Second Quarter 2022 Market Update

By: Cliff Noreen, Kelly Kowalski, Robert Lindberg, Bronwyn Shinnick

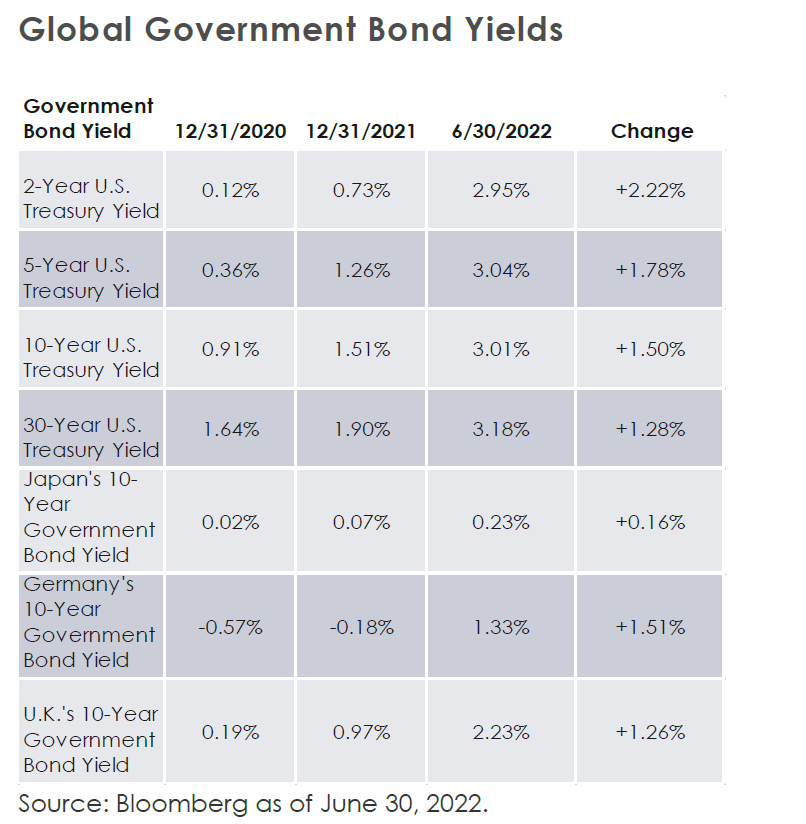

Inflation pressures continued to simmer in the second quarter and were met with the biggest increase (75 basis points) in the Fed funds rate since 1994. The two-year Treasury yield ended the second quarter of 2021 at 0.25%, and now a year later, it ended the second quarter of 2022 at 2.95%, an astounding increase and unfortunate reminder that the once consensus view for “transitory” inflation was dead wrong. Surging interest rates and persistent inflation put sharp downward pressure on bond markets, which are on track for one of their worst years ever, and on U.S. equity markets, which had their worst first half of a year since 1970.

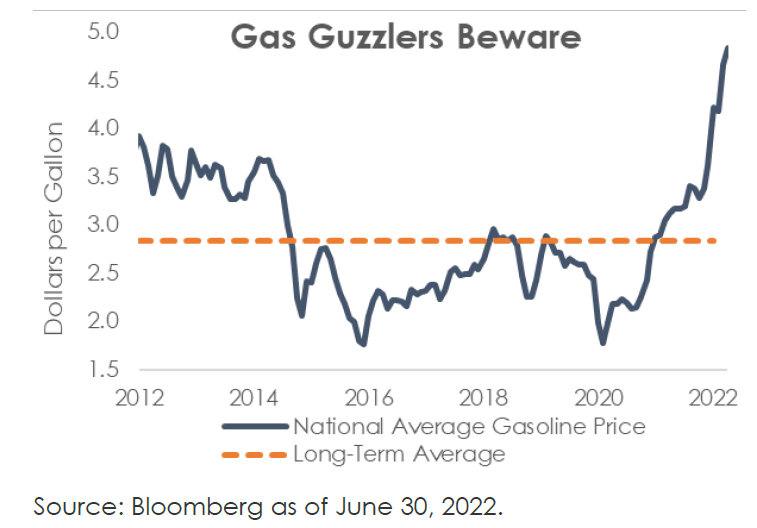

Consumer confidence has plummeted as gasoline prices exceed $5 per gallon, grocery bills skyrocket, and rents rise. Corporate profits are rising though profit margins ticked lower in the first quarter and companies continue to cite challenges such as rising input and labor costs. Signs of cooling are emerging in the overall economy and the U.S. housing market, but slowing growth and 1.50% of Federal Reserve interest rate hikes year-to-date still have not been enough to tame price pressures, leaving investors with the burning question: How far will the Fed have to go? More importantly, can the U.S. economy avoid a recession over the next 12-18 months? The answer to these questions depends highly on the path of inflation and interest rates, which have proven exceptionally volatile and difficult to predict over the past several months.

Commodities = S&P Goldman Sachs Commodity Index; REITS = Vanguard Real Estate ETF; Value = iShares Core S&P U.S. Value ETF; Mid Cap = Vanguard Mid-Cap ETF; Large Cap = Vanguard Mega Cap ETF; Growth = iShares Core S&P U.S. Growth ETF; Small Cap = Vanguard Small Cap ETF; Developed Markets = Vanguard FTSE Developed ETF; TIPS = iShares TIPS Bond ET; Emerging Markets = Vanguard FTSE Emerging Markets ETF; Aggregate Bonds = iShares Core Aggregate Bonds ETF; Gold = SPDR Gold Shares.

The bite of the bear market

U.S. equities entered bear market territory in the second quarter as inflation failed to ease and interest rates soared on the back of increasingly aggressive central bank actions, leading to compressed valuations. In fact, the decline in equity markets YTD has been entirely driven by valuations as the S&P forward earnings multiple has fallen from 21.8x in early January to around 16.0x currently. Companies have continued to grow earnings with S&P 500 earnings up 9.2% in the first quarter. However, there was a wide range of performance as the energy sector grew earnings 268% year-over-year while financials and consumer discretionary earnings were down 19.8% and 32.6% year-over-year, respectively. Company guidance has also skewed negative. Despite growth concerns and recession fears, earnings estimates for full year 2022 have not fallen over the past several months and indicate growth of over 9% for full year 2022.

The same sector and style performance themes that dominated in the first quarter continued into the second quarter, namely value over growth as higher interest rates and a reduction in market liquidity weighed heavily on growth and unprofitable companies. The mantra of

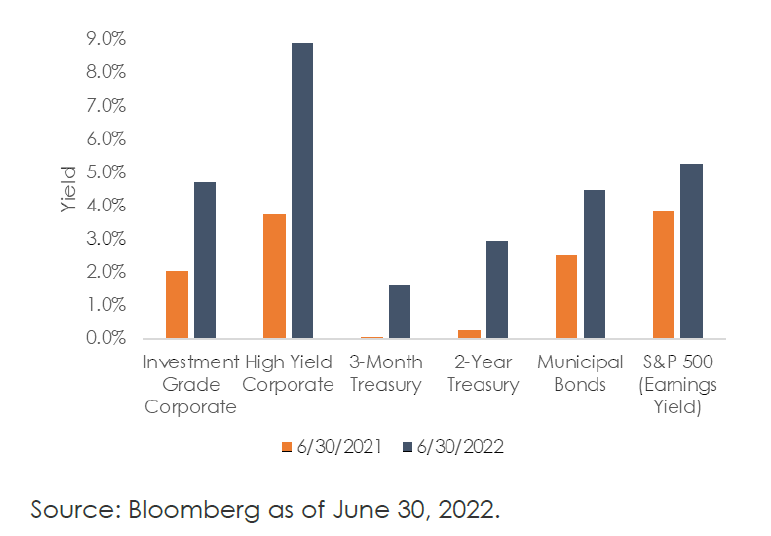

“TINA” or “there is no alternative (to equity markets)” is no longer applicable as many institutional investors maintain large cash positions. Bank of America’s most recent fund manager survey showed investors maintaining cash levels at 5.6% of their portfolios, down from a 20-year peak of 6.1% in May. Furthermore, as of June 30, 2022, investors can earn close to 3% yields on two-year Treasury, 4.8% yields on investment grade corporate bonds, and over 8% yields on high yield corporate bonds. With interest rates higher, there are

alternatives to equities, a significant difference from just a year ago.

Goodbye TINA

Can the economy land softly?

The path toward a soft landing, or slowing growth while avoiding the risk of a sharp economic downturn, is narrowing in the eyes of investors. Currently, two out of three investors expect a recession in the next 18 months according to Goldman Sachs’ May client survey, while economists peg the probability of a recession at 33%. Economic data has weakened; real consumer spending fell 0.4% in May over the previous month. Consumer sentiment reached a record low of 50 in June, reflecting the impact of decades-high inflation, a prolonged slump in stock prices, and generally downbeat views on the state of the economy amid growing fears of an imminent recession. Although the economy continues to add jobs, weekly jobless claims have ticked up, and many technology companies have announced layoffs or hiring freezes.

Consensus 2022 U.S. GDP growth has fallen from 3.9% at the beginning of the year to 2.4% currently. Furthermore, the World Bank cut its forecast for global economic expansion in 2022 to 2.9% from 4.1% at the beginning of the year, warning that several years of above-average inflation and below-average growth lie ahead with potentially destabilizing consequences for low- and middle-income economies.

U.S. housing market cooling off

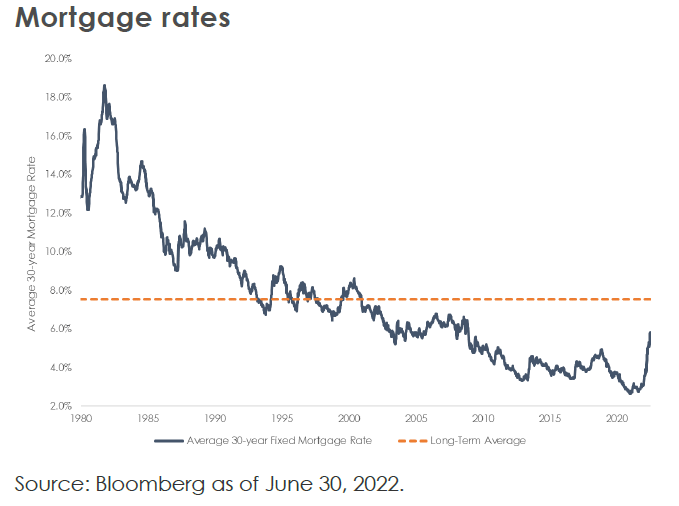

Home prices surged during the pandemic as interest rates collapsed and demand for living space intensified for those working from home. However, conventional 30-year, fixed mortgage rates have jumped more than 3% from pandemic lows to as high as 6% during the second quarter. Home sales are now falling in many countries including the U.S., the U.K., Canada, and Australia. U.S. mortgage application volume tumbled to the lowest level in 22 years in May.

Despite the housing market showing signs of softening, the median U.S. home price broke above $400,000 in May for the first time, and rents continue to rise, contributing to the stubbornly high consumer price index. A recent report from Redfin showed that nationally listed rents for available apartments rose 15% in May from a year ago, while the median listed rent for an available apartment rose above $2,000 a month for the first time. Despite chatter surrounding a housing bubble, a 2008-style collapse is unlikely. Lenders have tightened standards. Household savings are still robust, and many countries still have housing shortages. Household balance sheets are also strong, providing an important buffer. Still, housing price appreciation is very likely to slow amid higher interest rates and sluggish economic growth.

Federal Reserve accelerates

tightening amid persistent inflation

May’s higher-than-expected inflation report, which showed that prices rose 8.6% from a year earlier and marked the largest increase since December 1981, derailed the “peak Fed” and “peak inflation” narratives, and prompted the Federal Reserve to hike interest rates 75 basis points at its June meeting. Food, energy, and rents are contributing significant upward pressure to inflation. The average cost of a gallon of gasoline is up 56% since a year ago, and with the U.S. consuming around 370 million gallons per day, is costing the economy around $640 million more per day than a year ago.

According to new research from the Federal Reserve Bank of San Francisco, supply constraints, exacerbated by Russia’s war in Ukraine this year, account for about half of the post- COVID surge in U.S. inflation, with demand currently making up a third of the increase. While the Fed cannot untangle supply chains, which are showing some signs of improvement, they can influence demand.

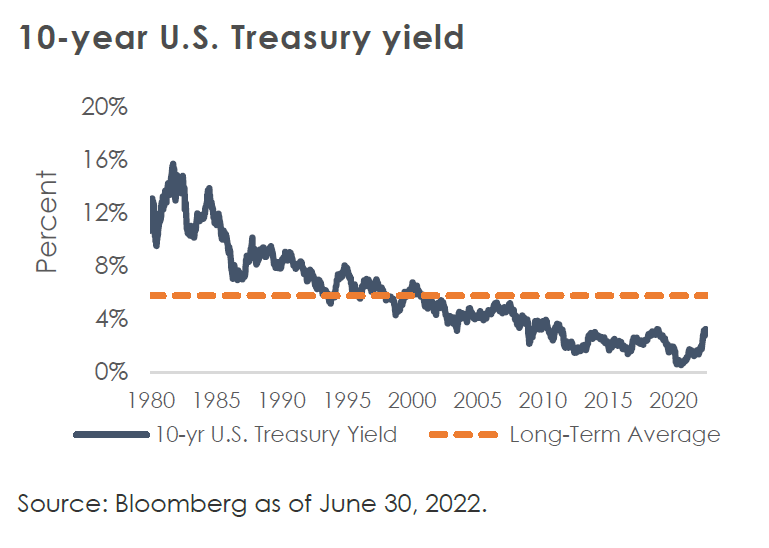

Through tightening monetary policy, the Fed is trying to reduce demand enough to bring inflation down, but also thread a delicate needle so as not to reduce it too much to throw the U.S. economy into a recession. The upper bound of the Fed funds target rate is currently 1.75%; the market expects the Fed to hike another ~1.6%, resulting in a peak Fed funds rate of around 3.4% in March 2023. Some investors do not believe the Fed will need to go that far if inflation comes down and/or growth disappoints. Others believe the Fed will have to be more aggressive than what is currently priced if inflation remains elevated and that recession is likely. While interest rates have risen sharply year-to-date, they are still low on a long-term historical basis, and real interest rates (nominal yields less inflation) are still negative.

The Fed also recently began shrinking its $9 trillion balance sheet through quantitative tightening. The Fed will begin reducing its balance sheet at an initial pace of $47.5 billion per month before ramping up over three months to a pace of $95 billion per month. This process is expected to put upward pressure on interest rates in contrast to quantitative easing or balance sheet expansion, which held interest rates at artificially low levels.

Outlook

As we look to the second half of the year, it is difficult to predict the path of inflation, interest rates, and equity markets. However, we do expect volatility to continue in an environment where monthly inflation readings can dramatically alter monetary policy decisions. The Fed will continue to raise interest rates, but the pace remains data dependent. We believe that 8-9% inflation is unlikely to sustain, but also that we are a long time away from seeing 2% inflation given disruptions from the pandemic and Russian war.

The economy is slowing, but we have not yet seen this translate into weaker corporate earnings, where we see downside risks. Companies have cut costs substantially already, leaving few additional levers to pull. Second quarter earnings and outlooks will be important for the market and for read-throughs on the health of the overall economy. From a valuation standpoint, we have seen a dramatic repricing of risk assets amid recession risk and higher interest rates, but have not yet seen weaker returns from broad-based earnings deterioration.

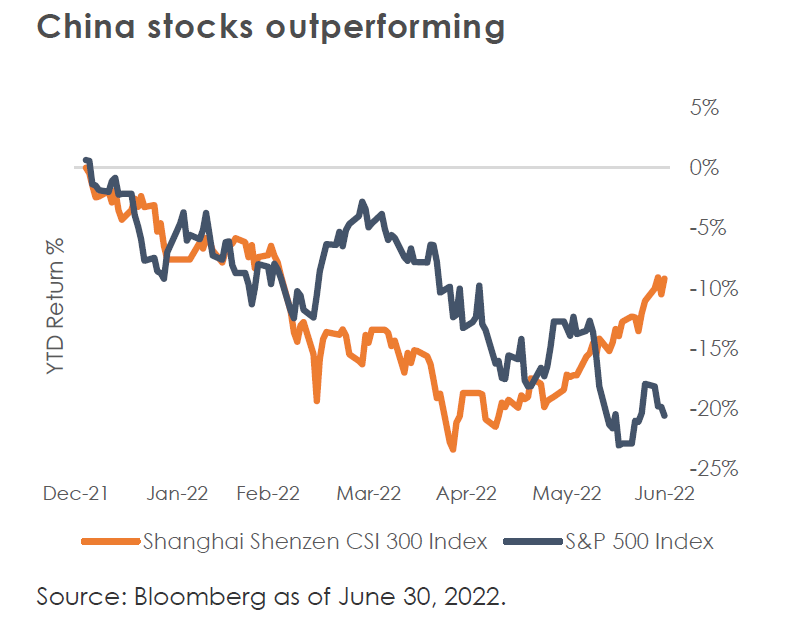

From getting a mortgage to issuing corporate debt, borrowing has become more expensive, and we are no longer in an issuer-friendly market, upping the risks for both companies and individuals who need capital or funding. On a more positive note, China has eased COVID restrictions and is starting to show signs of recovery. China may be one of few economies to actually accelerate in the second half of the year and could be a potential economic and market bright spot in the second half. Chinese equities have been on the rise since April, outperforming U.S. equities.

We continue to encourage investors to pay close attention to valuations and fundamentals, particularly earnings and margins, and interest rates, which we expect to continue to be a primary driver of equity and bond markets. As we learned with “transitory”, the consensus view and even the Federal Reserve are often wrong and should be met with skepticism. We look forward to reporting back you in the fall and encourage you to speak to a financial professional in navigating these unprecedented times.

Kelly Kowalski, Robert Lindberg, Cliff Noreen, Bronwyn Shinnick

MassMutual Investment Management

Past performance is no guarantee of future performance or market conditions.

Use of political figures or statements is solely for reference and relevance to financial markets and is not meant to be an endorsement or a reflection of the company’s opinion or position.

This material is intended for informational purposes only and does not constitute a recommendation to engage in or refrain from a particular course of action. The information within has not been tailored for any individual and is not intended as tax, legal or investment advice.

The views and opinions expressed are those of the author as of the date of the writing and are subject to change without notice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should be relied upon when coordinated with individual professional advice. Clients must rely upon his or her own financial professional before making decisions with respect to these matters.

This communication may include forward-looking statements or projections that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied.

Investments discussed may have been held in client accounts as of Dec. 31, 2021. These investments may, or may not be currently held in client accounts

Securities and investment advisory services offered through registered representatives of MML Investors Services, LLC.

(member FINRA/SIPC).1295 State Street, Springfield, MA 01111-0001.

MM202507-302122