July & August 2022 - First-Half Scratches

Kyle M. McBurney, CFP®

Managing Partner at Highland Peak Wealth

As we close the first half of ‘22, I can’t help but recall a scene from the movie comedy Monty Python and the Holy Grail.

While on his quest to find the Holy Grail, King Arthur encounters the Black Knight, a defiant and clumsy fellow who is impeding access to an important road. A duel ensues. As they fight, the more skillful King Arthur with his powerful sword chops off the Black Knight’s left arm, then the right arm, while the Black Knight famously mutters, ‘tis but a scratch. The Black Knight, seemingly undeterred, begins kicking with all his might, albeit rather hilariously. The battle continues, and King Arthur soon chops away all appendages, leaving the Black Knight with no arms and no legs, laying feebly on the ground. “All right,’ proclaims the Black Knight, “we’ll call it a draw.”

For investors, 2022 has felt like a battle against King Arthur. A January sell-off around fears of higher rates - ‘tis but a scratch. Putin invades Ukraine - I’ve had worse. Multi-decade high inflation – It’s just a flesh wound. Add it all up, and investors have been battered and bruised through the first half of ’22. Investors have had few places to hide with stocks and bonds declining together. So, what are investors supposed to think? For guidance, one famous study comes to mind.

According to a 2014 Business Insider article, Fidelity conducted an internal assessment of account performance between 2003 and 2013. Given its immense universe of portfolios, it was uniquely positioned to analyze trading habits and trends. In addition, this was an especially interesting period, as it covered a post-9/11 recovery, the ’08 crash, and the subsequent recovery – a fully market cycle. So, what did Fidelity find?

1) The best performing portfolios were balanced and well-diversified, and remained invested

2) The “worst” award went to those accounts who had the highest activity of getting in and out

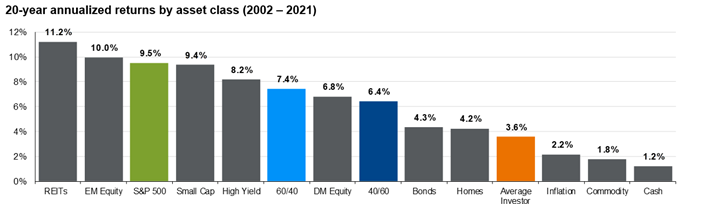

The second bullet point should come as no surprise. Study after study confirms that excessive trading activity, and the act of trying to get in and out of the market, is the absolute killer of returns. Those who sell based on emotion, or persuaded by doom and gloom, rarely match index returns. The chart from JP Morgan below speaks to this discrepancy.

Source: Bloomberg, Fact Set, Standard and Poor’s, J.P. Morgan Asset Management

OK, back to that famous Fidelity study. During a final review of their findings, one very interesting and darkly humorous category of accounts did very well – the accounts of dead people.

Yes, dead people.

More specifically, the category included those accounts of deceased individuals who had their estates in limbo and stuck with the courts for years and years. This category, as you might surmise, tends to include the accounts of very wealthy dead people with very complex estates. As such, these portfolios are typically professionally managed and well-diversified. Under the law of most states, no trading is allowed when such portfolio/estates are in litigation with the courts. Thus, these unique accounts are the ultimate, non-negotiable poster child for a buy-and-hold strategy. This steady approach led to exceptional returns, outperforming the average investor.

So, while dead people are poor conversationalists, as investors, they ain’t bad!

This study, along with so many others, continue to pound the theme – stay the course. Fear and uncertainty are everywhere, making it easy for investors to get sucked into the doom and gloom. After all, survey after survey reflects historic levels of negativity. This ultra-pessimism, as we all know, can lead to emotion-driven investment decisions, which almost always diminishes long-term returns.

As Daken Vanderburg, Head of Investments at MML Investor Services, so perfectly reminded us in his most recent newsletter, when it comes to market declines – first and foremost, breathe. Equity markets over the last 100 years have averaged a positive return of roughly 10%. Along the way, markets have been riddled with war, pandemics, recessions, and all-out market panics. Market volatility is simply the price of admission for exceptional long-term returns.

Of course, we at Highland Peak Wealth have been busy, especially around portfolio rebalancing and tax-loss harvesting - as the adage goes, never waste a good downturn. The below list was published back in February but is still as relevant as ever:

No one knows where markets will go next. However, at these market levels, we see a growing risk of exiting the equity market and missing potential upside. As history tells us, when markets recover, they recover very quickly. We continue to position portfolios more defensively (quality, dividend-paying focus) through the summer months. Still, we want to ensure that client portfolios remain balanced and ready to capitalize on any potential snapback.

When Will Things Reverse?

Or rather, the classic back-seat summer road trip question, “are we there yet?”

When it comes to calling a market bottom in a declining market, it is never easy. As anyone who has been in the industry long enough can attest, you never really know. Yes, there are historical similarities that we can point to, but every market cycle is unique, with a new set of challenges and variables. As Christopher Verrone at Strategas put it, the best one can do is hope to compile enough circumstantial evidence and make a judgment call – and then be ready to change if the market disagrees.

Some of the market/trading patterns we focus on when looking for a market bottom, to name a few, include:

o A spike in options training, specifically put/call ratio, which reflects excessive fear (not close)

o A VIX Spike (still at historically normal levels)

o The 10-day average of NYSE advancers – looking for momentum

o Leadership within “risk on” sectors

o Price performance of Consumer Discretionary vs. Consumer Staples (Staples still winning)

Frankly, we at Highland Peak don’t think we are there yet. After examining the data week in and week out, it is difficult for us to confidently claim that we have reached a buyable market bottom. Of course, we would love to be wrong and would welcome a sharp rally; we just don’t see it. The traditional “green light” indicators are simply not there yet (although improving). As such, we expect volatility to hang around a while longer.

So, does this mean we are selling? The quick answer is no. [Have you already forgotten the wisdom of dead people?]

While every client has unique short-term and long-term cash needs, in the aggregate, we remain invested, albeit with slightly elevated cash levels (taken from our fixed income allocation). For those specific clients with excess cash, we continue to dollar cost average into the market. Within stocks, we continue to tilt equity exposure further into value and dividend-paying stocks – what I routinely call the boring companies. This tilt allows us to maintain our equity exposure while providing a little more income and stability in case volatility remains and another leg down looms ahead.

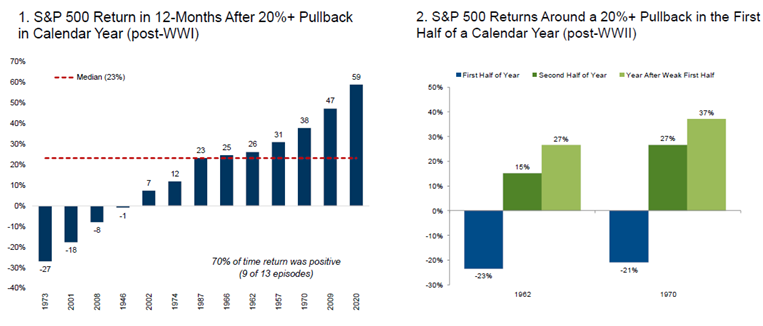

A look at 1970 is a powerful reminder of why we, as investors, want to remain invested. The start of ’70 closely resembles that of ’22. Even more, 1970 was a year that included high inflation, the Vietnam War, painful prices at the pump, and political instability – from the end of Bretton Woods to the Iranian Revolution. Yes, 2022 is unique is so many ways, but as far as historical parallels go, 1970 is a good one.

Source: Strategas

If nothing else, historical comparisons like this remind us how quickly things can change. 1970 was a year of similar market pessimism and falling investor sentiment to what we have seen thus far in ‘22. After bottoming in the early summer of ‘71, stocks ripped higher, recouping the entirety of the first half loss of 21%. In short, when market sentiment changes, for better or for worse, markets can move very quickly.

This quick recovery and a similar pattern in 1962 (see below) highlight the risk of exiting stocks after indexes have already suffered a bear market decline. While further downside is certainly possible, the upside risk, or rather the risk of missing a 1970ish rally, is arguably more of a concern.

Chart of the Month – A Friendly Reminder of Returns Post 20% Declines (23% median gain 12 months later)

Source: Goldman Sachs Consumer and Wealth Management

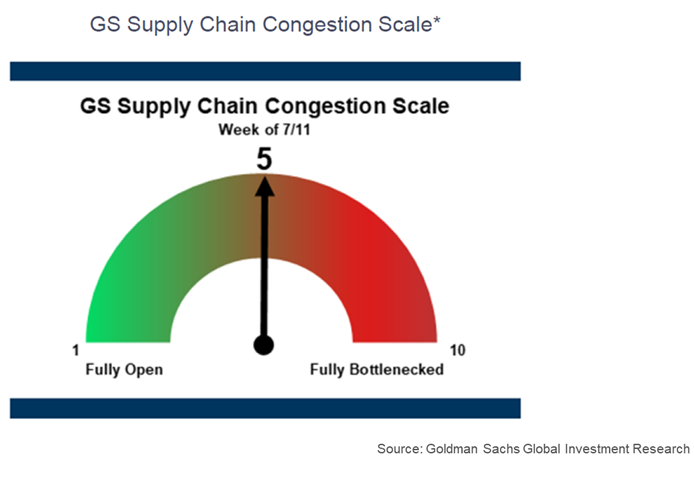

Scale of the Month – Easing Supply Chains?

This scale from Goldman Sachs is very interesting and something we have been keeping an eye on all year. While currently at a five, this scale was a 10 in January. The positive direction is good news, especially if supply chains continue to ease. This improvement can dramatically decrease inflation, and bail out a currently nervous Fed.

Allocation Update

Behind the scenes, we have remained as busy as ever. Our team has already executed more portfolio rebalances thus far in ‘22 than all of '21 combined, reflecting this year's tremendous market volatility. These rebalances typically achieve two powerful goals – 1) Keeping portfolios balanced through volatility and 2) tax-loss harvesting. This second goal is important, as we are hyper-focused on the tax side of the equation. We aim to do everything in our power to reduce your tax bill and harvest losses that clients can use, if not this year, then for years and years to come.

Around the edges, we continue to tactically fortify portfolios -

Equities – Neutral

o Continue to tilt portfolios more into value and dividend-paying stocks (and out of tech/growth)

o Leaning into Healthcare and Defense & Aerospace sectors – strong outperformance

Fixed Income – Underweight (but increasing)

o With more attractive yields, beginning to increase exposure to high-quality bonds

o We still prefer to keep our duration short, but long-term bonds are becoming more interesting

Alternatives – Overweight (but decreasing)

o Slightly reducing exposure to commodities – preparing for “peak inflation”

o Alternatives/Commodities have performed exceptionally well in ’22, but the story can change quick

Cash – Overweight

o Maintaining above average cash position for expected volatility through summer/midterms

o It may look to be opportunistic if we see more “bottom” indicators

As proudly introduced in our previous newsletter, the McBurney family is happily adjusting to the more chaotically eventful life as a family of four. Cooper, also referred to as Mini Coop or Buzz, continues to pack on excellent weight and sleep as much as his thankful parents can ask. Heather is doing very well and enjoying her Yoga and Barre classes, slowly getting back into the routine. Teddy has fully embraced his big brother role and happily wakes up Cooper to play (of course, we are thrilled at this development). Unfortunately, Teddy’s eagerness typically ends with Cooper in precarious positions, at times finding himself helplessly in an unwanted pillow fight. No wonder second-born children are so tough!

After a couple of weeks of Paternity leave, yours truly is fully back, and happy to chat anytime. As this newsletter hopefully indicates, habits/interest kept me in tune with markets and trading - my iPhone photos remain 100% either market charts or baby pictures. I did, however, have a minor accident. Sleep deprived, I comically tripped over an infant bathtub and bouncing milk bottles directly into a sharp corner of a cabinet. Although the accident left me with a small scar, I shall survive; ’tis just a scratch.

As always, thank you for your support and readership. We hope that you have a wonderful summer!

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202507-2727803.