June 2022 - Crossroads

By: Kyle M. McBurney CFP

Managing Partner at Highland Peak Wealth

The 2022 Oscars will go down in infamy. An otherwise blah night was made memorable when Will Smith…well, I think you know the rest. Anyway, Amy Schumer, tasked with following that bizarre incident, played it off perfectly:

Ugh, I’ve been getting out of that Spiderman costume. Did I miss anything?

The crowd erupted in laughter, breaking the tension of an otherwise anxious room. It’s a good watch on YouTube.

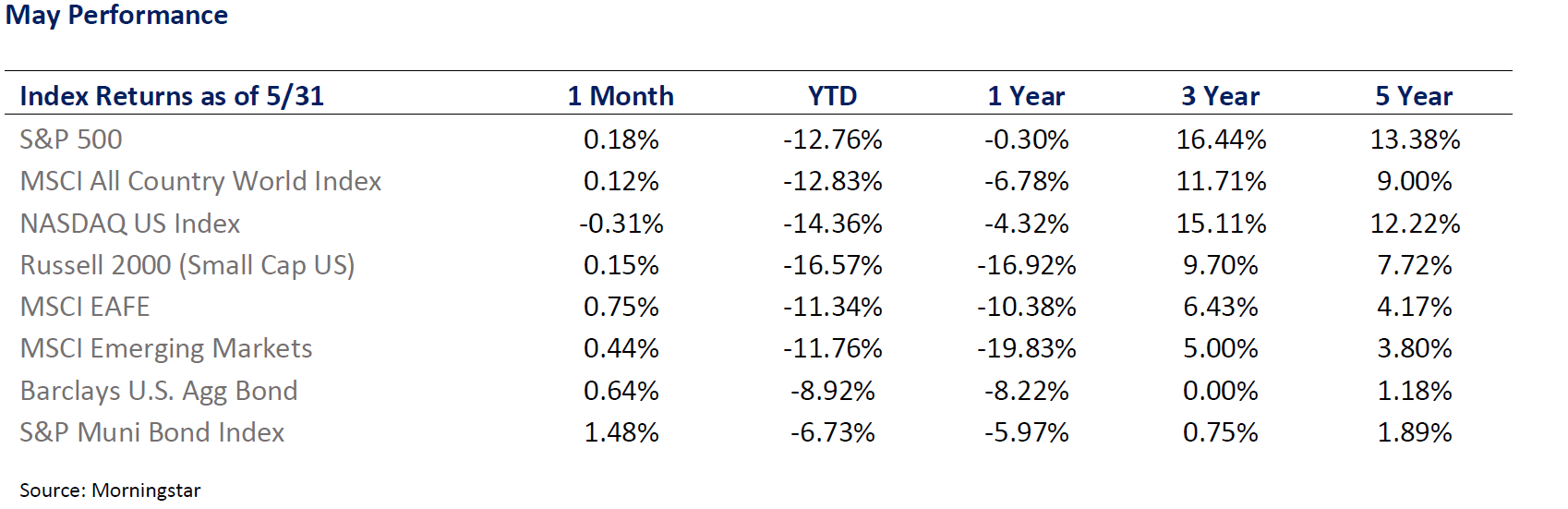

Looking at market returns for May, one might think did I miss anything?

Of course, the otherwise boring numbers don’t reflect reality. May was a volatile month for just about everything. Stocks fell hard to start the month as recession fears grew and the Federal Reserve communicated more rate hikes ahead. Things went from bad to worse when disappointing quarterly earnings from giants Walmart and Target renewed fears of runaway inflation and a potentially weakened consumer. This pushed stocks briefly into bear market territory (down 20%) before a strong rally recovered earlier losses. Bonds finally provided investors with much-needed relief, but only after rates fell following better-than-expected inflation readings – raising the important theme of “peak inflation” (more on that term below).

The question now is whether the most recent stock market rally has staying power. Inflation may be plateauing, with concerns now moving towards slowing economic growth and rising interest rates. Stock market valuation has come from “very high” to “historically average” in a short period. This is still a positive for stocks if earnings hold steady, but that’s quite a big “if.” Corporate profits were solid – growing 9.2% in Q1 – but results provided mixed outlooks for the future.

Put it all together, and the markets remain at a crossroads. So, expect May volatility to hang around a bit longer. What does it mean for client portfolios? In summary, it means a continuation of protective strategies. More on this later.

Peak Inflation

In the final trading days of May, stocks sharply rallied, climbing their way out of the bear-market territory. The S&P 500 rose 6.6%, and the tech-heavy Nasdaq gained 7.1%. This rally was fueled by solid earnings results in retail/housing and, more importantly, signs that we may be seeing a slowing pace of inflationary pressures.

The term “peak inflation” is an important one. Markets are obsessed over the following simple question: is inflation going down from here? In the same way that inflation can churn markets on the way up, it can be a boost to risk assets as it declines or plateaus.

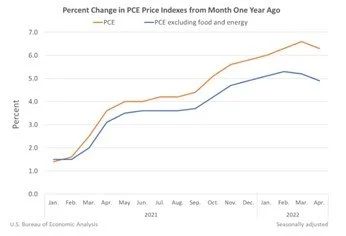

Last week’s Personal Consumption Expenditures (PCE), the Fed’s favorite inflation indicator, trended lower in April – down 6.3% vs. 6.6% in March. Of course, this is still a high number, but there is optimism that the direction is positive. See below:

The Consumer Price Index (CPI) told a similar story. Data for April ’22 illustrated an abrupt month-on-month slowing of price increases - further optimism that prices are stabilizing. Car prices, both new and used, for example, finally came down.

If the inflation scare is receding, the Fed will have some flexibility to dial back some of the more aggressive rate increases planned for ’22 and early ’23. If this is the case, expect stocks to pick up some steam and the consumer to breathe a little easier. This is likely what a “soft landing” would look like.

How do we know if we have reached peak inflation? Only from hindsight will we know for sure, but history can help.

Post-WWII Inflation and Peak Inflation

When evaluating our current environment, it would be easy to draw comparisons to the ’00 tech bubble or the hyper-inflation days of the ‘70s and ‘80s. While helpful, the uniqueness of the pandemic and the associated policy response make today’s market quite different.

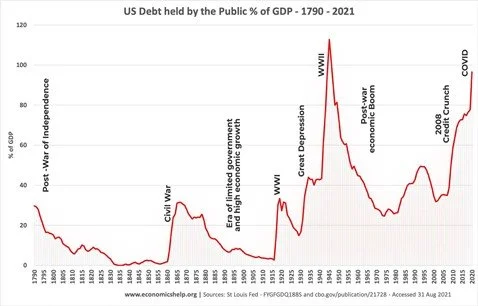

During client conversations over the past few months, I have typically mentioned how similar today’s markets resemble those that followed WWII. Like FDR’s response to WWII, government spending the past few years exploded to combat our microscopic enemy. This led to massive labor force disruption, screwed up supply chains, and lower consumer demand. The post-WWII economy also had meager bond yields, substantial employment, and a housing shortage – sound familiar? If you think about it, in many ways, COVID was a war, and wars are inflationary. World War II, World War I, and the US Civil War all ushered in comparable periods of seemingly overnight inflation and price pressure.

If you are not convinced, below is a quick peek at government spending as a % of GDP from 1790 through 2020. Again, the similarities between 1945 and 2021 are striking:

After World War II, as soldiers returned home, the economy experienced a tremendously sharp jump in inflation. Prices jumped higher due to supply shortages, pent-up demand, and the scrapping of wartime price controls (a WWII policy tool). Not surprisingly, inventories of goods were low, and the supply chain was in shambles. The economy had to absorb higher prices that surpassed even the levels measured in the ‘70s and ‘80s.

Luckily, this painful post-war period of exploding inflation didn’t last long. Almost as soon as it arrived, it waned.

The post-WWII inflationary episode came to an end as supply chains got back in order, consumer demand eased, and housing costs leveled off. It is important to note, however, that the economy did fall into a shallow recession, with the GDP declining by 1.5%. If post-WWII inflation can teach us anything, it’s that price pressure can come down fast as supply chains get back on-line and growth slows – providing us a potential blueprint of inflation’s present-day direction.

Post-WWII & The Stock Market

As you know, I always find historical parallels fascinating. Yes, no two market environments are ever perfectly alike, but there is usually a rhyme or two. Moreover, it is our nature as human beings to act somewhat consistently when faced with similar challenges and market cycles.

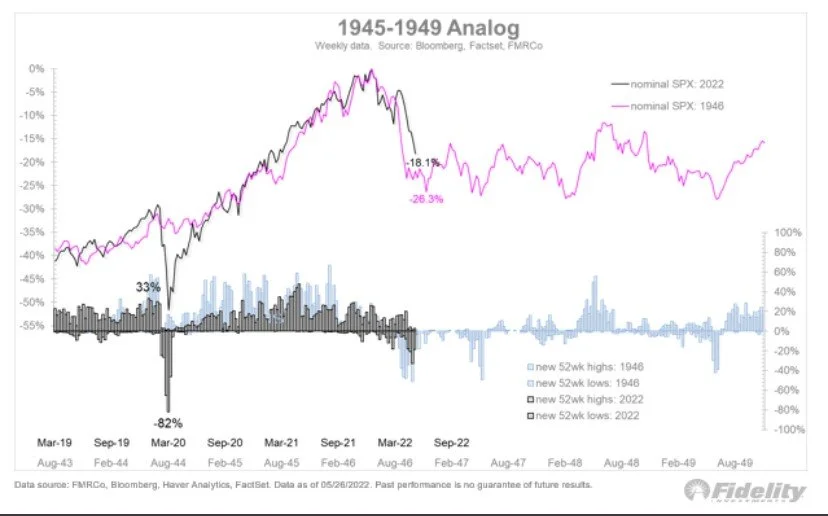

Like ’21, stocks exploded in 1945. Fueled by government spending and good feeling, US stocks jumped over 30% as a victory over the Axis powers became palpable. This rally continued into early ’46 but came to a screeching halt as prices exploded and inflationary pressures increased. Below is an overlay of the S&P 500 in 1946 (Pink) and today (Black) -

This is a very interesting chart. The way I see it, there is some good news, some not so good news, and some great news:

Good News – If we follow the trend, we have likely seen the bulk of the stock market decline in the short term.

Not So Good News – markets provided a whole heck of nothin’ in those years as the P/E Ratio fell from 22.4x to 5.6x.

This not-so-good news is especially noteworthy. So often, in the news or on TV, pundits declare either “doom and gloom” or “we’re due for a huge rally” type “all-or-nothing” outlooks. Very rarely do you hear the narrative that returns will be flat for a little bit of time. As the post-war stock market reminds us, this is a very realistic outcome in which to prepare. The current time is a more trying market environment in many ways as it tests patience and planning. However, there are investment tweaks to make should this occur – value and dividend stocks, for example, should continue to thrive. It may not be uplifting, but you, the long-term investor, can manage fine. Unlike Jack Nicholson in A Few Good Men – you can handle the truth!

Ben Carlson, in his blog, A Wealth of Common Sense, said it best: Recessions don’t always have to mean the world is coming to an end. Sometimes the U.S. economy just needs a pit stop. Every time inflation spikes, it doesn’t mean it has to be a repeat of the 1970s or the onset of hyperinflation. And every time the Fed tightens monetary policy, it doesn’t mean the economy will collapse. Sometimes interest rates need to rise from emergency levels to normalize the economy.

And now the great news. From 1945 to 1959, the U.S. stock market was up almost 900% (16% CAGR). It was a fantastic run as suburbs were built, big infrastructure projects took hold, and excess savings were put to work. Our future has the potential to mimic this period as demographics are on our side with Millennials (ages 25-40) entering prime spending years. Also noteworthy, this incredible run included a handful of market corrections, three pullbacks of 20%, and three periods of recessions (albeit mild ones). This is a reminder that economic contractions are simply part of the bargain. After all, as we are seeing today, recessions can help shake out excesses in the system (hello crypto).

Jamie Dimon & Allocation Update

JP Morgan Chase CEO Jamie Dimon made some noise recently when he told investors to prepare for a “hurricane at a financial conference in New York.” Quite a stern warning from one of Wall Street’s more seasoned and respected leaders. When Jamie Dimon speaks, people tend to listen.

I will say, however, that I think some of the headlines we are all seeing are a tad clickbaity. If you listen to his entire speech, he makes a very reasonable argument:

- He sees an economic hurricane on the horizon and is unsure if it will be mild or severe

- As the steward of one of the world’s largest banks, he is preparing JPM’s balance sheet accordingly

- In times like these, it makes sense to be prudent

At Highland Peak Wealth, we couldn’t agree more. Now is the time to adjust portfolios a little more defensively as we enter the summer months. Below is our summary of changes from last month and remains unchanged.

- Equities - Continue to tilt portfolios more into value and dividend-paying stocks (and out of tech/growth)

- Fixed Income – Stay light, and focus on high quality, short maturity/short duration fixed income

- Alternatives - Added 2% to the alternative bucket to better hedge against inflation and slowing growth

- Cash – Increase cash position and dry powder for what we believe will be continued volatility through summer

To throw some hope into the newsletter, there are still many very positive data points. The consumer boom, for example, continues as real consumer spending was up 0.7% in April, and the projection for Q2 growth is +4%. Anecdotally, this makes sense. Has anyone else noticed crowded malls, busy restaurants, packed airports, etc.? Also, consumer cash remains at all-time highs. According to Brian Moynihan, CEO of Bank of America, account holders have more cash than ever. Those who had an average balance of $1-2k before the pandemic now have an average of $4k. Those with a $2-5k balance now carry an average of $13k. Add this with a strong job market (at least for now), consumer spending should remain strong. If spending stays intact, any recession should be mild, just like what we saw post-WWII.

Yours truly has worked hard to complete this newsletter as McBurney #2 is set to arrive any day now. As a reminder, we are totally unaware of our upcoming baby’s gender. We enjoyed this surprise with Teddy and decided to do the same for round #2. Heather is at the “over it” stage and ready for the new addition. We have passed the time with long walks and Heather has a newfound appreciation of acupuncture. Even more, she has taken spicy foods to the next level. Totally out of character, she even went as far as to order Jalapeño poppers over the weekend – 15 years together and still being surprised.

Teddy is excited, but I know he will miss being the star of the show. Of course, it will be good for him in the long run, but there will be an adjustment period for sure, as with so many firstborns. Also, we have a sneaky suspicion that Teddy is expecting a fully cooked three-year-old who can immediately fill the role of a best friend. He may be a tad disappointed by reality.

As always, thank you for your support and readership. Questions and comments are welcome.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202506-2499456