May 2022 - Confused? Good!

By: Kyle M. McBurney, CFP

Managing Partner at Highland Peak Wealth

Amid the 2015 pullback, Charles Munger, famed investor, and vice chairman of Berkshire Hathaway, admitted he was as clueless as everyone else.

You ask me what’s going to happen? Hell, I don’t know what’s going to happen…Anybody who is intelligent who is not confused doesn’t understand the situation very well. If you find it puzzling, your brain is working correctly.

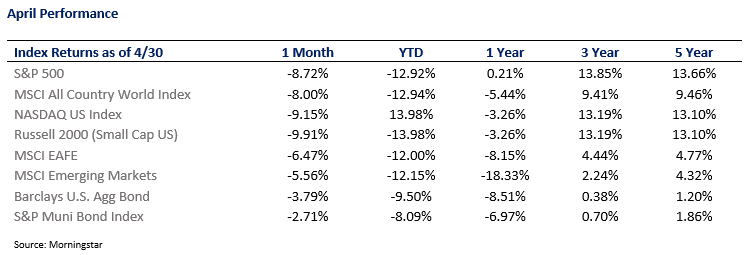

The reason I lead with this Charles Munger quote is because it so effectively hits the confusing nature of today’s market. Stocks have declined around concerns of higher rates, inflation, and the potential for slower growth. We knew that ’22 was going to be rocky, and it has thus far been true to form. What is harder to fathom is the fact that bonds have fallen almost as much, at times even more. Real estate is also down. Commodities and gold have provided some cushion, but not as much as one would expect. Gold, for example, has barely moved. Put it all together, and investors feel justifiably baffled.

So, to all of you who are confused, your brain is working correctly, and you have passed our mental evaluation. Congrats?

What makes things so confusing—in an interesting way—is that there are several counterintuitive and contrasting data points happening simultaneously. We have slowing growth yet a robust job market and wage growth. We have higher rates, yet the average household balance sheet has the lowest debt levels since the 1980s. Consumer surveys are negative, yet US retail sales have been up 5.5% since last year and up 36% since the start of the pandemic–a reflection of continued consumer strength. I can keep going, but you get the point. Figuring out why markets move is hard.

The way we see it, there are three ways investors can respond to volatility – do a lot, do nothing, or something in-between. In markets like these, the natural impulse is to do “a lot,” which is almost always more harmful than helpful. This impulse is a challenge for investors and money managers everywhere. Warren Buffet compared this investor impulse to a baseball player at the plate, with fans yelling “swing you bum!” from the stands. How easy it would be to swing at a pitch in the dirt!

Currently, our team at Highland Peak Wealth is in the “something in-between” camp. Doing too much will likely cause more harm, as no one has the skillset to time both sides of the trade but doing nothing is wasting an opportunity.

So, what does it mean to client portfolios? It means a continuation of protective strategies:

- Equities - Continue to tilt portfolios more into value and dividend-paying stocks (and out of tech/growth)

- Fixed Income – Stay light, and focus on short maturity/short duration fixed income to better protect against downside

- Alternatives - Added 2% to the alternative bucket to better hedge against inflation and slowing growth

- Cash – Increase cash position and dry powder for what we believe will be continued volatility through summer

We continue to implement these strategic changes in parallel with active tax-loss harvesting, portfolio rebalancing, and patient dollar-cost averaging strategies (for a handful of clients).

Slow Down or Recession?

Markets hate bad news. But, as much as it dislikes negative headlines, the stock market hates uncertainty even more. Why? With uncertainty all around, markets must price in the worst-case scenarios and, to some degree, assume the absolute worst one. But, of course, these worst-case scenarios rarely happen.

Currently, markets are dealing with uncertainty everywhere. As if interest rate and inflation speculation weren't enough, markets are trying to decipher if we are in the midst of a recession or simply a mid-cycle slowdown (like '11, '15, and ‘18). This question became even more interesting last week when first-quarter GDP surprised many, contracting by 1.4%.

Does a negative quarter mean that we are in a recession? Not at all. As a reminder, a recession is defined as two consecutive quarters of negative growth. Quarterly GDP declines within an expansion cycle are not uncommon. In recent memory, we have seen a few examples:

Q1 2011: -1.0%

Q3 2011: -0.2%

Q1 2014: -1.4%

It is also critical to understand the components within each GDP reading. Each quarterly print has its unique story/characteristics. For example, while a -1.4% GDP print surprised and scared many, markets exploded to the upside that day. Confusing? Yes. However, looking deeper at the numbers, the reading wasn't quite so scary. The decline in growth most notably came from inventory subtraction (expected), an 8.5% reduction in defense spending, and a 3.2% subtraction from net trade - likely the product of Q1's Omicron wave and the China "zero-covid" policies.

Of course, a recession could be coming, but most believe this is unlikely the beginning. Consumer spending was solid at 2.7% (albeit a touch light), and business investment continues to shine as it grew 9.2% last quarter. As a result, the latest estimate from the Atlanta Fed GDPNow model estimates that real GDP growth for Q2 is 2.2% (as of 5/4) - up from 1.6%.

To be clear, we believe that a recession is coming, and recessionary risks have risen of late. However, we are not sure when it will start, how long it will last, how deep it will be, and when it will be over. No one does.

In addition, knowing what the economy will do provides only a modest crystal ball advantage when it comes to stock and bond returns. As Warren Buffet asks, "You have all these economists with 160 IQs that spend their entire life studying it. Can you name me one super-wealthy economist that's ever made money out of securities? No."

Oh, and one more thing on Warren Buffet – he has bought more stocks this quarter than he did in all of 2008 combined. So, take from this what you will. He is unquestionably buying into fear.

Stocks and Recessions

Please repeat after me: the stock market is not the economy; the stock market is not the economy.

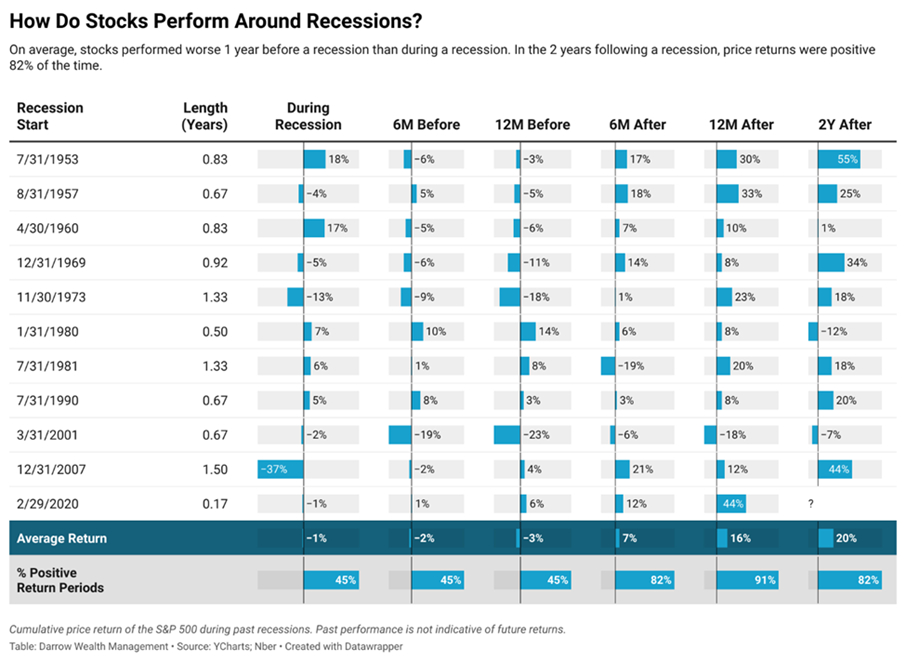

Let me propose a seemingly simple question – how often do stocks go down during a recession? I predict that almost everyone would assume 100% and give me a funny look for even asking (like many already have). The truth, however, is a bit surprising. Below is a fantastic graphic from Ycharts (apologies to all for the small font).

A few fascinating takeaways:

- Even before and during recessions, stocks are positive 45% of the time

- Stocks are worse leading up to recessions, but still down on average just 3%

- One- and Two-year returns are well above average (not surprising, I suppose)

Of course, each time is different. History is always a helpful guide, but it isn’t a way to predict the future with certainty. Moreover, our current environment deals with a unique cocktail of rising rates, inflation, and valuations. Still, it is constructive to keep these takeaways in mind.

Why do stocks not get battered in every recession?

Simple – economic data looks backward as the market looks forward. By the time we are aware of a recession, the markets have typically moved on to bigger and better things. Inversely, this also means that stocks can fall during economic strength. Is this one of those times? It is way too early to tell.

The takeaway: investors cannot predict what stocks will do, even if a recession is around the corner.

So, our collective mantra should be: the stock market is not the economy. Therefore, there can be pain without one affecting the other. We implore you to keep this in mind as economic growth likely decelerates.

Update from Jerome Powell

* Lucky you, I strategically waited to begin this newsletter following Powell’s testimony for a quick response. It had nothing to do with the stomach flu going through the McBurney clan earlier this week 😊.

As I write this newsletter, the Federal Reserve raised its benchmark interest rate by 0.50%, the most aggressive step in its fight against inflation. Along with higher rates, the central bank communicated that it would reduce its $9 trillion balance sheet. In response, on Wednesday markets ripped higher, with the Dow Jones Industrial Average up nearly 1,000 points, the largest rally since November 2020.

0.50% increase in rates is a big move. But how could this possibly be interpreted as good news?

It is all about what has and what has not been priced into stock prices. Because of uncertainty around the direction of rates, markets have priced in the likelihood of more aggressive rate hikes (such as a .75% move) or a path raising rates more frequently. Fed Chairman Jerome Powell has put some of these fears to rest – “Seventy-five basis points is not something the committee is actively considering…The American economy is very strong and well-positioned to handle tighter monetary policy.” All it took was for Powell to back off future 75 basis point hikes for the Dow Jones to explode 932 points higher – reflecting just how oversold the market was going into this Fed meeting. It was a classic “relief” rally. Editor’s note – that did not last long as markets erased the entire rally and then some on Thursday.

In our view, the Fed is trying to tiptoe around its future, doing its best not to box itself in a corner. However, it is noteworthy that some inflationary tensions are easing with supply chains loosening and some costs coming down – drop in car prices, chip shortage relief, and China reopening. Lower inflation numbers will give the Fed more wiggle room to raise rates in a controlled, communicated manner if these positive trends continue. If this happens, we expect stocks and bonds to rally.

However, this remains a massive question mark. If supply chains remain tight and these very elevated inflation levels stick around for an extended period, the Fed will have to raise rates aggressively. That would not be good for anyone.

We are watching closely and, in the meantime, positioning portfolios defensively in the short term. This is especially true as we enter the “pre-mid-term election” summer months – historically challenging for stocks.

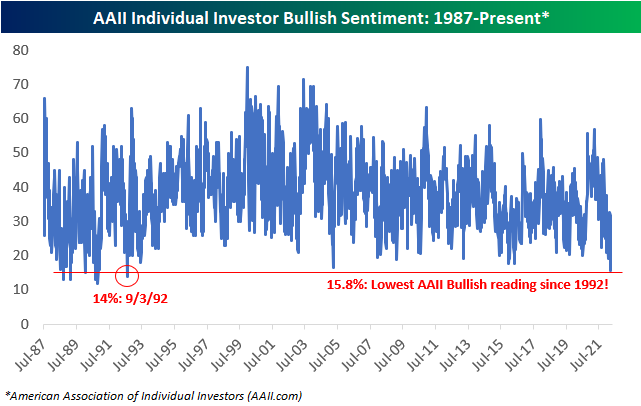

Chart of the Month – Historic Levels of Bearishness (not a market call…just interesting to point out)

A Quick Word on I-Bonds

We have been having more and more conversations around Series I Savings Bonds. Long ignored, I Bonds are conservative bonds issued by the US Treasury that adjusts based on inflation. With inflation at 40-year highs, this bond now offers a very attractive initial interest rate of 9.62%. Yes, these numbers change/adjust based on CPI, but 9% is 9%, and CPI is likely to stay elevated for at least a bit longer.

Does this sound too good to be true?

Unfortunately, these bonds are limited to $10,000 per person per calendar year. There are also some holding requirements that should be reviewed. For example, there are penalties if you sell the bond within five years of purchase. Also, income is taxable at the federal level, but it is exempt at the state and local levels (helpful for CA and MA investors). We recommend that all interested parties refer to treasurydirect.gov for all pertinent information.

While this may not be a needle mover to many, cash-heavy investors shouldn’t ignore it. Series I Bonds can be an excellent alternative for some cash/cd investments and can be strategically used around gifting, supplemental income, and education planning. Our team is happy to discuss this if you are interested. Unfortunately, we cannot purchase these bonds for you, but we are happy to walk you through the process.

Over April break, the McBurney family packed up and took a quick "babymoon" to the beautiful west coast of Ireland. We took a fantastic trip to Dingle pre-COVID and have been trying our best to get back. For those unfamiliar, a "babymoon" is a trip/excursion before the arrival of a new bundle of joy. It is the quiet before the storm. I also joke that it is a millennial stimulus package. Anyway, off we went to beautiful Westport and Galway. Teddy was especially excited. Before our trip, Heather (the true brain of the family) purchased Teddy a new, special dinosaur raincoat. So special, in fact, that the dinosaurs on the outside, typically white, change various colors. Absolutely genius. Teddy wasn’t just prepared for the inevitable Irish rainfall; he was looking forward to it. There is probably a cliché investment theme in there somewhere, but I have said enough already.

Anyway, we had a fantastic time exploring castles, enjoying methodically poured Guinness drafts (for research), and all the music Galway had to offer. Teddy especially got into the spirit and went into full tourist mode. For your pleasure, I have added a picture of Teddy at his finest. Begging for an Irish green hat, gelato, and Irish flag, he loved waving all three at everyone who passed by. Oh, the fantastic ability for young'uns to be present in the moment, uncaring of the opinions of others, is remarkable. I suppose with a rain jacket that cool, nothing else matters 😊.

Cheers to a great spring and a wonderful Mother's Day ahead! Given my allergies, we appear to be in full springtime bloom. We hope that you all enjoy it.

Otherwise, please do not hesitate to reach out. Given both past and future market volatility, we do our best at Highland Peak Wealth to "drop everything" when clients reach out. It is something we welcome. In times like these, communication is crucial.

As always, questions and comments are welcome.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index.