MassMutual Market Update: July 18, 2022

By: Daken J. Vanderburg, CFA

Head of Investments, Wealth Management

MML Investor Services

During the imperialist rule of India, the British government became frustrated with the number of cobras in Delhi. Why, they said, should a progressive city run by the most powerful nation (at the time) in the world be overrun by snakes? As any great society does, they quickly set their best minds on the problem.

Their best (and as the story goes, most ambitious) minds soon returned with a solution. Aha, they posited, we know what to do. Incentives drive behavior, and therefore, we will pay a bounty for every dead cobra that is placed at our feet!

Soon, Indian citizens began showing up with, at first, a couple of dead snakes, then, a dozen dead snakes. I can so clearly imagine one British solider slapping another on the shoulder as he drank his gin and tonic exclaiming “Jolly O’, you old chap! You’ve finally done it!”

As the months went on, however, what resulted is where the real lesson begins. Soon, not dozens, but hundreds and hundreds of dead snakes began showing up. The British soldiers could not believe the quantity! Where, they wondered, did all these snakes come from? The sheer quantity was far more than originally estimated in all of Delhi, and yet the delivery of dead snakes to their door was increasing daily!

What they soon realized was the true power of incentives. Several enterprising Indians had realized it was quite dangerous and dirty work to run around the city trying to capture snakes, when it made far more sense to simply produce them en masse. As such, those same clever fellows established cobra farms just outside of Delhi. They could produce hundreds, if not thousands, of cobras, kill them, and deliver them to the British soldiers with very little effort, and certainly, far less hassle.

The British government responded predictably: they shut down the program and refused to pay any future bounties. While disappointed, the Indian farmers closed their farms and subsequently released all their snakes. And, as our dear readers might surmise, this naturally increased the snake population to levels higher than when the program began!

I was reminded of this story recently when the latest inflation report was released. As you might have heard, inflation was announced just higher than expected and a bit higher than the previous month.

What follows is a relatively straightforward attempt to clarify why we, thus far, remain optimistic about getting inflation under control. Interestingly, we think this perspective may also explain why the bond market hardly moved with this latest inflation announcement.

With that, let us begin.

Section 1: Money Matters

As we’ve discussed in previous updates, we never felt inflation was transitory because money supply was increasing too quickly for inflation to be transitory. As the cobra story illustrates, it has always been about incentives. Let me try and explain.

Over the past 40 years, the U.S. Federal Reserve has incentivized borrowing and spending by decreasing both the costs of borrowing and the benefits of savings. If I can borrow at 2%, I am more likely to borrow than when I can borrow at 8%. Further, if I can invest in a savings account and earn 2%, I am less likely to save than when I can earn 8%. (Note: All those decisions should be relative to inflation, but the point remains.)

Accordingly, when COVID-19 hit, the Federal Reserve flooded the market with liquidity and the U.S. Government flooded the market with stimulus (literal checks sent to mailboxes).

Those two decisions, again, at the margin, incentivized spending.

At the same time, we had two other powerful forces:

1) Spending habits changed. During COVID-19 lockdowns, consumers did their own cooking and focused on their homes. They eschewed restaurants, traveling, and purchasing of many sorts. As COVID-19 impacted our lives less toward the beginning of 2022, those spending habits reversed and suddenly the pent-up demand was released.

2) Supply chains were disrupted. Similarly, over the past two-and-a-half years, supply chains around the world have been disrupted. Manufacturers were closed due to Omicron breakouts, ports were closed due to restrictions, and it became very hard to get raw materials.

As such, in aggregate, we now have a massive increase in demand, a contraction in supply, and because of the remarkable monetary and fiscal stimulus, a decrease in the value of our dollars.

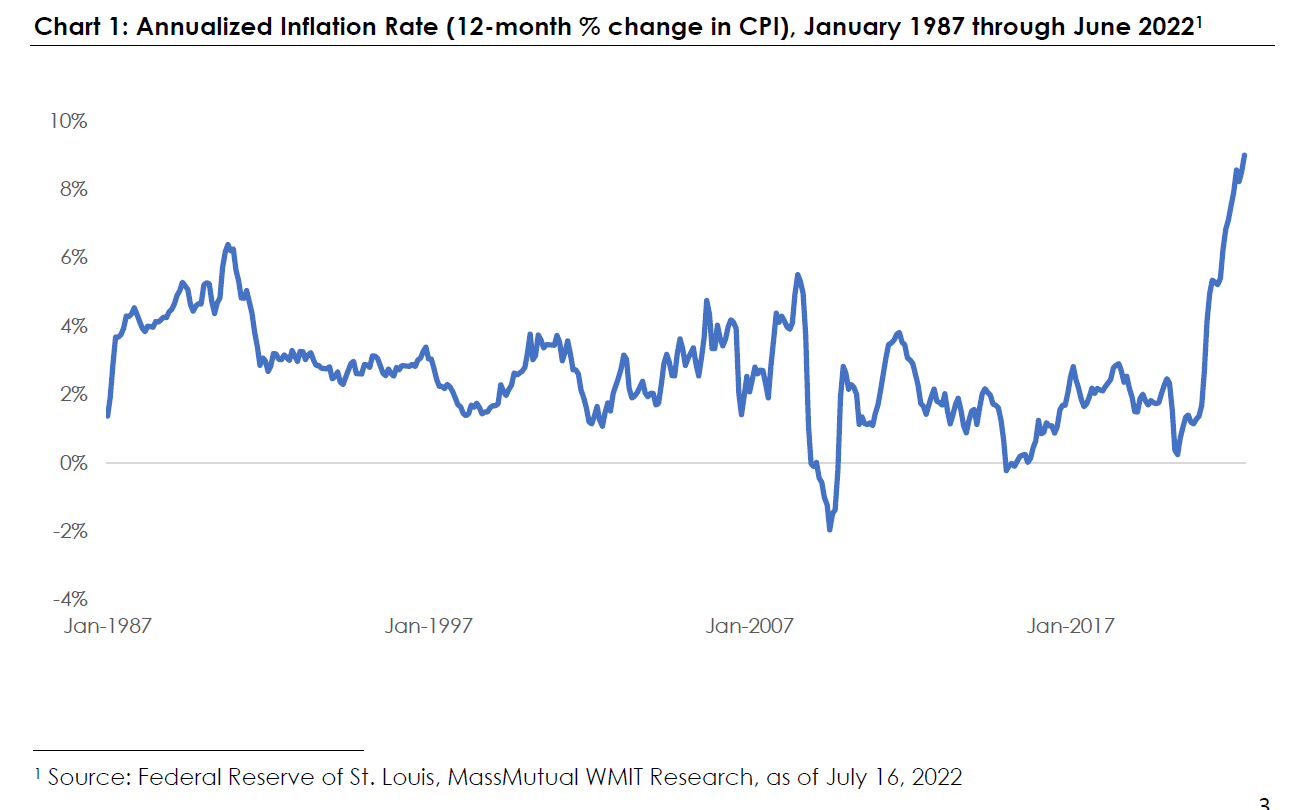

All of this resulted in the activity illustrated in Chart 1.

Over the past 40 years, inflation has bounced between -2% (during the financial crisis) and 6%. As of the end of June of 2022, it has now crossed 9%.

So, what to do? If you watch the financial news, the amount of red would surely have us panic. First, let us breathe. We have lived through periods far worse than this, and we will survive this as well.

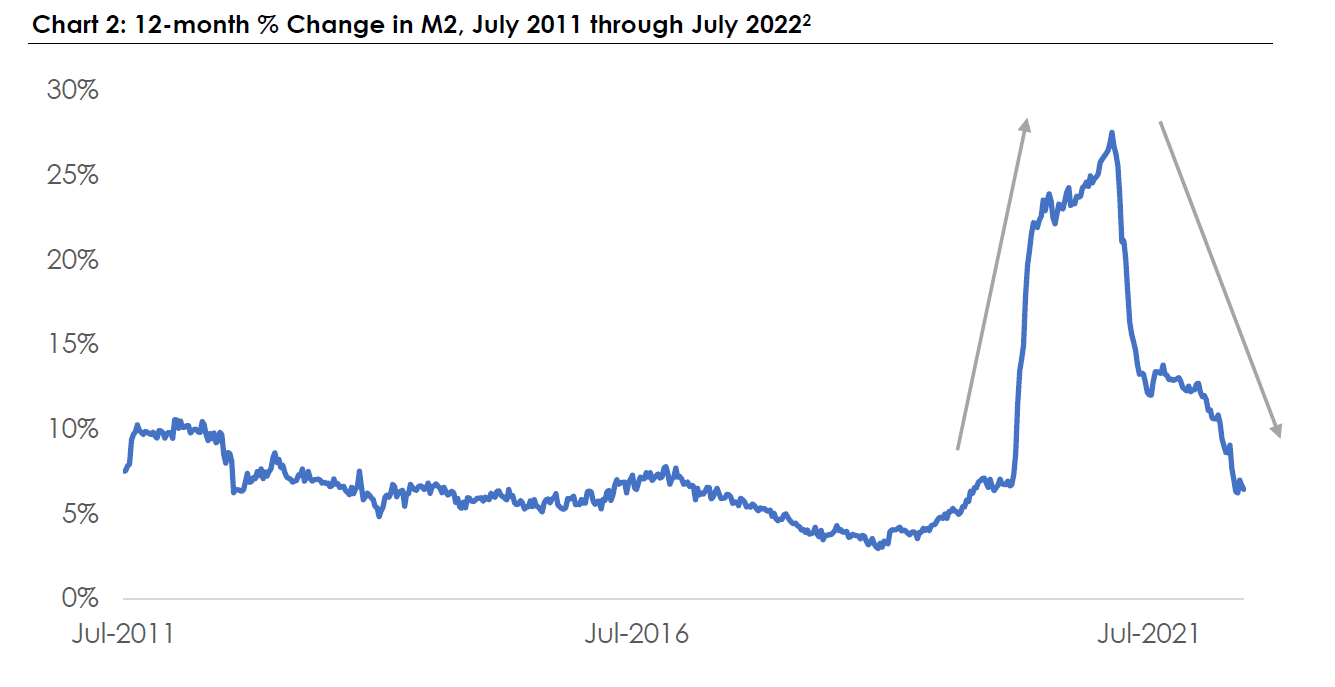

Second, focus on the money and on incentives. This brings us to Chart 2 and the item I focus on most intently right now.

Source: Federal Reserve of St. Louis, MassMutual WMIT Research, as of July 16, 2022

First, some context.

In the United States, there are various measures of money. There is the amount of currency printed, there is the amount of money in bank accounts, there is the amount of money created through credit cards, and on and on.

The definition I prefer is basic cash (currency + coins), plus savings deposits and retail money market funds. It’s far from perfect but it’s a good indication of how “flush with cash” consumers feel. If they have more cash, they will likely spend more, and if they have less cash, they will likely spend less. We call this definition M2, and that data is represented in Chart 2.

Referring to the chart, you will notice three periods. Period one: From 2011 through early 2020, cash growth stayed under 10%. Period two: starting in March 2020, cash growth exploded, and in period three, cash growth has suddenly contracted.

Over the last two years, we’ve been watching this measure and becoming worried about inflation, while most of the world ignored inflation. We’re now watching this measure while the world is worried about inflation, and we’re becoming less worried about inflation.

It’s all about incentives. If U.S. consumers are incentivized to spend (as the Federal Reserve has done by printing currency and buying bonds), then they will spend more and inflation will likely rise.

But now, the U.S. Federal Reserve has realized the perfect storm of increased demand, decreased supply, and the massive increase in money has pushed inflation to an untenable level…and it is absolutely doing the right thing.

The Federal Reserve is withdrawing liquidity and doing so rapidly. Hence, money growth is slowing. We are seeing that impact demand for housing and cars in particular, and will likely see it impact demand elsewhere soon.

Ladies and gentlemen, we are going to get through this. Inflation is painfully high, and while we are not through the storm, we are getting there. If the Federal Reserve sticks to its mandate and focuses on the real economy (not the markets), then inflation will begin to moderate. It has done so in 2022, and we are optimistic it will continue to do so. Yet, this requires a re-setting, and the markets have taken a bit to understand the new regime.

In closing, let’s recap:

1) Inflation has risen rapidly because of pent-up demand, supply disruptions, and a massive infusion of liquidity and dollars that incentivized consumers to spend.

2) The Federal Reserve has now realized inflation was not transitory and is acting appropriately to withdraw liquidity. This always is a bit painful, but we believe it is (finally) on the right track.

As such, items to consider:

1) Focus on long-term decision-making. Try not to react emotionally to market selloffs (as hard as that often is). Just as consumers are driven by incentives, so are companies. They use our capital to capture market share and generate income to return to us as shareholders. Those incentives have not changed, and it is those incentives that produce value over the long term.

2) Watch the money. If the Federal Reserve loses sight of its mandate, we will likely become more concerned. While we don’t think that is likely, should that occur:

a. Consider shortening duration of portfolios.

b. Consider assets that provide better inflation protection (inflation-linked bonds, real assets, equities, etc.).

3) Refer to your long-term plan, and if you don’t have one in place, this is a great opportunity to create one.

Lastly, in closing, please remember we continue to watch closely, and we are here to serve you. Take a moment to breathe…we will get through this difficult time.

We remain at your service.

Daken J. Vanderburg, CFA

Head of Investments, Wealth Management

MML Investors Services

Asset allocation and diversification does not guarantee a profit or protect against loss in declining markets. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio or that diversification among asset classes will reduce risk. Investing involves risk, including the possible loss of principal. There are no guarantees an investment’s stated objective will be achieved.

This material does not constitute a recommendation to engage in or refrain from a particular course of action. The information within has not been tailored for any individual. The opinions expressed herein are those of Daken J. Vanderburg, CFA as of the date of writing and are subject to change. MassMutual Trust Company, FSB (MassMutual Trust) and MML Investors Services provide this article for informational purposes, and do not make any representations as to the accuracy or effectiveness of its contents. Mr. Vanderburg is an employee of MassMutual Trust and MML Investors Services, and any comments, opinions or facts listed are those of Mr. Vanderburg. MassMutual Trust and MML Investors Services, LLC (MMLIS) are subsidiaries of Massachusetts Mutual Life Insurance Company (MassMutual).

This commentary is brought to you courtesy of MassMutual Trust and MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. An index is unmanaged and one cannot invest directly in an index. Material discussed is meant for informational purposes only and it is not to be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed or independently verified Please note that individual situations can vary, therefore, the information should be relied upon when coordinated with individual professional advice. Clients must rely upon his or her own financial professional before making decisions with respect to these matters. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied.

Securities, investment advisory, and wealth management solutions offered by MML Investors Services, LLC member SIPC, a registered broker-dealer, and a registered investment adviser.

©2022 Massachusetts Mutual Life Insurance Company, Springfield, MA 01111-0001 All Rights Reserved. www.massmutual.com MM202507-302242