January 2024 — Navigating Traffic and an Election Year

By: Kyle McBurney, CFP

Managing Partner at Highland Peak Wealth

It was a brisk, late March day in Boston, with the city's notoriously bad traffic at a standstill. There I was, sitting with a close friend - a sharp, well-read individual - when our conversation took a turn towards the financial.

"Kyle," he began, his voice cutting through Bloomberg Radio in the background, "why the heck should I invest in stocks when I can get a guaranteed 5% return in a money market account?"

Remember, this was just weeks after the tumultuous downfall of major banks, most notably Silicon Valley Bank and First Republic Bank. Investors were already fighting looming recession fears, and now, the threat of bank failures and systemic instability loomed large. The allure of money market rates hitting 5% was undeniable.

In response, I offered the conventional wisdom on risk and return, highlighting the potential long-term benefits of staying invested in the market. The usual stuff. Yet, as I spoke, I couldn't help but recognize the lack of conviction in my own words. Here I was, a seasoned professional who had always championed the mantra of staying invested, yet I found myself questioning the very advice I was giving. The outlook, undeniably, appeared grim.

The rest, as they say, is history.

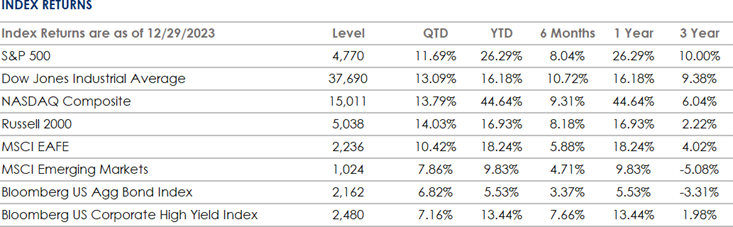

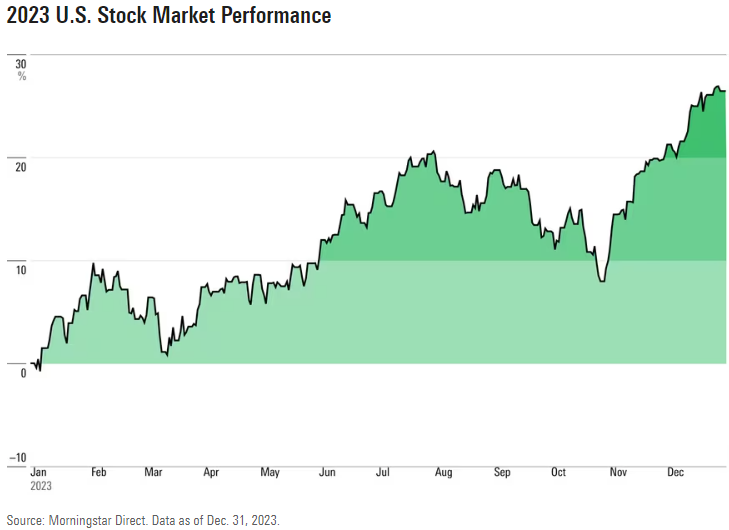

Since that car ride, according to Morningstar, the S&P 500 is up a whopping 26.29%. Even bonds, a sore spot for all '22 and much of '23, closed the year up 5.53%, setting the stage for what could be a strong 2024.

As exciting as a story about sitting in traffic can be, the point is this – even in significant market years, investors will be challenged, tested, and tortured. Even advisors like me, a student of stock market history and psychology, can be beaten up by the 24/7 news cycle and daily bombardment of doom and gloom headlines.

Our mantra remains straightforward yet powerful: have a plan, stick to it, and tune out the distractions.

And that recession that everyone was so confident over? As with the Y2K scare, it never appeared, yet was discussed frequently. According to Google Trends, google searches for "Recession" hit historic highs in early 2023. In December of 2022, the Financial Times published a survey showing that 85% of economists projected a recession in 2023. This is a potent reminder that forecasts are just that - not certainties but educated guesses. Those investors who made big changes to their portfolios to prepare for a recession likely feel some serious FOMO.

To tap into my inner Mark Twain - "It ain't what you don't know that gets you in trouble. It's what you know for sure that just ain't so."

Reflecting on the past year, we at Highland Peak Wealth acknowledge that, while not every decision was perfect, our approach remains steadfast – grounded in rigorous research, diversification, and a long-term perspective.

As we step into 2024, we recognize the ongoing market challenges. Yet, our role is not to avoid the storms but to navigate through them. This newsletter is committed to providing insights and strategies for succeeding in the current market landscape.

We hope you find value in our perspectives.

Source: Morningstar Direct℠

Past Performance is No Guarantee of Future Results

A Final Word on 2023

And exhale.

Last year defied widespread skepticism as stocks rose substantially, buoyed by advancements in artificial intelligence and a more resilient economy than Wall Street predicted. The anticipated recession never materialized, and now, the S&P 500 is tantalizingly close to a record high, fueling greater optimism among investors – at least for now.

In many ways, 2023 was a typical stock market year:

A strong start in January set the tone for the year

Mid-year volatility gave way to a Q4 rally

Year 3 of the Presidential cycle earned big gains

A big recovery followed the previous year’s decline

This positive shift that occurred in ‘23 is largely attributed to the belief that the Federal Reserve's inflation-fighting interest rate hikes are likely ending, with expectations of rate cuts in the near future. However, risks remain, including potential economic shocks, like inflation regaining steam, which would cause the Fed to alter its course and potentially throw markets into a tizzy.

Despite these concerns, 2023 witnessed a remarkable "everything rally," with significant gains across various asset classes, including stocks, bonds, gold, and even cryptocurrencies. The S&P 500 posted a 26.29% return, while the 10-year Treasury yield and Wall Street's fear gauge, the CBOE Volatility Index, stabilized at relatively low levels. Investor sentiment ended the year largely positive, with a December survey by BofA Securities revealing the highest optimism since early 2022. Bonds, notably, made a strong comeback in the fourth quarter, leading the Bloomberg U.S. Aggregate Bond Index to outperform with a 5.553% return, slightly edging out the Bloomberg US Short Treasury Index.

Wall Street's forecast for corporate earnings remains optimistic. For better or worse, according to FactSet, markets anticipate earnings growth of 11.6% for the S&P 500 in 2024 and an even higher 12.5% in 2025. These are somewhat lofty expectations and will be an important theme heading into 2024. Amidst these expectations, a cautious eye is kept on the "Magnificent Seven" tech giants, whose dominance, and high valuations in 2023 pose intriguing questions about their future performances.

The major risk remains around interest rates, with Fed projections and market expectations potentially leading to market volatility. We know this, of course, and the other risks and headlines that dominated the airwaves in 2023 and are still here as we start 2024. I credit Morningstar for putting together the below graphic that captures what's currently on our minds -

Source: Morningstar

As we step into 2024, we are far more optimistic now than we were this time last year. The recent market shifts present unique opportunities, particularly in the realm of income generation.

On our minds are three crucial topics:

The Federal Reserve's next steps

2024 strategy for bonds

Navigating the stock market in an election year

Rate Cuts in 2024?

The market certainly believes so.

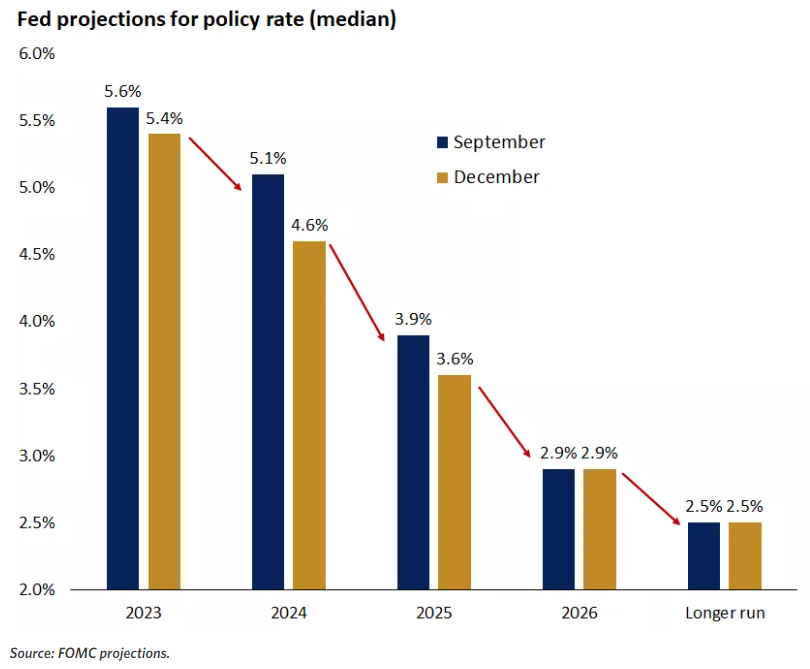

The markets are signaling an expectation of rate cuts in the coming year. This sentiment, a big reason for Q4's rally in stocks and bonds, has been fueled by a notable shift in the Federal Reserve's stance, particularly evident following the December FOMC meeting. The Fed's unexpectedly dovish pivot, opening the door for rate cuts in 2024, sent ripples through global markets. In his post-meeting commentary, Jay Powell struck a balanced tone, acknowledging the risks of over- tightening and what he referred to as "underaction" – interpreted as the risk of not cutting rates in the face of lower inflation.

This announcement spurred a significant bond rally, with the futures market rapidly adjusting to anticipate as many as six rate cuts in 2024.

Below is a chart that illustrates not only the forecasted trajectory of interest rates but the change in expectation following December's meeting:

Should these rate cuts indeed come to pass, we anticipate several key reactions in the market:

- Once-juicy yields on cash at risk

- Longer-dated bonds would be particularly well positioned – especially if there are more cuts than anticipated

- Falling rates may boost housing activity

According to a survey conducted in December by BofA Securities, over 90% of surveyed fund managers think that the Fed has halted its interest rate hikes, and more than 60% are predicting lower bond yields within the following year. If these forecasts hold true, the fixed-income market may provide some opportunities for investors to deploy some cash on the sidelines – an exciting possibility in a recently unexciting part of the market.

Navigating a Shifting Fixed Income Landscape

As highlighted in our previous newsletter and still holding true, the current bond market presents a unique opportunity. The convergence of high yields, geopolitical uncertainties, and a potential shift in monetary policy positions bonds as an increasingly attractive option for investors seeking safety and reliable income. Echoing this sentiment, Bank of America's Michael Hartnett recently suggested in a note that "bonds should be the best-performing asset class in the first half of 2024."

While the future remains to be seen, what is clear is the significant impact of the swift shift in rate expectations on bond portfolio strategies.

The anticipated decline in interest rates brings longer-term bonds into the spotlight. John Ferguson at GW&K points out that with the futures market currently forecasting over six rate cuts in the next year, the scenario for reinvestment risk is at one of its highest points, making the case for longer-term bonds even more potent.

In layman's terms, reinvestment risk involves the possibility that returns from an investment might need to be reinvested at a lower rate. For example, if a short-term bond matures, you may have to reinvest the proceeds in a new bond with potentially lower yields if rates have decreased.

This increased reinvestment risk highlights the appeal of longer-term bonds in today’s markets. With current rates being compelling, especially versus the previous ten years, investing in longer-term bonds offers several advantages:

Securing Attractive Yields: Locking in appealing yields while they are still available.

Potential for Price Appreciation: If rates do fall, the value of these bonds could increase.

Superior Returns Compared to Cash: Longer-term bonds may offer returns that outpace those available from holding cash.

This will be a focus of ours as we begin 2024. No doubt we will keep you, the reader, updated on movements made within fixed income portfolios.

Now, onto the stock market.

Stocks in an Election Year

Unless living under a rock, you are likely aware that we're gearing up for an election year. To borrow a line from Cameron Frye in “Ferris Bueller’s Day Off” – “Oh, joy. Oh, bliss. I thought I was dying.” But let’s take a moment to breathe and look at the facts.

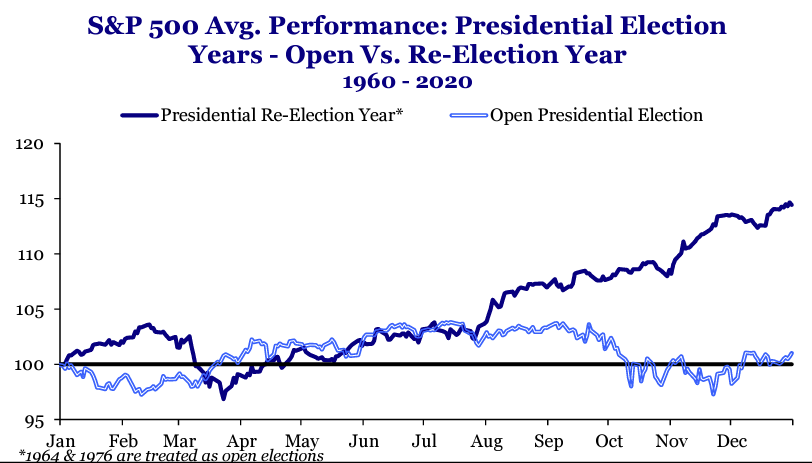

Historically, election years have been surprisingly kind to the markets, especially for stocks. There's a common misconception that elections spell doom for market performance, but the data tells a different story. Let’s delve into the S&P 500’s historical performance during presidential election years compared to non-election years:

Source: Strategas

Interestingly, the market tends to fare even better in years when an incumbent president is running for re-election. Research from Strategas reveals a compelling trend: since 1952, encompassing the past 15 elections, the S&P 500 has not experienced a decline in any re-election year. In fact, during these periods, the market has consistently achieved above-average gains, with the S&P 500 averaging an impressive return of 12.70%.

In many ways, this makes sense. Presidents up for re-election will use whatever policy levers that are needed to boost the economy and markets. They like to prime the pump so voters are feeling good come election day. After all, every president who dodged a recession two years before their re-election went on to win election. And every president who had a recession in the two years before their re-election went on to lose. Ouch.

Take a look at another insightful chart from Strategas, which highlights the striking difference in returns between re-election and open election years:

Source: Strategas

This isn’t to say that presidential election years are smooth rides. What year is? Election years, historically speaking, have bumpier starts to the year (as primary season picks up) and an even bumpier late summer and early fall (as markets price in outcomes).

Interestingly, the S&P 500 has frequently acted as a bellwether for presidential election results. This has been the case for Bush, Obama, Trump, and now Biden. This makes sense as the stock market is a barometer of future economic conditions, and the economy is arguably the most significant factor in whether a president is re-elected.

So, we implore investors to expect some bumps but stay the course. We are prepared to be surprised frequently by politics in 2024. That we are sure of. But that is no reason to abandon long-term goals; perhaps simply adjust as needed.

Allocation Update

As we embark on 2024, we are reminded of Shakespeare’s quote from The Tempest: “What’s past is prologue.”

A furious and much-needed rally to close 2023 has left investors feeling more optimistic towards equities. Recent strong economic and earnings growth, along with favorable fiscal conditions and balanced inflation and job market figures, are boosting investor confidence. We share some of this optimism, but as risk managers have no interest in getting too far ahead of ourselves. Rather than having unwavering conviction in higher markets, we believe in staying agile, ready to adapt as market conditions evolve.

As it stands today, our focus is on money market funds. With interest rates on a downward trajectory, the appeal of cash and treasury bonds is waning. As we've discussed before, our attention is turning towards longer-term fixed income opportunities, aiming to secure favorable rates while available. In line with this approach, we anticipate a strategic shift from cash holdings to a more active commitment in bond markets, seeking out opportunities that align with our clients' goals and market trends.

Here’s a snapshot of our current outlook, in line with our tradition:

· Equities – Balanced Approach:

U.S. Stocks Preferred: Our inclination continues towards U.S. equities over international markets.

Emerging Markets: We maintain a selective approach, with an increasing focus on Indian markets.

Sectoral Watch: Special attention is being given to the Artificial Intelligence sector, particularly in Technology and HealthTech, due to their innovation potential and growth opportunities.

· Fixed Income – Slightly Underweight (with increased focus):

Long-Term Bonds: We are actively seeking longer-term bonds to lock in the higher yields currently available.

Floating Rate Bonds and CLOs: Our outlook remains positive for these options, offering attractive yields and returns, particularly when compared to Treasury Bills.

Opportunistic Strategy: With lower returns from cash, we are exploring more strategic opportunities within fixed income.

· Alternatives – Slightly Underweight

Private Markets: These offer additional diversification benefits during uncertain market conditions.

Gold Performance: Gold rose nearly 13% in 2023 amidst global uncertainties.

· Cash – Overweight (with plans to adjust):

Current Trends: The appeal of money market funds and Treasury Bills has diminished with falling rates.

Strategic Use of Cash: Our strategy involves using this excess cash to seize market opportunities in fixed income.

We hope that you all had a wonderful holiday season and new year. From a market perspective, 2023 was a fantastic year. Even better, however, were the client meetings, work trips, and new relationships made. After a year of lock down and abbreviated travel, I will not take it for granted!

As we turn the page to a new year, our Highland Peak Wealth family is so thankful for all your support and appreciation. Cheers to a fantastic ’24.

And for yours truly, as is a holiday tradition, I still have 78,689 Lego pieces to put together – forever a recession-proof industry. Lego ninja has morphed into Lego castles, knights, and catapults. It's a Lego world, and I'm just living in it. Send good vibes my way!

As always, thank you for your support and readership.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Supervisory office: 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. This material does not constitute a recommendation to engage in or refrain from a particular course of action. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202701-5650730

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information