July/August 2023 – Reflecting on 2023’s Unexpected Bullishness

By: Kyle M. McBurney CFP

Managing Partner at Highland Peak Wealth

In life, we've all encountered that sinking feeling of uncertainty - whether it's watching our favorite sports team confront a formidable opponent, witnessing a friend's ill-advised toast, or observing our adventurous toddler daringly join the big kids on the playground. We've all thought –

There is no way this ends well.

As we entered 2023, investors were enveloped in a cloud of doubt, with little optimism for the year ahead. Pessimism extended beyond market outlooks, as inflation dominated headlines and economists foretold impending doom and gloom. The fear of inflation, a looming recession, and potential rate hikes by the Federal Reserve left bullishness a lonely stance on Wall Street.

In short, very few believed that '23 would bode well for the markets.

To the surprise of many, market bulls lead at the halfway mark and by a wide margin. US stocks are up 20% and continue to regain a meaningful chunk of '22's brutal decline. Even better, Since the market low in mid-October, per FactSet data, the Dow Jones is up over 20%, the S&P 500 nearly 30%, and the Nasdaq 100 up over 40%.

As markets so often do, they have defied expectations and wrong-footed even the most seasoned market bears once again. Inflation declined sooner than expected, and the economy showed resilience despite numerous concerns. Employment numbers remained strong, housing prices absorbed the impact of higher mortgage rates, and the economy continued to grow.

2023's significant gain has reminded us that optimism usually pays off when it comes to investing. After all, general wisdom holds that markets spend more time advancing than they do retreating. It recalls an old Abraham Lincoln quote – I am an optimist because I don't see the point in being anything else.

Yet, many investors remain cautious, unwilling to sound the all-clear signal. Despite the positive first half, Wall Street strategists just issued their most bearish second-half outlook on record. They point to unsettling economic signals, expensive stock valuations, and the lingering possibility of the Federal Reserve persisting with its high-interest rates.

At Highland Peak Wealth, we acknowledge the enigmatic nature of the current market. This year's impressive gains have unfolded amidst mixed economic signals. The data portrays a classic slowdown, but technical buy signals are emerging, supported by robust price momentum and signs of improved market breadth – through July, a high percentage of the S&P 500 currently trades above their 50-day moving average.

This newsletter, hopefully reaching you in the throes of a fantastic summer, will spotlight the positives and concerns we see in the markets, shaping the outlook for the second half of 2023. As we applaud and celebrate this year's rally, our steadfast focus is on the future. The combination of lagging economic indicators and elevated stock market valuations reinforces our belief in a balanced, well-diversified portfolio with a cautious tilt, the wisest play in town.

Our team eagerly looks forward to engaging in discussions, debates, and writing about what promises to be an exciting second half of the year.

Source: Morningstar Direct

Past Performance is No Guarantee of Future Results

Balancing the Pros and Cons of the Market

Heading into the back half of 2023, we cheer on the market rally but are hyper-aware of the uncertainties ahead. The big question we have been obsessed with for the past two years - whether the US economy can stave off a recession – remains unanswered.

So far, the economy has proved resilient. Last week's 2nd quarter GDP rose at a 2.4% annual rate, exceeding the 2% expectation. Look deeper into the report; you will see signs of a healthy consumer and investment. Throw in a strong labor market, improving manufacturing, and robust spending in the Artificial Intelligence sector, and this just doesn't look like an economy on the cusp of economic decline.

Of course, these are all lagging indicators (backward looking). Our job is to pay attention to the numbers but stay focused on what lies ahead. Repeat after me – the stock market leads the economy, not the other way around.

Bond markets are predicting a slowdown, while stocks are readying for a decent economy. Both can't be right. Thus lies the puzzling nature of our current market. Exciting but perplexing. Depending on which research firm you ask, we are either on the cusp of a new bull market or on the precipice of a severe pullback. Of course, the truth likely lies somewhere in the middle.

As we look at markets today, we see a plethora of both good and bad – let's break down both.

Three Positives for Stocks

1) Market Momentum

According to data organized by Ryan Detrick at Carson Investment Research, the stock market’s strong first half is a good omen. Going back to 1945, a positive gain in the first half of the year has led to second-half gains 72% of the time. It gets even better. When the S&P 500 is up more than 10% as of the end of June this year, the final six months are up a median of 10%.

Pleas see Ryan Detrick’s chart below (apologies for the small print):

The bottom line, a solid first half should be viewed favorably. To remind you all of Sir Isaac Newton’s first law of motion, an object in motion will tend to stay in motion.

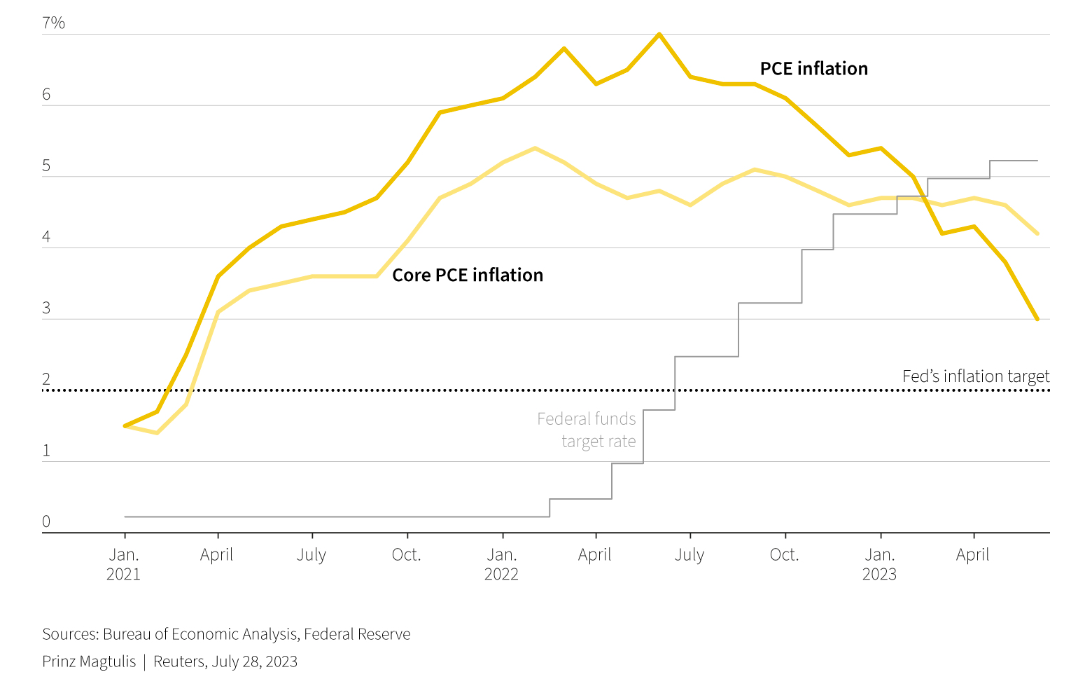

2) Inflation Continues to Cool

The good news keeps coming regarding the fight against inflation. We are not there yet, but inflation numbers reaffirm their downward trajectory towards more palatable levels as supply chains loosen and commodity prices return to earth.

Personal Consumption Expenditures (PCE) came out last week at 4.1% over the prior year, the lowest reading since September 2021. This data followed CPI numbers released earlier in July, showing core inflation at 4.8% - a slight decrease from the previous month.

The Federal Reserve raised its policy rate by 0.25% despite the lower inflation. This, however, was expected by markets. Fed Chair Jerome Powell and the central bank are committed to maintaining price stability. They are keenly aware of the dangers of a "stop and go" rate hike scenario, reminiscent of the turbulent 70s, and are determined to avoid it.

The fight against inflation is far from over, but the signs are encouraging. Lower inflation brings more stable economic growth, better stock valuations, and a healthier consumer – all good things for stock prices.

3) Market Breadth Improving

A healthy and sustainable market rally is characterized by solid market breadth – when a significant number of stocks rise together, indicating broad market participation.

In early '23, market breadth was missing from the rally. As explained by our previous newsletter, we witnessed the dominance of "The Magnificent Seven," a term coined for the seven largest tech companies driving much of the market gains from 2023 until June. However, relying solely on a small basket of stocks for returns is not ideal, as it leaves the market vulnerable if the sector slows down.

Fortunately, the market landscape has evolved, and now we are seeing a broader rally. Many companies are contributing to the market upswing, with over 140 stocks in the index hitting fresh 52-week highs since our last newsletter in June. Notably, all 11 sectors of the S&P 500 have experienced growth during this period, propelling the index up more than 19% for the year. Additionally, small-cap stocks are also on the rise, enhancing market breadth.

Three Negatives for Stocks

As investors, it's imperative to maintain a balanced perspective and not be solely swayed by the euphoria of a bullish market. Instead, our efforts should be focused on identifying potential hidden risks and maintaining vigilance as markets rise. While it's tempting to become more bullish as the market surges, we should focus on scrutinizing what we might be overlooking.

On that note, let us address some of the concerns we see in the current landscape.

First on our list is the presence of an inverted yield curve within fixed-income markets.

1) Inverted Yield Curve

The yield curve serves as a vital indicator of economic health and vulnerability. In regular markets, investors are rewarded with higher returns for holding assets over extended periods. However, when the yield curve inverts, with shorter-term bonds offering higher yields, it signals an expectation of imminent short-term rate cuts by the Federal Reserve as a defense against recession and economic decline. At the very least, it suggests that something is amiss.

The significance of an inverted yield curve lies in its historical association with recessions. Since 1987, the yield curve has inverted six times, and on each occasion, a recession has followed. Moreover, yield curve inversions typically correlate with rising unemployment rates, which inevitably create challenges for equities.

Nevertheless, it's crucial to understand that the inverted yield curve isn't a crystal ball—it does not specify the onset, severity, or duration of a forthcoming recession.

Yet, examining the magnitude of the inversion can provide additional insights. The yield curve is currently sharply inverted, with rates unseen since 1981. To provide perspective, the 1-year Treasury note presently yields 5.4%, while the 10-year Treasury note yields a lower 3.97%. The below charts illustrate the bond markets deep inversion –

Peak inversion typically emerges within a three-to-nine-month period before a recession takes hold. Given the depth of the current inversion, this historical pattern has our attention. It will be interesting to see if history repeats itself.

Of course, using the inverted yield curve for predictive purposes is imperfect, but there is enough track record here to merit our attention.

2) Lackluster Leading Indicators

As a reminder to readers, there are three types of market indicators – lagging, coincident, and leading.

A leading indicator, as the name implies, is a tool or metric designed to anticipate the future direction of a market. Elements such as manufacturing orders, building permits, and credit lending—activities that generally occur at the beginning of the supply chain—comprise these indicators. Because the stock market is a forward-looking mechanism, leading indicators are important.

Recently, leading indicators have not been painting a pretty picture.

On July 20, the Conference Board reported that its Leading Indicator Index (LEI) fell 0.7% in June. No big deal, right? July’s reading marked the 15th straight month of declines, the longest losing streak since the oh-so-fun Great Recession of 2008.

The individual constituents of the LEI further compound our concerns. For instance, the ISM manufacturing surveys suggest manufacturing is contracting at a rate typically indicative of a recession. In fact, only thrice since World War II has the manufacturing industry faced such severe conditions without precipitating a recession.

Despite 15 months of lackluster LEI readings, the U.S. economy and stock market have exhibited remarkable resilience. Still, as this index indicates, the coast is far from clear.

3) Elevated Market Valuations

These concerns come when the stock market boasts rich valuations relative to history. In the near term, market multiples might offer little predictive insight. Also, they should never be the sole criterion for holding or relinquishing stocks. Nonetheless, market valuations can be instrumental in estimating potential growth and upside ahead.

So far in ’23, multiple expansion has given stocks a significant boost. According to FactSet, S&P 500 started the year at 16.8 times its projected earnings over the next twelve months – attractive versus the 10-year average of 17.7. This year’s stock market rally, however, has been fueled almost entirely by multiple expansion, considering that corporate earnings have modestly declined.

As such, markets have gone from cheap to expensive in short order. Last week, the S&P 500 traded at 19.5 times its projected earnings.

With such a heavy premium against the 10- and 15-year average, these elevated valuations typically imply expanding economic growth and higher expected corporate profits. Currently, we see neither. Interestingly, we see the reverse.

The question arises—can investors persistently lean on multiple expansion to propel stocks upwards? Historical evidence indicates that multiples can remain extended for a prolonged duration. However, at some stage, the earnings growth needs to kick in.

Allocation Update

Confused yet?

To summon my inner Charlie Munger – if you’re not a little confused about what’s going on, you don’t understand it.

Market forecasting is hard. We all know this. The challenge we often face regarding markets and the economy is that there are often conflicting signals about what’s happening. Confusion, as a result, should be the default state. After all, even in the best of times, there are always signs of doom an investor could point to.

As I mentioned in our previous newsletter, I can’t recall a time when pundits and research firms were so polarized – a seemingly 50/50 split between those who believe a bull market is here and those who think that severe pain lies ahead.

Luckily, we don’t have to pick a side and cross our fingers. Like the sport of baseball, we can don’t have to swing at every pitch. In summary, we are sticking to our guns and maintaining a disciplined approach to portfolio positioning, waiting for our proverbial pitch. While this may sound boring, we continue to preach the gospel of diversification as we await further direction from the ever-elusive Mr. Market. Below is a summary of our positioning:

- Equities – Slightly Underweight

o The rally in stocks has increased overall exposure

o Stock allocations sit closer to neutral targets, which we are comfortable with

o Artificial intelligence, and those associated stocks, continue to have our attention (for now)

- Fixed Income – Slightly Underweight

o Continue to seek longer-term bonds to lock in higher yields while they are available

o Positive on High Yield amid low default risk and attractive yields

- Alternatives – Neutral

o Private markets can add extra diversification through uncertain market periods

o Gold exposure is likely to provide a cushion should the economy slow

- Cash – Overweight

o Money market funds and Treasury Bills continue to offer 4.75 – 5.25% yields

o Timing the market is hard, but cash offers dry powder in the event of a decline

Ah, summertime! A season of sunburns, exciting travels, and much-needed relaxation. In our home, it's also the official birthday season. If you remember Cooper's birthday tale from our last newsletter, now it's Teddy's turn.

Teddy wanted a slip-and-slide party with a birthday cake. As ever-obliging parents, we set it up. Here's the kicker: Teddy, our party planner, isn't really a fan of water... or cake! So, our birthday boy ended up being the happiest spectator at his own bash, watching everyone else enjoy the festivities he'd set in motion.

This could indicate some unique character traits budding in Teddy, but only time will tell. And the birthday loot? A mountain of Legos, of course! Because... well, what's a birthday without a midnight Lego landmine in the hallway? As a parent, there is nothing better.

As always, thank you for your support and readership. We hope that you have a wonderful summer!

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth. Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202608-4801760

Securities and investment advisory services offered through qualified registered representatives of MML Investors Services, LLC, Member SIPC. 280 Congress Street, Boston, MA 02210. (617)-439-4389. Highland Peak Wealth is not a subsidiary or affiliate of MML Investors Services, LLC or its affiliated companies.

Glossary of Index Definitions

Indexes are unmanaged, do not incur fees or expenses, do not reflect any deduction for taxes, and cannot be purchased

directly by investors.

The S&P 500® Index is a widely recognized, unmanaged index representative of common stocks of larger capitalized U.S. companies.

The S&P Muni Bond Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. Municipal bond market.

Dow Jones Industrial Average is a price-weighted average of 30 actively traded Blue Chip stocks, primarily industrials, but also including other service-oriented firms; may be used as a benchmark for large cap stocks

NASDAQ Composite is a broad-based index of over 3,000 companies, which measures all domestic, and non-U.S.-based common stocks listed on the NASDAQ Stock Market, Inc.

The NASDAQ 100 U.S. Index is a composed of the 100 largest, most actively traded U.S. companies listed on the Nasdaq stock exchange.

The Russell 2000® Index is a widely recognized, unmanaged index representative of common stocks of smaller capitalized U.S. companies.

The MSCI EAFE Index is a widely recognized, unmanaged index representative of equity securities in developed markets, excluding the U.S. and Canada.

The MSCI Emerging Markets (EM) Index is an unmanaged market capitalization-weighted index of equity securities of

companies domiciled in various countries. The Index is designed to represent the performance of emerging stock markets

throughout the world and excludes certain market segments unavailable to U.S.-based investors.

The MCSI All Country World Index (ACWI) captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets.

The Barclays U.S. Aggregate Bond Index is a broad measure of the U.S. investment-grade fixed-income securities market.

The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of fixed-rate investment-grade securities with at least one year to maturity, combining the Bloomberg U.S. Treasury Bond Index, the Bloomberg U.S. Government-Related Bond Index, the Bloomberg U.S. Corporate Bond Index, and the Bloomberg U.S. Securitized Bond Index.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its

content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information