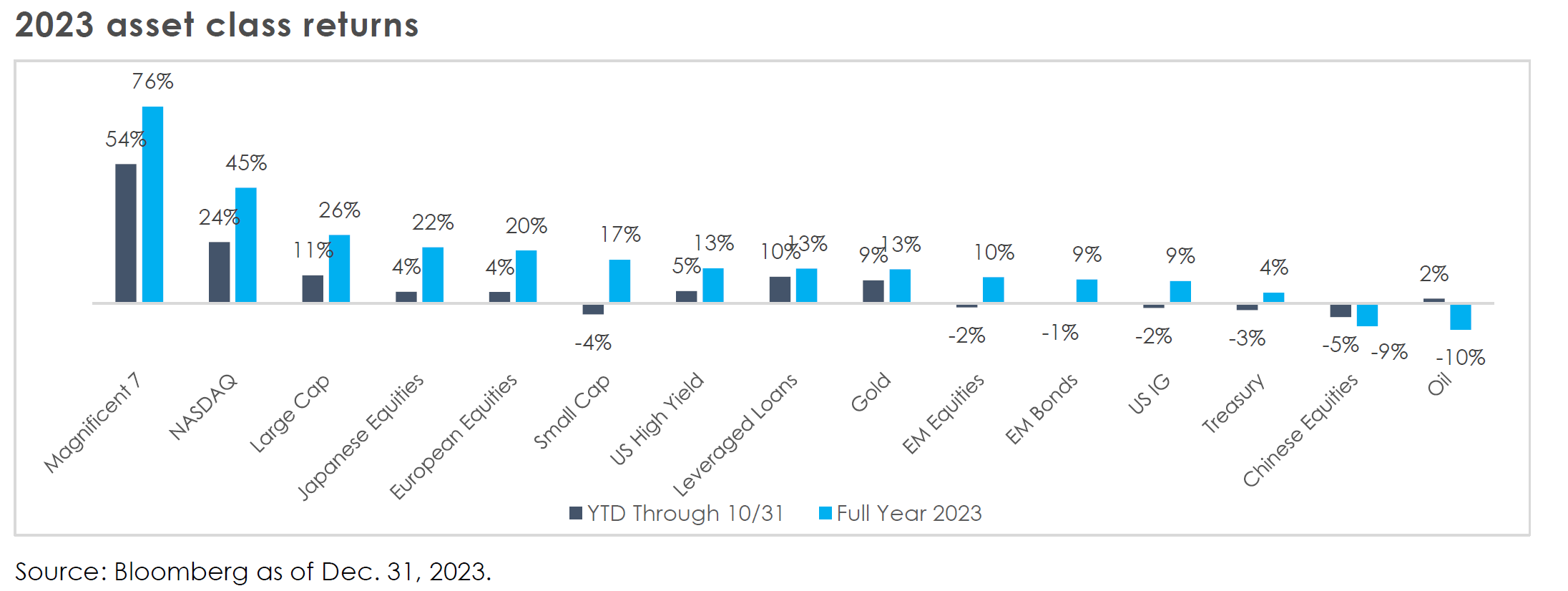

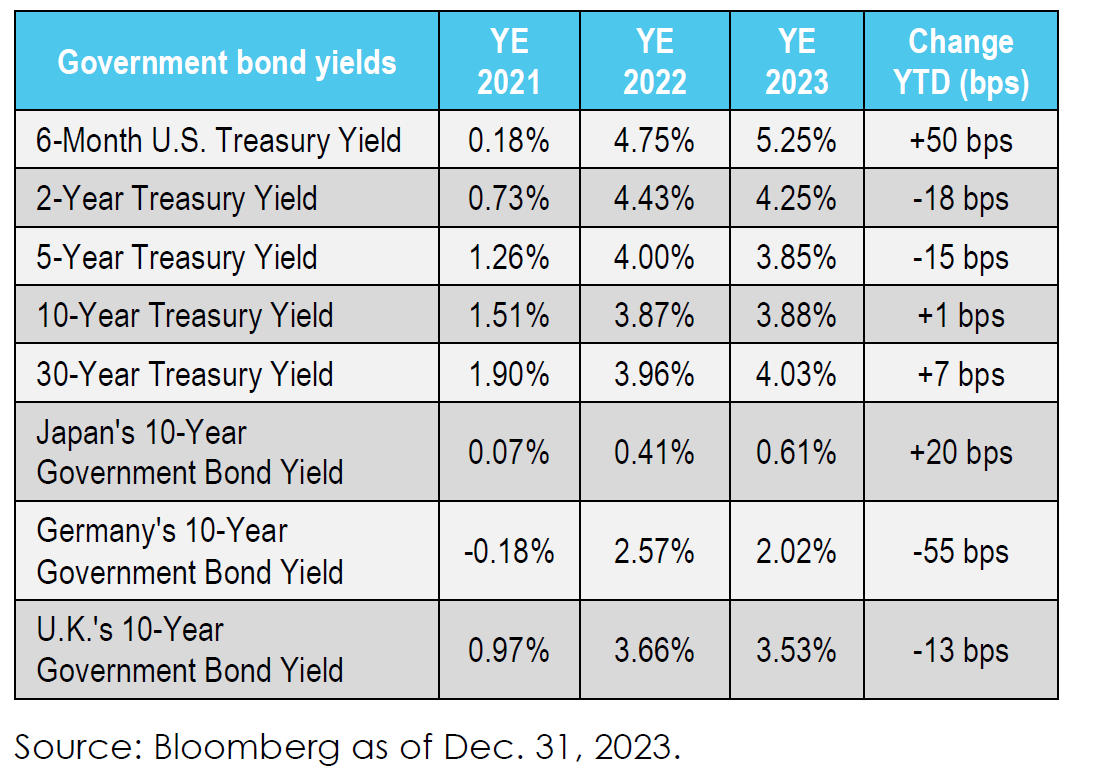

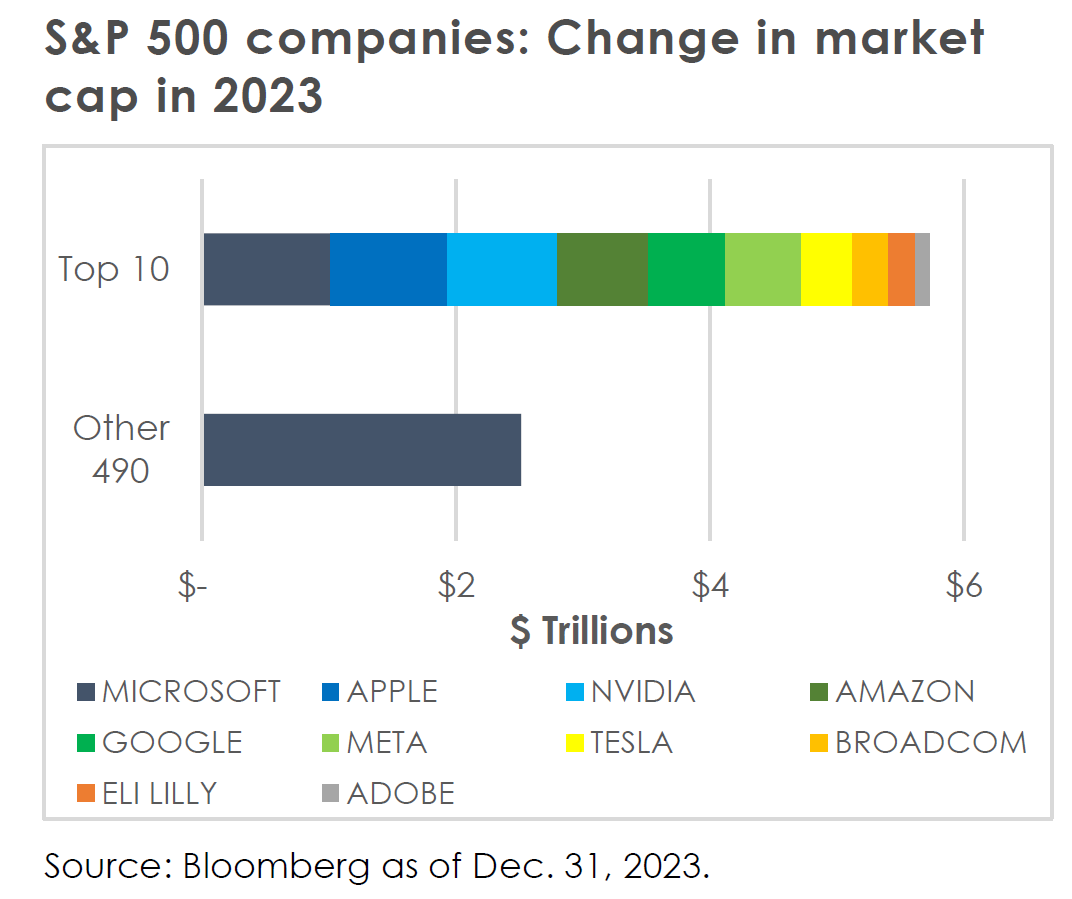

Most U.S. equity indices more than erased their 2022 slides. The S&P 500 returned 26% on the year and the NASDAQ returned a whopping 45%, its best year since 1999 as continued economic momentum and an artificial-intelligence frenzy drove technology shares to outsized gains. Similarly, bonds were tracking toward another disappointing year, but began a sharp rally at the end of October as the Fed signaled both an end to its interest rate hiking cycle and multiple interest rate cuts on the docket for 2024. Financial conditions eased considerably as Treasury yields plummeted and corporate credit spreads dropped to their lowest levels since the beginning of the Fed’s tightening cycle. As a result, the fourth quarter saw a broadening out of strength beyond the “Magnificent Seven” companies (Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia, and Tesla) that drove much of U.S. equity market returns through the first three quarters of the year.

An outstanding year for asset returns came despite intensified geopolitical and political uncertainty. A horrific terrorist attack in Israel on October 7th and continued conflicts in the Middle East have led to many questions regarding implications for oil and the risk of broader conflict. Russia’s war on Ukraine remains in a stalemate. A lack of U.S. fiscal responsibility and growing deficit and debt have resulted in the U.S. having to issue more Treasury debt, putting upward pressure on interest rates. U.S. debt crossed the $34 trillion threshold in the first few days of 2024. Lastly, 2024 will bring another U.S. presidential election with political polarization remaining at troubling extremes.

Magnificent 7 = UBS Magnificent 7 Index; NASDAQ = NASDAQ Index; Large Cap = S&P 500 Index; Japanese Equities = Nikkei 225 Index; European Equities = Stoxx 600 Index; Small Cap = Russell 2000 Index; US High Yield = Bloomberg US Corporate High Yield Total Return Index; Leveraged Loans = Bank of America Leveraged Loan Index; Gold = Gold Spot Price; EM Equities = MSCI Emerging Markets Index; EM Bonds = Bloomberg Emerging Markets Aggregate Bond Index; US IG = Bloomberg U.S. Aggregate Index; Treasury = Bloomberg US Treasury Total Return Index; Chinese Equities = Shanghai Shenzhen CSI 300 Index; Oil = Brent Crude Oil Spot Price.

Confidence grows that the Fed has actually nailed the “soft landing”

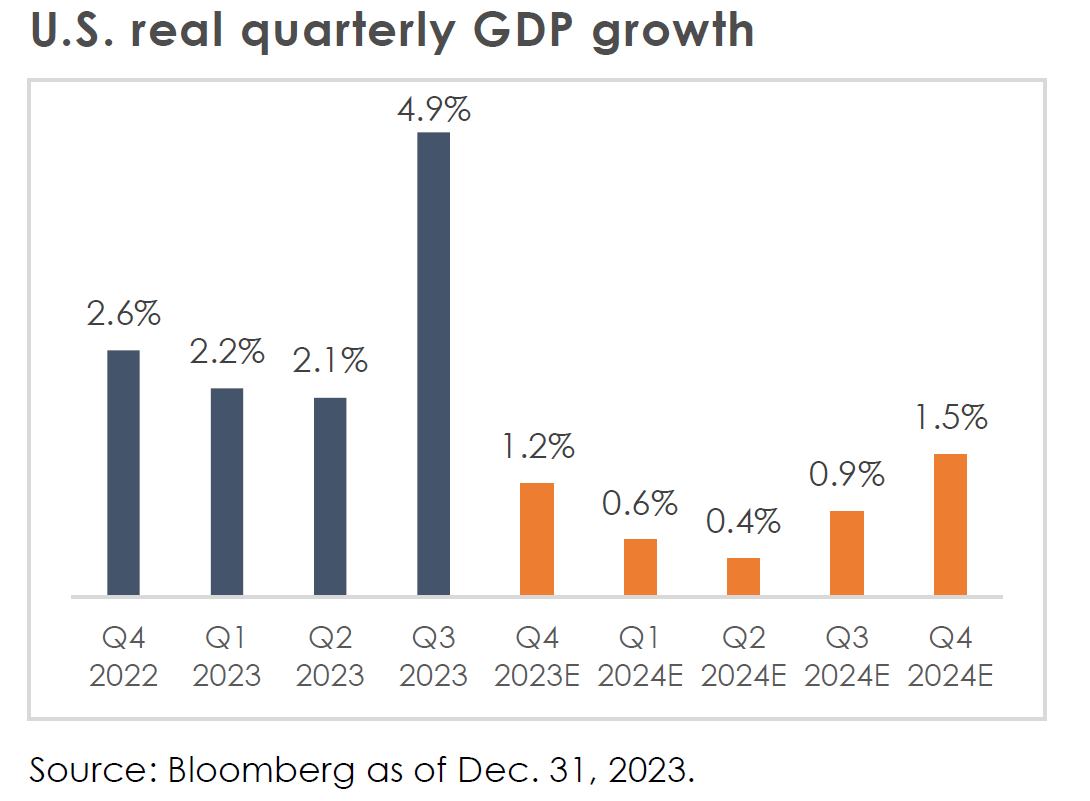

Fourth quarter market performance was the result of everything investors have been hoping for: declining inflation, stable growth, and most importantly, the Fed backing off its restrictive stance. The U.S. soft landing scenario is still intact, but we are not yet at “mission accomplished”. After the U.S. economy expanded 4.9% in the third quarter, the consensus estimate for fourth quarter at 1.2% growth is a slowdown, but not a contraction. Full year growth of 1.3% is expected for 2024 versus 2.4% for 2023. The consensus probability of near-term recession has dipped to 50%, while inflation continues to wither, and employment has held up.

From a starting point of 6.5% inflation at the end of 2022 (and a peak of 9.1% in June 2022), are we in fact in a scenario of “immaculate disinflation”, or even potential deflation? We’ve made welcome progress towards the Fed’s goal of 2%. In November, the U.S. Consumer Price Index rose 3.1% and 4.0% year-over-year on the headline and core (excluding food and energy) measures, respectively. Per the Fed’s Summary of Economic Projections released in December, officials see core inflation falling to 3.2% in 2023 and 2.4% in 2024, then to 2.2% in 2025. Finally, it gets back to the 2% target in 2026. At the same time, the labor market continues to supply enough jobs for almost all who want them, although signs of loosening are materializing. The number of available jobs in the U.S. decreased to 8.8 million in November from 8.9 million in the prior month, the lowest level since early 2021.

Fourth quarter brings a friendlier Fed

At the December FOMC meeting, the Federal Reserve held its key interest rate steady for the third straight time and set the table for multiple cuts to come in 2024 and beyond. The market has taken care of some of the Fed’s work; the month of November saw the largest easing in U.S. financial conditions of any single month in the past four decades, equivalent to ~90 bps of interest rate cuts. In the words of Fed Governor Christopher Waller, it’s now time for officials to “wait, watch, and see” before acting on interest rates.

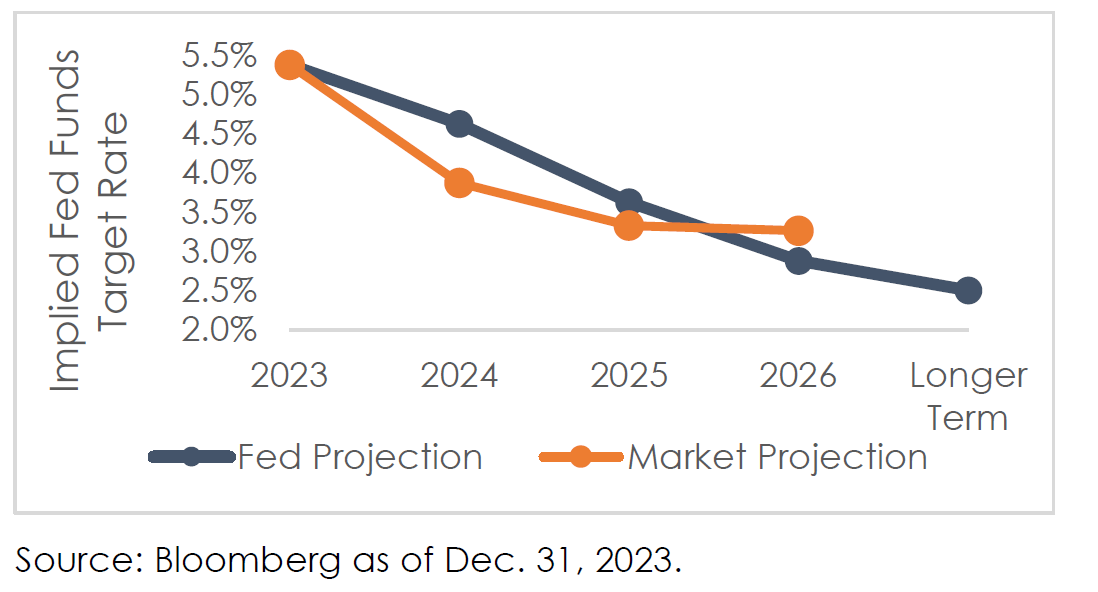

In 2024, inflation is projected to fall further. Because the Fed targets the level of real interest rates (nominal interest rate i.e., what we observe as interest rates quoted on bonds or loans minus the rate of inflation), to maintain the same level of restriction the Fed needs to cut the nominal rate in line with falling inflation. That has led the Fed to project three, 25-basis-point cuts in 2024. The market has priced a more ambitious pace, projecting approximately six cuts, or a 150-basis-point reduction in interest rates by the end of next year, double what the Fed is projecting. Beyond 2024, both the Fed and market foresee future rate cuts.

Throughout the past several months, many warned of the risk that the Fed has “overtightened” or instituted policy that is too restrictive. Those concerns have thus far been alleviated by the resilience of the U.S. economy. Now, some are raising the possibility that the recent easing in financial conditions and strong market backdrop could reignite another wave of inflation or inhibit progress towards the Fed’s 2% target. As the past two years have shown, inflation, like the economy, has been incredibly difficult to forecast.

U.S. consumer chugging along despite some signs of exhaustion

The consumer is not in dire straits, but not without worry either. When staples like gasoline and groceries have cumulatively risen 43% and 20%, respectively, since January 2021, it should come as no surprise that shoppers are increasingly price sensitive. Consumers across all income levels have been seen trading down for lower-priced alternatives as they manage tighter budgets due to last year’s record inflation and interest rates. Per Bloomberg, the average consumer is spending $4,250 per month on mortgage payments, car, and student loans, combined. That is about two-thirds of median household income.

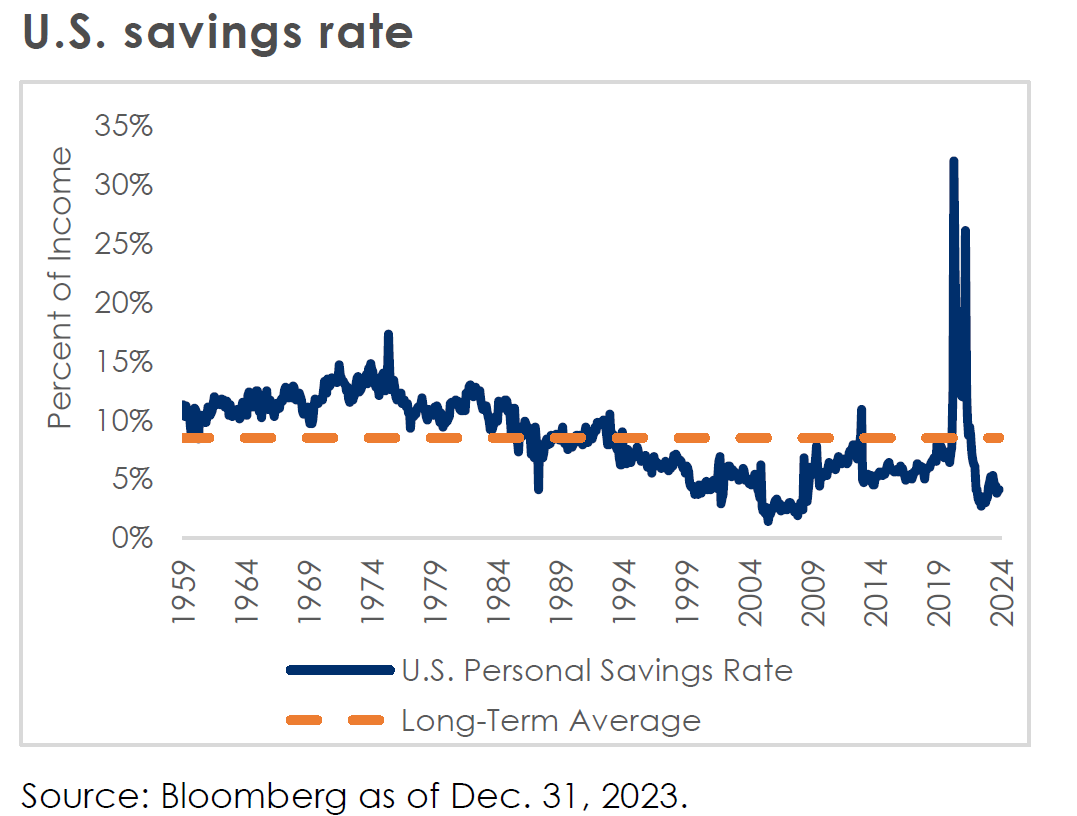

The U.S. personal-savings rate was just 3.8% in October, even as savers are incentivized by higher interest rates. These levels were last seen during the Great Recession and could be a signal that consumers are tapped out. The 65-year average is 8.5% and the all-time low was 1.8% in 2005, per Bloomberg data. At the same time, Americans are racking up credit-card debt as inflation pressures consumer budgets, a sign that current spending levels for select income cohorts could be unsustainable. The Federal Reserve Bank of New York calculated total credit card balances as having jumped 16.6% to a record $1.08 trillion in the third quarter. Furthermore, the percent of U.S. credit card accounts that are 90 or more days delinquent has almost doubled since the first quarter of 2022 and is now above the pre-pandemic level and 15-year average.

A key question is whether current trends are simply a normalization as we adjust back to a world of non-zero interest rates and reduced government support, or the beginnings of a broader deterioration. We believe the answer lies in the future performance of the labor market; so long as the labor market remains stable and unemployment relatively low, the consumer should continue to chug along as well.

Tech turbocharges 2023 U.S. equity market returns

According to Goldman Sachs, the NASDAQ 100 Index has risen in 14 of the past 15 years for a post-2008 cumulative gain of 1,517%! 2023 was no exception as the largest seven U.S. technology companies surged by 76% compared to the S&P 493’s 12%. As a result of the huge gains seen across a narrow basket of stocks that included a 239% return in NVIDIA shares and 194% gain in META, equity concentration in the S&P 500 is now at levels not seen since the 1970s.

Higher interest rates have been a fundamental boost for mega tech companies with billions of dollars in cash on their balance sheets. Net interest payments paid by corporations have fallen to 40-year lows thanks to earnings on short-term investments and businesses locking in ultra-low interest rates on debt when they had the opportunity. Meanwhile small and medium-size businesses that tend to have floating rate debt are under pressure with higher interest expenses, hiring slowing, and credit card balances rising.

Zooming out on the U.S. equity market, many investors are asking: was the ferocious fourth quarter rally overdone? Equities are not exactly cheap. According to Apollo, investors buying the S&P500 today are buying seven companies that were up approximately 80% in 2023 and have an average P/E ratio above 50. Earnings growth has turned positive despite sticky and top-line price inflation fading. After growing by a meager 0.6% in 2023, the consensus expects S&P 500 earnings per share to rebound sharply, growing 11% in 2024 despite a slowing economy.

Looking ahead

For 2024, consensus expects ideal market and economic conditions to persist. Inflation and interest rates are projected to decline while economic growth slows but remains positive enough to drive double digit corporate earnings growth. Expectations for Fed easing are nearly double what the Fed itself is projecting for 2024. As we saw with 2023, interest rate, inflation, and economic growth projections significantly missed the mark and are very difficult to project accurately.

Therefore, as we look ahead to 2024, we are thinking about risks and alternatives to the consensus view:

• What if the economy remains resilient, growth continues to surprise to the upside, inflation rebounds or stalls, and the Fed must maintain restrictive policy for longer than anticipated?

• Alternatively, what if the much-anticipated recession finally arrives, leading to weakness in corporate earnings and risk assets?

• Could increased Treasury issuance due to soaring U.S. debt levels put renewed pressure on long-term interest rates?

• Will markets continue to remain largely immune to geopolitical shocks and risks?

If 2023 taught us anything, it is to expect the unexpected and that market and economic projections, especially over relatively short timeframes, are usually wrong. We wish you a happy 2024 and encourage you to speak with a financial professional in navigating this complex backdrop.

Kelly Kowalski, CFA, Bronwyn Tierney, CFA, and Cliff Noreen

MassMutual Investment Management