October 2022 - Meet Mr. Market

By: Kyle M. McBurney CFP

Managing Partner at Highland Peak Wealth

I would like you all to meet a famous character named Mr. Market – your mercurial manic-depressive friend. The brainchild of famed investor Benjamin Graham, the allegorical Mr. Market was first introduced to the world in Graham’s 1949 book The Intelligent Investor to explain stock market fluctuations.

As Graham explained, Mr. Market is your fictional partner in a private business. Every business day, rain or shine, Mr. Market appears at your door and names a price at which he will either buy your stake or sell you his. Here’s the kicker. While the business may be economically stable, Mr. Market’s emotions are all over the place. After all, this poor fellow has inoperable emotional problems – a true modern-day Dr. Jekyll and Mr. Hyde. Some days, he is elated with limitless optimism. Other days, he is helplessly depressed and sees nothing but total doom and gloom ahead.

But there is one pivotal detail: Mr. Market doesn’t mind being ignored. As his business partner, you have every right to say “no thanks” to your heart’s content. Our friend takes zero offense. Undeterred, he will simply come back the following day with a new price. Easy enough, right?

Graham does, however, provide one important warning: do not, under any circumstances, fall under his influence. After all, you are interested in his financial offer, not his knowledge or business sense. Thus, the more manic/emotional he is, the better opportunity its is for you to take advantage of his emotional vulnerability.

Easy to say, of course, but hard to do.

Moving forward, I implore you to keep the comical idea of Mr. Market in mind.

Warren Buffet certainly does as reflected in his 1987 letter to Berkshire Hathaway shareholders:

Rather an investor will succeed by coupling good business judgement with an ability to insulate thoughts and behavior from the super-contagious emotions that swirl around the marketplace. In my own efforts to stay insulated, I have found it highly useful to keep Ben’s Mr. Market concept in mind.

Mr. Market has become especially overwhelmed lately as first-half scratches have become deeper cuts. Pricing in a more aggressive Federal Reserve, more rate cuts, and continued fear of slowing growth has pulled down prices everywhere from stocks to bonds to commodities. It has been a challenging year, to say the least, as there have been few places to hide.

In our view, we still see some downside ahead. Like our last newsletter, we simply are not seeing any traditional “market bottom” indicators. Bottoming is a process and will likely take some time. That said, timing the market is impossible, and we recognize that no crystal ball exists. While selling investments and moving to cash can feel like the “safe thing to do,” it often results in a different type of risk – the risk of not achieving long-term goals. Most clients have multi-year or multi-decade time horizons. Markets can (and will) be very painful for months or perhaps years. Our job is to help clients through trying times and avoid financial mistakes that can derail a long-term financial plan.

Stocks fell hard last Friday, marking the end of a tough week, month, and quarter that saw the US stocks touch a new low for 2022. For September, the S&P 500 and Dow were each down over 9%. The Dow Jones, an index of the largest well-known US companies, was especially excruciating. It amounted to the worst monthly performance since the infamous month of March 2020. Quarter to date, the S&P 500 and tech-heavy Nasdaq Index logged their first three-quarter losing streak since 2009.

To put it mildly, it's hard to find too much positive in today's market. In fact, recent surveys suggest that investors are as pessimistic as they have ever been. Then again, maybe that IS the good news. After all, at some point, negativity can't get any more negative. This week's market activity is a perfect example – a furious 6% rally with no real drivers behind it.

The Trail Guide Bear Market Survival Kit

To many, a bear market pushes all the emotional buttons to sell everything and run for cover. But you absolutely cannot, under any circumstances, sell after such a significant decline. We call this “the big mistake” – you just can’t do it.

So how can investors tune out all this negativity and stay in the game?

Well, we are glad you asked.

Follow these steps, and we are confident that your blood pressure will decrease, and your long-term strategy will remain intact.

1) First and Foremost, Breathe

As Daken Vanderburg, Head of Investments at MML Investor Services, so perfectly reminded us in his most recent newsletter, when it comes to market declines – first and foremost, breathe.

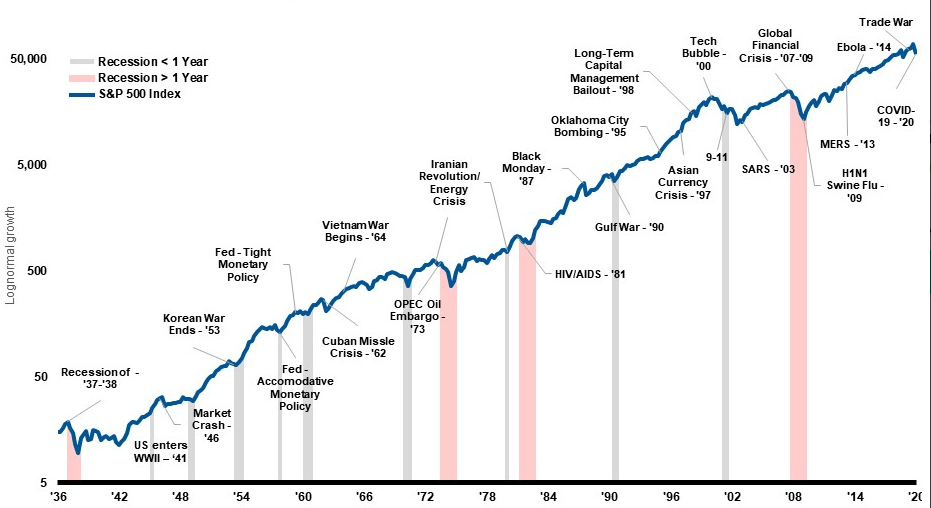

Equity markets over the last 100 years have averaged a positive return of roughly 10%. Along the way, markets have been riddled with war, pandemics, recessions, and all-out market panics. Market volatility is simply the price of admission for exceptional long-term returns. Market sentiment is quite nauseating, but this, too, shall pass.

2) When in Doubt, Just Zoom Out

It is always fascinating to look at a 100-year chart of the S&P 500 or Dow Jones. On a day-to-day basis, the market can, at times, feel like a chaotic casino. Zoom out a little more, and you notice big swings year in and year out. Yet, amazingly, the more and more you zoom out, the smoother the line becomes. Once fully zoomed out, the growth of the S&P 500 appears surprisingly smooth -

Source: Morningstar Direct - S&P 500 Index, St. Louis Federal Reserve

Above is one of my favorite charts –despite numerous recessions, negative headlines, and uncertainty over the last 85 years, markets keep chugging along.

3) Keep Long-Term Returns in Mind

Here is some more good news: the riskier stocks feel, and the more they decline, the more attractive they get over time. For example, Blackrock’s long-term capital market assumptions have increased since the start of the year – with an expected 10-year return in stocks increasing to 7.7% from 6.1% back in January.

Even more, history tells us to buy with markets now down 25% for the year.

History provides no guarantees, of course, but there is comfort in these numbers. Buying significant market dips is almost always the intelligent thing to do, eventually.

No, we have no plans at Highland Peak Wealth on jumping all in right now. For those with cash on the sidelines, we continue to dollar-cost average into the market.

4) Look for Opportunities

Bear markets all have one thing in common – they end. While not apparent amid a market decline, bear markets typically provide investors with excellent long-term entry points. Think back to previous bear markets and opportunities available, such as picking up Apple stock at $3 per share or Microsoft at $16 in the ’08 crash.

So, where do we see opportunities?

While stock valuations are getting more interesting, we currently see more opportunities in bonds. Yes, bonds.

“This is nirvana for a fixed-income investor.” Rick Reider CIO of Global Fixed Income and Global Allocation at Blackrock

The Fed’s rate hikes, and normalization of interest rates, are finally putting the acronym TINA (there is no alternative to stocks) to bed. Finally, at long last, stocks are no longer the only gig in town. With Treasury bonds offering 4%, the highest nominal yields for short-term bonds since before the 2008 crash, the game is starting to change. As such, we see more and more opportunities within fixed-income markets. This looks like an excellent time to lock in higher yields for the long run, which is beneficial for those investors in retirement.

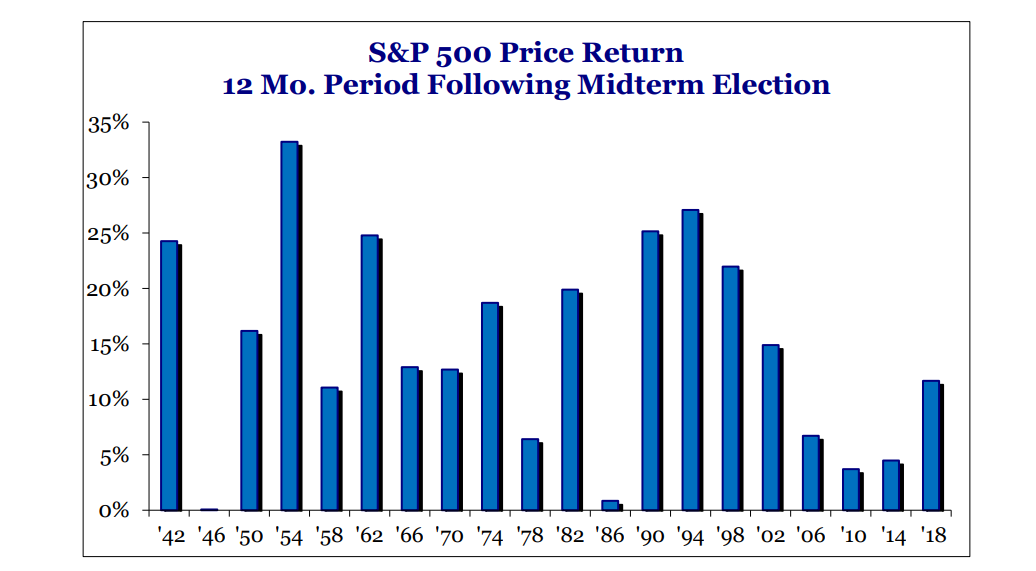

Chart of the Month #1 – Just a reminder – Do stocks typically rally into mid-term elections? Yes, but will it matter?

Chart of the Month #2 – Also noteworthy, the S&P 500 has not declined in 12 months following Midterms since ‘38

Source: Strategas

Allocation Update

Bottoming is a process, and we feel we are not quite there yet. Readers of our work will recall this from the recent mid-month market update. Mindful that the Fed’s monetary policy works with a lag, we still believe there is some time to go until the full implications of rate hikes are felt. As such, we continue to prefer positioning client portfolios in higher quality, more defensive sectors for the short term. Over the last 6 months, we have also increased exposure to those stocks that throw off large amounts of cash (dividends) to investors. The way we see it, if we get a redux of the post-WWII stock market, we can increase yield as we wait for market valuations to reset.

Below is a summary of our current portfolio positioning -

- Equities – Underweight (reduced in August)

o Continue to tilt portfolios more into value and dividend-paying stocks (and out of tech/growth)

o Leaning into more defensive sectors – Healthcare, Utilities, Consumer Staples

- Fixed Income – Slightly Underweight (recently increased)

o Beginning to take advantage of more attractive bond yields

o We still prefer to keep our duration short, but long-term bonds are becoming more interesting

- Alternatives – Neutral (recently reduced)

o Alternatives can serve as a means of diversifying the portfolio allocation and a hedge against turbulence

o Continued European conflict and supply chain complications likely to keep commodity prices higher

- Cash – Overweight

o Maintaining above average cash position for defensiveness and dry powder

Our team at Highland Peak Wealth has also begun to turn our attention to end-of-year “to-do’s.” This is a great time of year to organize end-of-year gifting, donations, tax planning, and satisfy those pesky required minimum distributions. Please do not hesitate to reach out.

The end of the summer also marked the fourth birthday of Teddy (my very own Mr. Market). His party was another big hit, and we enjoyed our third straight year of using the same construction truck decorations (talk about a win!). Of course, as Teddy gets older, his tastes have changed, and his truck obsession has been replaced by the most logical next step – Legos. He is obsessed. Also, being four years old, he does not quite have the dexterity and mental acumen to put complicated Lego trucks and buildings together. Enter Kyle. Over the last month, I have become a Lego expert. This skill, however, comes with a price. The second a fire engine or helicopter is finished; two more have already been destroyed or misplaced. It has become a non-stop cycle - like some evil Lego herculean hydra. While I remain a full-time portfolio manager, I hereby announce a second career as a Lego builder. The pay isn’t great, but it’s a gig!

As always, thank you for your support and readership.

Kyle M. McBurney, CFP®

Managing Partner

The opinions expressed herein are those of Kyle McBurney, CFP as of the date of writing and are subject to change. This commentary is brought to you courtesy of Highland Peak Wealth which offers securities and investment advisory services through registered representatives of MML Investors Services, LLC (Member FINRA, Member SIPC). Past performance is not indicative of future performance. Information presented herein is meant for informational purposes only and should not be construed as specific tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, it is not guaranteed. Please note that individual situations can vary, therefore, the information should only be relied upon when coordinated with individual professional advice. This material may contain forward looking statements that are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Referenced indexes, such as the S&P 500, are unmanaged and their performance reflects the reinvestment of dividends and interest. Individuals cannot invest directly in an index. CRN202510-3148904.